The vast majority of financial advisors surveyed for Investment Executive’s annual Dealers’ Report Card have been quite happy to recommend their firm to another advisor during the past 10 years, regardless of the ups and downs that may be happening within their dealers or in the industry at large. But there are exceptions, and some advisors have been less than keen to give their firms a vote of confidence among their peers.

-

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

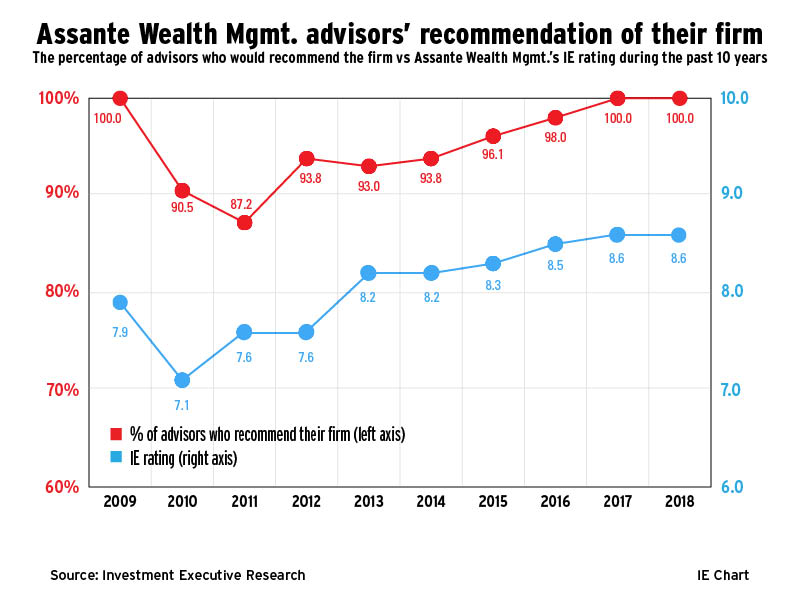

Assante Wealth Management (Canada)

Although Assante’s advisors are quite happy to recommend their dealer to another advisor, there have been times during the past decade when they have been less inclined to do so. In 2011, only 87.2% of Assante’s advisors said they would recommend the firm because of issues surrounding technology. The trend since has been upward; in fact, 100% of Assante’s advisors said they would recommend the firm in both 2017 and 2018 because of its strong ethics, reputation and compensation. This high level of advisor satisfaction also was evident in the IE rating, which hit a 10-year high of 8.6 in both years.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

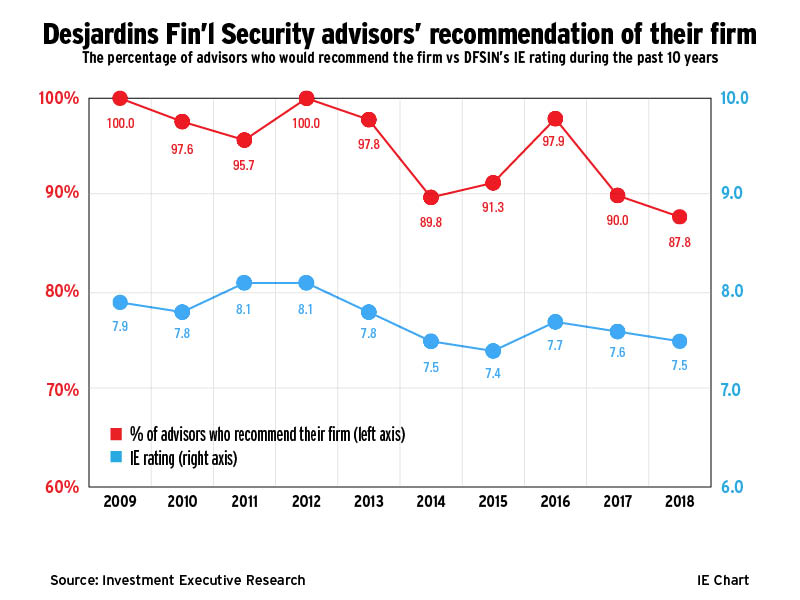

Desjardins Financial Security Independent Network

Most of DFSIN’s advisors would recommend another advisor to take a look at what their dealer has to offer — but the size of that majority has shrunk during the past 10 years. In 2009, 100% of DFSIN’s advisors said they would recommend their dealer, a sentiment that was in alignment with the firm’s third-highest IE rating during the past decade. This year, though, only 87.8% of DFSIN’s advisors said they would recommend the firm, a 10-year low. Those advisors who are hesitant to recommend DFSIN said it’s because of the many changes currently underway at the firm.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

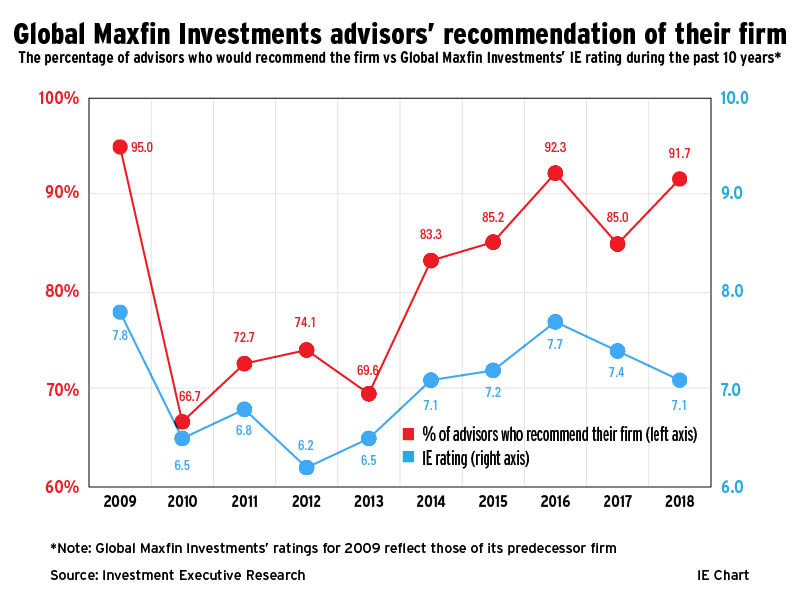

Global Maxfin Investments

Despite a few difficult years this past decade, most Global Maxfin advisors are now happy to recommend their dealer to another advisor. In 2010, only 66.7% of Global Maxfin advisors said they would recommend the firm. That was due, in large part, to the uncertainty around the acquisition of their former firm, Professional Investments Services (Canada). Since then, there have been a few ups and downs, but the percentage of Global Maxfin advisors who recommend the firm has improved consistently. This year, 91.7% of Global Maxfin advisors said they would recommend the dealer to a seasoned, independent advisor even though the IE rating dipped slightly to 7.1.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

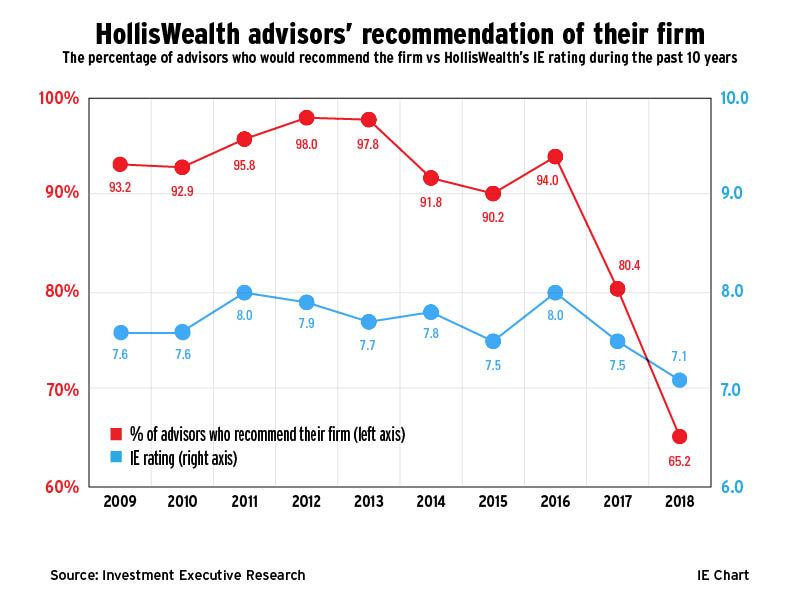

HollisWealth

HollisWealth’s advisors have seen plenty of changes over the years, which has taken a toll on both the IE rating and the percentage of advisors who would recommend the dealer to another advisor. In 2012, 98% of advisors with HollisWealth, then known as DundeeWealth, said they would recommend the dealer — marking a 10-year high. By 2017, the percentage of HollisWealth advisors willing to recommend their dealer had dropped to 80.4% because of the uncertainty surrounding the December 2016 announcement that Industrial Alliance Insurance and Financial Services was acquiring the dealer from Bank of Nova Scotia. The transition to IA continued to weigh on many of HollisWealth’s advisors this year as is evident from the 65.2% of advisors who said they would recommend the firm. This also corresponded with the dealer’s IE rating of 7.1, the lowest during the past decade.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

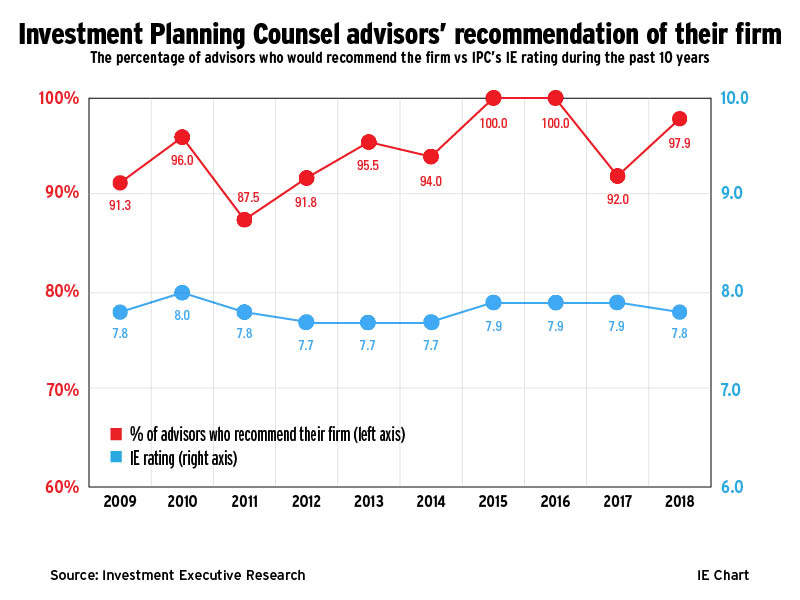

Investment Planning Counsel

More than 90% of IPC’s advisors said they would recommend the dealer to another advisor during the past decade — with one exception. In 2011, only 87.5% of IPC advisors said they would recommend the dealer because they were unsure about the impact IPC’s acquisition of Partners in Planning Financial Group would have. Since then, the majority of IPC’s advisors have been happy to pass on their business cards. In 2015, 100% of IPC’s advisors said they would recommend the firm — a feat that would be repeated the following year. This year, 97.9% of IPC’s advisors said they would recommend the firm because of the freedom they have to run their own business.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

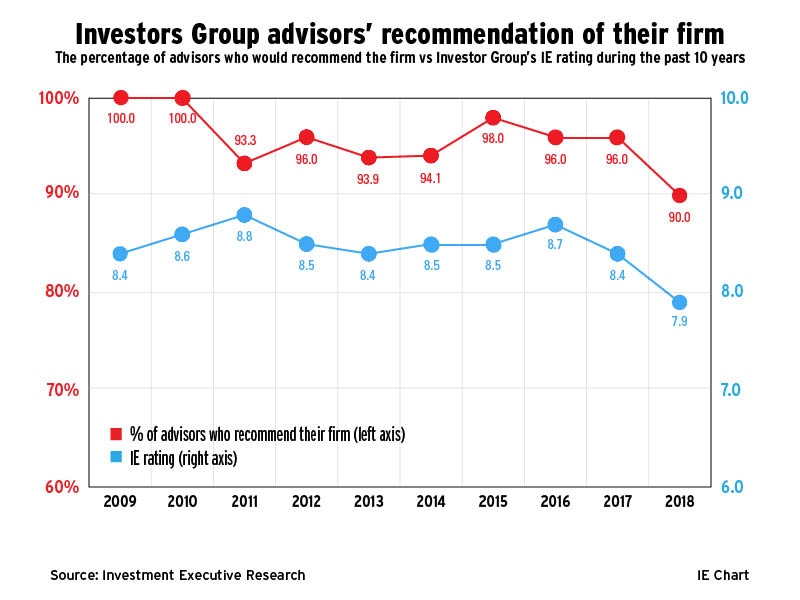

Investors Group

Most of Investors Group’s advisors have been happy to recommend the dealer to another advisor during the past 10 years, even though that percentage has dropped a little recently. In 2009 and 2010, 100% of Investors Group’s advisors said they would recommend the firm. Since then, the percentage of advisors willing to recommend Investors Group has bounced around a little, but managed to stay at the 90% and above level. In fact, 2018 was a 10-year low for Investors Group in terms of both its IE rating (7.9) and the percentage of advisors willing to recommend the firm (90%) because of the impact of several organizational changes.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

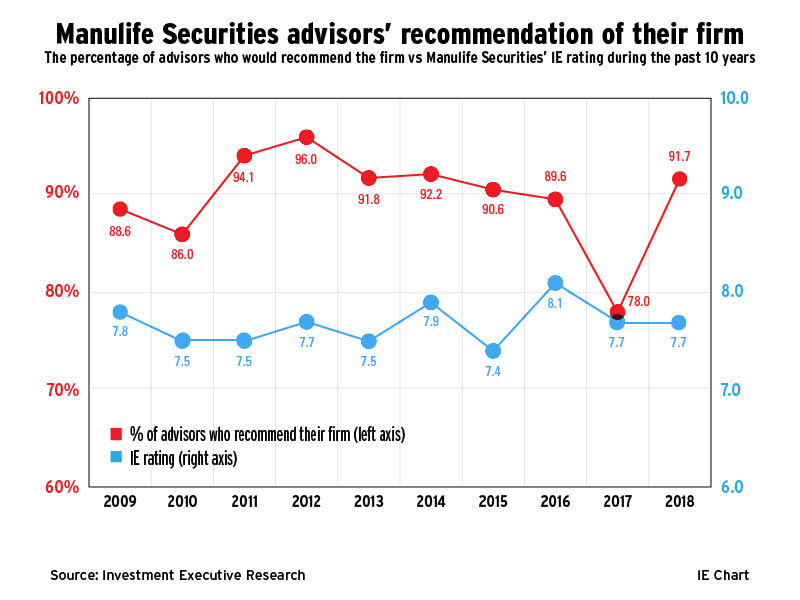

Manulife Securities

Manulife Securities’ advisors have had strong opinions about their dealer during the past 10 years, which has been reflected in the IE rating and the percentage of advisors willing to recommend the firm. Case in point: 2012 marked a 10-year high with 96% of Manulife Securities’ advisors saying they would recommend the firm to another advisor because of its strong ethics and brand recognition. Advisors were less keen to recommend the firm in 2017, though, with only 78% saying they would do so — a 10-year low. That percentage bounced back once again this year with 91% of advisors saying they would recommend Manulife Securities because of the freedom they have to run their businesses. Interestingly, Manulife Securities’ IE rating did not follow suit but remained steady at 7.7.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

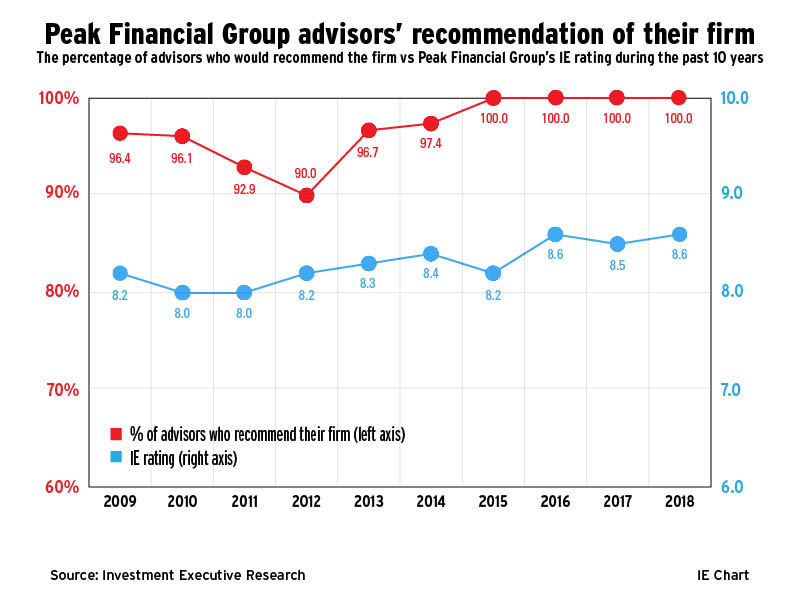

Peak Financial Group

Advisors with Peak are more than happy to recommend their dealer to another advisor. Since 2015, 100% of the firm’s advisors have said that they would recommend Peak, the longest stretch of any dealer included in the Dealers’ Report Card. Advisors pointed to the firm’s management as well as its ethical and independent culture as key reasons why other advisors should consider joining Peak. Advisors’ satisfaction with the Montreal-based firm is also evident in its consistently strong IE rating during the past 10 years.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

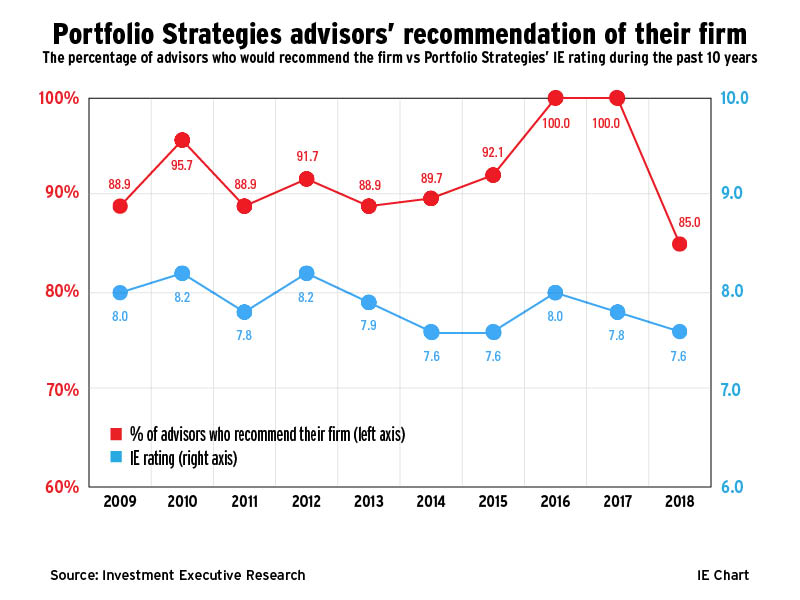

Portfolio Strategies

Portfolio Strategies’ advisors often are quite happy to recommend the dealer to another experienced advisor. In fact, in 2016 and 2017, 100% of Portfolio Strategies advisors said they would recommend the firm because of its independent business model. However, Portfolio Strategies advisors were a little more hesitant to recommend the firm this year as only 85% said they would do so. That opinion also happens to correspond with the firm’s IE rating of 7.6, which is tied for the lowest IE rating during the past 10 years. Most of those who would not recommend the dealer said it was because of the fear that a smaller firm such as Portfolio Strategies will eventually be bought out.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

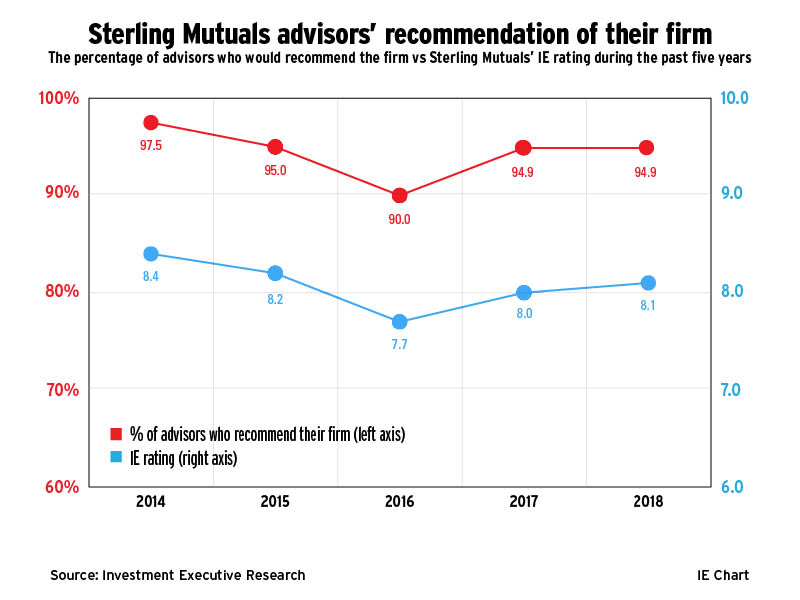

Sterling Mutuals

At least nine of every 10 Sterling Mutuals advisors said they would recommend the firm to another advisor since the mutual fund dealer’s Report Card début in 2014. In fact, that year proved to be the strongest of all for the firm as 97.5% of advisors said they would recommend Sterling Mutuals. This enthusiasm corresponded with the dealer’s highest IE rating of 8.4. Those numbers hit a low of 90% and 7.7, respectively, in 2016, but have since bounced back. In 2018, 94.9% of Sterling Mutuals advisors said they would recommend the firm to a like-minded advisor because of its payout and independent model.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

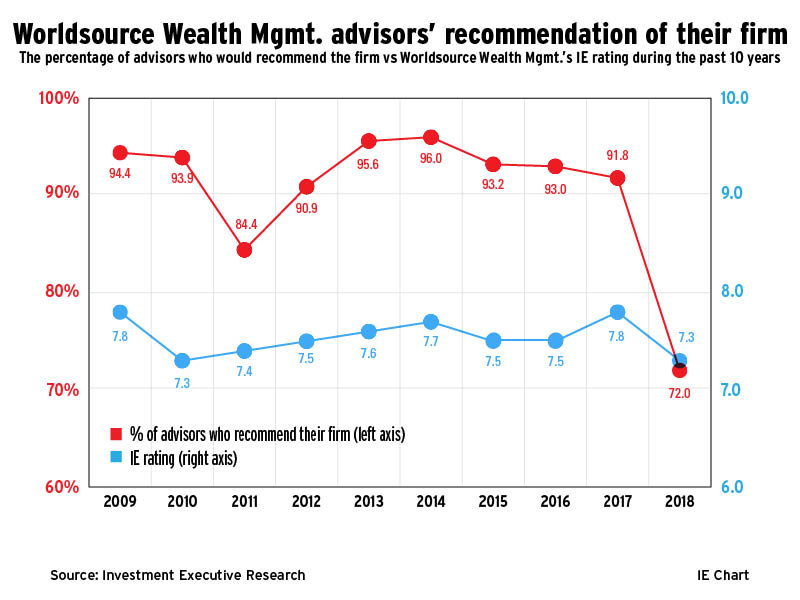

Worldsource Wealth Management

With some exceptions, the percentage of advisors willing to recommend Worldsource to another advisor has declined during the past decade. In 2009, 94.4% of advisors said they would recommend the firm while only 84.4% would say the same in 2011. That percentage would later rise to 96% in 2014. although advisors’ enthusiasm has waned since. Specifically, 2018 marked a 10-year low as only 72% of Worldsource’s advisors said they would recommend the dealer because of the rocky rollout of the firm’s new technology platform. This also had a negative effect on Worldsource’s IE rating, which dropped to 7.3 from 7.8 year-over-year.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

Dealers’ Report Card 2018: How a dealer’s ratings and advisors’ recommendations correlate

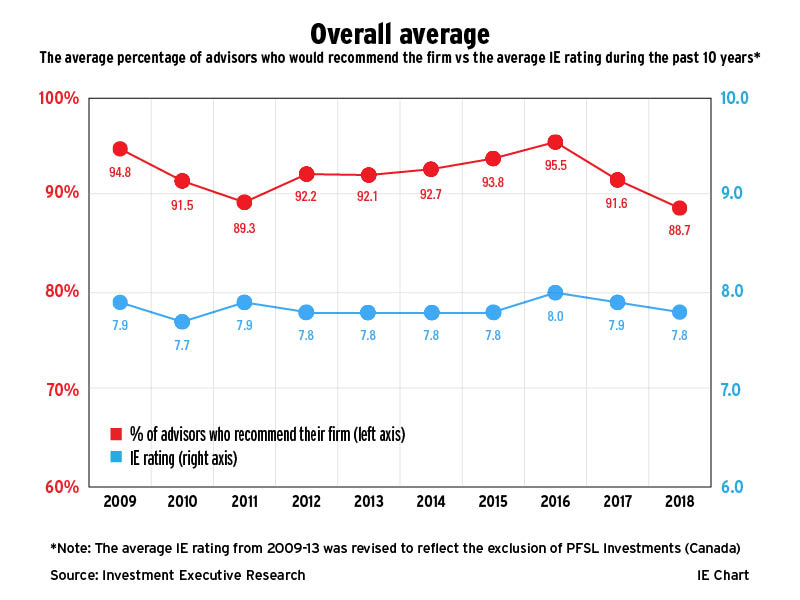

Overall average

The vast majority of advisors have been more than happy to recommend their firm to another advisor during the past decade. In fact, the percentage of advisors who said they would do so has remained at 91% or higher for eight of the past 10 years — and the average IE rating has remained similarly steady. The two exceptions were 2011 and this year, when the average percentage of advisors who said they would recommend the firm dropped to 89.3% and 88.7%, respectively. This year’s decline is due, in large part, to major transitions happening at several dealers, which have made advisors a little hesitant to recommend their respective firms.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive

At least 88.7% of the advisors surveyed for the Report Card have said they would recommend their firm to another advisor each year during the past decade. However, a closer look at the individual firms included in the Report Card reveals that there have been times when advisors hesitated to recommend their dealer. This hesitation usually happens during times of transition at a firm and often corresponds with a lower IE rating for that dealer. (A firm’s IE rating is the average of all the categories for which the dealer received a score on the main ratings table.)

This slideshow breaks down the percentage of advisors who would recommend their firm to another advisor over the past 10 years and how that has compared to the dealer’s IE rating.