Canadian Imperial Bank of Commerce’s earnings took a tumble as it allocated an increasing amount of money towards bad loans triggered by the Covid-19 pandemic.

The Toronto-based bank said Thursday that it earned $1.17 billion or $2.55 per diluted share in its third quarter, down from nearly $1.4 billion or $3.06 per diluted share a year earlier.

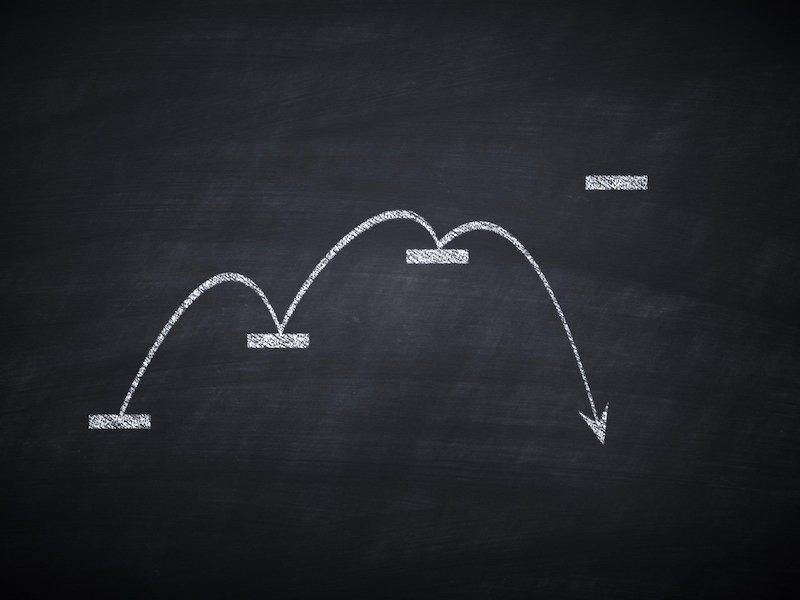

Provisions for credit losses were $525 million for the period ended July 31, up from $291 million a year ago, but down from $1.41 billion in the second quarter.

CIBC executives blamed the drop in profit and hike in loan loss provisions on COVID-19 and the bank’s exposure to low oil prices, though they are starting to see signs of a rebound.

“The Bank of Canada’s message last month underscored that the path to a full recovery could be both lengthy and uncertain. In the U.S., while many states reopened during the quarter, the continued spread of the virus could translate into a prolonged recovery,” chief executive Victor Dodig told financial analysts.

“Against this backdrop, we remain cautiously optimistic and believe that our strong core franchise, client-centric focus and diversified business will enable us to get back to pre-COVID levels of profitability.”

Requests for payment relief have been on a steady decline after peaking in April, Dodig said.

In the last six weeks, the number of new requests have been minimal, he said.

Residential mortgages account for the majority of the deferrals and uninsured mortgages represent approximately 60 per cent of the outstanding balances.

Most Canadian business banking clients who negotiated deferrals have now finished accessing the bank’s relief program, added chief risk officer Shawn Beber.

“The commercial clients coming off payment deferrals are not exhibiting higher delinquencies than the overall book, which remains very low, and we’ve had almost no requests for deferral renewals,” he said.

His remarks came as CIBC said on an adjusted basis it earned $2.71 per diluted share in its third quarter, down from an adjusted profit of $3.10 per diluted share a year ago.

Analysts on average had expected an adjusted profit of $2.15 per share, according to financial markets data firm Refinitiv.

CIBC’s Canadian personal and business banking business earned $508 million in the quarter, down from $658 million in the same quarter last year.

The bank’s Canadian commercial banking and wealth management business earned $320 million, down from $344 million a year ago, while U.S. commercial banking and wealth management earned $62 million, down from $173 million last year.

Capital markets earned $392 million, up from $235 million a year ago.

The bank is trying to invest for the long-term so that it can emerge from the pandemic and take advantage of growth and existing relationships, said Dodig.

“The investments that we’ve made over the past several years to simplify and to modernize our bank and deepen client relationships have positioned us well,” he said.

“The results this quarter reflect the resilience of our bank.”

In a release, the bank declared a dividend of $1.46 per share on common shares, for the quarter ending Oct. 31 and unchanged from the previous quarter.