For advisors across the industry, learning to identify and satisfy the needs of retired clients is important.

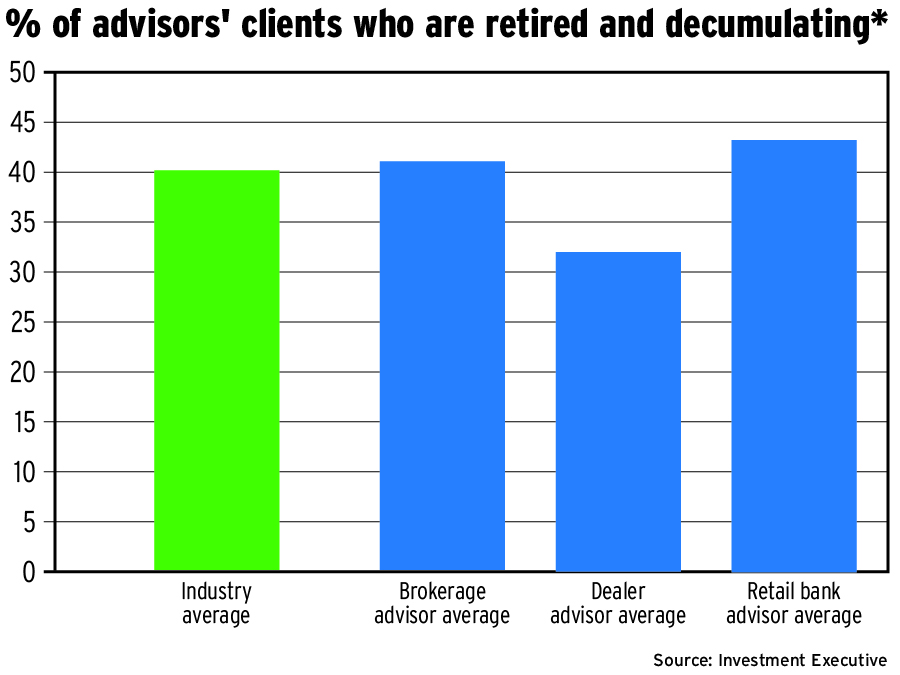

The 2023 Report Card series, which analyzed the brokerage, dealer, and retail bank channels, revealed that more than one-third (40.3%) of the average advisor’s book was comprised of retired clients in the decumulation stage (see chart below). When providing this data, the advisors polled also discussed the challenges faced by these clients and their own hurdles in finding solutions.

The main obstacles were different for each industry channel. For example, many brokerage advisors were learning how best to facilitate intergenerational wealth transfers and handle complex family relationships, while many retail bank advisors were preoccupied with helping aging clients use technology.

Monitoring the health of older clients was a shared theme.

Here’s what advisors across the three channels had to say:

“The challenges that many of my [retired, decumulating] clients are faced with are around income and estate planning. [There’s] portfolio management and income generation, and how they can effectively transition their wealth. The need for solid financial planning is what it comes down to.”

– brokerage advisor in Ontario, who added that significant tax burdens “can become costly to clients and their heirs.”

“[The] main challenge is designing a customized retirement income plan or cash flow schedule for them [retired clients], so they [can] get exactly what they want.”

– another brokerage advisor in Ontario

“There are too many who are trying to help adult children. There is very little understanding, emotionally and from a financial literacy standpoint, about the decumulation phase. Everybody knows about RRSP contributions, but few know how [decumulation] works unless they ask the questions.”

– a third brokerage advisor in Ontario

“[The] biggest problem is planning for the future and passing money on to the next generation, and navigating family stuff around that. [I’m] a therapist sort of for my clients, [managing] complicated family relationships.”

– brokerage advisor in British Columbia

“Capacity is an issue. As [clients] age, their cognitive ability is a challenge. I’m making sure I’m getting to know their families.”

– another brokerage advisor in B.C.

“The cost of living is a huge challenge. [Retired clients] haven’t had good returns for a while. My average client is getting older and living longer.”

– dealer advisor in Ontario

“[Decumulation] is a huge challenge for them, as opposed to the accumulation stage. There are so many moving parts: determining their tax position, [and] deploying strategies that can be efficient and sustainable.”

– dealer advisor in Alberta

“[These clients are] resistant to change. But things that worked 20 years ago, don’t work now [with] inflation and rising costs.”

– another dealer advisor in Ontario

“For the clients, their obstacle is tech. As the new gen comes up this will go away, [but] we didn’t grow up on computers. [My bank] allows us to do tutorials with clients to help them learn. We also want to make sure their money outlasts them.”

– retail bank advisor in the Prairies

“Keeping [retired clients] up-to-date on digital is a challenge, but it’s also an opportunity. They feel connected more in the digital world but they are hesitant because of all the scams, which have been everywhere. [We’re] trying to inform them of safe ways to be online.”

– retail bank advisor in Atlantic Canada

“Sometimes [retired clients] are too conservative. So what I can offer is very narrow. [For] clients who don’t have children or people they trust, at a certain age they start to degrade [and] I have to do my best.”

– retail bank advisor in Quebec

“Last year the market was a challenge. Low- to medium-risk investors were hit harder than they thought [with] market volatility, rising interest [rates] and inflation. People were living a certain way in retirement, not realizing they have to make some choices [as] not as much money [is] coming in as we are used to.”

– another retail bank advisor in the Prairies

Click image for full-size chart

*Advisors were asked, “As an approximate percentage of your book, how many of your clients are currently retired and in the decumulation phase?” n=1,324