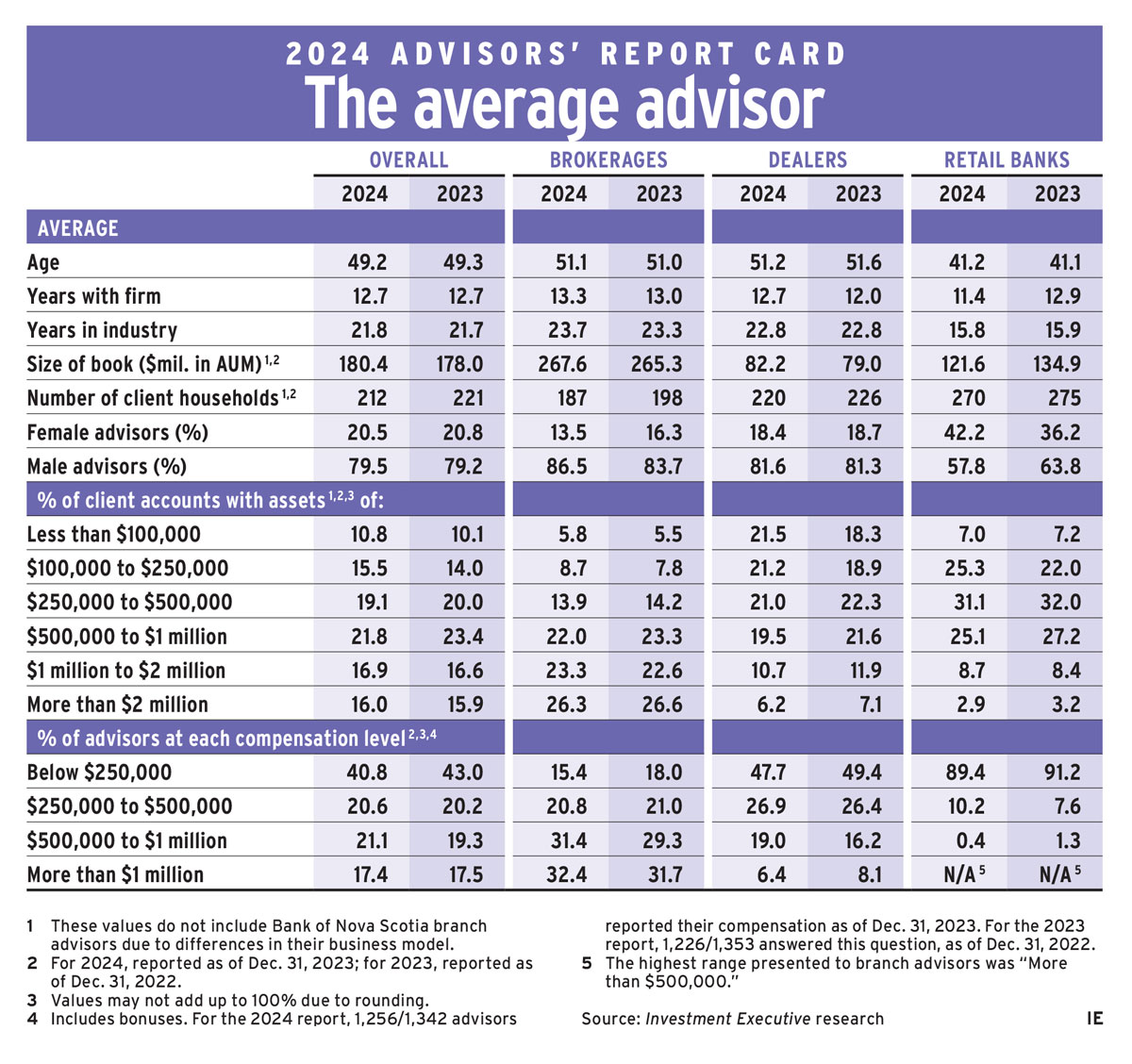

Investment Executive’s 2024 Report Card series found that the average financial advisor’s business is slightly more productive — and lucrative — than it was last year. At the same time, average advisor demographics and other data remained steady over the same period.

On the surface, the crop of advisors surveyed for the 2024 Brokerage Report Card, Dealers’ Report Card and Report Card on Banks displayed characteristics that were similar to the group surveyed in 2023. In this year’s Report Card series, the average advisor’s age, time in the industry and firm tenure were all essentially unchanged from 2023.

Underneath that headline stasis, however, there were changes in advisors’ businesses. (All book, client and compensation data reported in the 2024 Report Cards refer to the most recent full year of business activity, ending Dec. 31, 2023. Results are compared with corresponding data reported in 2023 for the year ended Dec. 31, 2022.)

Overall, the financial advisory industry enjoyed some growth in average assets under management (AUM). At the same time, the average number of client households was down, indicating continued reliance on higher-value clients.

Overall average AUM reported in the 2024 Report Cards rose to $180.4 million, from $178.0 million in last year’s series of reports. That increase in assets was small and came in the context of narrowing client bases across all three advisor groups: the average client roster among those surveyed in the brokerage, dealer and retail bank channels contracted to 212, down from 221 in last year’s research.

However, there was a good deal of variation in these overall trends among the individual channels.

In the investment-licensed brokerage channel, AUM growth was about equal to the modest gains reported for the overall financial advisory industry. But the narrowing of client numbers was more pronounced in this channel than in the other two, when compared with the overall data points.

Comparing all three channels, the brokerage advisors continued to boast the highest average AUM, at $267.6 million. But that was up only slightly in this year’s research from $265.3 million as reported last year. This small gain in assets came amid the industry’s largest contraction in client numbers, by percentage, with average client rosters for the brokerage firms dropping to 187 from 198, year over year.

For the dealers, a mix of full-service and mutual fund-only wealth firms, asset growth was strongest among the channels. At the same, there also was a reduction in client numbers.

Average AUM among advisors in the dealer channel remained the lowest of the three channels. But these advisors saw the sharpest increase, in both absolute and percentage terms, over the period assessed; average AUM rose to $82.2 million, up from $79.0 million in the 2023 report. These advisors’ average client numbers decreased slightly, to 220 from 226.

In the retail bank channel, comprising branch planners and advisors with the Big Six banks, client numbers decreased modestly while average assets were down more notably. This anomaly was shown in the 2024 Report Card on Banks as being driven by a demographic shift in that channel’s top-performing branch advisors. Top performers were notably younger, less experienced by tenure and reported less in AUM, on average, in the 2024 Report Card on Banks than in the 2023 retail bank research.

Advisors in the retail bank channel also reported a small dip in client numbers, with the average client roster shrinking to 270 in this year’s report, down from 275 last year. However, average AUM in this channel dropped in the period measured, unlike in the other channels, to $121.6 million from $134.9 million in 2023’s research. (This data excludes Bank of Nova Scotia, as its individual advisors can’t report asset totals.)

The 2024 Report Card series data pointed to a general shift toward higher compensation, reported as of Dec. 31, 2023. While the proportion of advisors in the highest-paid segment (more than $1 million in annual pay, including bonuses) remained almost flat (at 17.4%), the share that reported making between $500,000 and $1 million per year rose to 21.1% from 19.3% a year ago.

This increase among the share of advisors in the $500,000–$1 million category came as the proportion of advisors in the lowest-paid segment (less than $250,000 per year) shrank to 40.8%, from 43.0%, showing some migration from the bottom end of the pay scale to the upper half.

Similar trends were evident in the channels individually, although the distribution of advisors across compensation categories varied widely. For example, the share of brokerage advisors who reported earning more than $1 million per year rose a bit, to 32.4% in this year’s report from 31.7% in last year’s.

The share of brokerage advisors in the preceding range ($500,000 to $1 million) also climbed, to 31.4% from 29.3%. These increases came as the share of brokerage advisors in the sub-$500,000 categories decreased, on average.

Among dealers, the share of advisors who belonged to the lowest-paid category was 47.7%, down from 49.4% in last year’s report. Meanwhile, the share of advisors in that channel who said they earned more than $1 million per year was down as well. The share in the $500,000 to $1 million category climbed to 19.0% this year, from 16.2% in 2023’s research.

The same basic trend was evident among the retail bank advisors, although the shift in that group toward higher compensation occurred in the $250,000 to $500,000 category. This year’s report found that 10.2% of bank advisors reported that they are now in that pay bracket, up from 7.6% a year ago.

No retail bank advisors reported earning more than $1 million per year, and only a handful said they took home more than $500,000.

The increase in the share of these advisors that occupied the $250,000 to $500,000 range came out of the sub-$250,000 group, which still accounted for the vast majority of the retail bank group’s advisors (89.4%, compared with 91.2% in the 2023 report).

While the research indicated much of the financial advice industry hasn’t added significant assets in the past two calendar years, many of the advisors surveyed still managed to boost their productivity and enhance their compensation.

Click image for full-size chart

This article appears in the November issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.