INVESTMENT EXECUTIVE ASKED TWO exchange-traded funds (ETFs) portfolio strategists – Daniel Straus, director of ETF research and strategy, structured products and derivatives, with Toronto-based National Bank Financial Inc.; and Tyler Mordy, president and chief investment officer with Toronto-based Forstrong Global Asset Management Inc. – to put together a hypothetical $1-million retirement investment portfolio made up entirely of ETFs.

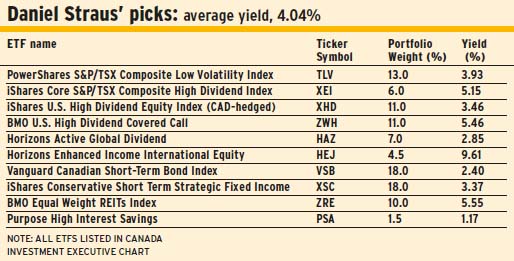

The guidelines: the portfolios could hold up to 10 ETFs; should be globally diversified, as well as balanced between stocks and fixed-income exposure; and generate an average annual yield of 4%.

Although both strategists include stocks- and bonds-based ETFs, the tilts were different. Straus’ portfolio asset mix allocates 52.5% to stocks; Mordy’s, 36% to stocks. However, both portfolios have significant real estate exposure (which could be considered equity): Straus recommends 10% exposure; Mordy, 11%. On the fixed-income side, Mordy recommends 51% in bonds, while Straus recommends 36%.

Mordy made his picks from ETFs that trade both in Canada and internationally, with variety on the fixed-income side. For example, he included emerging-market government bonds and even some China-related offshore bonds that trade in the “dim sum” market, as well as a global opportunities ETF with the freedom to include a wide range of asset exposures.

Straus stuck to Canada-listed ETFs, but still was able to achieve international strategic fixed-income exposure with an ETF offering global diversification and exposure to alternative asset classes such as convertible bonds.

“Adequately diversifying a portfolio – especially a retirement portfolio,” Mordy says, “is of paramount importance.”

© 2015 Investment Executive. All rights reserved.