Succession planning and financial planning resources were dominant themes in last year’s Brokerage Report Card. How do financial advisors feel about these issues in 2024?

Mixed views on succession planning

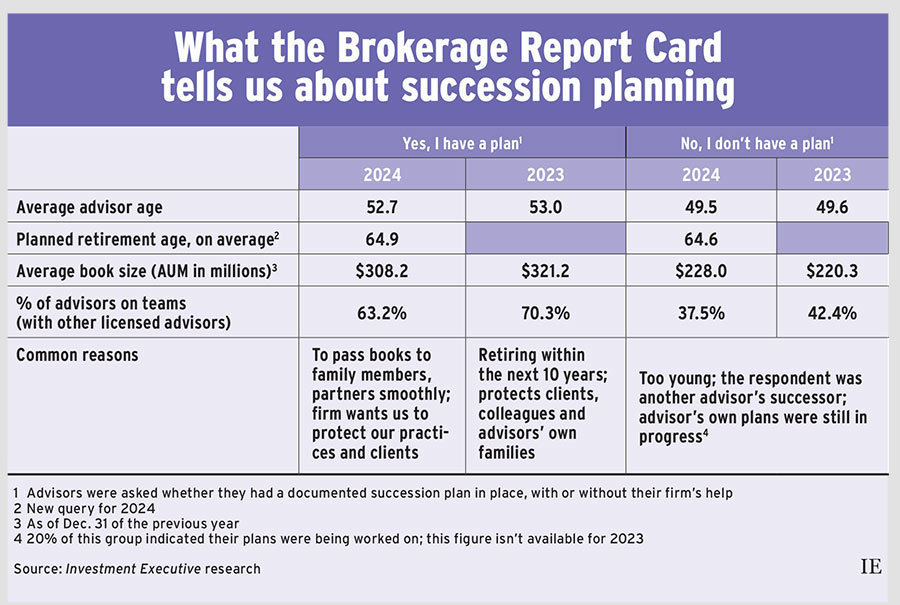

In both 2023 and 2024, less than half of the advisors surveyed for the Brokerage Report Card had documented business succession plans. Just under half (49.5%) said in 2024 that they’d created formal plans, up slightly from 44.2% last year.

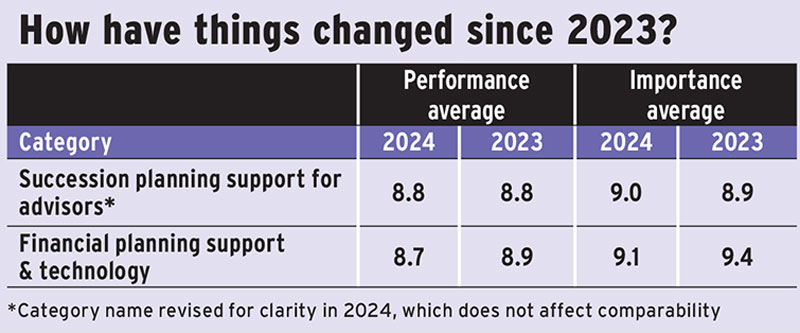

Over the same period, advisors rated their firms similarly, on average, for their succession planning tools and resources. (See “How have things changed since 2023?”)

Advisors with plans highlighted that early planning is best. “A lot of advisors are retiring, and the firm does discuss [succession planning] often. It takes a lot of time and effort to have succession planning come together,” said an advisor with iA Private Wealth in Ontario.

Even among advisors without documented succession plans, 20% were working toward one. “I’m in the middle of that right now. I’ve been trying to [work on] succession for a few years,” said an advisor in Alberta with Edward Jones. Several other advisors mentioned they were considering their family members and associates as potential successors down the line.

Brokerage firms also appreciate the importance of futureproofing.

Adam Elliott, senior vice-president of iA Private Wealth, said the firm increased efforts to help advisors formalize plans tied to sudden, catastrophic events as well as long-term retirement goals over the past year. This effort remains a priority for 2024, he added, as “we’re in the process of rolling out a couple of options [to help] younger advisors or associates take over practices of retiring advisors on their teams.” These options are in addition to the firm’s internally financed book purchase program.

iA Private Wealth was one of two firms that saw their performance ratings in the succession planning category shift significantly (by half a point or more) compared with 2023. Its result was 7.5 out of 10, down from 8.0 a year ago, with advisors asking for more templated resources and guides.

Edward Jones, meanwhile, had a significantly higher result for its succession planning support: 9.3, up from 8.5. The firm has a transition program for advisors that guarantees payouts rather than depending on them to buy and sell their books.

Moira Klein-Swormink, principal, branch development Canada with Edward Jones, said the firm enhanced its program in 2023 through increased advisor payouts and a new team of consultants who guide advisors and clients through book transitions. That process can take two to four years.

One comment on the program was that payout levels depend “on where your business is at. If you’re good, [the program] is very competitive,” said an Edward Jones advisor in Alberta.

Planning remains important

Most advisors interviewed for the 2024 Report Card (nearly nine in 10, or 89.4%) said they prepare financial plans for clients. Almost two-thirds of those advisors’ clients (64.7%), on average, had plans in place — lower than in 2023 (66.4%) but higher than in 2022 (64.2%).

Moreover, advisors surveyed in the Report Card continued to give the “financial planning support & technology” category a high average importance rating. (See “How have things changed since 2023?”)

Still, advisors continued questioning their firms’ support in this area.

The performance rating for three of the 12 firms assessed for financial planning support changed significantly compared with a year ago. BMO Nesbitt Burns Inc. was rated 8.5, down from 9.2, while ScotiaMcLeod Inc. and TD Wealth Private Investment Advice were rated 8.0 and 7.8, respectively (down from 8.5 and 8.4). Advisors with these brokerages acknowledged their firms were investing in the area but also identified technology limitations and a scarcity of experts.

One ScotiaMcLeod advisor in Ontario said their technology was improving and was a key focus area for the firm, while a ScotiaMcLeod advisor in Alberta said the brokerage “continuously sharpens the tools for us, which is fantastic because it’s an integral part of our business as clients age.”

Yet, several other advisors with ScotiaMcLeod said in-house planners were spread too thin and that the bank-owned firm’s tools lacked flexibility. As a result, some advisors hired their own external resources and experts.

Advisors with TD Wealth PIA cited a planning system that wasn’t well integrated with their technology suite as well as limitations that made complex planning for clients difficult.

Executives with both TD Wealth PIA and ScotiaMcLeod said holistic planning was a priority. Todd Barnes, senior vice-president and head of ScotiaMcLeod, said the firm will roll out a new platform in June backed by software from Conquest Planning Inc. This platform will be linked with the brokerage’s systems, he said, so advisors and clients can more easily view their progress against their financial objectives.

Ryan McNally, senior vice-president of wealth advice distribution with TD Wealth PIA, said the brokerage aims to connect advisors with specialists “who can complement the advice they are providing” to clients in areas such as general planning, banking, estate and trust solutions.

TD Wealth PIA’s planning platform also is getting enhancements. “We are evolving client reports and illustrations,” said Leo Pollard, vice-president, investment management practices and specialized services, wealth advice, TD Wealth. The brokerage also plans to release a tool for the bank’s high-net-worth planners and a resource for all advisors to present customized investment strategy recommendations.

Click image for full-size chart

Click image for full-size chart

This article appears in the June issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.