The eurozone has officially slipped into another recession as the region copes with the sovereign-debt crisis and severe austerity measures. But despite this economic weakness, fund portfolio managers see attractive investment opportunities in the region although they warn investors to be cautious of the risks.

Most portfolio managers expect economic growth for the region to remain negative well into this year, but are optimistic that Europe will gradually improve in the second half of this year and through 2014.

“As a whole, I think you’re not going to see much in the way of growth in 2013,” says Sadiq Adatia, chief investment officer with Toronto-based Sun Life Global Investments (Canada) Inc. “But we could potentially see a rebound the year after.”

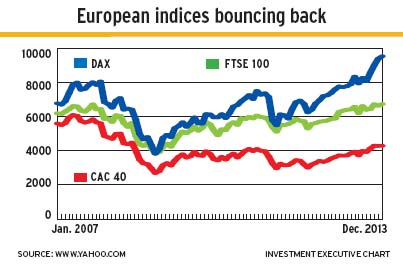

Despite the weak economic conditions, European stock markets outperformed most other global markets in 2012.

Defensive sectors performed well and there’s the rub. Valuations are getting expensive, although many portfolio managers continue to see upside potential for these stocks, especially among consumer staples.

So, with optimism that the eurozone’s economy will improve later this year, portfolio managers have begun to increase their exposure to cyclical sector stocks gradually, but will scale back if things suddenly take a turn for the worse.

“Europe, for me, is a risk-management game,” says Simone Loke, vice president and director with TD Asset Management Inc. in Toronto and lead portfolio manager of TD European Growth Fund. “Especially in the past few years.”

There are plenty of risks. Spain must roll over a huge volume of sovereign debt in the next few months, which could produce the need for a bailout. In addition, elections scheduled in Italy and Germany threaten to shake up the political landscape at a time when co-operation among European Union policy-makers is critical.

“It’s pretty clear that there are significant long-term problems in Europe,” says Stephen Oler, portfolio manager in Smithfield, R.I., with Pyramis Global Advisors LLC, a Fidelity Investments company, and co-manager of Fidelity Europe Fund. “None of this is going to resolve itself overnight.”

However, most portfolio managers think the worst of the crisis has passed, in the belief that policy-makers have taken the necessary steps to contain the crisis.

In particular, the pledge in September by the European Central Bank to buy unlimited amounts of government bonds has provided markets with much needed reassurance that policy-makers were prepared to do whatever it takes to prevent a disaster. The announcement immediately sent bond yields lower and stock markets higher.

“That’s definitely been a big positive development,” says Matthew Benkendorf, vice president and portfolio manager with Vontobel Asset Management Inc. in New York, and manager of BMO European Fund. “When you have such a massive crisis, where uncertainty is running so high and the financial system is so precariously balanced, the central bank plays a critical role in at least putting a backstop in the system.”

Says Martin Fahey, head of European equities with I.G. International Management Ltd. in Dublin and manager of Investors European Equity Fund: “Economic growth is likely to be weak for a number of years, given the scale of the deleveraging required in different economies.”

Economic fundamentals in Britain appear to be slightly stronger, but not by much, with that economy expected to grow by only 0.6% in 2013.

Some of the opportunities portfolio managers are finding:

– FINANCIALS. Encouraged by improving balance sheets, portfolio managers are looking more favourably at the financial services sector, although they are still avoiding institutions that hold a lot of debt issued by the peripheral countries.

Benkendorf favours Switzerland-based UBS AG, which, he says, has strong growth prospects and has proven its ability to comply with the growing set of regulations in the sector. “It’s a very profitable business,” he says. “[UBS] as a whole has been very successful in raising capital levels to a very high place.”

– TECHNOLOGY. Benkendorf is partial to tech companies with diversified global exposure, such as Germany-based software company SAP AG and Ireland-based technology services firm Accenture PLC. “You can find some franchises,” he says, “that are growing globally.”

Loke favours Amadeus IT Holding SA in Spain, which processes transactions for the global travel and tourism industry. Amadeus has about 33% of global market share in this business, with the potential for growth.

– DEFENSIVE SECTORS. Utilities, consumer staples and telecommunications stocks have been a popular safe haven for investors in the past two years and now are generally, as Loke puts it, “quite expensive.”

But there are exceptions. One is Paris-based telecom company Iliad SA. It’s not the largest telecom player in France’s market, Loke says, but Iliad has gained considerable market share by undercutting its competitors while maintaining a healthy profit margin.

Many portfolio managers see upside potential in consumer staples, despite recent market gains.

Benkendorf says about 30% of the BMO fund’s assets under management is in this sector: “We tend to find much better businesses there that are growing at very attractive rates and are undervalued. They have really predictable franchises.”

In particular, Benkendorf is keen on consumer-goods firm Unilever Group, which has headquarters in both London and Rotterdam: “You get a diversified portfolio of highly branded consumer-staple products, with a very strong emerging-markets footprint.”

Benkendorf also likes Belgium-based Anheuser-Busch InBev NV, a brewing company with a variety of prominent international brands: “It’s a very well-run, very stable, very predictable business.”

– PERIPHERAL ECONOMIES. Portfolio managers are generally more confident investing in countries with more stable finances and economic fundamentals, such as Germany, Britain, France, Switzerland and Sweden. But some are finding selective opportunities to pick up shares in strong companies in Spain, Italy and Portugal at attractive valuations.

“There is a risk of being too negative on some of these peripheral countries,” Oler says. “Yes, they’re in the headlines as [being] very troubled, but that doesn’t mean there aren’t some very interesting investment opportunities.”

Specifically, both Oler and Peter Hadden, portfolio manager with Pyramis and co-manager of Fidelity Europe Fund, like the Spanish fashion group Industria de Diseño Textil SA (commonly known as Inditex Group), which owns such international fashion brands as Zara and Massimo Dutti, and has expanded into global markets in recent years.

– GLOBAL COMPANIES. Given the risks in Europe, many portfolio managers prefer investing in companies with broad global exposure. Many multinational firms have seen their stock prices plummet due to their ties to the shaky European region, even though those companies earn a large proportion of their profits from high-growth markets such as Asia.

“There are companies that do not necessarily rely on the domestic economy,” Loke says, “and yet they’re being completely sold off to ridiculously low valuation levels, just because they’re based in Spain, for example, or Italy.”

One example, Hadden says, is Germany-based Volkswagen AG, one of the largest auto manufacturers in the world. Another is London-based British American Tobacco PLC, one of the largest tobacco companies in the world.

© 2013 Investment Executive. All rights reserved.