When the U.S. stock market delivers outsized returns, it’s easy for clients to lose focus. The allure of potential gains often overshadows an investor’s long-term strategy and diverts their attention from what truly matters for achieving their financial goals.

As of Oct. 31, 2023, the S&P 500 total return year-to-date (as measured in Canadian dollars) was 12.96%, outpacing most other assets in a typical diversified portfolio. As a result, S&P 500 envy seems to be creeping its way into the investor mindset.

In times like these, it’s imperative for advisors to educate their clients about how investing in a defensive, diversified portfolio can help them earn more by accumulating more capital. All things being equal, a defensively constructed portfolio that mutes volatility and experiences smaller drawdowns can compound more efficiently. Volatility acts as a tax that causes investments to compound less efficiently, thereby reducing the growth of an investor’s wealth over time.

For example, the average return of the S&P/TSX composite total return index over the past 10 years ended Dec. 31, 2022, was 8.4%, but the actual compound return was 7.7%. The difference between the average and compound returns is due to the impact of “volatility tax” on the S&P/TSX composite index’s return.

Volatility tax is roughly equal to half of an asset’s variance. For example, over the 10 years ended Dec. 31, 2022, the volatility of the S&P/TSX composite was 12.1%, which corresponds to the 0.7% difference in average and compound returns over this period (0.1212 ÷ 2 = 0.7%).

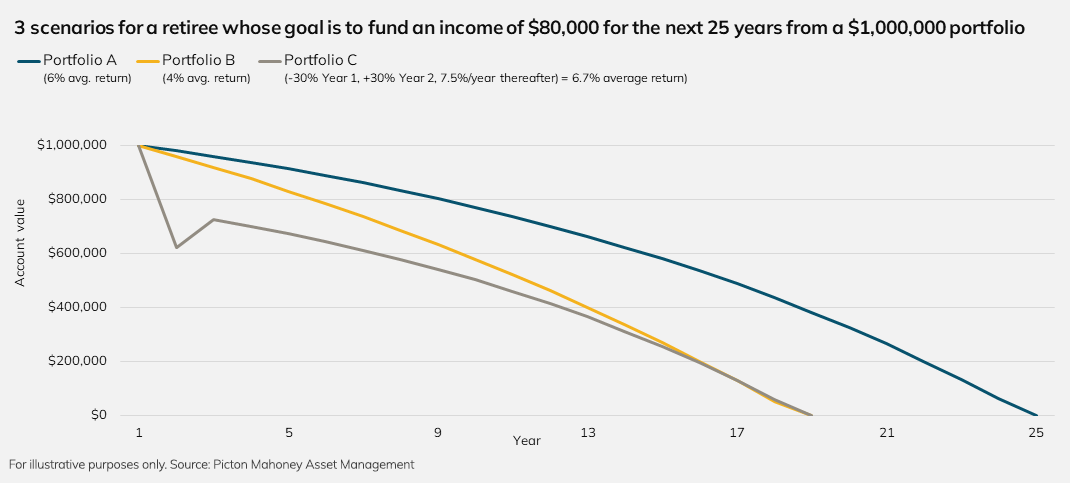

Diversified portfolios can also help protect investors against sequence of return risk. Over the next decade, five million Canadians will turn 65 and enter retirement. As they begin decumulating assets from their portfolios, this diversification benefit will be of growing importance. If an investor experiences a large loss at the beginning of the period when they start drawing income from their investments, their financial plan can fail even if their overall investment returns would have been sufficient to fund their retirement needs.

In the example below, a 6% annualized return is needed to fund the retiree’s spending objective. If the portfolio were to generate insufficient returns (see Portfolio B, with a 4% annualized return), then the investor would have a shortfall. Importantly, if the investor achieved a higher average return of 6.7% but had a poor sequence of returns (–30% in year 1, +30% in year 2, and then +7.5% each year thereafter), the shortfall would be similar.

But volatility doesn’t have to be a drag. As an advisor, you can meaningfully improve potential outcomes for your clients by implementing strategies to enhance downside protection. In other words, you can help investors make more by losing less.

Compound returns in action

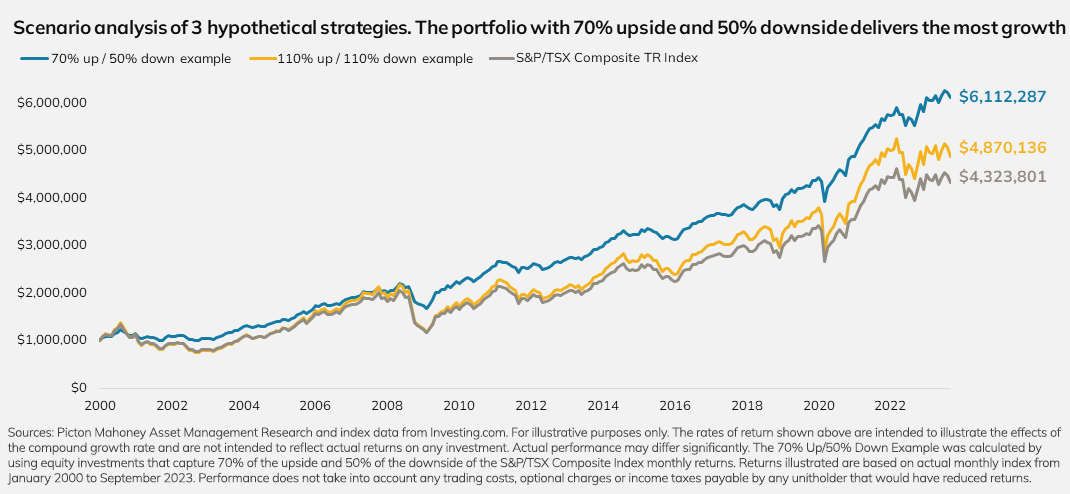

Many investors erroneously believe that, because equity markets rise, they need to invest in risky strategies that try to capture more than 100% of the markets’ upside if their goal is to outperform markets. In reality, this is unnecessary. Because of how returns compound over time, an investor needs to capture only a portion of the upside — as long as they can protect themselves against market drawdowns.

Below is a comparison of three strategies: the first delivers 70% of the market’s upside and 50% of the market’s downside, the second delivers 110% of each, and the third delivers the return of the market (in this case the total return of the S&P/TSX composite index).

When I show this chart to someone for the first time, the most common reaction is a pause, then a double take followed by a smile. As you can see, the strategy with 70% upside and 50% downside delivers the greatest growth in wealth while experiencing much less volatility than the other strategies. Contrary to what people may think, the most defensive strategy is the one that accumulated the most wealth over time.

How to make more by losing less

To implement a defensive strategy without compromising the long-term return potential of your investor’s portfolio, the key is to focus on seeking asymmetric and uncorrelated returns. In my experience, these are best found by investing in alternative asset classes and strategies.

Asymmetric returns are typically delivered by skilled active managers who use various strategies to maximize upside capture while mitigating downside capture. Within alternative investments, “enhancers” such as long/short equity and long/short credit are examples of strategies that seek to provide asymmetric returns relative to those of traditional assets. You can look to these enhancers as an efficient way to get outsized exposure to the manager skill needed to target asymmetric returns, because the strategies typically have greater than 100% gross exposure, giving managers the leeway to express their market views.

Uncorrelated returns, on the other hand, come from implementing a scientific approach to portfolio construction. Strategies that provide uncorrelated returns can help a portfolio maintain long-term return potential while improving its resilience because, while returns are additive, uncorrelated risks are not. To find uncorrelated sources of return, an advisor should identify alternative strategies that are currently absent in a portfolio and assess their sensitivity to various risks. If the strategy can generate returns that are independent of the level or direction of equity markets, then it may be a good candidate for investors to consider.

In challenging markets, minimizing downside risk takes on added importance. Guiding your clients through market volatility with a fortified portfolio that offers a better way to mitigate downside can pave the way for more consistent results and greater wealth accumulation. It could be the difference between financial health and a retirement shortfall.

Robert Wilson is the head of the Portfolio Construction Consultation Service with Picton Mahoney Asset Management.