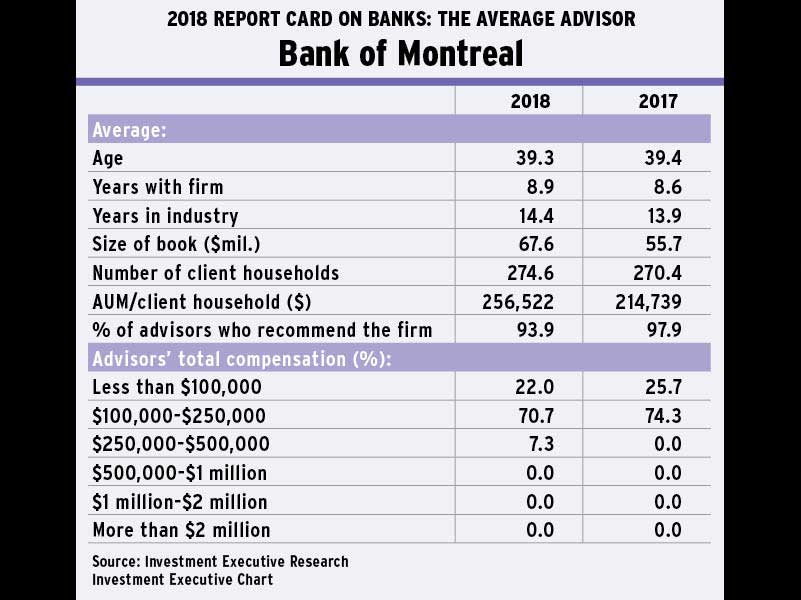

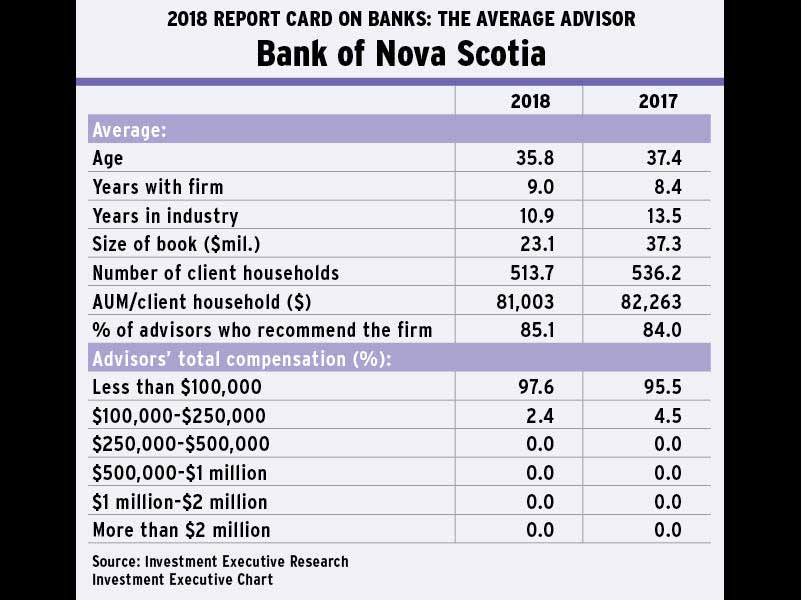

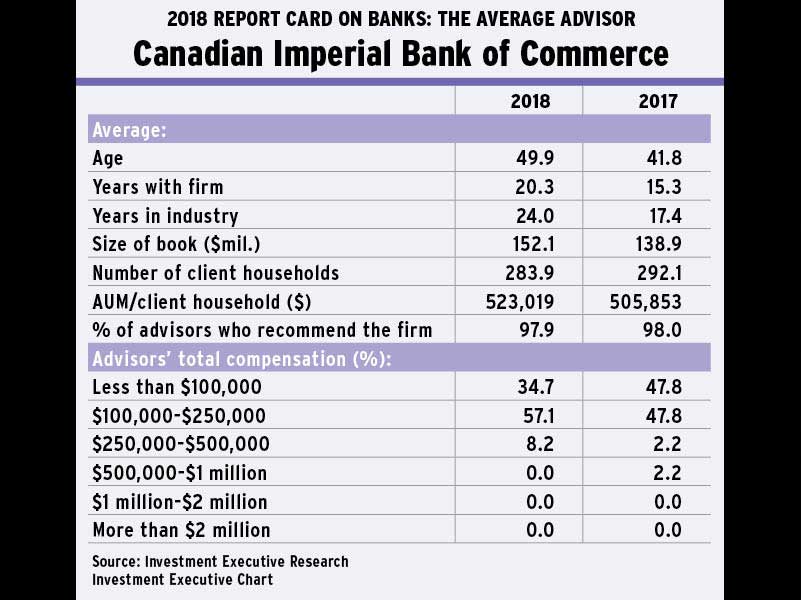

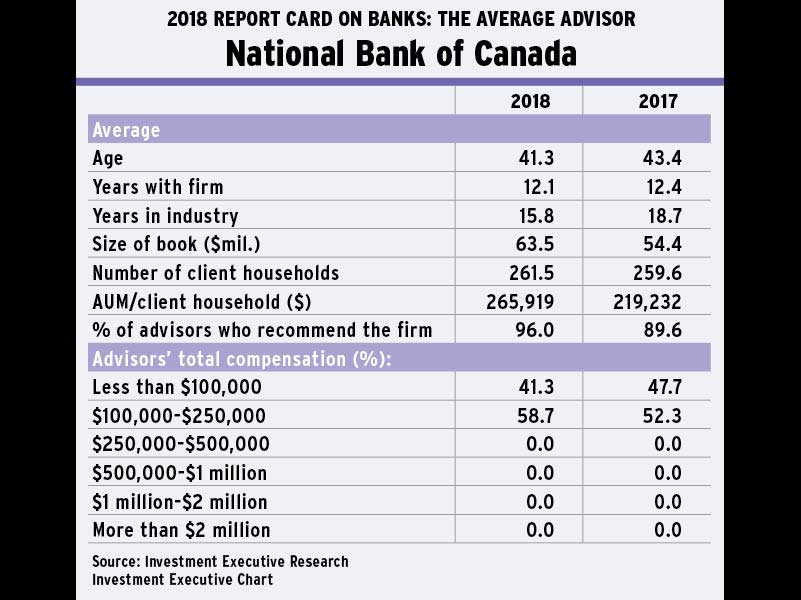

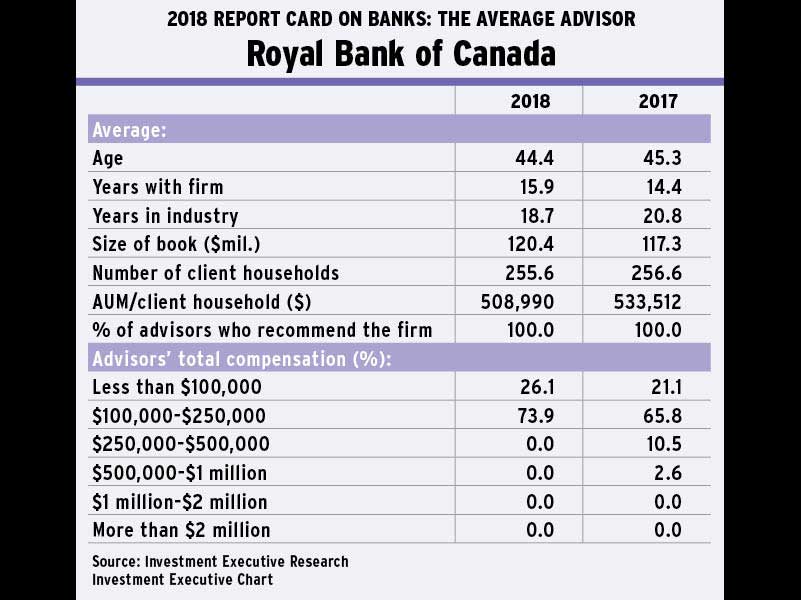

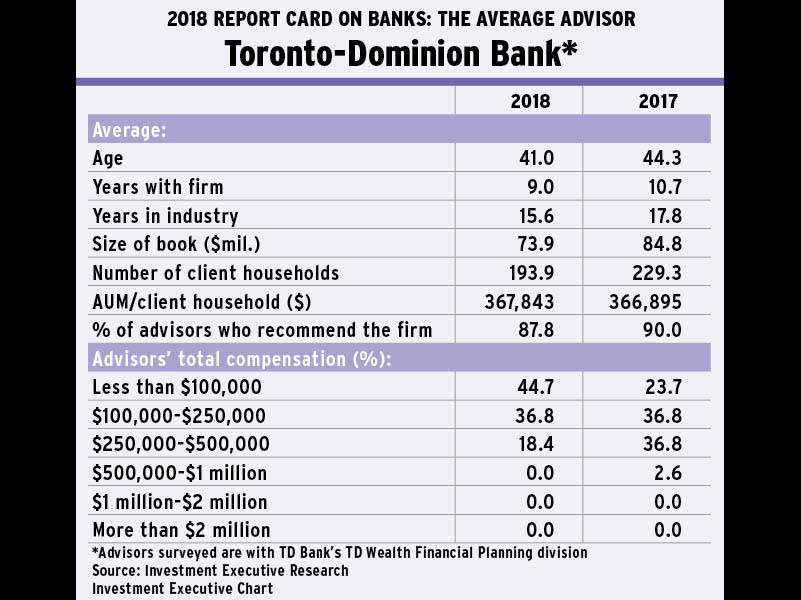

The wide disparity in the size and maturity of the books of business of financial advisors with Canada’s Big Six banks’ retail branch networks appears to be growing. In fact, Investment Executive’s (IE) latest annual survey of Canada’s banking channel finds that the broad gulf between the sales forces of the big banks is growing even larger.

Banks that field less experienced, less productive sales forces are skewing even younger. At the same time, banks with advisors who are older and whose books of business resemble those of their brokerage counterparts are maturing even further.

Given the relatively small sample sizes involved, the data should be interpreted cautiously; but, with that caveat, the banks are taking increasingly distinct approaches to their branch-based investment businesses.