From a standing start only a decade ago, exchange-traded funds (ETFs) have emerged as favoured investments among clients who are increasingly concerned about the ability of mutual funds to meet the investment expectations of those clients.

The rapid growth of ETFs has been aided in no small measure by their low costs, intraday trading flexibility and great transparency. That growth also has been helped by the economic environment: record-low interest rates, ongoing stock market volatility and global economic uncertainty.

“There is arguably a lower-cost ETF alternative to almost every type of mutual fund mandate,” says Howard Atkinson, CEO of Horizons ETFs Management (Canada) Inc. in Toronto. “What we’re witnessing is a deployment of assets that would have historically gone into traditional securities such as stocks, bonds and mutual funds [into] ETFs.”

ETF manufacturers suggest that these products provide easier access to the markets for clients who do not have to worry about picking the right stocks. Says Mary Anne Wiley, managing director and head of BlackRock Asset Management Ltd.’s iShares Canada division in Toronto: “You can buy a handful of ETFs and have exposure to the entire world.”

Not to be forgotten in the rise of ETFs is the impact of the recent deep recession on the mindset of clients, says Vikash Jain, vice president, portfolio management, with archerETF Portfolio Management, a division of Oakville, Ont.-based Bellwether Investment Management Inc. In the face of meagre or negative returns, he says, some clients are concerned that mutual funds, which carry higher management fees than ETFs do, will not add to their portfolios, much less outperform the market.

Clients can’t control the market, but they can control costs, says Atkinson: “So, they get a more predictable source of return, knowing that by investing in low-cost investments, they are enhancing their returns. With such a large proportion of expensive mutual funds offering very little in the way of relative outperformance, more and more investors are opting to go with lower-cost ETFs.”

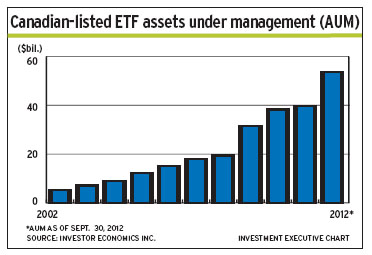

The mutual funds industry’s more than $827 billion in assets under management (AUM) dwarfs the $54-billion ETF industry AUM. However, the pace of mutual fund growth has declined dramatically to slightly more than 10% for the year ended Sept. 30, vs 35% for the ETF industry. Since the end of 2008, the compound annual growth rate of AUM in ETFs is more than 28%, vs 3% for the mutual fund industry.

It can be argued that the high growth rate of ETFs is reflective of that industry’s smaller asset base. However, as Toronto-based research firm Investor Economics Inc. notes in a September report: “With 16 times the assets, the mutual funds industry generated just 2.5 times the sales of ETFs” during the first half of this year – indicating a significant decline in mutual fund sales.

The total number of ETFs has increased dramatically over the past decade, from just 16 as of the end of 2003 to 257 as of Sept. 30 this year. However, new mutual fund launches have slowed in 2012, with only 35 new funds, compared with 71 in 2011, leading Investor Economics to note: “The Canadian-listed ETF universe is beginning to experience some consolidation.”

The Canadian ETF marketplace is dominated by three large players – BlackRock; BMO Asset Management, a division of Toronto-based Bank of Montreal; and Horizons. Together, these firms accounted for 97% of total ETF AUM at the end of September. BlackRock, through its iShares division, is by far the largest player with a 77% market share at the end of the third quarter.

A notable new entrant is Vanguard Investments Canada Inc., a wholly owned subsidiary of the U.S.-based investment-management company, Vanguard Group Inc. Vanguard Canada opened its doors in Canada last December.

However, there also has been consolidation at the top. In January, BlackRock acquired Claymore Investments Inc., an independent Canadian subsidiary of U.S.-based Guggenheim Partners LLC. This has added $7 billion to the $29 billion in AUM that BlackRock already held.

Typically, ETFs can be classified into three primary categories – index, actively managed and inverse/leveraged:

– index etfs track an index or benchmark, which can be the broad market or a specific segment or sector of the market. Index ETFs’ returns are closely correlated to their underlying index.

Most ETF assets, says Atkinson, “have been in index-tracking funds, which, as a proportion of the investment fund world, is still a small fraction of the money invested in actively managed strategies.” However, he notes, “There are only so many indices out there. Even with custom indices, the number of opportunities in the indexing space are fast drying up. We may have hit market saturation in the ETF index space.”

– actively managed etfs comprise 7% of total ETF AUM, according to Investor Economics.

And this ETF subgroup has been attracting increasing attention, says Mark Raes, portfolio manager with BMO Asset Management in Toronto. These ETFs use an active quasi-portfolio manager to make investment decisions, with the objective of outperforming rather than tracking a specific index. The ETF may use more specific strategies, such as covered call options, to enhance income generation.

– inverse etfs use derivative strategies, such as futures and swaps, to produce a daily performance result that is the opposite of the underlying index. Thus, when the index drops in value on a given day, the ETF will rise in value on that day.

Leveraged ETFs, on the other hand, seek to provide a multiple – say, two times – of the daily performance of an underlying index through the use of derivative strategies.

Both inverse and leveraged ETFs, most of which track commodity prices, are designed for short-term trading and are riskier than index ETFs.

It is worth noting that commodity-based ETFs cross over into all three primary categories. Commodity-based ETFs provide exposure to commodities such as energy, precious metals or agricultural products. These ETFs may either hold physical commodities or track the performance of spot market prices through physical contracts or invest in or track the performance of commodity-based futures contracts. About half of all commodity-based ETFs incorporate inverse/leverage strategies.

As acceptance of ETFs gains momentum, issuers have responded with a suite of new products to differentiate themselves and offer your clients a wider choice of investment opportunities. For instance, there now are ETFs linked to indices and other investment products across the full spectrum of sectors and subsectors in all geographical locations; some use specific strategies, such as covered calls and leverage, to enhance returns and meet the expectations of clients with different risk profiles.

In today’s uncertain economic climate, fixed-income ETFs have been in the spotlight. According to the Canadian ETF Association, this category accounts for the lion’s share of new ETFs, “a trend that has persisted since 2009.”

Investor Economics statistics indicate that fixed-income ETFs’ AUM has grown by 64% over the year ended Sept. 30.

Nonetheless, equity-based ETFs still rule the roost, accounting for 63% of total ETF AUM, as of Sept. 30, according to Investor Economics. In comparison, fixed-income ETFs’ AUM is about 32%; commodities-based ETFs, 3%.

Canadian equity-based ETFs comprise the largest group of equity-based ETFs, with 40% of total ETF AUM; next is U.S. equities, at 5%; then, global, international and emerging-markets equities, with a combined share of about 4%.

The equity-based ETF category also offers a range of sector-based ETFs, which together account for 14% of total ETF AUM. Among the target sectors are materials, real estate, energy, financials, utilities and infrastructure, metals, tech, health care and consumer staples.

In the fixed-income sector, investment-grade ETFs, which track government and corporate bonds, hold a 28% market share, while high-yield bond ETFs, which include exposure to corporate and emerging-markets issues, account for 4%. The high-yield component of this last subcategory, while having only $2.2 billion in AUM, has been growing the fastest over the past year.

Unlike equity- and fixed-income-based ETFs, those linked to commodities (including agriculture, energy and metals) have lost ground over the past year, with total AUM declining by 9%. This has been largely the result of underperforming commodities markets.

As the ETF industry takes off, competition among product manufacturers has increased and led to lower fees. In October, for instance, both Horizons and BMO reduced the fees on some of their ETF products.

“Incumbent ETF providers are dropping fees,” Atkinson says, “in what is being referred to as a ‘race to the bottom’ in order to differentiate their offerings from competitors.”

Regarding portfolio construction, Jain advises that ETFs alone, in any combination, can be used to achieve your clients’ objectives, or ETFs can be used as part of the total asset mix. However, he cautions, clients must be aware that some specialty and core ETFs use leverage to enhance returns, which can magnify losses.

The ease of trading ETFs makes these products suitable for any portfolio structure, Wiley says. Clients can get in or out of positions as they choose, especially in the case of satellite positions that rotate around core positions.

For example, an aggressive client could have a portfolio composed of only equities-based ETFs. The asset mix of such a portfolio could include core ETFs linked to the S&P/TSX composite index for Canadian exposure; to the S&P 500 composite index for U.S. exposure; and to the MSCI world index for global exposure. Satellite ETFs linked to the MSCI emerging markets index, for instance, or a specific sector or country index, could be added to enhance the risk/reward profile of the portfolio.

Alternatively, equity- or bond-based mutual funds could be used as the core component of a portfolio, then complemented by satellite ETFs linked to sectors that are favoured by the client.

Whether a pure ETF or a combined ETF/mutual fund strategy is employed, the satellite positions could be rotated easily to adjust the risk of the portfolio or to enhance returns.

In all cases, of course, the asset mix of the portfolio would depend on the risk profile and investment objectives of the client.

Coming in the Mid-November issue: ETF product innovations; plus, portfolio construction.

© 2012 Investment Executive. All rights reserved.