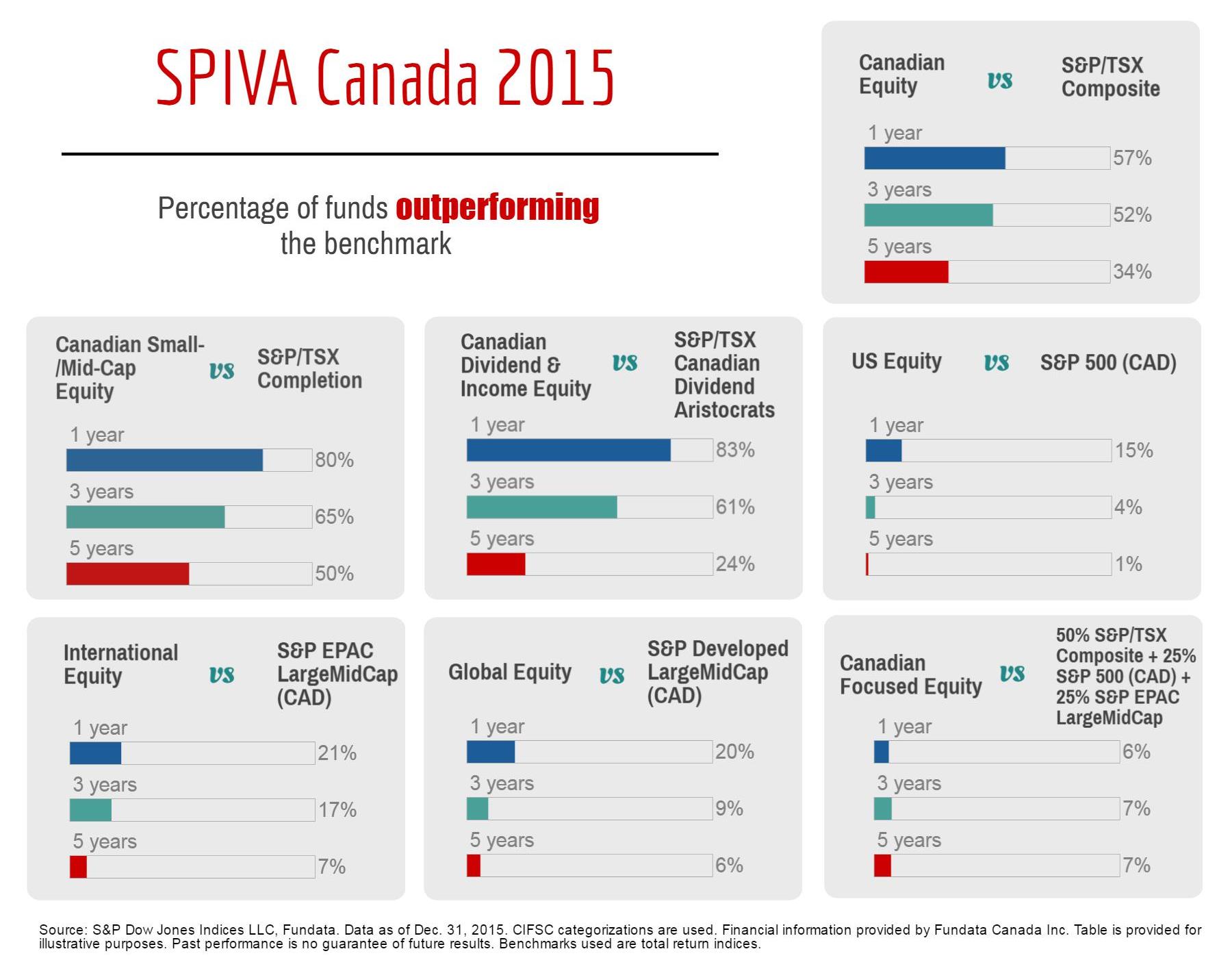

The majority of active equity managers investing in domestic equity fared better than their respective benchmarks, with more than 57% of Canadian equity funds outperforming the S&P/TSX composite index, according to the year-end 2015 results for the S&P Indices Versus Active Funds (SPIVA) Canada Scorecard.

New York City-based S&P Dow Jones Indices released the scorecard results on Monday.

The dividend and income equity category performed especially well, with more than 82% of funds outperforming the S&P/TSX Canadian dividend aristocrats index.

The one-year data also show favorable results for actively managed funds in the Canadian small-/mid-cap equity category, with 80% of managers outperforming the benchmark, the S&P/TSX completion index.

However, only 6.06% of managers in the Canadian focused equity category outpaced the blended index, which allocates 50% of its weight to the S&P/TSX composite, 25% of its weight to the S&P 500, and 25% of its weight to the S&P EPAC largemidcap.

Managers investing in the international equity space fared unfavorably, according to the scorecard.

The majority of active managers in the international equity category saw their returns lag the benchmark, as only 21 of international equity managers beat the S&P EPAC largemidcap index over the 12-month period ending Dec. 31, 2015.

Similarly, only 19.64% of global equity managers had higher returns than the S&P developed largemidcap benchmark during the same period.

The SPIVA Canada scorecard reports on the performance of actively managed Canadian mutual funds versus that of their benchmarks, corrected for survivorship bias. It also shows equal- and asset- weighted peer averages.

All index returns are total returns (i.e., include dividend reinvestment) in Canadian dollars.