The idea of buying leveraged ETFs can be enticing, as they can provide potentially better returns over a shorter time period versus traditional long-only ETFs.

Of course, with the opportunity to generate higher returns comes higher risk. It’s extremely important to understand the specific risks of leveraged and inverse-leveraged ETFs in assessing whether the funds are an appropriate investment for clients.

Let’s look at this class of ETFs in Canada and find out what’s important to consider before potentially incorporating them into a portfolio.

1. What are leveraged and inverse-leveraged ETFs?

Leveraged and inverse-leveraged ETFs typically use financial derivatives aiming to amplify the returns of an underlying index or asset class.

For instance, while a traditional index ETF seeks to match the returns of a benchmark index like the S&P/TSX 60, a leveraged ETF could seek to deliver multiple times the daily performance of that index. In the case of inverse-leveraged ETFs, the investment objective may be to generate a potential profit from negative performance of a given index, so if the index were to fall, the ETF would potentially see a gain. Typically, these ETFs are used by high-conviction end investors with a short-term trading horizon, looking to utilize a higher-risk profile to generate potentially higher short-term returns.

Unlike leverage achieved through margin accounts or options trading, the risk of losses is limited to the principal investment when using these ETFs. However, to maintain this, their exposure typically needs to be reset daily.

In Canada leveraged and inverse-leveraged ETFs are predominantly offered through Horizons ETFs’ BetaPro fund lineup. These ETFs provide a wide range of exposure to equity indexes, such as the S&P 500, S&P/TSX 60 and Nasdaq-100, to futures-based strategies that invest in commodities like oil and gas. South of the border, several fund providers offer ETFs with returns that can be up to 3x or -3x the underlying exposure.

2. Can you hold these ETFs for more than one day?

The short answer is yes. However, as mentioned, leveraged and inverse-leveraged ETFs typically require their exposures to be reset daily to maintain a risk level limited to the principal investment. Due to this daily reset, the return of the ETF is not expected to match the performance of the reference commodity or index for periods longer than one day.

Compounding also impacts returns, resulting in a larger annual return in a rising market or averaging costs down in a declining market. If you plan to hold these ETFs for more than one day, note that the actual returns will likely be different than the anticipated returns over an observed period.

These simplified hypothetical examples using a BetaPro Daily Bull ETF (with full 2x exposure), a BetaPro Daily Bear ETF (with full -2x exposure) and a BetaPro Inverse ETF (-1x) in two different markets show the potential effects of compounding as a result of daily rebalancing.

If an investor is going to hold a leveraged (or inverse-leveraged) ETF for more than one day, they should closely monitor that the ETF provides exposure that matches the original intent of owning the investment.

3. How volatile are leveraged and inverse-leveraged ETFs?

All leveraged and inverse-leveraged ETFs are inherently riskier and potentially more volatile than a single-long ETF that invests in the same universe of securities, since they’re highly speculative and use leverage that magnifies returns and losses.

The volatility of these ETFs is also impacted by the underlying investment. For example, a leveraged ETF that has natural gas futures as its underlying exposure is going to be significantly more volatile than one that invests in large-cap Canadian equities. In general, leveraged commodity ETFs would be expected to have higher volatility than traditional equities.

Volatility is also important to note because it can impact the anticipated direction of the ETF. The more volatile the asset class,the more the performance of the ETF, beyond one day, may deviate from its benchmark due to the daily resetting of the exposure.

4. Do leveraged or inverse-leveraged ETFs invest in futures?

Depending on the underlying asset, such as crude oil, an ETF can be required to invest in futures.

Futures are contracts with uniform terms and maturity dates — typically involving specific asset classes and commodities — that require parties to exchange money for the asset at a specified time at a later date.

Instead of settling on the specified time in the future, ETFs that use futures typically roll from a specified delivery month to a subsequent delivery month before contract maturity (when the holder of the contract would be required to accept or deliver a physical commodity). As a result of this function, investors should pay special attention to the futures curve.

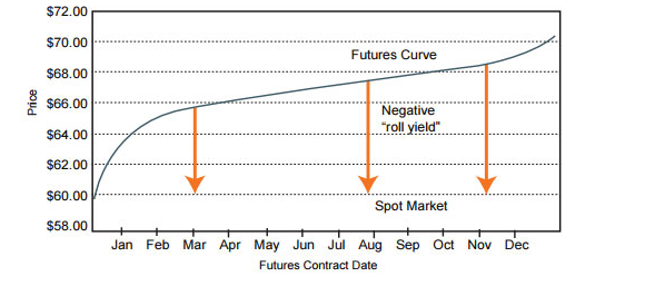

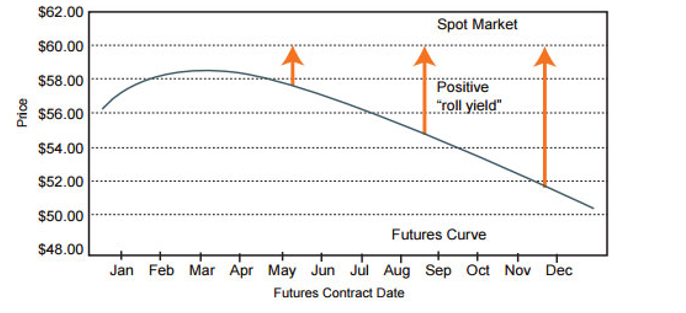

Typically, the futures held by an ETF roll into a contract that is at a higher price (where the futures curve is in “contango”; see Graph 1) in which the futures holder will pay a premium to roll into the next contract. Conversely, there are periods where the futures contracts will be rolled into a contract at a lower price (where the futures curve is in “backwardation”; see Graph 2), and the ETF would then earn money from rolling into the lower-cost contracts.

If the price of oil is range-bound for an extended period but the futures are in contango, an investor who buys a 2x Daily Bull ETF will likely lose money from paying two times the roll premium. On the other hand, an investor on the short side of the trade with a -2x Daily Bear ETF would expect to generate a positive return from earning 2x the roll premium over that period — assuming all other things equal, and the market return of oil didn’t move.

Graph 1: Futures curve in contango

Graph 2: Futures curve in backwardation

Leverage on futures, then, means it’s not good enough to get the directional call on the asset class right; the investor also has to factor in the cost of future roll costs if the ETF is held over a multiple-day period.

5. Do these ETFs meet your risk/return objectives?

Too often, self-directed investors use a leveraged or inverse-leveraged ETF as a position in their core portfolio instead of simply buying and holding a non-leveraged ETF. This can be a very risky proposition due to the high risk associated with investing in these ETFs. Leveraged and inverse-leveraged ETFs are speculative investments, and an investor should have high conviction on the direction of the investment, with the ability to monitor and adjust their position on a frequent basis. These ETFs are generally more appropriate for experienced investors who understand that their losses can be significant if their speculation is wrong.

For everyone else, a leveraged or inverse-leveraged ETF may not be an appropriate investment despite the tantalizing returns that can sometimes be generated.

Think of it as using a Formula One racing car to drive to the grocery store. The car can go extremely fast but it’s not practical (or safe) for this purpose. If your goal is to be a long-term investor who doesn’t want to frequently change allocation to meet return objectives, simple long-only index ETFs are likely more appropriate.

Understanding your risk tolerance and objectives will go a long way in determining whether leveraged and inverse-leveraged ETFs are a type of investing you are comfortable engaging in.