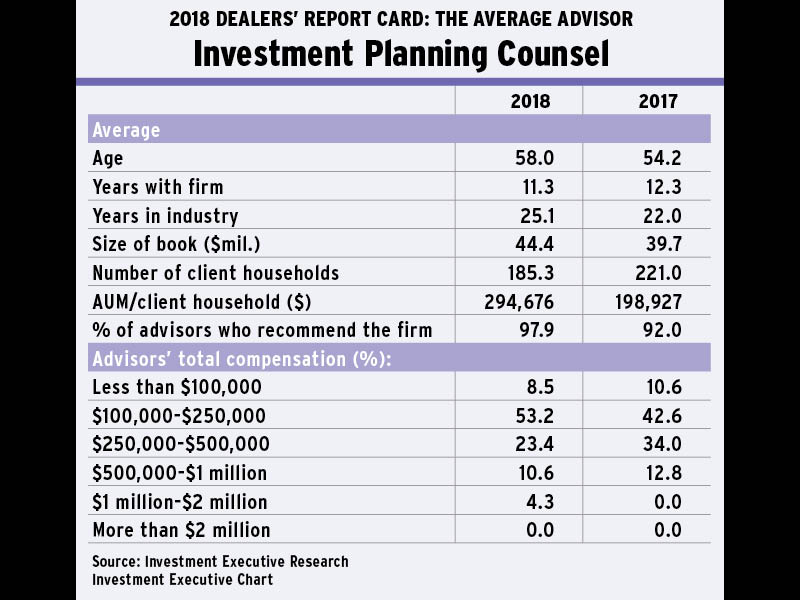

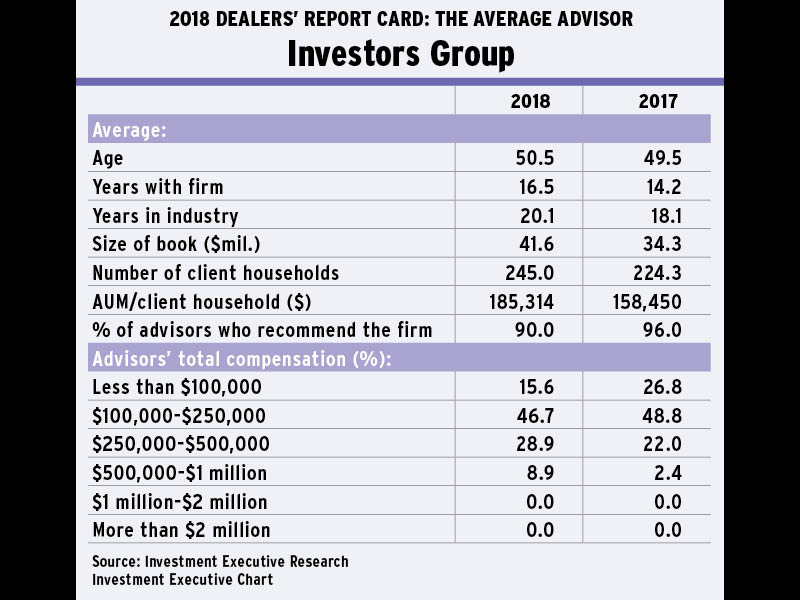

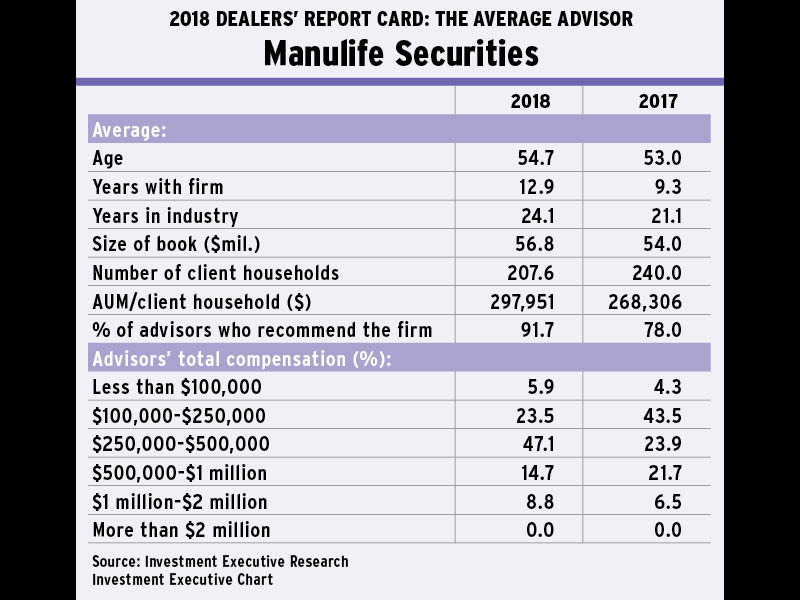

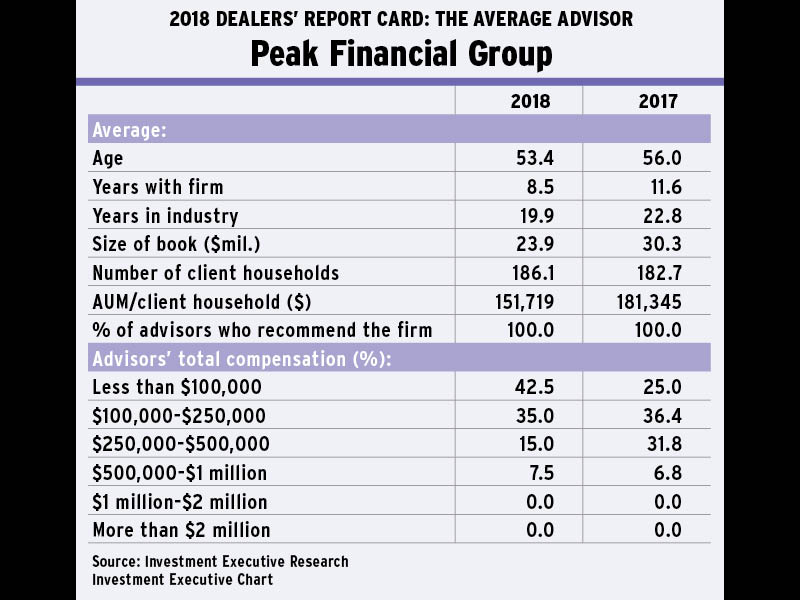

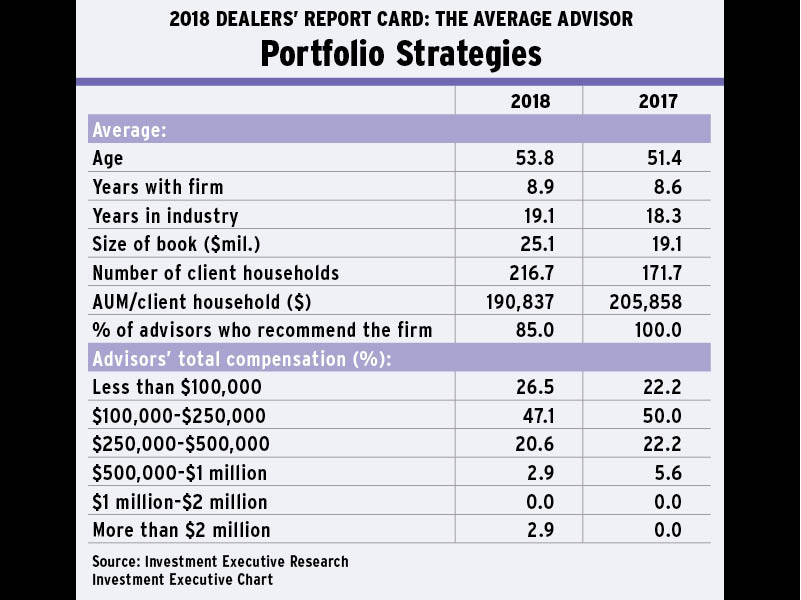

Overall, the average advisor at Canada’s mutual fund dealers reported modest gains in assets under management (AUM), stable client household numbers and slightly improved productivity (as measured by AUM/client household) this year. However, drilling down into the responses from individual firms exposes a lot more volatility in these metrics.

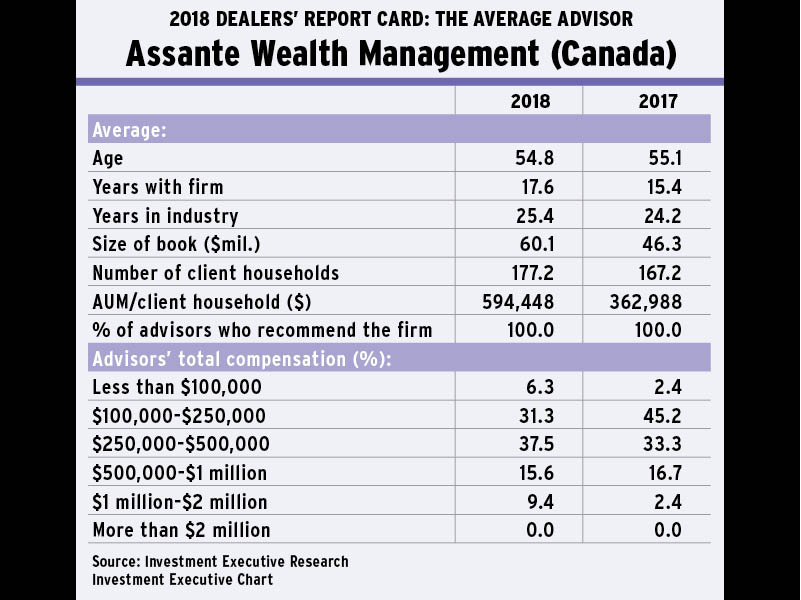

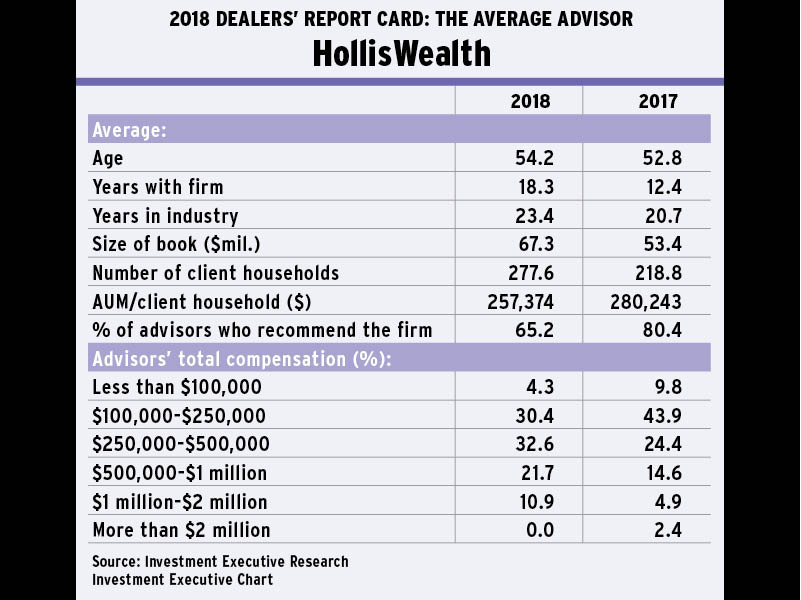

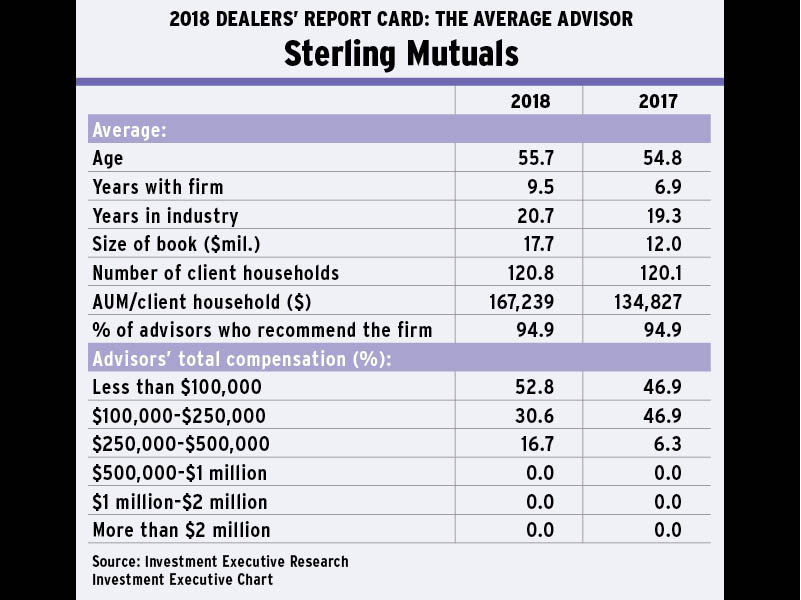

In fact, the increase in AUM and improvements in productivity among some firms’ average advisors were relatively dramatic. This is evident among advisors with a couple of the bigger firms in the dealer channel — Assante Wealth Management (Canada) Ltd. and HollisWealth Inc., both based in Toronto — at which industry-leading AUM totals enjoyed strong growth, and at some of the smaller firms in the survey — Calgary-based Portfolio Strategies Corp. and Windsor, Ont.-based Sterling Mutuals Inc. — at which average AUM was up sharply, albeit from much lower starting points.

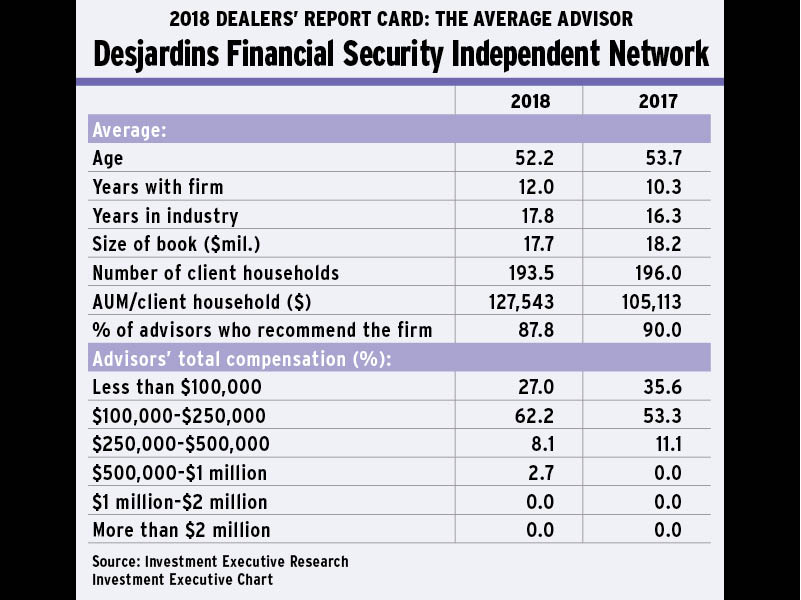

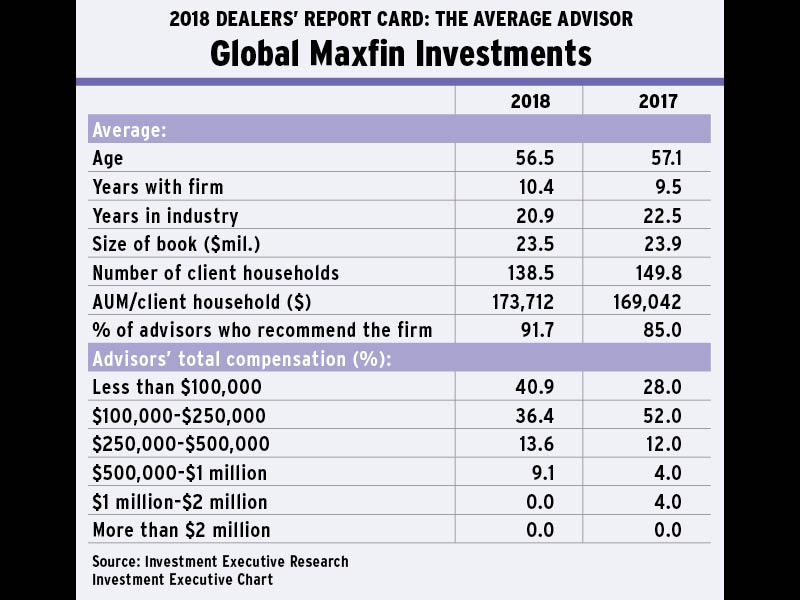

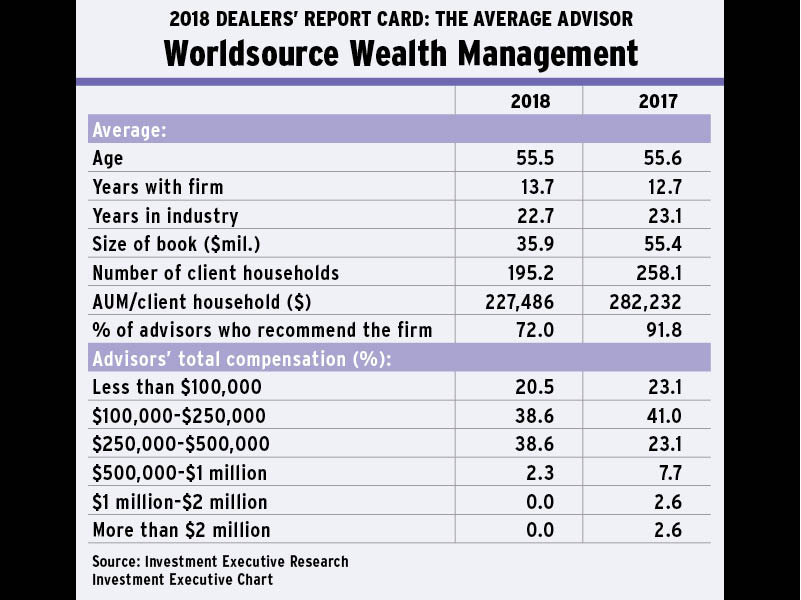

At the same time, there are also a couple of sales forces that reported a decline in these key metrics. In some cases, this may represent a shift in the underlying demographics at the firm, at which an influx of newer advisors with smaller, less productive books of business weighed on the average for the firm.

In addition, some of these changes also may reflect a difference in the sample population year-over-year. Indeed, it’s important to be aware that some volatility in these numbers — both positive and negative — is inevitable because of the relatively small sample sizes that result from breaking down the overall survey by firm.

View the slideshow to see how the average advisor for each firm compares.