The 2021 Advisors’ Report Card (ARC) has revealed an industry that persevered in the face of unprecedented challenges. Advisors across the four segments included in this year’s research indicated that their firms continued to offer stable environments in which they could grow and adapt.

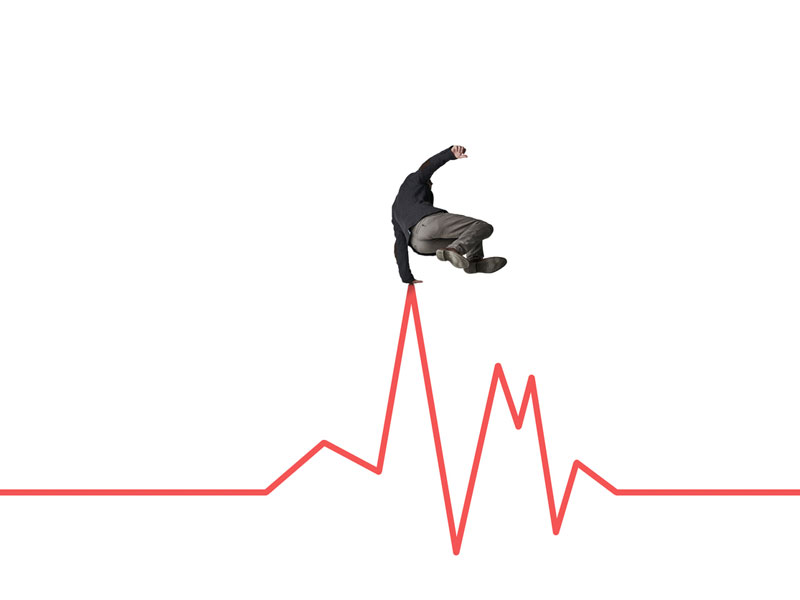

The ARC, which brings together data averages from categories that apply to each of the brokerage, dealer, retail-bank and insurance Report Cards, offered up positive headline ratings. Not only was the collective performance average of the 30 categories rated by advisors higher than in 2019, at 8.4 compared with 8.1, but none of those category performance ratings fell significantly (by 0.5 or more) in that same period. (The ARC wasn’t produced in 2020 due to the pandemic.)

Of the 27 categories that were used in both the 2019 and 2021 ARC, the performance ratings of the vast majority (23) actually rose by at least 0.1 over the past two years, and three had ratings that rose significantly. Those three were “Mobile technology support,” “Social media support” and “Business development support” (rated 8.1, 7.5 and 7.8, respectively, up from 7.6, 6.9 and 7.2).

The categories’ importance ratings also increased noticeably. For the mobile technology and social media categories, advisors gave importance ratings of 8.9 (up from 8.1 in 2019) and 7.2 (up from 6.5).

“Our industry is always behind the times. Everyone should be able to get an investment app or insurance app. Everything should be accessible on an app in today’s world,” said an advisor in Ontario with insurance agency Canada Life, about mobile technology. (In 2021, the category’s satisfaction gap — the amount by which the importance of a category exceeds its performance — rose to 0.8 from 0.5).

“I can see it becoming more important each year, [although] it’s not that important to my client base. [My firm] is revamping things now,” said an advisor in Atlantic Canada with dealer firm Assante Wealth Management (Canada) Ltd., also about mobile offerings.

As for social media, the vast majority of advisors continue to struggle with the strict industry-wide compliance regime, and they want solutions.

“I wish I could do a lot more,” said an advisor in Ontario with brokerage firm Edward Jones. “I would like to be able to do [more on] LinkedIn and I’d like to be able to do live chats on Instagram. I’d like to show more personality with text and on social media platforms.”

The two categories with the largest satisfaction gaps were “Back office & administrative support” (rated 7.6 for performance and 9.3 for importance, resulting in a gap of 1.7) and “Technology tools & advisor desktop” (rated 7.8 and 9.3, with a gap of 1.5). These gaps have persisted for years, although advisor dissatisfaction was especially acute in 2021 due to the pandemic.

Across the four Report Cards, back-office issues were related to processing delays and staffing shortages. Technology transitions also became more difficult to stomach as advisors worked remotely.

On the subject of technology overall, one advisor in Ontario with bank-owned brokerage ScotiaMcLeod said: “Firms [are] rolling out a lot of great tech; there’s significant change for advisor teams. The next stage is going be making sure we’re all utilizing it at a high level.”

The categories among the best-performing and most important included many long-time entries such as “Freedom to make objective product choices” (rated 9.3 for performance and 9.7 for importance) and “Leadership stability” (rated 8.9 and 9.1) — both of which had stable or improved satisfaction gaps.

Advisors have tended to value stability even if they’re independent. “It’s important to maintain that leadership, especially when the economy is changing so much,” said a retail-bank advisor in Alberta with CIBC Imperial Service.

Two categories with improved satisfaction gaps compared with 2019 were “Effectiveness in keeping advisors informed” (0.4 in 2021, down from 0.7 two years ago) and “Receptiveness to advisor feedback” (0.9 down from 1.1). This is perhaps unsurprising, given that firms in all segments went to great lengths over the past 18 months to stay connected with their advisors.

But changes in advisor needs were evident. As one advisor in Ontario with dealer firm Investment Planning Counsel Inc. said, “I think the industry is changing and our advisor team is changing, to the point where we’ll need less stability from [firm management].” That advisor said back-office and compliance support both matter, but that “the rest is less important.”

For advisors who continue to value firm leadership and direction, execution matters. “Stability is one thing; leadership is another,” said an advisor in Atlantic Canada with bank-owned brokerage BMO Nesbitt Burns Inc., who added that advisors want to know their concerns are being heard.

Advisors in all segments were asked to rate their firms’ pandemic support on a scale of zero to 10. The average rating for the industry was 9.0, and the averages for each of the brokerage, dealer, retail-bank and insurance spaces were close: the insurance agencies came out on top at 9.2, followed by the brokerage firms (9.1), dealer firms (8.9) and retail-bank divisions (8.8).

Advisors across all firm types weren’t shy about recommending improvements to technology and firm communications. Still, advisors noted that they were able to maintain client connections effectively. Others deeply appreciated that firms had relaxed growth targets and offered mental health support.

“For a small firm, we did a great job. We don’t have the assets a bank would, but I think we had a fantastic response. For our clients, we’ve done everything we could do,” said an advisor with independent brokerage Leede Jones Gable Inc.

“They would send cards in the mail, little gift packages, [and] have people phone to see how you’re doing. I couldn’t believe that,” said an advisor in Ontario with dealer firm Worldsource Wealth Management Inc. “Here, you actually feel like people care.”

As in all past Report Cards, advisors were asked how likely they would be to recommend their firms to peers on a scale of zero to 10 (with 10 being the most likely). In this year’s ARC, those recommendations were used to determine a firm’s Net Promoter Score (NPS).

Firms with the highest NPS across the research series were generally those that had the highest IE ratings (the average of all of a company’s category ratings, excluding NPS) in their respective Report Cards.

Overall, brokerage firms stood out. Seven of the 10 top firms by NPS — all of which had scores of more than 70.0, a threshold that’s considered exceptional — were Brokerage Report Card firms. The remaining three in that group were from the Dealers’ Report Card and Insurance Advisors’ Report Card.

Most advisors surveyed in 2021 generally wanted a firm that could innovate and grow, while also remaining attentive — regardless of firm size. That’s not an easy order, but one of Odlum Brown Ltd.’s advisors put it this way: “In the time that I’ve been here, there’s been constant improvement. IT [has been] ramped up in the last three to four years.” They added, “A firm like ours needs to keep up. It’s tough to be independent these days, but we’re really using that to our advantage [as] a point of attraction.”