Financial literacy levels among younger Canadians lag both those of individuals who are in their mid-life years and those approaching or in retirement, according to recent research conducted by Mississauga, Ont.-based Credo Consulting Inc.

For financial advisors, making the effort to approach younger prospects can represent an opportunity not only to bridge the generation gap in terms of financial knowledge, but also be a way to expand advisors’ businesses, says Kelley Keehn, consumer advocate with the Toronto-based Financial Planning Standards Council, a speaker and a former advisor.

For example, offering to sit down with a client’s children to explain financial fundamentals and perhaps open a TFSA or an RRSP on their behalf – even if they don’t yet have money to contribute toward it – can help launch the process of learning.

“It’s like getting two stamps on a new [loyalty] card at the store for [younger] clients,” Keehn says. “They feel like they’ve already done something right, and they’re much more likely to invest.”

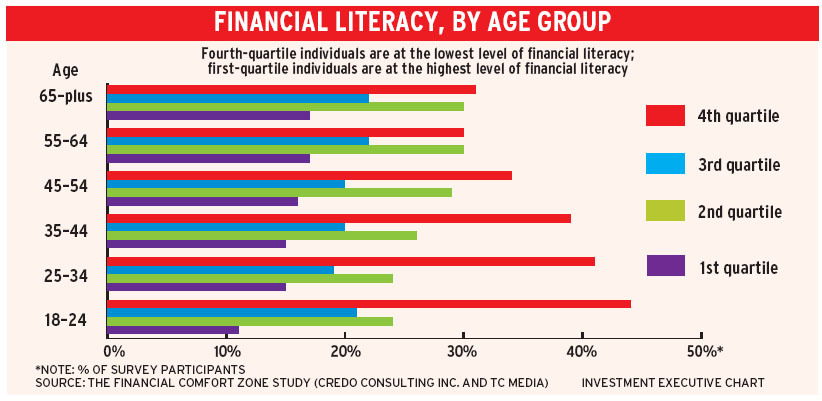

Credo asked survey participants a series of questions as part of a financial literacy test, then ranked participants into quartiles based on their scores. Participants with the lowest scores were placed in the fourth quartile; those who scored highest were placed in the first quartile.

Among the Canadians Credo surveyed in the 18-24 age range, 44% ranked in the fourth quartile and 11% ranked in the first quartile. In comparison, among Canadians surveyed in the 65-plus range, 31% ranked in the bottom quartile and 17% were in the top quartile. In general, scores in the survey improved at each successively older age range, plateauing at age 55 and above.

These findings were drawn from recent research conducted by Credo for the ongoing Financial Comfort Zone Study, a national consumer survey, in partnership with Montreal-based TC Media’s investment group. (TC Media publishes Investment Executive.)

According to Credo’s research, individuals with low levels of financial literacy were more likely to report feelings of financial defeat. When asked if they agreed (on a scale of one to 10) with “I feel a sense of defeat when I think about my finances,” survey participants in the fourth quartile gave an average score of 4.7. In contrast, surveyed participants in the first, second and third quartiles gave an average score of 3.2, 3.5 and 3.8, respectively.

There are three core issues that often serve as obstacles for younger people when seeking the financial advice they need, Keehn says:

– Being overwhelmed by financial jargon and information being directed at them by the financial services sector and the media.

– Uncertainty about how to determine if financial advisors and professionals are trustworthy.

– The stigma associated with being seen to be financially unsophisticated.

“Younger people tell me: ‘I’m going to be told I need millions to retire, and there’s no way that’s ever going to happen. So, I won’t bother to reach out for help’,” Keehn says. “There are a lot of myths out there about what help is [available], and how you get that help.”

Younger Canadians often don’t have enough assets built up to be able to access quality financial advice. However, you can approach these prospects in a way that makes business sense, such as offering group events, seminars and webcasts that focus on financial fundamentals, says Sara Gilbert, founder of Montreal-based Strategist Business Development.

“[You should] share information on how to manage debt, or how to manage cash flow or how to do a budget,” Gilbert says. “In my opinion, it’s part of an advisor’s responsibility that clients understand what they’re doing.”

Professionals in the financial services sector understand they have a key role to play in teaching younger Canadians about their finances. The Toronto-based Canadian Bankers Association (CBA), for example, developed a program called Your Money Students that offers young people, their parents and teachers resources to expand financial literacy.

That program offers non-commercial classroom seminars delivered by volunteers from the banking sector and focused on topics such as budgeting, borrowing or investing rather than on products.

“In certain pockets [of the younger population], there’s some degree of hesitation and reticence [about asking for financial information], and I understand why,” says Neil Parmenter, president and CEO of the CBA. “The goal is how do you make it more accessible for people, and more comfortable for them to put up their hand, tap into resources and, ultimately, ask the right questions.”

In fact, Parmenter says, he prefers the term “financial education,” as “it implies a continuing journey” as opposed to the term “financial literacy,” which implies that someone is either financial literate or not.

“It’s not a stop-and-start exercise,” he says. “When you’re at different points in your life, there are different levels of depth that you need to have about financial products and advice.”

In fact, although older Canadians in general may feel more comfortable with financial concepts and terms than younger individuals do, the older set also may benefit from financial education programs – particularly those identifying financial abuse and fraud, managing money in retirement and understanding government benefits, says Jane Rooney, Canada’s financial literacy leader who is overseen by the Ottawa-based Financial Consumer Agency of Canada.

For example, the Canadian credit union industry launched a program, developed as part of the national financial literacy strategy, to help front-line staff better identify financial abuse and to report it, says Rooney, who was appointed to her role by the federal government in 2014.

“Higher-risk consumers need to understand better that there’s financial advice and advisors out there because we don’t expect consumers to be experts about financial products and services,” she says. “But we’d like [those consumers] to get information, be confident to ask the right questions, then better understand their rights and responsibilities, so that they’re making a decision around the best products or services that suit their needs.”

The online Financial Comfort Zone Study has polled 22,000 Canadians thus far. The survey is meant to gain insight into the relationships among financial advice, financial well-being and overall life satisfaction in Canadian society. Canadians are polled monthly, and the number of survey participants will increase each month.

© 2017 Investment Executive. All rights reserved.