People are becoming more financially capable, but that these gains are not evenly shared throughout the population, and that their financial savvy hasn’t necessarily improved, new U.S. research finds.

The FINRA Investor Education Foundation on Tuesday released the results of the latest edition of a long-running study, which finds that in general Americans are feeling less financial stress, despite a continued lack of financial literacy.

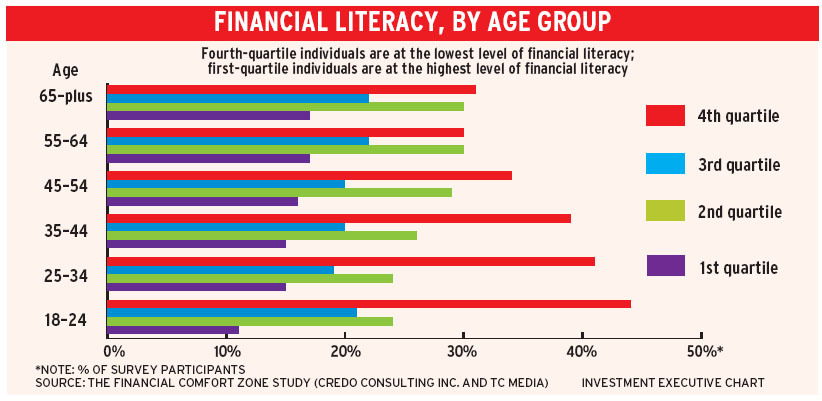

The survey finds that only 37% of respondents are considered to have high financial literacy, down from 39% in 2012 and 42% in 2009. Despite the apparent decline in financial literacy, the survey also finds that financial capability has increased, with the percentage of respondents reporting no difficulty in covering monthly expenses increasing from 36% in 2009 to 48% in 2015, and the percentage of respondents with emergency funds has also increased from 35% in 2009 to 46% in 2015.

However, the survey finds that certain populations — including women, millennials, African-Americans, Hispanics, and those lacking a high school education — continue to have a tough time financially. For example, 21% of Americans have unpaid medical debt, and women are more likely than men to go without medical services due to cost; 29% of millennials with a mortgage have been late with a mortgage payment; and Hispanics and African-Americans are much more likely to use high-cost forms of borrowing such as pawn shops and payday loans, the survey finds.

“This research underscores the critical need for innovative strategies to equip consumers with the tools and education required to effectively manage their financial lives,” says Richard Ketchum, chairman of the FINRA Foundation, in a statement. “My hope is that policymakers, researchers and advocates will use these findings to make more informed decisions about how to best reach underserved populations.”

The study is part of a large-scale, multi-year project that aims to understand financial capability and behaviours. It was first conducted in 2009, then in 2012 and in 2015. It draws on a data set of responses from more than 27,000 U.S. adults.

Photo copyright: designer491/123RF