With volatility continuing to be a major theme in global financial markets, it can be a harrowing task trying to figure out where to invest your clients’ assets for 2015.

Most global portfolio managers have their eyes set on equities rather than fixed-income, but their enthusiasm is tempered by rich valuations for U.S. stocks. They caution that markets are likely to continue to be volatile if the U.S. Federal Reserve Board starts raising interest rates this year and with oil prices and the possibility of deflation remaining major question marks.

When it comes to the equities in which to invest, portfolio managers and strategists are divided between those who believe that U.S. equities will outperform and those who see more opportunities in Europe, Japan and some emerging markets.

In terms of sectors, most portfolio managers believe there could be short-term opportunities in oil and gas stocks, which were beaten up badly by the drop in the oil price to below US$50 a barrel in early January. These stocks should recover if the price of oil stabilizes at a higher level, but your clients need to be selective and stick to high-quality, low-cost companies with good balance sheets.

Many portfolio managers also like consumer discretionary and industrial stocks, which should benefit from the expected acceleration in U.S. consumer spending. Health care will continue to benefit from aging populations. There also are opportunities in technology stocks because of the ongoing need for productivity-enhancing breakthroughs – but only those stocks that aren’t currently overvalued. Many financial services stocks are quite cheap. And little is expected from material/mining stocks, including gold, and utilities, but there’s some interest in European telecommunications stocks that are benefiting from recent consolidation.

The fixed-income picture remains a difficult one to figure out. If U.S. interest rates rise, your clients will be better off if they invest in short-term bonds, treasury bills or guaranteed income certificates. But if U.S. interest rates don’t rise, your clients will have to roll these investments over at the same, low-yielding rates.

The magnitude of potential interest rate hikes depends upon the U.S. economy being strong enough to keep growing in the face of those higher interest rates. That, in turn, depends upon consumer confidence, which, in its turn, relies on continued growth in jobs and increases in wages.

U.S. consumer confidence is high, as consumers find themselves with more money left in their pockets after they fill up their gas tanks. But further drops in the jobless rate and higher wages are less certain. Some of the job growth in recent years has come from shale-oil production, which may be cut back severely as a result of lower oil prices.

There also have been fewer people looking for work – and if some of those “discouraged workers” re-enter the labour market, they would be counted as unemployed. As a result, the unemployment rate could stall or even move upward – and if this rate doesn’t keep dropping, wage increases will be less likely.

The U.S. is the only major country expected to experience accelerating real gross domestic product growth (GDP) this year, with the consensus being about 3%. Real GDP growth of 1% is the best that can be expected from Europe, and Japan will be lucky to get 1.5%. In contrast, China’s growth is decelerating; Russia is in recession; and Brazil and Argentina are barely moving. Meanwhile, India’s GDP growth is expected to pick up, but its economy is too small to make a significant impact globally.

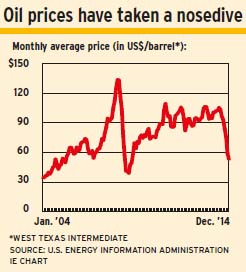

Oil is the big wild card. There are various theories about why oil prices have fallen by 50% since September. The decline may be mainly demand-driven, resulting from: subpar global economic growth; a shift toward consumer spending from infrastructure expenditures in emerging markets including but not confined to China; and increasing energy efficiency.

Or the decline could be supply-driven, resulting from: increasing U.S. oil production; the return of oil producers such as Libya and Iran to the export market; and OPEC’s decision not to cut production.

There’s also a theory that OPEC, led by Saudi Arabia, wants to hold down the price of oil for a significant period of time to drive out high-cost producers of U.S. shale oil and in the Canadian oilsands, and/or cripple Russia’s and Iran’s economies via a huge drop in their oil revenue.

There’s no consensus about how far oil prices will fall, how long these low prices will remain or where prices will stabilize in the medium term. In fact, there is debate on whether oil will settle in the US$60-US$70 a barrel range or rise to US$70-US$80 a barrel – or even a little higher. (See story on page B7.)

Then, there’s the risk of deflation. Lower oil prices are good for consumers and non-energy companies. But, with inflation already low in the industrialized world and falling dramatically in emerging countries, overall price levels could move into negative territory. The risk is that a vicious circle could be established, in which consumers put off spending because they know prices will be lower a year later, thus resulting in recession, layoffs and rising unemployment rates. This scenario would be compounded each year, as more and more purchases are postponed. (This situation is what has ailed Japan for many years.)

Consumer price indices are already in or very close to negative territory in many European countries – and the inflation rate in Japan would be almost zero were it not for a three percentage point sales tax increase in April 2014. Countries such as China, Singapore, South Korea, Brazil and Mexico, which usually struggle to keep inflation down, have inflation rates of less than 2%. Even inflation in the U.S. is low, at an annualized rate of 1.3% in November – significantly below the Fed’s target rate of 2%. The inflation rate is so low because of both lower gasoline prices and downward price pressures from the strong rise in the U.S. dollar (US$), which makes imports cheaper. (See stories on pages B5 and B6.)

The concern about deflation is focused primarily on Europe because economic growth is so weak in that region. But there also are concerns about the U.S., based on the possibility of the Fed raising interest rates too soon or too fast and the economy grinding to a halt – and lack of growth is essential for deflation to take hold. In contrast, as long as an economy is growing and there’s enough domestic demand, prices can’t go into a widespread, continuous decline.

However, the Fed is unlikely to make a mistake. Quantitative easing (QE) has worked, and the Fed probably is correct in its plan to raise interest rates. The Fed likely will be cautious and not take such action until it’s sure the economy is on a self-sustaining growth path.

But Ross Healy, chairman of Strategic Analysis Corp. in Toronto, and Nandu Narayanan, chief investment officer (CIO) with Trident Investment Management LLC in New York and portfolio manager of several funds sponsored by Toronto-based CI Investments Inc., both believe that QE has been a bandaid solution that has simply delayed a serious downturn in the U.S. economy. Thus, these money managers consider the U.S. economy, with its monumental public-sector debt, to be very fragile.

And the Fed may delay the interest rate hikes. In fact, Wendell Perkins, senior portfolio manager with Manulife Asset Management (U.S.) LLC in Boston, doesn’t think the U.S. will be “in any position to handle rate increases this year.”

Perkin’s fear is that if U.S. GDP growth decelerates and the Fed delays its planned interest rate hikes, financial markets will “lose confidence in central banks and their policies.” That would produce market turmoil for equities as well as bonds and also raise huge questions about prospects for Europe and Japan, which are in the early stages of their QE programs. For Europe, in particular, such questions could give Germany enough ammunition to prevent the implementation of a strong QE program in Europe.

However, these downside risks are unlikely to materialize. Here’s a look at the major equities markets’ prospects for 2015:

– THE U.S. Most portfolio managers think the U.S. will grow at around 3% this year, but François Bourdon, chief investment solutions officer with Fiera Capital Inc. in Montreal, thinks U.S. GDP growth could surprise on the upside, at 3.5%-4%.

The problem with the U.S. is that domestic stock valuations are high, which is making many portfolio managers more cautious. “We’re less positive on the U.S. because of the rich valuations,” says Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd. in London, U.K., who adds that there could be some pressure on margins from higher wages and lower revenue from exports when translated into US$. “It’s difficult to find value.”

Sadiq Adatia, CIO with Sun Life Global Investments (Canada) Inc. in Toronto, is reducing some of his U.S. stock weightings.

Todd Mattina, chief economist and strategist, asset allocation team, with Mackenzie Financial Corp. in Toronto, is concerned that U.S. stocks are overvalued.

There’s also concern that there could be a correction after six years of rising stock prices. The markets are probably “ripe for some kind of adjustment, although not as severe as in 2000 or 2008,” says Leo de Bever, formerly the CEO of Alberta Investment Management Corp. in Edmonton.

Craig Basinger, CIO with Richardson GMP Ltd. in Toronto, agrees with de Bever. In fact, Basinger believes that with U.S. capacity utilization moving to more than 80% and the Fed starting to raise interest rates, we are moving into the late stage of a bull market, which usually has higher volatility – that is, bigger swings – in prices.

Nevertheless, the U.S. still has its fans. “It’s hard not to like the U.S.,” says Ian Nakamoto, director of research with MacDougall MacDougall & MacTier Inc. in Toronto.

Also in this camp are Lloyd Atkinson, an independent financial and economic consultant in Toronto; Peter O’Reilly, head of the global equities team at I.G. Investment Management Ltd. in Dublin; and Clément Gignac, senior vice president and chief economist with Quebec City-based Industrial Alliance Insurance and Financial Services Inc.

– Europe. Some portfolio managers are overweighted in European equities because their valuations are lower than those of U.S. stocks and the continent is home to many strong multinationals that are major exporters and, thus, not dependent on domestic demand, which is likely to stay sluggish.

Perkins thinks there could be “meaningful upside” for European equities in the next several years, although not necessarily in 2015.

Nakamoto prefers European consumer discretionary companies, noting how many good, high-end companies there are, but he doesn’t like European banks, which may not make the loans needed to get their earnings growing.

– Japan. Portfolio managers are divided on Japanese equities, with some overweighted but a few underweighted – or avoiding the country entirely.

Stephen Lingard, senior vice president of Franklin Templeton Solutions, a division of Franklin Templeton Investments Corp. in Toronto, believes there are more gains to come in the Japanese market.

Burbeck also is enthusiastic and expects Japanese multinationals to increase their market share in international markets. That’s because the big drop in the yen over the past two years has increased the value of the revenue these firms receive from exports when translated into yen, which allows Japanese exporters to lower prices and steal market share from competitors.

Both Burbeck and Lingard recommend that Japanese investments be hedged against further drops in the yen, which both analysts think are likely.

On the other hand, Perkins is negative on Japan because he doesn’t think Prime Minister Shinzo Abe will succeed in making the reforms needed to get the economy on a healthy growth path.

– China. Most portfolio managers expect China’s real GDP to grow at 6.5%-7% in 2015, slightly less than the estimated 7.3% for 2014 and well below the 10.2% annual average from 1981-2011. But this growth rate still is sufficient to keep unemployment low and social unrest at bay. The biggest concern about China is its banking and “shadow banking” systems because no one knows how many bad loans there are or how easily they can be absorbed.

– India. This economy is the sleeper, with many portfolio managers expecting real GDP growth of 8% vs an estimated 5% in 2014. India’s new prime minister, Narendra Modi, is making a major effort to reform the entrenched bureaucracy, get rid of the rampant corruption and remove infrastructure bottlenecks, is garnering fans. The only caveat is that markets have already assumed that Modi will be successful, so valuations are high. Nevertheless, Lingard, for example, believes that India’s potential is so strong that these stocks are still worth considering.

– Other emerging markets. Russia is expected to remain in recession unless oil prices rebound more quickly than expected. Russian authorities have been forced to raise interest rates sharply to try to attract money into the country and stem the drop in the ruble.

Still, Jurrien Timmer, director of global macro and portfolio manager with FMR LLC in Boston, for example, believes there are opportunities in some emerging markets. He says there are some opportunities for bold investors, but adds that you must be selective and invest in economies such as Mexico, which will benefit from good U.S. growth; and Indonesia, which relies more upon consumer spending than commodities exports; rather than resources-dependent Brazil and slowing China.

Lingard is intrigued by eastern Europe, but says caution is needed because exports to Russia are very important to these countries’ economies. The region also is dependent upon growth in Western Europe.

Lingard doesn’t like Brazil, which is “in or near recession” and its “socialist government doesn’t want to make the tough structural reforms that are needed.”

Gignac doesn’t see emerging markets’ stocks performing well in the near term, but he thinks clients willing to hold stocks for three to five years can find good stocks that are inexpensive.

© 2015 Investment Executive. All rights reserved.