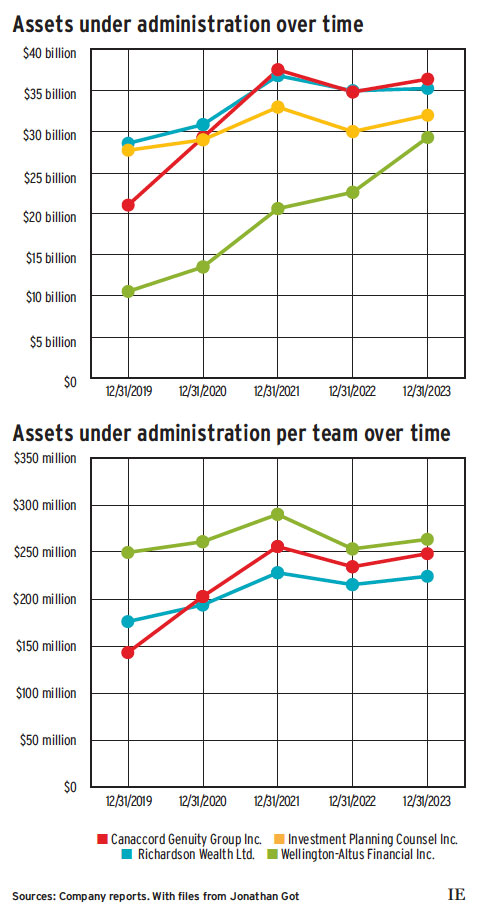

Winnipeg-based Wellington-Altus Financial Inc. has established a credit facility to fuel its growth goals.

The credit facility, from private credit funds managed by Los Angeles–headquartered Ares Management Corp., will provide Wellington-Altus with capital to keep adding advisor teams and making acquisitions of a “medium to large nature,” said Shaun Hauser, founder and CEO of Wellington-Altus, in an interview.

A company spokesperson said the firm has more than 110 advisor teams, which is up from 89 teams in 2022 — an increase of roughly 24%.

Acquisitions have been “few and far between, but when they happen, they’re additive,” Hauser said.

Last month, Wellington-Altus acquired investment management firm Wickham Investment Counsel Inc. in Ontario, adding about $200 million to seven-year-old Wellington-Altus’ $34.5 billion in assets under administration (AUA).

Wellington-Altus’ annual revenue now exceeds $300 million.

The debt partnership with Ares is “a byproduct of the evolution of our business progression,” Hauser said. “Looking for debt is a luxury of size that we’ve now attained.”

Debt-financed growth is particularly risky for a smaller firm if an unexpected event like a pandemic or bear market hits, he said: “All of a sudden, your debt covenants are defining your strategy.”

Wellington-Altus has so far financed its growth using public equity — to the tune of $125 million since 2021 — which has allowed the firm to “play the long game” and continue re-investing in the business, Hauser said.

When looking for a debt partner, Wellington-Altus focused on two factors: the amount of debt and the contract terms, including representations, warranties and covenants.

“Ares knocked both out of the park,” Hauser said.

Regarding the amount of debt, “We wanted a lot of bandwidth to continue to grow,” he said. “We shared with the folks at Ares our growth up until now and our projected growth.”

Hauser expects the firm to maintain its AUA growth average of about $4 billion to $6 billion per year.

“We believe we have Ares as a long-term partner and don’t need anyone else from a growth financing perspective for the foreseeable future,” he said.

The firm’s goal is to reach $50 billion in AUA by the end of November 2026.