Fears of a recession are weighing on Canadian financial services companies.

All sectors except insurers experienced a year-over-year earnings decline in the quarter ended March 31, according to Investment Executive’s quarterly profit survey. Four of five lifecos reported higher net income, while two of the property, casualty and mortgage insurers posted a gain.

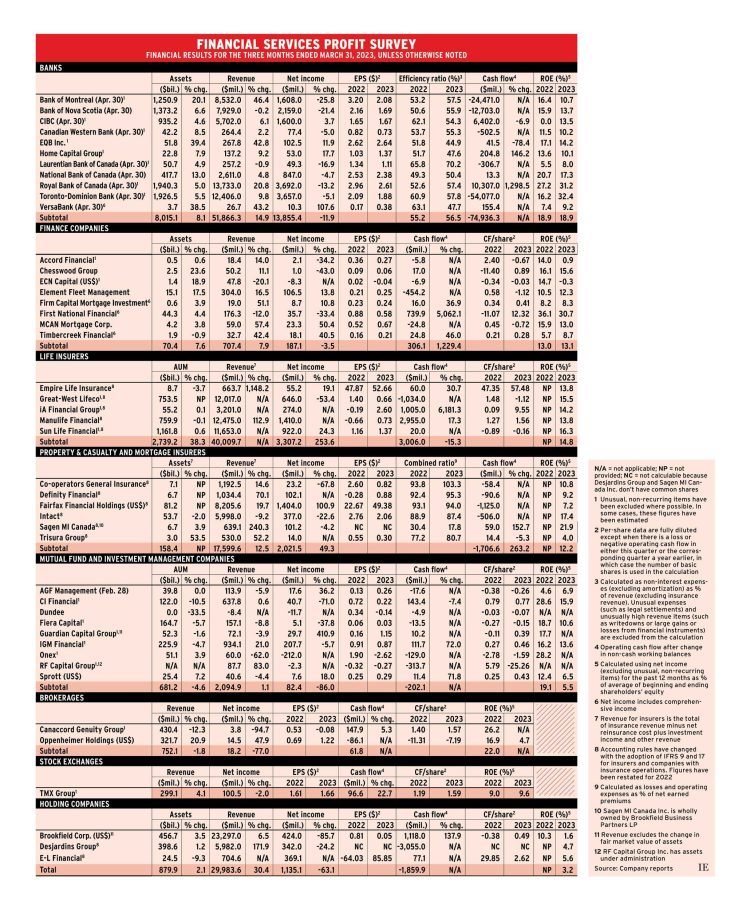

Eighteen of 43 companies reported improved year-over-year financial results, while 21 had lower net income and four were in a loss position. (These figures exclude Empire Life Insurance Co., whose results are included in E-L Financial Corp.’s, and Sagen MI Canada, which is included in Brookfield Asset Management Ltd.’s.)

Nevertheless, 13 companies increased their dividends, indicating optimism about future earnings. That included eight banks, three lifecos, AGF Management Ltd. and Guardian Capital Group Ltd.

Consolidation continued in the quarter, with Bank of Montreal completing its acquisition of U.S.-based Bank of the West, and Smith Financial Corp. in the process of acquiring Home Capital Group Inc. Great-West Lifeco Inc.’s subsidiary Canada Life Assurance Co. plans to buy Investment Planning Counsel from IGM Financial Inc. by the end of 2023, while Desjardins Group is buying Guardian’s three Worldsource companies.

One acquisition that isn’t going through is Toronto-Dominion Bank’s merger with U.S.-based First Horizon Corp. That’s because TD didn’t have a timetable for regulatory approval. In addition, a management-led bid to buy Canaccord Genuity Group Inc. has expired.

There were also asset sales. Sun Life Financial Inc. completed the sale of its U.K. business on April 3 and CI Financial Corp. announced it was selling its minority stake in U.S.-based Congress Wealth Management Inc., as well as a 20% stake in its U.S. wealth management business.

Here’s a look at the sectors in more detail:

Banks

Only four of the 11 deposit-taking institutions reported higher earnings and, with the exception of CIBC, it was smaller companies reporting gains.

The average decline in net income for the 11 banks was 11.9%, primarily due to loan-loss provisions (LLPs). These totalled $3.7 billion in the quarter vs. only $284 million a year earlier. The drop in the banks’ total net income was $1.9 billion.

The increase in LLPs is partly because they were unusually low a year earlier after banks overestimated what was needed during the pandemic. But this quarter’s LLP of $3.7 billion is more than $1 billion higher than the pre-Covid norm of $1.5 billion–$2.5 billion. The banks are being cautious given the possibility of a recession.

Eight banks still felt optimistic enough to raise their quarterly dividends: five of the Big Six (TD was the exception), Canadian Western Bank, EQB Inc. and Laurentian Bank of Canada.

Finance companies

Results were mixed. Four companies increased their earnings, ECN Capital Corp. reported a profit vs. a loss the year before and three saw earnings drop — all by 33% or more.

ECN is reviewing what it calls “strategic alternatives to maximize value for shareholders.” Its recent financial report said these alternatives could include “a sale of the company or one of its business units, strategic funding arrangements and capital relationships.”

Life insurance

Only GWL had lower earnings. Empire Life Insurance Co. and Sun Life had higher earnings, and iA Financial Group Inc. and Manulife Financial Corp. reported positive net income compared to a loss a year earlier. Empire, iA and Sun Life increased their dividends.

Accounting rules have changed for insurance companies and data was only restated as of Jan. 1, 2022. That means there is no return on equity calculable for the year ended Mar. 31, 2022.

Property, casualty and mortgage insurers

Four firms saw earnings drop. Definity Financial Corp. reported positive net income vs. a loss the year before, and Fairfax Financial Holdings Ltd. had a 100.9% increase in net income.

Fairfax emphasizes the investment side of its operations, including using derivatives. As a result, investment performance is usually the main driver of earnings. In this quarter, the company had US$771.2-million in gains in the fair value of investments vs. a loss of US$195.2 million a year earlier.

Mutual fund and investment management firms

Of the nine firms, just AGF, Guardian and Sprott Inc. reported higher earnings. Three had lower net income and three were in a loss position.

Guardian’s massive 410.9% earnings gain came from a large increase in fair market gains in its corporate investment portfolio. That doesn’t include its gain on the sale of the Worldsource companies, which is excluded as a non-recurring item.

All three big independent mutual fund companies — AGF, CI Financial Corp. and IGM Financial Inc. — had positive net sales in the quarter.

Brokerages

Oppenheimer Holdings Inc.’s net income was way up while Canaccord Genuity Group Inc. reported a big decline in earnings. Oppenheimer had a small 1.3% decline in investment banking revenue while Canaccord’s drop was 53.2%.

Exchanges

TMX Group Ltd. had a 2% drop in net income.

Holding companies

E-L Financial Corp. reported positive net income compared to a loss the year before, while both Brookfield Corp. and Desjardins saw earnings fall.

Desjardins’ personal and business services had a small increase in net income, while both wealth management and life & health insurance, and property & casualty insurance, saw a deterioration in earnings.

E-L’s results reflect those of subsidiary Empire Life as well as fair market value gains of $323 million compared to a loss of $462 million a year earlier.

Brookfield’s earnings were also pulled down because its gains in fair market value were only US$38 million, way down from US$1.8 billion a year earlier.

Insurance accounting changes: what you need to know

Canadian insurance companies implemented IFRS 17 on Jan. 1, 2023. These major changes to the accounting rules affect the calculation of most major metrics. Insurers have provided restated figures for the previous year but not for earlier periods.

The changes are meant to create greater transparency, particularly for the two sides of insurers’ operations: underwriting, and investing the assets that back up contract liabilities. While reporting templates differ by insurer, in general, there is no longer a total revenue line but rather lines pertaining to “insurance revenue,” “net insurance serve result” and “net investment result,” with related expenses deducted in both cases. There also is a line for “other revenue.” In our Profit Survey, we have calculated total revenue for insurers in a way similar to how we calculate the revenue provided by other financial services companies.

IFRS 17 introduced a new concept for the lifecos: the contractual service margin (CSM). This is a measure of the potential future income of existing insurance contracts and is represented as a liability on the balance sheet. CSM is calculated for new business each quarter and added to the CSM balance.

Other changes to the CSM over a reporting period include the release of CSM into profit, experience gains and losses, changes in actuarial assumptions and the impact of markets.

CSM is not widely used for property and casualty insurers because they don’t typically have long-term contracts. P&C companies continue to measure their current underwriting profitability with a slightly changed combined ratio.

The insurers also adopted IFRS 9, which deals with the measurement of financial instruments and had already been adopted by Canadian banks.