When insurance advisors are asked whether they would recommend their agencies to another advisor, their response is likely to be an overwhelming “yes.”

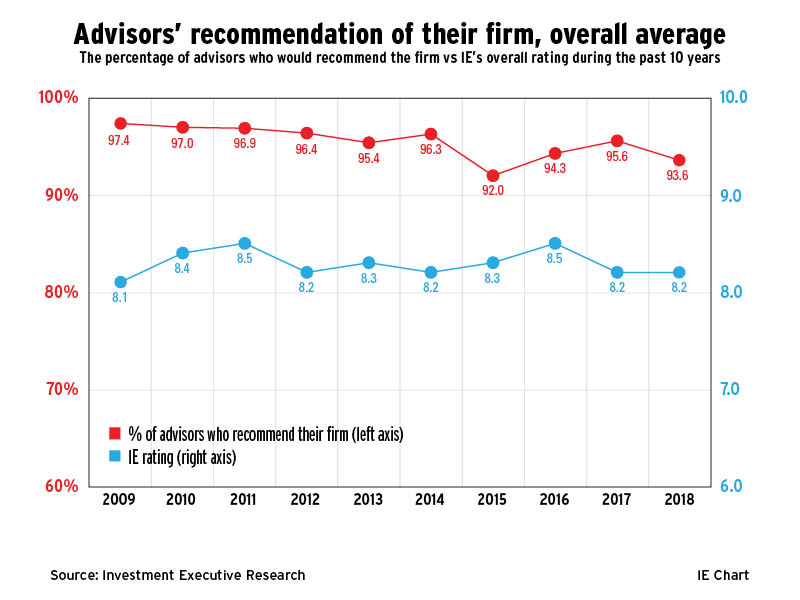

In fact, during the past 10 years, 92% or more of advisors surveyed for Investment Executive’s annual Insurance Advisors’ Report Card said they would make just such a recommendation. However, that recommendation is perhaps a little less hearty today than it has been in previous years.

In addition, the overall average IE rating in the Report Card also has remained fairly stable during the past decade, within a range of 8.1 and 8.5. This could be part of the reason why advisors are willing to recommend their firm (Each insurance agency included in the Report Card — whether it’s a dedicated sales agency, a personal producing general agency [PPGA] or a managing general agency [MGA] — has an IE rating every year. This rating is the average of all categories for which a firm received a score on the main ratings table; the overall average IE rating is the average of every firm’s IE rating.)

This slideshow takes a closer look at some of the reasons why insurance advisors are so keen to recommend their insurance agencies, and why they’re hesitant to do so sometimes, compared with each insurance agency’s IE rating during the past decade.

-

IARC 2018: Advisors keen to recommend their agencies

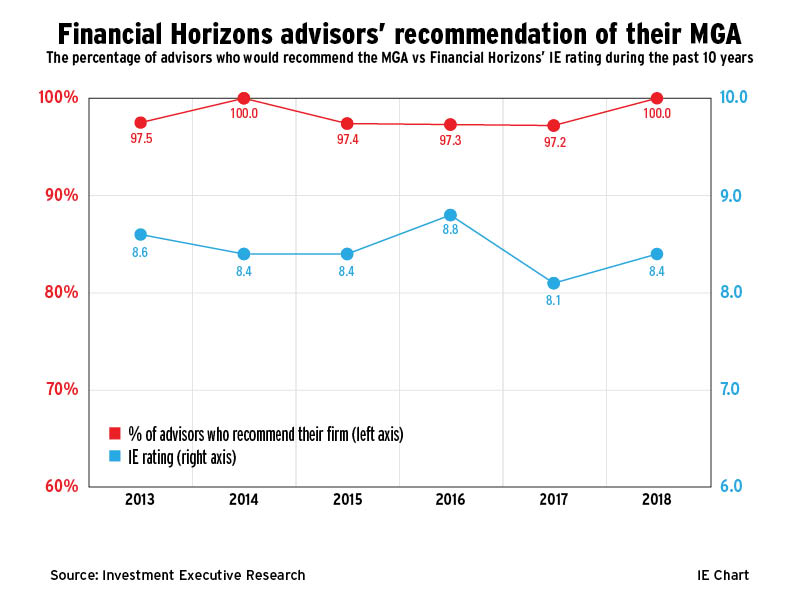

Financial Horizons

Financial Horizons has received strong results — both in terms of its IE rating and the percentage of advisors who would recommend the MGA — since making its Report Card début in 2013. In both 2014 and 2018, 100% of advisors said they would recommend the MGA to another advisor; in fact, that percentage has never fallen below 97%. Furthermore, Financial Horizons has posted a solid IE rating, ranging between 8.1 and 8.8, during that time. Financial Horizons advisors often have said they would recommend their MGA because it’s ethical and well-run.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

IARC 2018: Advisors keen to recommend their agencies

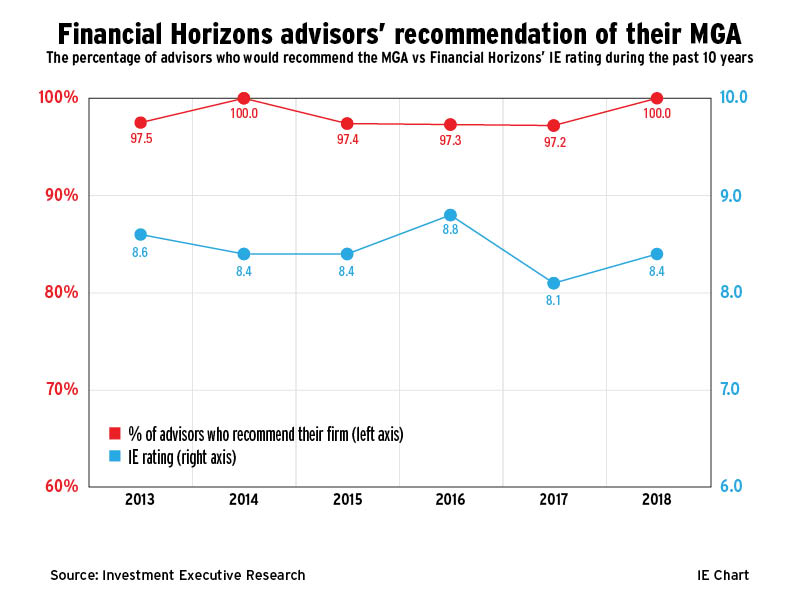

Freedom 55 Financial

The percentage of advisors willing to recommend Freedom 55 and the dedicated sales agency’s IE rating both increased marginally this year. However, both figures have declined, in general, during the past decade. In 2009, 96% of Freedom 55 advisors said they would recommend the firm; that year, the firm also received its highest IE rating of 7.9 in the past decade because advisors felt Freedom 55 was a good place to work. That percentage dropped off sharply in 2015, as 86% of advisors said they would recommend the firm that year. The percentage of advisors willing to recommend Freedom 55 has yet to break through the 90% mark once again. In fact, this year, 87.5% of advisors said they would recommend Freedom 55, while also giving the firm its second lowest IE rating of the past decade, at 7.2, because of the uncertainty they felt about recent changes at the company.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

IARC 2018: Advisors keen to recommend their agencies

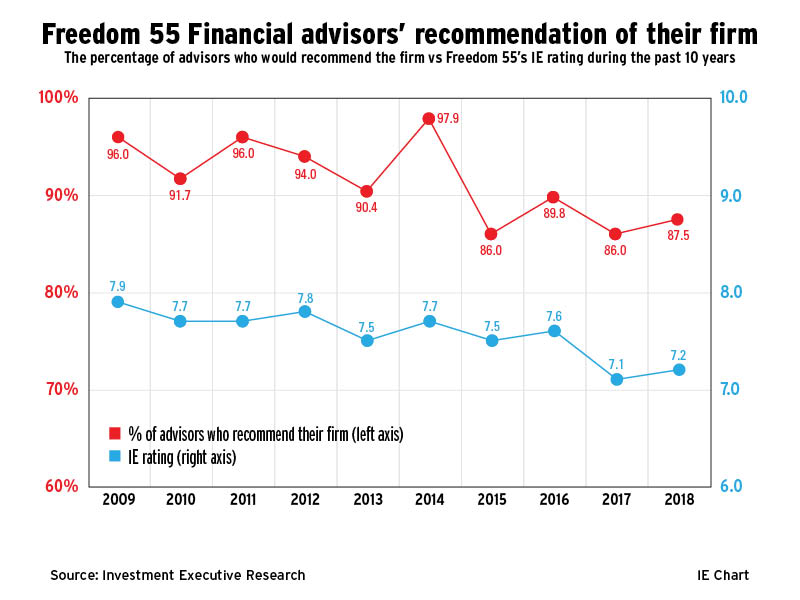

Great-West Life Assurance

This year, GWL advisors were less keen than they have been during the past decade to recommend the PPGA to another advisor. Indeed, 2010 marked a high point for GWL, with 98.3% of advisors saying they would recommend the firm because of its strong support services and product shelf. Things took a turn for the worse in 2015, when 84.8% advisors said they would recommend GWL because of issues related to a new technology platform. However, once those issues were rectified, the percentage of advisors willing to recommend the PPGA rose above the 90% level in 2016 and 2017. This year has proven to be a setback for GWL as the percentage of advisors willing to recommend the firm and GWL’s IE rating had 10-year lows of 77.6% and 7.0, respectively, because of the recent shift to the company’s new WISE network from the former Gold Key network.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

IARC 2018: Advisors keen to recommend their agencies

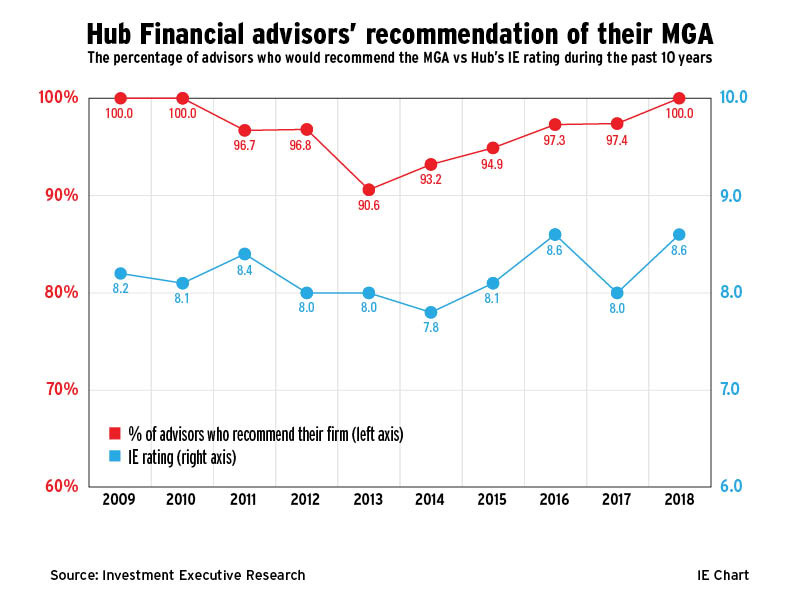

Hub Financial

Advisors who run their businesses through Hub are quite happy to recommend the MGA to another advisor. Indeed, 100% of Hub advisors said they would make such a recommendation three times in the past 10 years. The first two times were in 2009 and 2010. That metric, along with the MGA’s IE rating, would remain fairly strong during the next seven years. In fact, those numbers would stay at or above 90.6% and 7.8, respectively during that time. This year, 100% of Hub advisors said they would recommend the MGA once again while Hub’s IE rating hit a 10-year high of 8.6. The reason? Advisors said the MGA supports its advisors and is a good company to work with.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

IARC 2018: Advisors keen to recommend their agencies

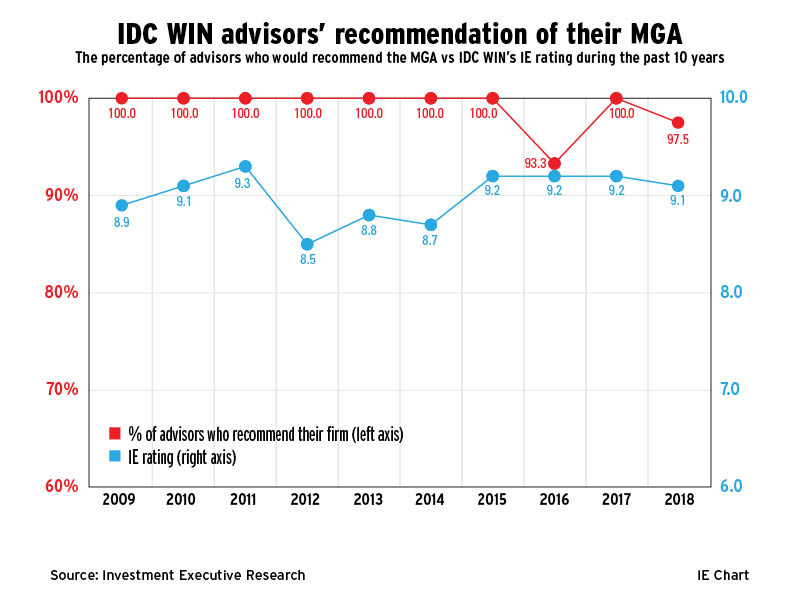

IDC Worldsource Insurance Network

IDC WIN advisors are adamant that other advisors should consider joining the MGA. In fact, 100% of IDC WIN advisors said they would recommend the MGA in eight of the past 10 years. Such was the case in 2011, when advisors praised IDC WIN for being a good firm that helps advisors grow their business. That year also marked a 10-year high for the MGA’s IE rating of 9.3. There have been a couple of exceptions over the years, though. For example, in 2016, 93.3% of advisors said they would recommend the firm while 97.5% of advisors said they would do so this year.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

IARC 2018: Advisors keen to recommend their agencies

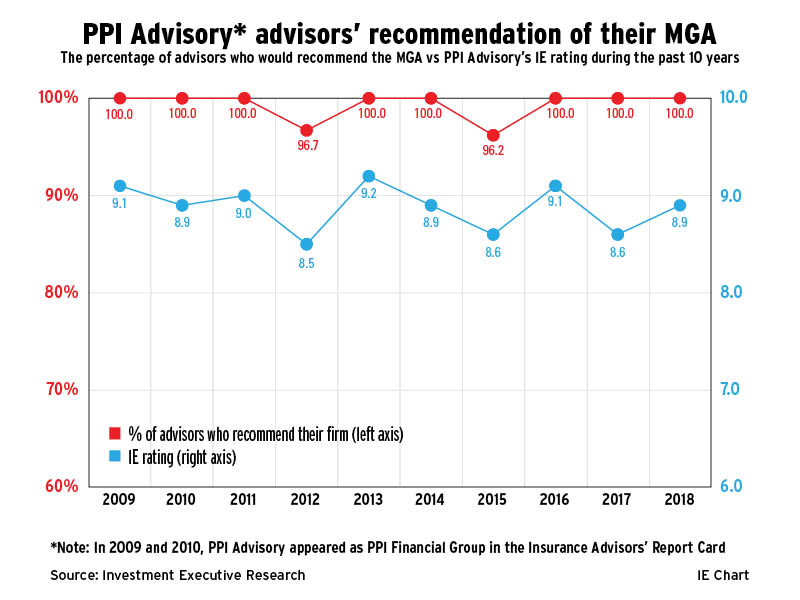

PPI Advisory

Advisors who work through PPI Advisory are happy to recommend their MGA to another advisor — so long as that advisor is a right fight. Indeed, 100% of the MGA’s advisors said they would recommend PPI Advisory eight times in the past 10 years. The two exceptions were in 2012 and in 2015, when when 96.7% and 96.2% of advisors, respectively, said they would recommend PPI Advisory. But in 2016, 100% of advisors once again said they would recommend PPI Advisory — while the MGA’s IE rating hit a 10-year high of 9.1. Since then, advisors with PPI Advisory have remained unanimous in their willingness to recommend their MGA to seasoned advisors looking for an ethical agency that provides the tools they need to work with wealthy clients, even though the IE rating has dropped off slightly.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

IARC 2018: Advisors keen to recommend their agencies

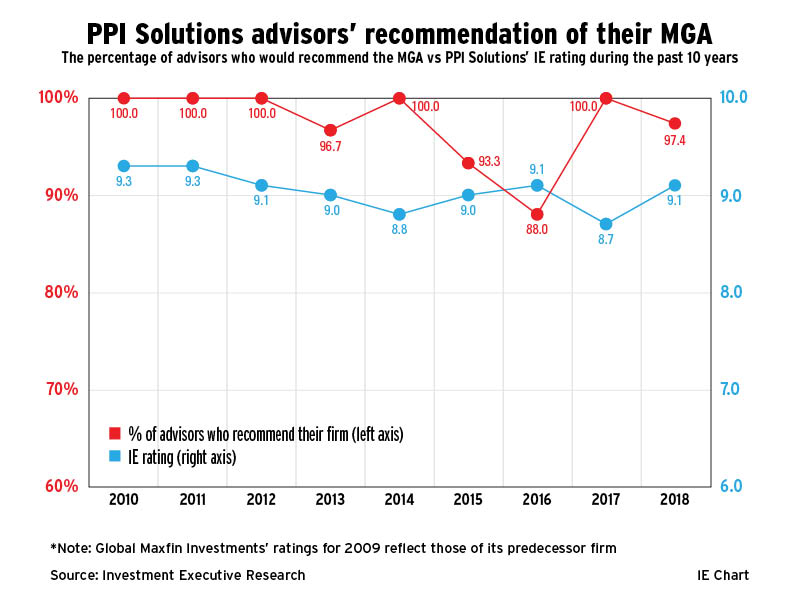

PPI Solutions

Advisors who work through PPI Solutions are likely to recommend their MGA to another advisor. In fact, 100% of advisors said they would recommend the MGA five times since PPI Solutions first appeared in the Report Card in 2010. That year, advisors were unanimous in their recommendation of PPI Solutions because of its professional staff. This vote of confidence corresponded with PPI Solutions’ highest IE rating of 9.3 in the past 10 years. By 2016, though, that percentage had dropped to 88% as had the IE rating, to a still solid 9.1. This year, PPI Solutions again fell short of unanimous endorsement although the percentage of advisors willing to recommend the firm remained quite strong at 97.4%.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

IARC 2018: Advisors keen to recommend their agencies

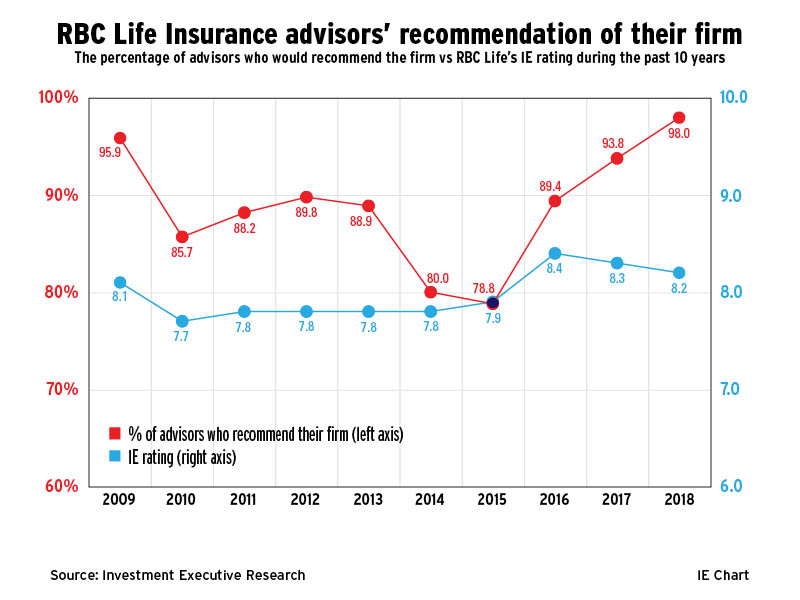

RBC Life Insurance

RBC Life advisors have been more willing to recommend their firm in recent years. Indeed, after hitting a 10-year low of 78.8% in 2015, things have turned around for the firm. This year, the percentage of advisors who would recommend RBC Life reached a 10-year of 98% — largely because it’s a good, stable company with a strong brand. RBC Life’s IE rating was also a healthy 8.2 this year, although it’s off slightly from the 10-year high IE rating of 8.4 in 2016 and significantly better than the 10-year low of 7.7 in 2010.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

IARC 2018: Advisors keen to recommend their agencies

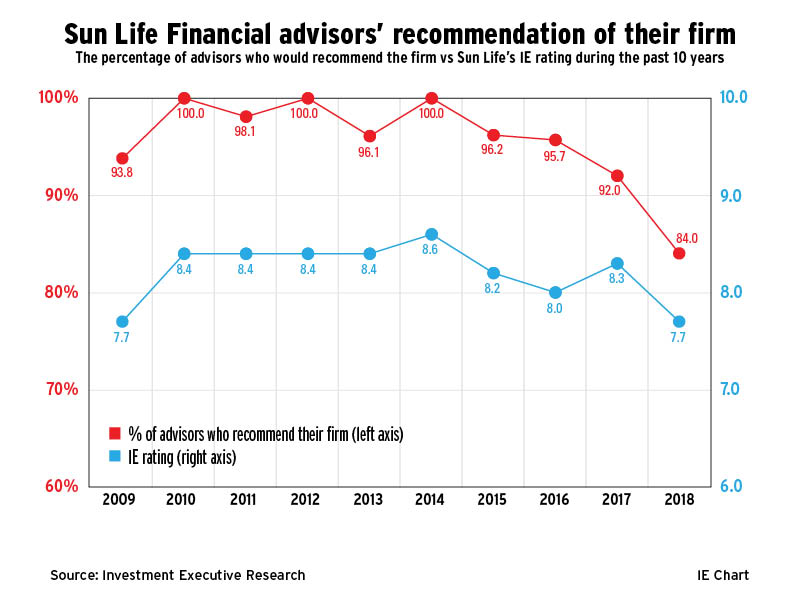

Sun Life Financial (Canada)

Sun Life advisors are not as keen to recommend their firm today as they have been during the past 10 years. In fact, this year marked a 10-year low for Sun Life, as only 84% said they would recommend the firm. For the most part, some advisors are hesitant to recommend others join their specific branch while others felt that advisors should think twice before joining the insurance industry, in general. Advisors have not always been so cautious about recommending Sun Life, though. In fact, 100% of advisors said they would make recommend the firm in three of the past 10 years.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

IARC 2018: Advisors keen to recommend their agencies

Overall

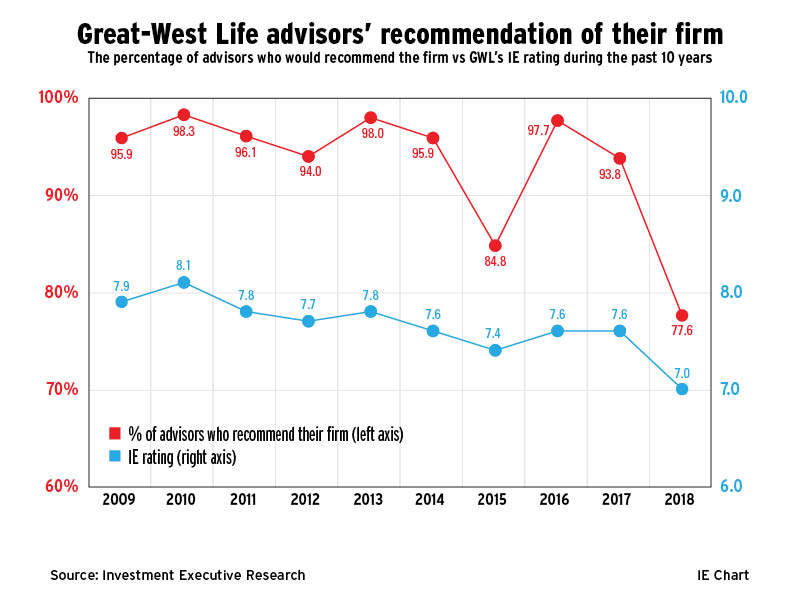

The percentage of insurance advisors willing to recommend their agency to another advisor has remained strong during the past 10 years, although their ranks are shrinking. For example, 2009 marked a 10-year high point with 97.4% of advisors saying they would recommend their firm. Since then, that percentage has declined and hit a 10-year low of 92% in 2015. Although that percentage did pick up in the following two years, 2018 has proven to be a setback year as 93.6% of advisors said they would be willing to recommend their firm. Meanwhile, the overall IE rating for the insurance channel has remained largely consistent during the past decade, ranging from 8.1 to 8.5.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive