Advisor as therapist? The challenges of managing clients’ emotions

Communication and education can help calm clients’ anxieties amid challenging economic conditions

- By: Serge Rousskikh

- June 2, 2023 June 1, 2023

- 10:24

Communication and education can help calm clients’ anxieties amid challenging economic conditions

The fundamental priorities of advisors haven't changed as much as the brokerage landscape in the past few decades

Methodology for the Brokerage Report Card 2023

The Report Card’s top-rated and improving firms are focused on adaptability and advisors’ priorities

How investment advisors rated their firms' performance

Growth was due to flows in financial assets and rising markets rather than expanding client bases

Pay has remained important to financial advisors, who value straightforward grids

Technology investment alone is not a panacea

Firms are investing in support systems for a hybrid future

The key to success is providing ongoing support and system adjustments

Check out the trends from the past five years across the brokerage firms

Methodology for the Brokerage Report Card 2022

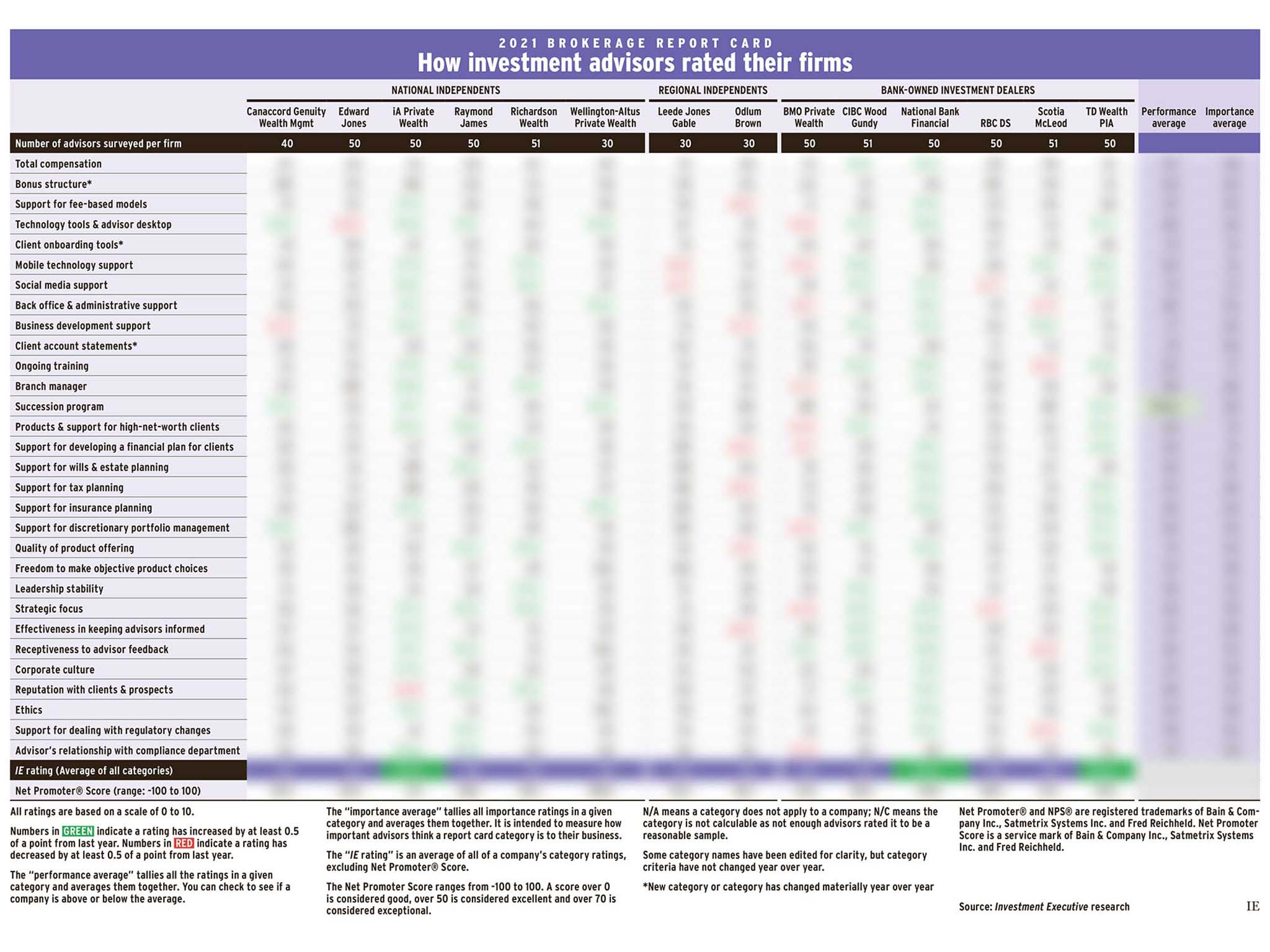

Respondents to the 2021 Brokerage Report Card had plenty to say about their firms’ performance over the past year

Despite a tumultuous 2020, most firms received positive ratings from their advisors in this year’s Report Card

How investment advisors rated their firms

While AUM was up, overall productivity has declined from 2020

More advisors are reporting discretionary assets under management, and firms are investing in discretionary platforms

How advisors and firms have adapted to working from home

Paying attention to advisor feedback remains crucial for firms

Fewer advisors report having a succession plan in place this year, but advisors who have a plan are happy with their firms’ support

Firms’ ratings varied widely as some struggled to adopt e-signatures

Using data from Investment Executive's Brokerage Report Card, we looked at the differences between advisors who use ETFs and those who don't

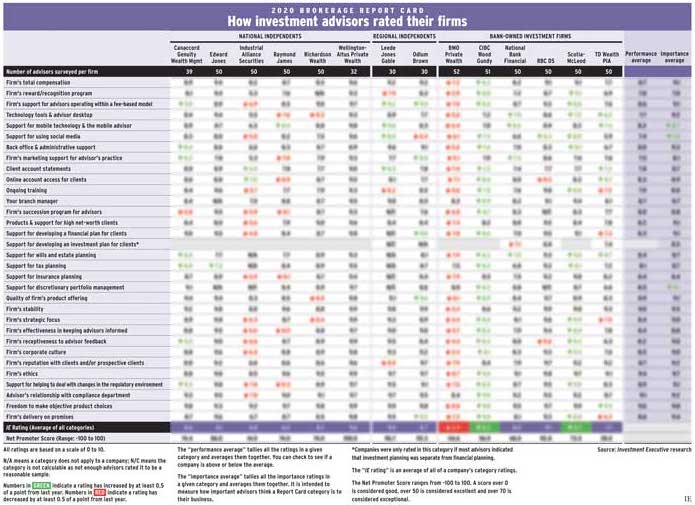

Brokerages must help advisors weather the economic crisis

How investment advisors rated their firms

AUM rose as advisors focused on wealthy clients in run-up to pandemic