Earlier this year, the Bank of Canada issued a dire warning about productivity in Canada. In a speech in Halifax in March, the bank’s senior deputy governor, Carolyn Rogers, called the situation an “emergency” that could drive higher interest rates and limit wage increases for Canadians. “You know those signs that say, ‘In emergency, break glass’? Well, it’s time to break the glass,’” she told the audience.

I don’t think Rogers overstated the situation, given the statistics. We are 30% less productive than the U.S., and, among countries in the Organization for Economic Cooperation and Development, we’ve fallen from the sixth most productive economy in 1970 to the 18th in 2022. Relative to the U.S., we now rank second only to Italy in productivity decline.

Many factors have brought us to this point, including lack of business investment, insufficient competition across industries, policy uncertainty, and challenges in matching skilled immigrants to appropriate jobs.

While the country’s productivity struggles are troubling, I am proud that the investment funds industry is bucking that trend. In fact, our industry is thriving.

Economic impact of investment funds industry

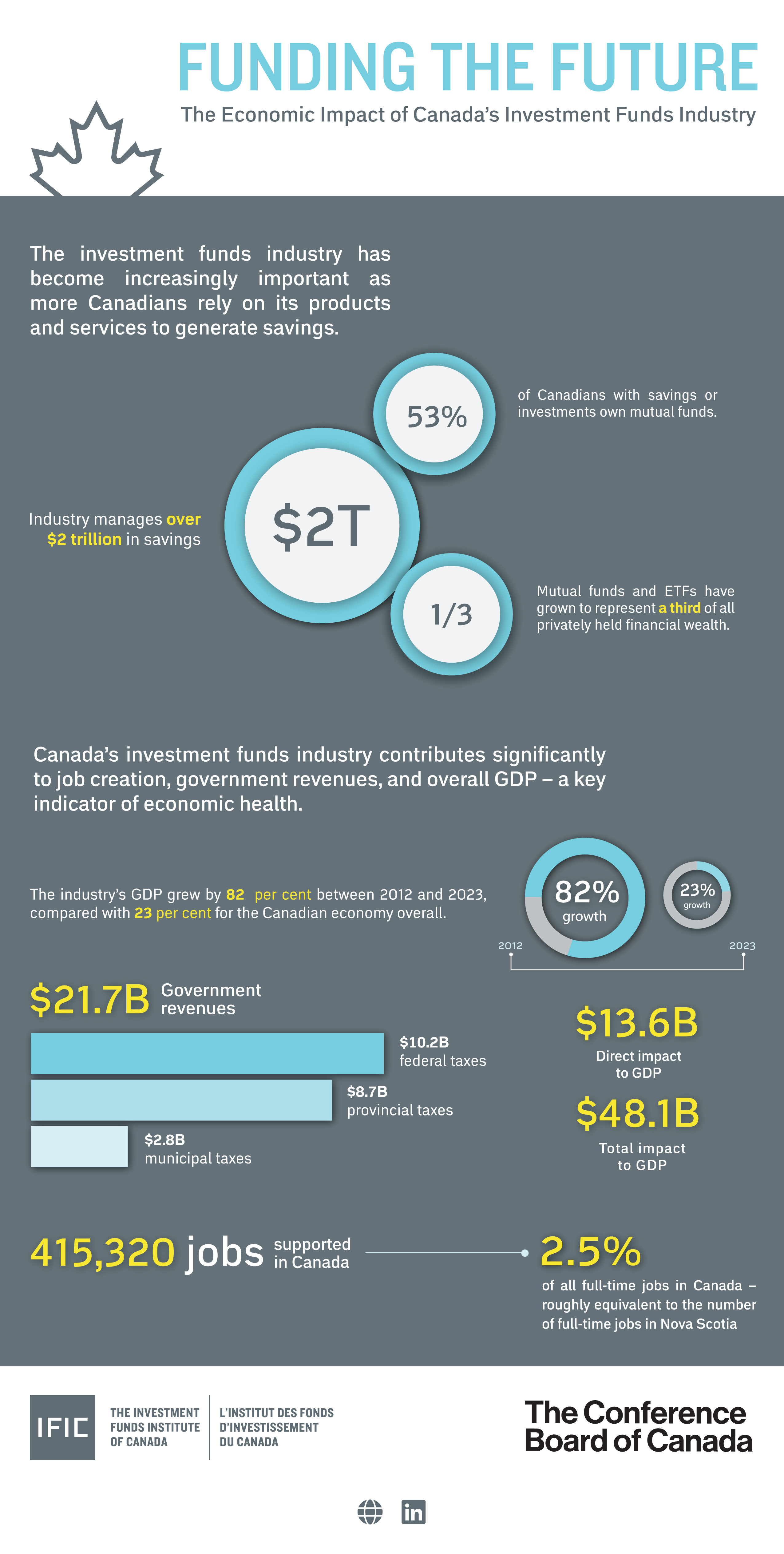

In late September, IFIC released a research report entitled Funding the Future: The Economic Impact of Canada’s Investment Funds Industry, produced by the Conference Board of Canada. The report underscores the robust health of the investment funds industry as well as its outsized contribution to Canada and Canadians.

For example, the industry’s contribution to gross domestic product (GDP) grew by an eye-popping 82% between 2012 and 2023, compared with 23% for the Canadian economy overall (see infographic below). And in stark contrast to other industries, which overall have seen a flattening of productivity, our industry achieved large productivity gains over the past decade, driven primarily by technology and innovation.

The report also found that in 2023 the investment funds industry:

- added $48.1 billion to Canada’s GDP, accounting for 2.1% of the country’s total GDP;

- earned $42.6 billion in revenues;

- supported 415,320 full-time jobs, representing 2.5% of all full-time jobs in Canada — roughly equivalent to the number of full-time jobs in Nova Scotia; and

- contributed $21.7 billion in taxes.

I think these numbers speak volumes about the critical role the industry plays in supporting Canadians, both in terms of personal savings and broader economic growth. Canadians increasingly depend on the industry’s products — mutual funds and ETFs — to meet their financial goals. And at the same time, it’s clear that our industry contributes significantly to job creation, government revenues and overall GDP.

Growth of private retirement savings

The report includes other interesting themes about investing trends, especially the finding that Canadians increasingly rely on personal savings to help fund their retirements. For those 65 years of age and older, private retirement income (as a percentage of total income) has risen from 18% in 1990 to 33% in 2022. Meanwhile, the proportion of paid workers covered by employer-sponsored pension plans has declined, as has pension value.

The report also found that over half of Canadians own mutual funds and one-quarter own ETFs. Together, mutual funds and ETFs have grown to represent a third of all privately held financial wealth.

These facts taken together point to an even bigger role for the investment funds industry in the coming years.

Industry innovation

Consumer preferences for ETFs and DIY investing are transforming the industry and revenue streams. The industry is adapting right along with these trends and has responded to growing consumer interest in responsible investing by offering more of these types of funds.

As well, over the past decade Canadian investors paid significantly less in mutual fund fees. The average mutual fund management expense ratio in Canada for long-term funds (for all series) between 2013 and 2023 saw a drop of 29%, as noted in the Conference Board report.

It is important to highlight that financial advice is highly valued by investors. According to Pollara’s most recent annual investor survey, 83% of investors believe the guidance provided by their financial advisors is worth the fees they pay. A similar portion believe they get better returns because of their advisors.

While our industry cannot single-handedly fix Canada’s economic and productivity woes, I am heartened to see how strong and healthy we are and how well we are continuing to serve Canadians. We should celebrate this success and continue to innovate to drive value to Canadian investors and the broader economy.

Andy Mitchell is president and CEO of the Investment Funds Institute of Canada.