Business-owner clients who have been affected by the wildfires in British Columbia and the Northwest Territories have more time to file their tax returns.

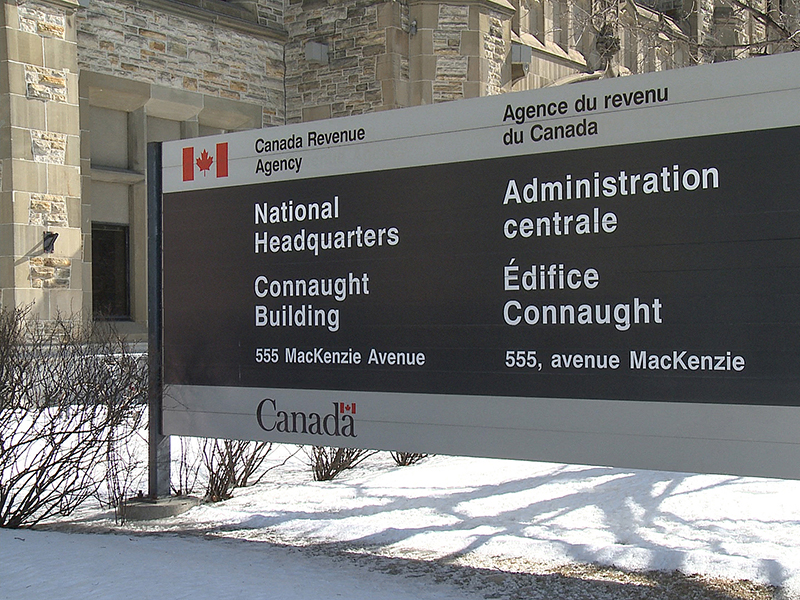

The Canada Revenue Agency (CRA) said it will not charge penalties or interest for late filing of all T2 corporation tax returns and GST/HST returns that would normally have been due between Aug. 15 and Oct. 16, as long as the returns and payments are submitted by Oct. 16. Businesses must be located in these postal codes.

The agency also will not charge interest on instalments or balances due for T2 and GST/HST returns that would normally have been due between the same timeframe.

Affected businesses located outside of the postal codes specified by the CRA may submit a request for relief of penalties and interest.

The CRA also warned that taxpayers who usually receive CRA benefits and credit cheques by mail may experience a delay due to the wildfires, and encouraged them to sign up for direct deposit.