Bob Lyon, senior vice-president and portfolio manager at Signature Global Asset Management, says that in times of weak natural-resource prices, companies with low-cost assets and high-quality management can still make money for shareholders.

A long-standing natural-resources specialist, Lyon has seen both the boom times in commodities and the periods of price declines. He says companies that are proficient in allocating capital are using the cyclical slowdowns and lower commodity prices to cull weak assets, buy strategic assets from weaker companies and improve operating efficiencies. This, he adds, establishes a strong base to allow these companies to take full advantage of a rebound in the commodity price. “These are the types of companies that we are looking to add to the portfolio.”

Over the long haul, a key determinant of natural-resource prices is the marginal cost of producing the commodity, says Lyon. “This is the price necessary to bring production to market.” The commodity price can vary above or below the marginal cost for shorter-term reasons, he says.

At around US$1,200 per ounce, gold bullion has been trading at close to its marginal cost for some time, says Lyon. “The price of gold is less tied to the economic cycle than the price of many other natural resources,” he says. “It is more reliant on investor sentiment and on central-bank activity.”

After a nine-year bull market, bullion peaked in the fall of 2011 to reach around US$1,900, says Lyon. It then fell for three years into 2014 in the face of weaker demand and a rising U.S. dollar. “There were large sales by bullion exchange-traded funds.”

Base metals, such as copper and iron ore, are economically sensitive and have seen their prices decline in recent years, Lyon says. This weakness is “a reflection of tepid global economic growth, including the marked slowdown in China’s growth.”

Copper, he says, has seen its price drop from above US$4.50 per pound in mid-2011 to around US$2.80 recently. “As such it is now trading at close to its marginal cost of about US$3 per pound.”

The price of iron ore, which has continued to decline into 2015, is trading at lower than the marginal cost of many of the higher-cost producers, says Lyon. This commodity recently traded at US$52.90 a tonne.

The oil price, he notes, has been halved since mid-2014 to around US$50 a barrel. Looking at the United States, which has been a significant source of incremental global production, the marginal cost of its production is about US$75 per barrel. “This is far cry from oil’s US$140-per-barrel peak in June of 2008, one month before the start of the global financial crisis.”

The natural-gas price has been languishing at low levels for quite some time, says Lyon. “Low gas prices are now built into the share prices, so this provides a good hunting ground for new ideas in the energy sector.”

Signature Global Asset Management is a separate portfolio-management group under CI Investments Inc.’s umbrella. Lyon, who was a key member of Signature’s team from 1999 to 2006, returned to the group last fall. At Signature, Lyon is lead portfolio manager of CI Signature Global Resource, CI Signature Global Resource Corporate Class, CI Signature Global Energy Corporate Class and CI Signature Gold Corporate Class. He is also responsible for the natural-resource equity holdings in other Signature funds.

At the end of February, Signature Global Resource, with 56 names, had 43.1% in Canadian equities, 38.8% in U.S. equities and 8.9% in international equities. Looking at sectors, the fund had 59% in energy, 31.9% in materials and 4.9% in a gold-bullion ETF, SPDR Gold Shares GLD.

Lyon’s investment style is growth at a reasonable price. In stock selection, his focus is on companies “with quality assets and a management team that is disciplined in managing the company’s capital and is respectful of equity holders.” Management, he says, “must demonstrate its ability to enhance the company’s return on invested capital throughout the economic cycle.”

Two significant gold stock holdings in CI Signature Global Resource are Canada’s Goldcorp Inc. (TSX:G) and Franco-Nevada Corp (TSX:FNV). The latter is a gold-focused royalty company and, as such, “is a defensive holding.” Goldcorp is a producer with properties in Canada, the United States, Mexico, and South and Central America. “The company has low-cost assets and a management team that it is relatively proficient at capital allocation.”

Many gold-producing companies have historically not been good at generating “decent returns on invested capital,” says Lyon. This is one reason why the portfolio continues to have a significant position in the SPDR Gold Shares, a direct play on the bullion price.

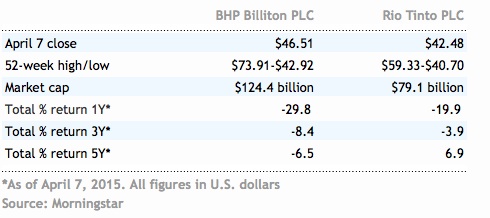

“Given the low price of iron ore, the only way to invest in this base metal is through low-cost producers,” says Lyon. A top-10 and “core holding” in the portfolio is Rio Tinto PLC, which has an American Depository Receipt (ADR) and trades on the New York Stock Exchange under the ticker RIO. “Rio Tinto can produce iron ore at a cash cost that is less than half the current spot price for the commodity.”

Another top-10 holding is BHP Billiton PLC, which has an ADR that trades under the ticker BBL. This globally diversified mining company is a significant iron-ore producer, says Lyon. The company, he says, is spinning off its unwanted assets including its holdings in nickel, manganese and aluminum into a separate company so as to concentrate on core areas — copper, iron ore, metallurgical coal, energy and potash. “In this way BHP Billiton will become more efficient with a slightly less diversified asset base.”

Also in the mining industry, Canada’s Lundin Mining Corp. (TSX:LUN) is a top-10 holding in Signature Global Resource. Examples of its holdings are its 24% stake in one of the world’s leading copper and cobalt resources, Tenke Fungurume in the Democratic Republic of Congo, and its recently acquired Candelaria mine in Chile. It also owns the Neves-Corvo copper and zinc mine in Portugal. “Lundin continues to grow its copper production and is one of the cheapest copper stocks,” Lyon says.

In energy, Lyon has been concentrating on U.S.-based producers, which have significant land positions in leading resource plays on both sides of the border. Major holdings in CI Signature Global Resource include Devon Energy Corp. (NYSE:DVN), EOG Resources Inc. (NYSE:EOG) and Pioneer Natural Resources Co. (NYSE:PXD).

Devon Energy is “an inexpensive stock,” says Lyon, adding that the company has assets in several top North America energy plays. These include the Barnett Shale play, which is in the Fort Worth basin of north Texas, the Permian basin in west Texas and southeast New Mexico, and the Eagle Ford play in south Texas. Devon also has “a good heavy-oil footing” in its Jackfish properties in the Alberta oil-sands.

EOG has “one of the most outstanding management teams in both the Canadian and U.S. energy industries,” says Lyon. The company has large, core holdings in the Eagle Ford, the Bakken and the Permian Basin. Pioneer, for its part, has “a major footing in the fast-growing Permian Basin,” he says. Lyon reports that he has added to his holdings in EOG and Pioneer since the beginning of the year.

Lyon has reduced the portfolio’s holding in Whiting Petroleum Corp. (NSYE:WLL), which was another significant U.S. energy holding. “I took advantage of the recent surge in the stock price following reports that the company had put itself up for sale.” Whiting Petroleum has assets in the U.S. Bakken and Niobrara formations.