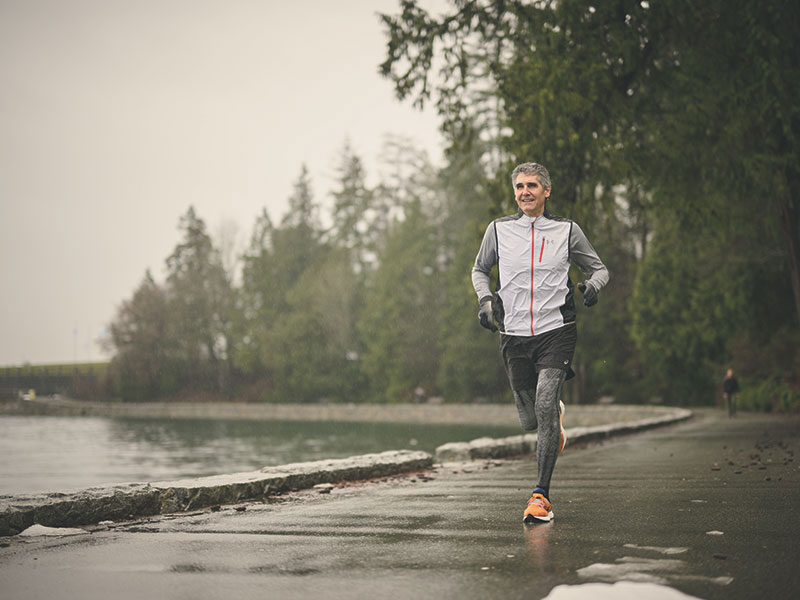

As a long-distance runner with two Boston Marathons under his belt, Glen Rattray knows preparation is paramount for success in both athletics and finance.

Rattray, senior investment counsellor with Dixon Mitchell Investment Counsel in Vancouver, has been in the investment industry for almost 40 years. Over that time, he has learned the value of planning in order to achieve long-term goals.

With running, he said, “you set out a game plan, which is similar to an investment policy statement. It’s usually over a long period. There are so many variables — nutrition, health, injury, hydration, weather, et cetera.

“It’s really all about developing and executing that plan over the long term,” he added. “A successful investor and a successful distance runner use a lot of the same skills.”

Rattray, who is 61 years old and a native of Winnipeg, developed his passion for the financial services profession early in life.

Although he initially considered a career in law, “in my last few years of high school, I had a wonderful teacher who really turned me on to math and numbers,” he said. “I was also involved in an organization called Junior Achievement.”

Junior Achievement provided Rattray with valuable business knowledge, including the steps needed to establish a company or create a product or service, develop a marketing plan and make a profit. The organization got him interested in the business world and investing, he said.

Rattray has a client base of about 50 high-net-worth families and individuals, with the average private-wealth client holding in excess of $3 million in assets. He also serves 30 institutional clients, including pension plans, corporations, endowments, trusts and foundations. In addition, he manages money for Indigenous trusts and clients, which, he said, represent “the fastest-growing part of our business.”

He learned early in his career that successful management of retail client relationships was intergenerational, and also involved emotional family dynamics. “Listening is key, as is making sure portfolios are flexible and open to fine-tuning, as client circumstances always evolve and change over time,” he said.

Rattray noted that institutional relationships taught him the importance of working well with a team, including various advisors, committees and boards, featuring people with different skills and backgrounds.

Rattray built up his book of clients largely through referrals, with his longest client relationship spanning 28 years. He attributes his success, in part, to cultivating strong personal relationships with each client.

“We host regular client appreciation events. Many of these involve non-investment-related activities: wine tasting, live theatre, et cetera,” he said. “Scheduling quarterly interactive webinars also helps clients stay on top of current financial topics while allowing us to provide support on other important subjects. For example, [there was] a health and wellness focus during the Covid lockdown.”

Furthermore, the investment style at Dixon Mitchell, which focuses on equities, fixed income and balanced management, is a good fit for Rattray.

“We do all of our research ourselves and follow a very select, concentrated group of high-quality companies,” Rattray said. “They tend to be more financially sound than most out there, with established management and track records. We’re really all about looking for sustainable cash-flow growth.”

Rattray has navigated several periods of market adversity throughout his career, including the “Black Monday” stock market crash of 1987. During such trying times, he said, “part of our jobs as investment counsellors is to make sure that emotion stays in check, that we give perspective to what is going on in the world and make sure that people stay on the long-term path, because there are tremendous rewards in not reacting to the daily volatility of markets.

“Success, to me, is sticking to a long-term plan, having good counsel and advice to keep emotions away from your long-term investment plan, and achieving consistent above-average returns at a reasonable level of risk,” he added.

Rattray recalled a valuable piece of advice he received from a senior investment professional when he first arrived in Vancouver more than 30 years ago: that he should obtain equity or ownership in the firms he works with.

Rattray has taken that advice to heart by acquiring a stake in various firms throughout his career, including Dixon Mitchell. “You have skin in the game,” he said of that strategy. “You’re financially involved. It makes you think like an owner. It gives you a measure of control over the organization as well, and tends to bring you a little bit closer to clients.”

Rattray graduated from the University of Manitoba with an honours bachelor of commerce degree in 1984. He joined Prudential-Bache Securities Inc. in Winnipeg the year after, and worked as an account executive until 1990. In that position, he learned he was more interested in valuation and research than sales. That realization spurred his decision to earn the chartered financial analyst (CFA) designation in 1992.

Rattray moved to Vancouver in 1992, joining a company that eventually became Legg Mason Canada. Over the next 15 years, Rattray rose to vice-president and portfolio manager.

In 2007, Rattray joined Sceptre Investment Counsel Ltd. as vice-president and senior portfolio manager. After Sceptre was acquired by Fiera Capital, Rattray became vice-president of institutional markets, a position he held from 2010 until he moved to Dixon Mitchell in 2019.

Rattray is married, with two grown children. His wife Anne is a retired commercial banker.

In addition to running, Rattray is an avid skier and road cyclist. He is a board member of a local car club interested in classic sports cars and owns a 1964 Austin Healy 3000 Mark II BJ8 with a black and red interior.

He travels widely, both for business and personally, noting that his family has always regarded travel as “the best education.”

Rattray has enjoyed long-time involvement with CFA Society Vancouver. He is a past president and served on its board for six years. He remains involved with the group’s mentorship program.

“I feel very strongly about those in our industry giving back to the industry,” he said. “A lot of the best contacts I have now were the ones I developed through that association. It’s good for the industry, and it’s good for the person.”

This article appears in the February issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.