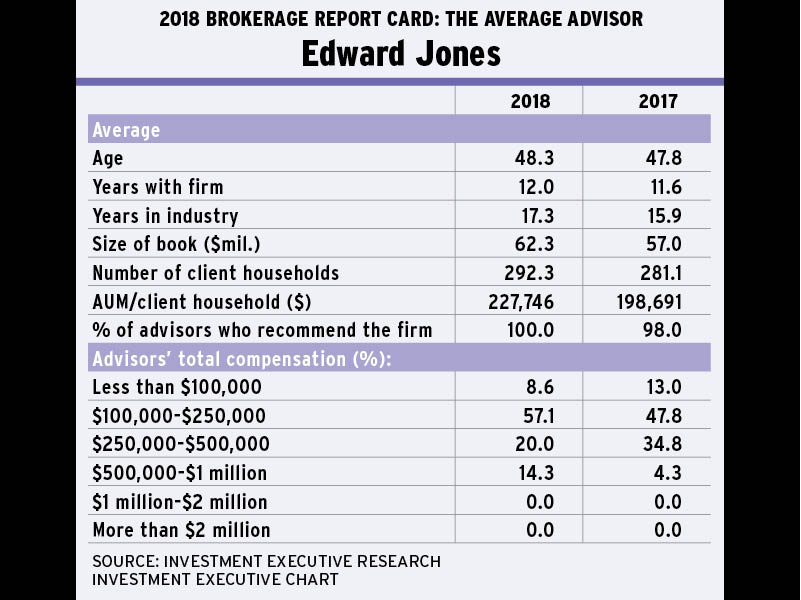

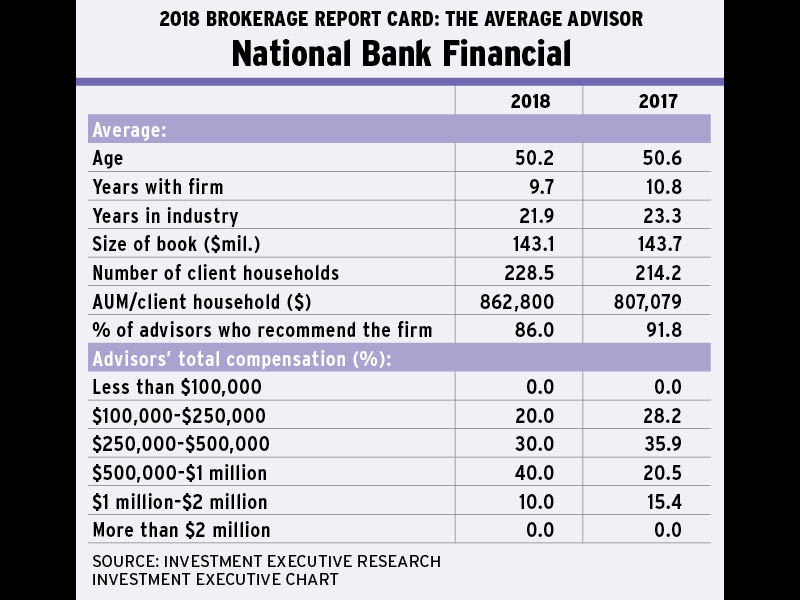

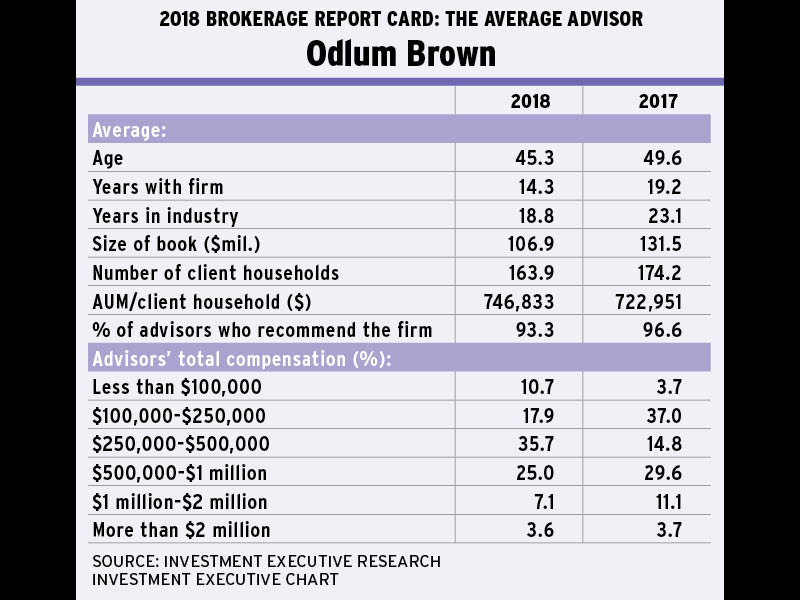

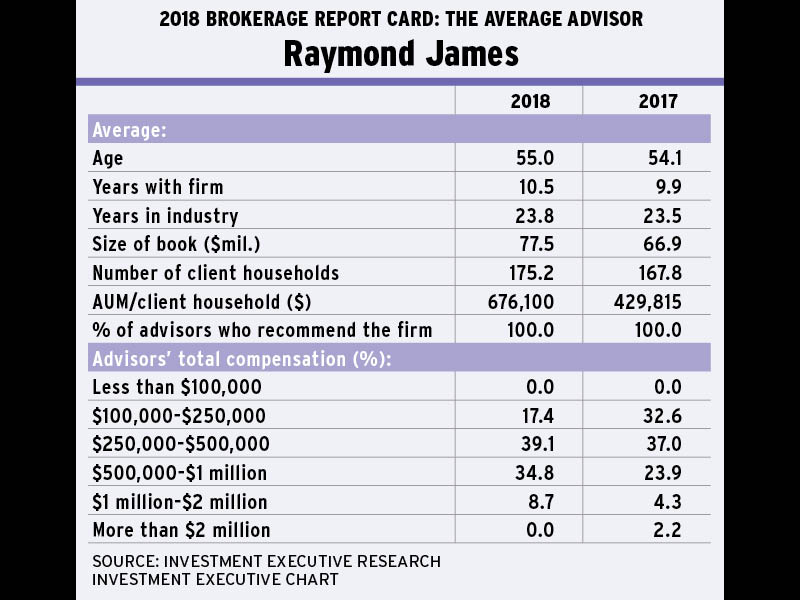

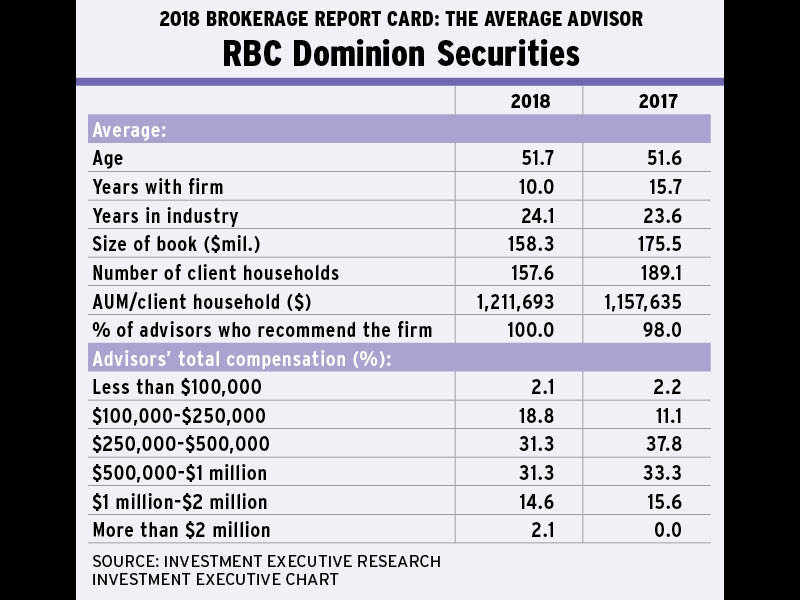

Although investment advisors surveyed for this year’s Brokerage Report Card have enjoyed strong growth in assets under management (AUM) and enhanced productivity as measured by AUM/client household, this positive momentum hasn’t been felt universally across the entire brokerage channel.

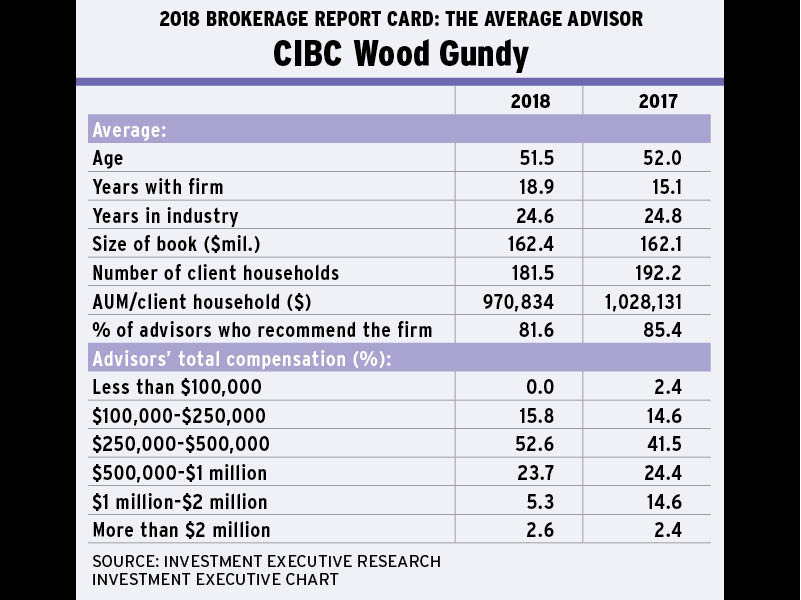

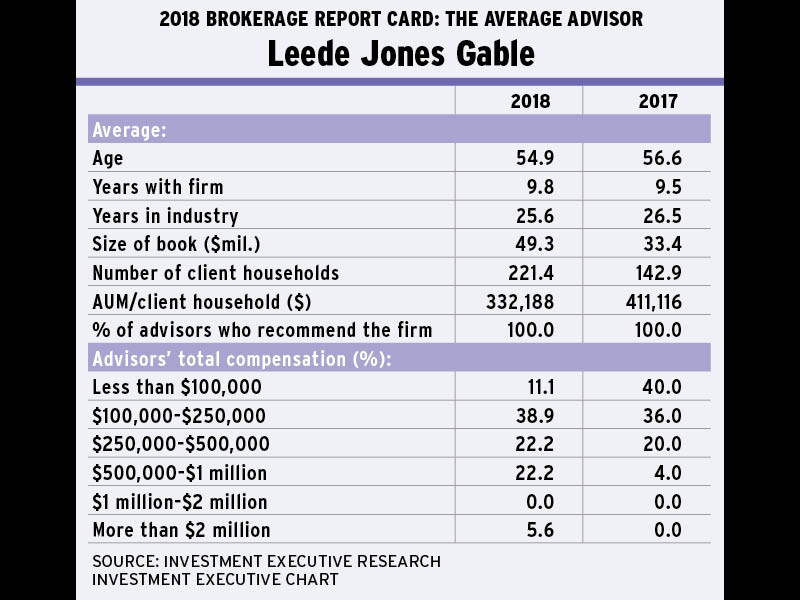

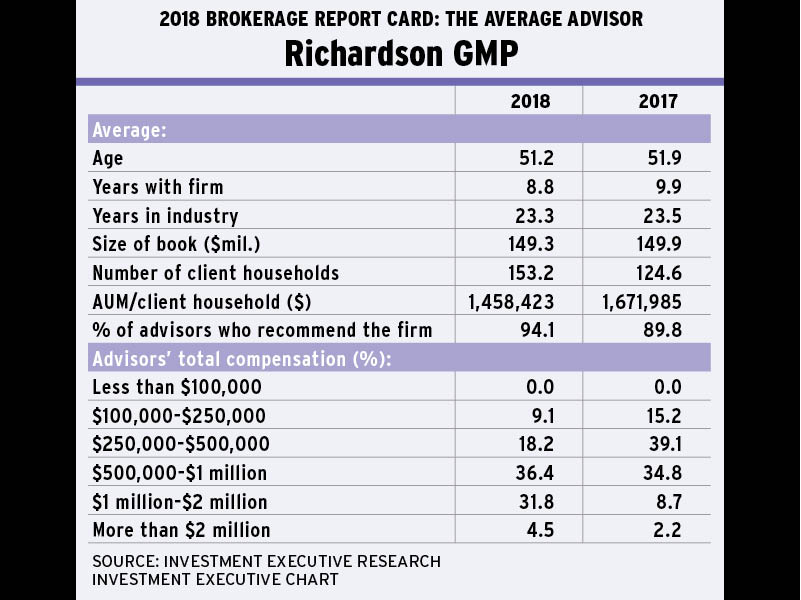

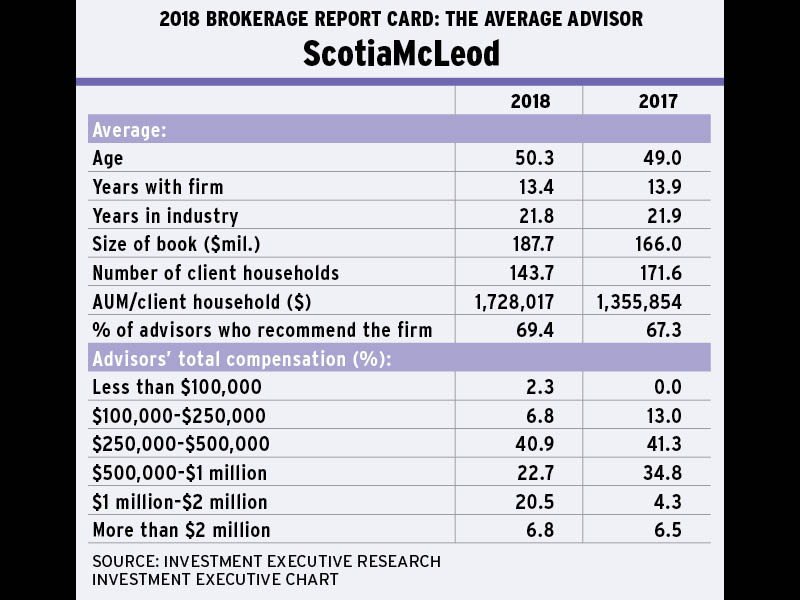

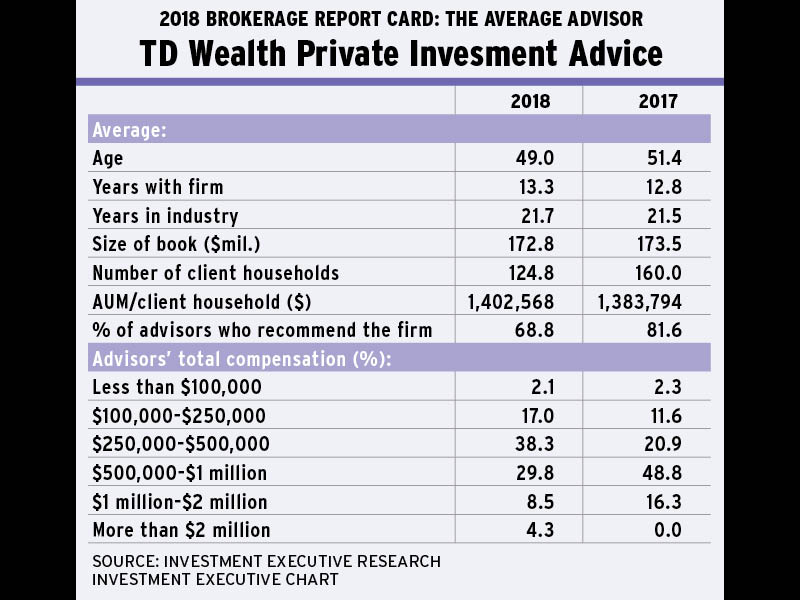

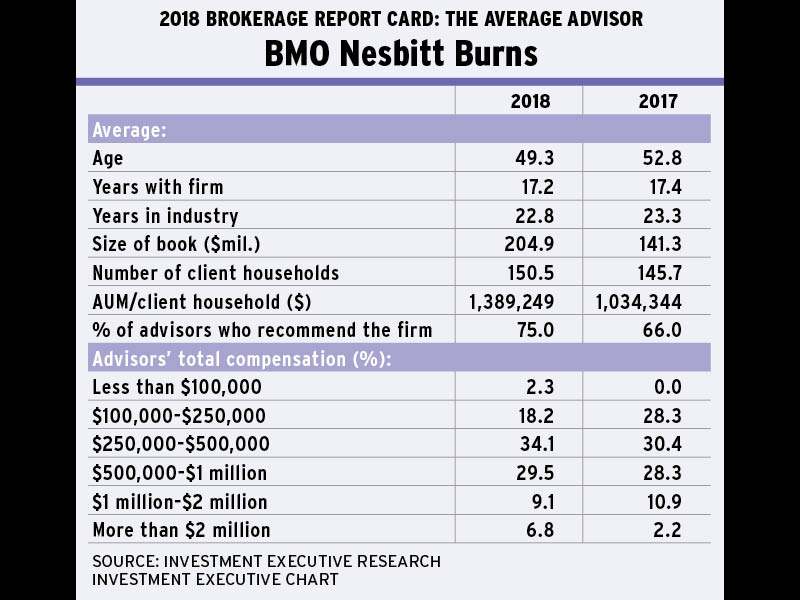

According to the data collected this year, advisors with some firms are doing better than others, and the underlying trends among these firms diverge quite widely. Specifically, advisors at some firms reported that AUM is stagnant, or has even declined a bit, compared with last year’s survey. As well, advisor productivity has declined a bit at a couple of firms.

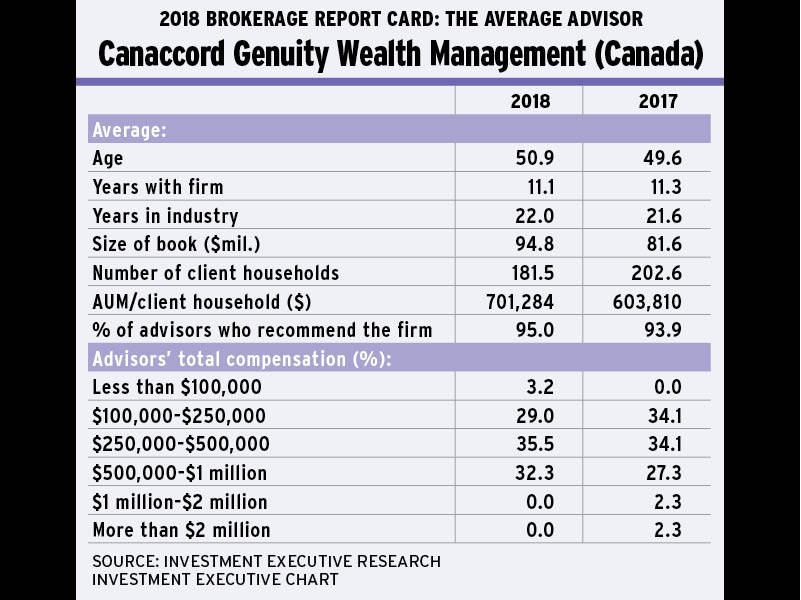

There are no clear trends to this in terms of the types of firms. A couple of the strongest gainers were bank-owned dealers (BMO Nesbitt Burns Inc. and ScotiaMcLeod Inc.), but there are other bank-owned dealers among the brokerage channel’s laggards. At the same time, advisors with some national independents, such as Raymond James Ltd. and Canaccord Genuity Wealth Management (Canada), also reported robust gains.

It’s also important to remember that when focusing in on the data for individual firms, sample sizes are inevitably smaller than for the overall average and, therefore, the data are noisier and less reliable. With that caveat in mind, this year’s survey reveals some of the disparate and diverging trends underlying the brokerage channel’s top-line growth.

View the slideshow to see how the average advisor for each firm measures up.