This article appears in the Mid-October issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

Crafting comprehensive financial plans remains an essential service for advisors across the industry.

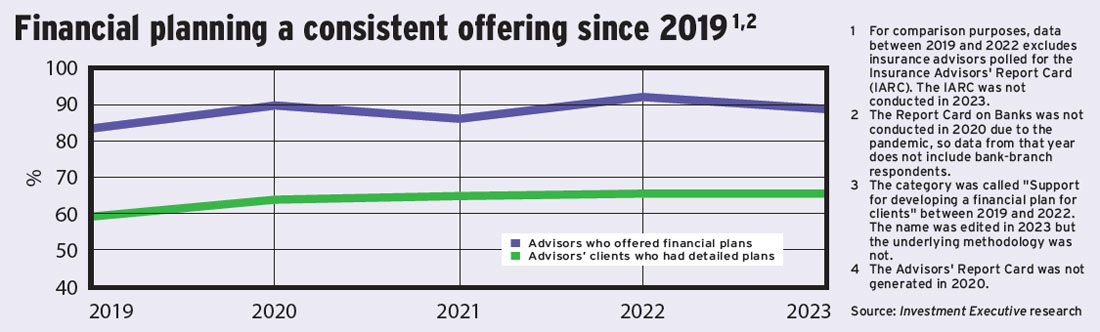

Over the past five years, a consistently high percentage of advisors across the brokerage, dealer and retail bank channels have said they offer planning services. That has led to a growing percentage of their clients having detailed plans (see chart).

Most firms have been responding by investing in tools and hiring experts. But as the industry shifts, so too do the needs of advisors and investors.

Here’s what advisors had to say:

“The firm has made a commitment to providing a total wealth experience. We’ve hired experienced [chartered accountants]. We have a great team now for the complex planning work.”

– brokerage advisor in Ontario

“We have an excellent financial planning department, but they’re very overwhelmed. [There’s] just a lack of support for the service.”

— brokerage advisor in British Columbia

“They’ve added a [financial planning] person recently who I can contact whenever I want. [That person can] give me tips on improving my plans. And they already had a support line, but now they have a dedicated person just for my region. The support was already good and now it’s gotten better.”

— retail bank advisor in Ontario

“They give us support for software but not support for actual financial planning.”

— retail bank advisor in the Prairies familiar with CFP designation requirements

“I use third-party software and support; it’s hard for any dealer to appeal to everybody. Every advisor has different skill sets and knowledge. I think they have done nothing just because they can’t please everyone.”

— dealer advisor in B.C.

“Add [too] many data points and [planning] doesn’t become relevant. The client won’t sit and give you all that data information; usually clients are very vague. Trying to do plans with too many data points will be hard and not beneficial.”

— dealer advisor in Ontario

“My job is to give my clients the highest probability of meeting their financial goals. I’m not a superstar or a stock jockey. The science of accumulating wealth is different from the science of staying wealthy.”

— brokerage advisor in Ontario

“There could be more [planning] customization. [The firm] strictly [uses] the FP [Canada] guidelines, which are not in line with the current [interest rate] environment. [With my previous firm], we had to be flexible and customize to client scenarios. You can’t just use one-size-fits-all.”

— brokerage advisor in Alberta

“[My firm] doesn’t really have a [good] tool, and I could really use one. What they have is too confusing. It takes so much time to navigate.”

— dealer advisor in Atlantic Canada