By and large, the financial advisors who work at Canada’s Big Six banks’ branch networks are happy with their arrangements, and they believe other advisors would be as well.

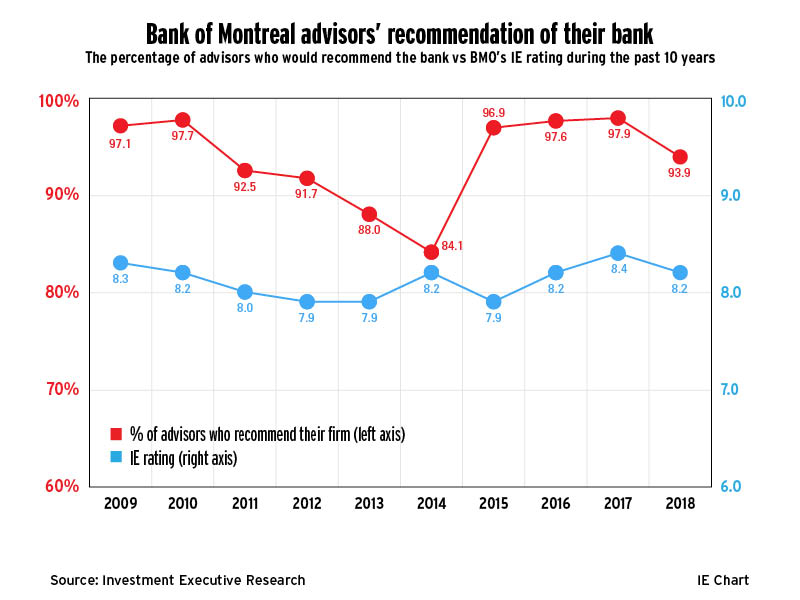

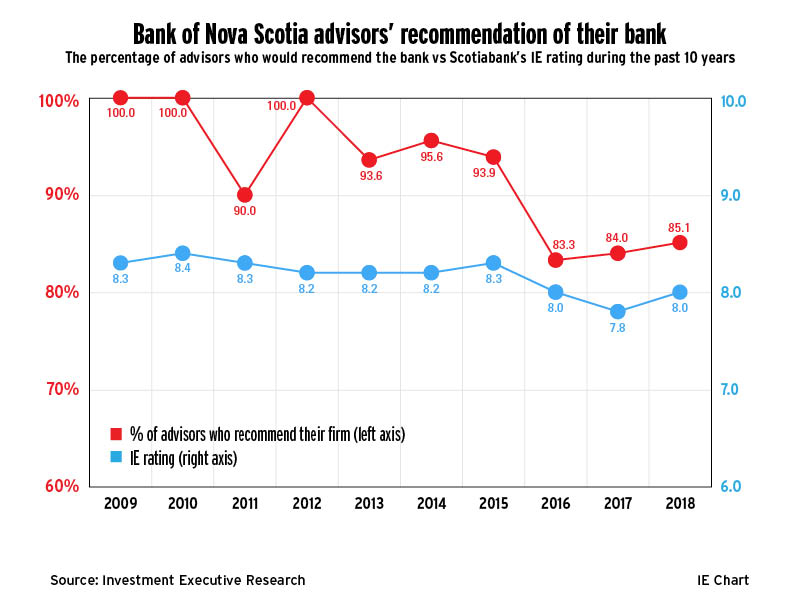

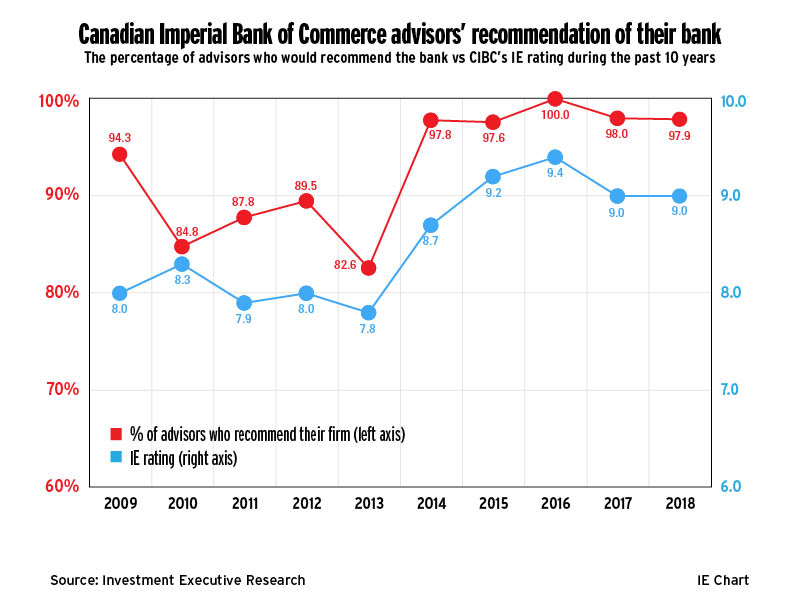

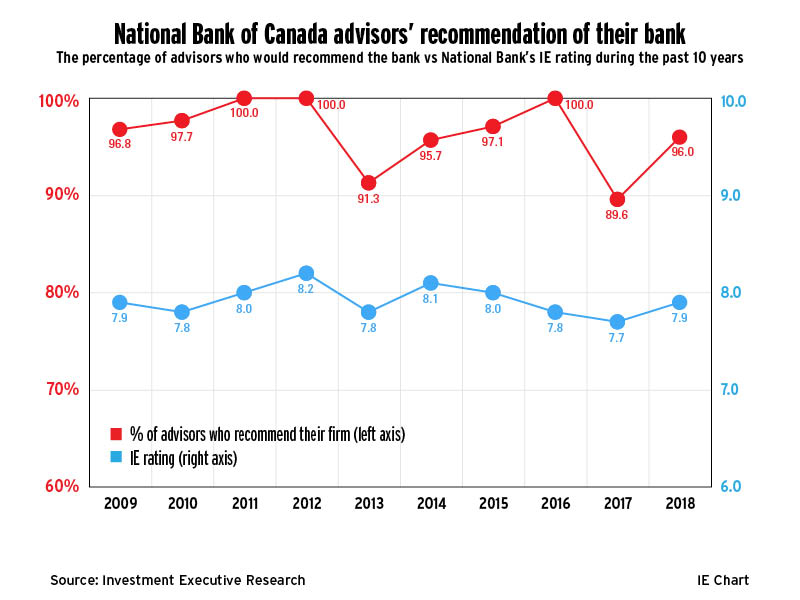

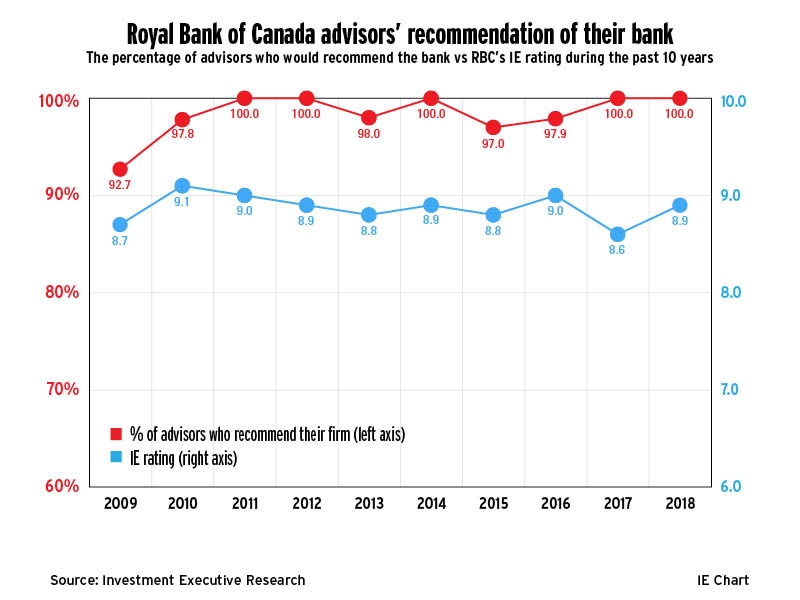

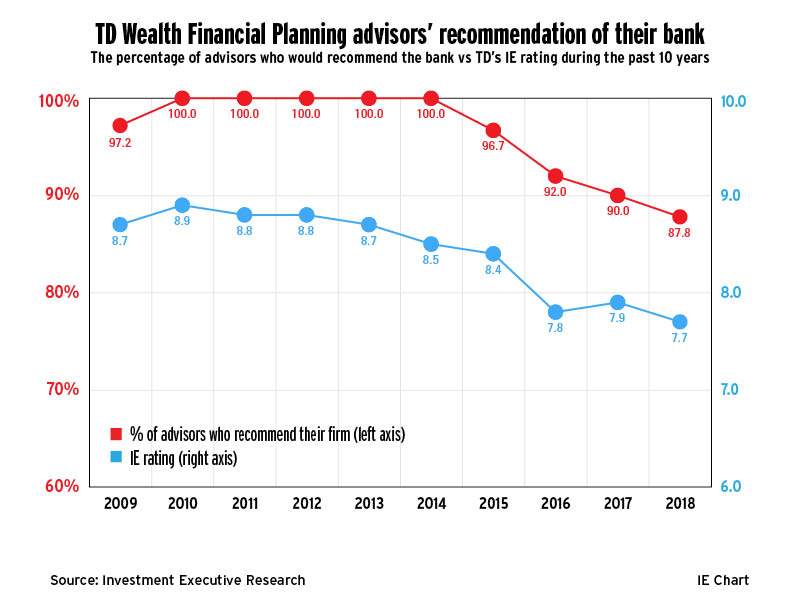

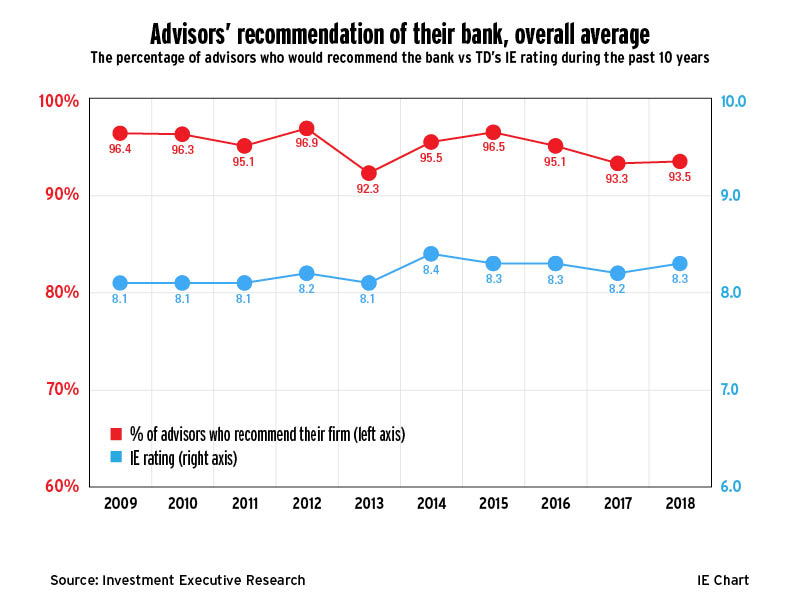

In fact, 92% or more of advisors surveyed for the Report Card on Banks during the past decade have said they would recommend their bank to another advisor. That these advisors are generally satisfied with the services and work environments their banks offer also is evident in the steady, overall average IE rating they’ve given these banks during the past 10 years. (Each firm’s IE rating is the average of all categories included on the Report Card’s main ratings table.)

Of course, some advisors have been more hesitant to recommend their bank than others over the years, which is evident when the banks’ individual IE ratings are analyzed further. Some banks have seen increases and decreases in these ratings during the past 10 years, and this was particularly evident in 2016. A reason for this could be that this was the year in which Investment Executive tightened its criteria for the advisors who participate in this survey. Specifically, IE has targeted branch-based financial advisors who work with mass affluent clients, have their own book of business, and focus on investment rather than credit products for the annual Report Card on Banks since 2016.

This slideshow compares the percentage of each bank’s branch-based advisors who would recommend their bank to another advisor, and why, vs each bank’s IE rating during the past decade.