Securing new business is the lifeblood of any insurance advisor, but insurance firms are not doing enough to grease the rails and facilitate the application process for their advisors – despite continuing advances in technology.

The results of Investment Executives‘s 2017 Insurance Advisors’ Report Card reveal that firms, on average, fail to live up to their advisors’ expectations in the “back office and administrative support for new business (application processing)” category.

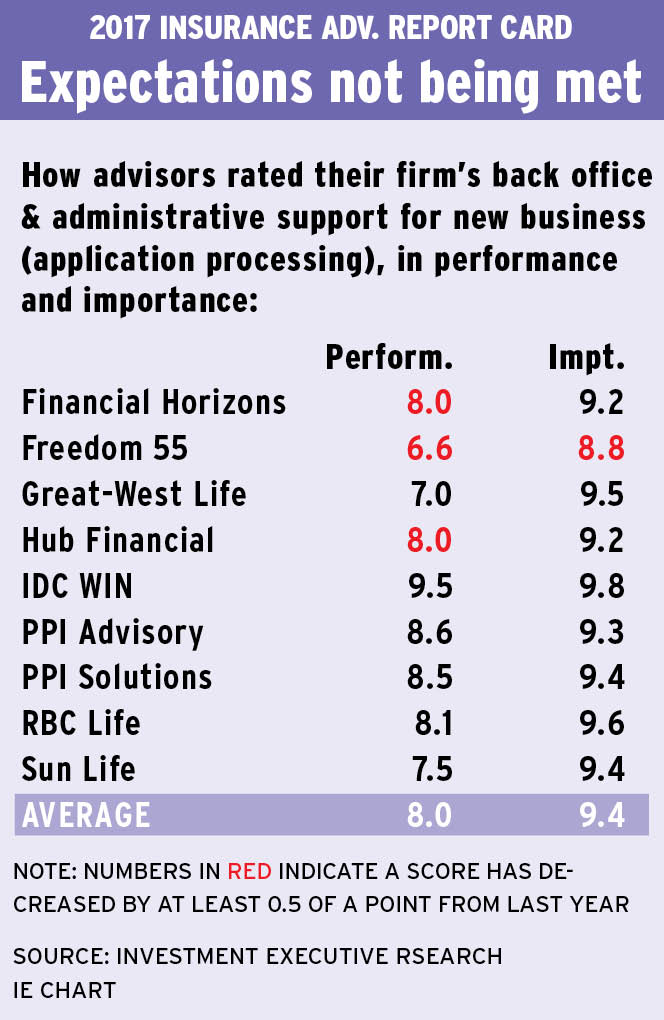

Case in point: although this support is highly important to advisors (the category was tied for the second-highest overall average importance rating, at 9.4), the overall average performance rating advisors gave their firms was only 8.0. The difference of 1.4 points between the two ratings represents the second-largest “satisfaction gap” in this year’s survey.

Common complaints from surveyed advisors pointed to back-office staffing that’s inadequate and human responsiveness that needs improvement. Specifically, advisors cited high turnover in back-office departments, resulting lack of experience, dedication, expertise and execution on the part of staff.

“The [back-office staff is] very slow,” says an advisor on the Prairies with Waterloo, Ont.-based Sun Life Financial (Canada) Inc. “They lack knowledge. We get a lot of right hand not talking to the left hand. There’s no co-ordination.”

In addition, many advisors said they’re not sure where to turn to get their problems fixed and bottlenecks unplugged as their firms move away from providing specialized support in this category – even as they invest in new technology.

This issue has been of particular concern to advisors with sister firms London, Ont.-based Freedom 55 Financial and Winnipeg-based Great-West Life Assurance Co. (GWL). The two firms have had issues related to the launch of the New Business Now application-processing system.

“For the past few years, the [system has] been horrible,” says an advisor in Ontario with Freedom 55 Financial, which garnered the lowest rating in the category, at 6.6. “The [company] made a change in [its] administrative process and it backfired. [The firm] still is recovering from [the change], as the service level went down with the ship.”

“[The back office support] is brutal,” adds an advisor in Ontario with GWL, which received the second-lowest rating in the category, at 7.0. “The GWL systems always fail and the staff don’t know what they are doing. There are huge delays.”

GWL has been dealing with issues in implementing New Business Now, which is in Phase 2 of its rollout. Complaints included slowness and inaccuracies in the back office.

“We recognize we do need to improve the overall turnaround times,” says Mark Foris, vice president of the Wealth and Insurance Solutions Enterprise (WISE) network, a unit of Great-West Lifeco Inc., GWL’s and Freedom 55’s parent. “We have stabilized and we’re at a point in time at which we’re confident that we are processing business as quickly as we did before New Business Now. But that wasn’t the goal of introducing New Business Now; we want to improve the timeline.”

There are several improvements being introduced to shorten the timelines and improve the advisor experience, including a new, streamlined application form, which is in the pilot stage, Foris says. That form should be available by this autumn, following thorough testing during the next few months to iron out the kinks, Foris points out.

In addition to the new technology, GWL is building a “concierge” service platform as part of its value proposition for advisors who are part of the WISE network – and this service also should be available by early autumn, Fortis says. (WISE brings together top advisors from Freedom 55’s wealth and estate planning group and GWL’s Gold Key network.)

This new concierge service will offer advisors across the country access to a live person, with a team of experts positioned in various places who can be points of contact and who can resolve various issues that advisors face.

“If [advisors are] having challenges, they’ll be able to access us directly through the concierge service platform,” Foris says, “and we’ll ensure that the advisor experience is improved.”

At Freedom 55, business volumes and service standards using New Business Now have stabilized, but the firm is conducting a strategic review to “improve the experience” for advisors, including tweaking the technology, says Abbie MacMillan, vice president with the firm.

Although there have been improvements in service, the company has not yet achieved the vision originally laid out when Freedom 55 embarked on the New Business Now strategy, says MacMillan, echoing Foris’s comments on the matter.

“We obviously want to improve the technology that’s existing and make sure it’s functioning to meet the needs of advisors and our clients,” MacMillan says. “And, of course, we’re always going to be open to looking at innovative approaches as we move forward.”

In contrast, advisors with Mississauga, Ont.-based IDC Worldsource Insurance Network Inc. (IDC WIN) gave that managing general agency (MGA) the top rating in the category, at 9.5, praising the back-office staff for being supportive, personable and easy to deal with.

“They’re always on time and they give us feedback,” says an IDC WIN advisor in Ontario.

Colleagues praised the back office’s efficiency, saying that new business applications were processed within 24 hours.

Similarly, advisors with Toronto-based PPI Advisory commended that MGA’s back office for its responsiveness, speed and accuracy.

“If I have a problem, I know who to call,” says an advisor in Alberta with PPI Advisory, which received the second-highest rating in the category, at 8.6. “I get a real person, [who is] very service-oriented. [That contact person] quickly understands the problem that I face and can help resolve it.”

© 2017 Investment Executive. All rights reserved.