Canadians who are 55 years old or older are the least likely to contribute to registered education savings plans (RESPs). However, these individuals increasingly are more open to the plans if they have grandchildren.

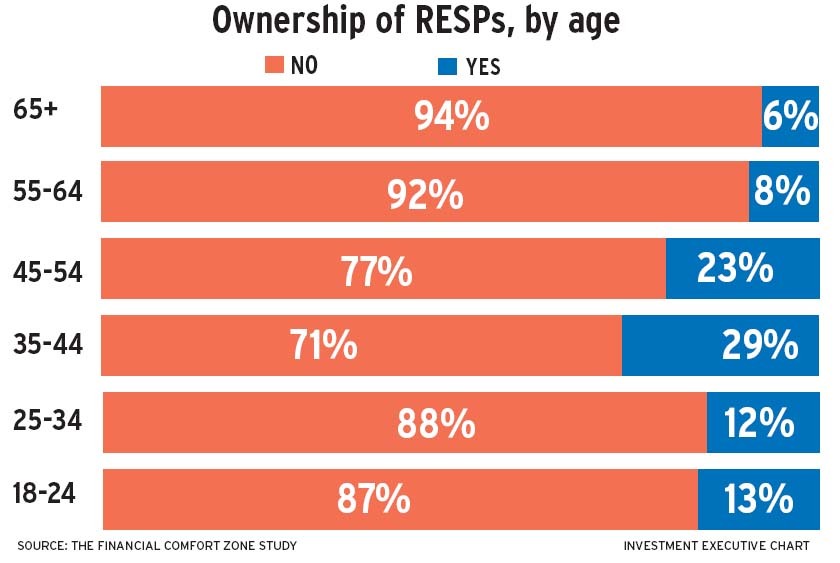

Fewer than one in 10 (8%) of Canadians between the ages of 55 and 64 have an RESP and even fewer contribute to a plan if they are 65 years old or older, according to the most recent edition of The Financial Comfort Zone Study, conducted by Mississauga, Ont.-based Credo Consulting Inc. in partnership with Montreal-based TC Media’s investment group. (Investment Executive is published by TC Media’s investment group.)

These rates compare with the 29% of Canadians between the ages of 35 and 44 who subscribe to RESPs.

That gap in subscribership may shrink as a growing number of older individuals look to RESPs, according to Angela Iermieri, a financial planner with the wealth-management arm of Lévis, Que.-based Desjardins Group.

Specifically, more of Iermieri’s older clients are interested in these plans as a way to help their grandchildren and protect their assets from taxation, she says.

The latter point is a distinct advantage for individuals considering their legacies, says Jamie Golombek, managing director of tax and estate planning with Canadian Imperial Bank of Commerce‘s wealth strategies division in Toronto: “It’s really the most effective intergenerational wealth transfer you can do.”

An RESP allows contributions and earnings in the plan to grow on a tax-deferred basis. Withdrawals that are used to pay for post-secondary education for a plan beneficiary (i.e., a student) are taxed in the beneficiary’s hands. If the beneficiary has no or low income, the withdrawal will not be taxed, says Golombek.

RESPs also benefit from Ottawa’s Canada Education Savings Grant, which is additional funding available to all subscribers, as well as the Canada Learning Bond, which is targeted at families of modest income. RESP-holders in British Columbia, Quebec and Saskatchewan also can take advantage of provincial education savings grants.

Regardless of demographic, Credo’s research found that Canadians who have financial advisors are more likely to be contributing toward an RESP than people without an advisor.

Advisor’s guidance

For example, 19% of Canadians who have an advisor also contribute to RESPs, while 12% without an advisor do the same. An advisor’s guidance may not be the sole explanation for the difference, but that does not negate an advisor’s important role in showing clients how education savings are linked to future financial success, says Hugh Murphy, managing director of Credo Consulting.

“If you’re taking the time to become educated, then you’re much more likely to be generating high income for yourself,” says Murphy. “Encourage [your clients] to save for their kids’ education. Spending money on education pays dividends in the long run.”

More than half (57%) of Canadians with a university degree or a postgraduate degree describe themselves as earning a “high” level of income in comparison with 8% of high-school graduates who state the same. Among Canadians with a low level of income, 24% completed a university degree or post-graduate degree, while 20% stated their formal education ended after high school.

Advisors also should be ready to educate their clients regarding on the benefits of an RESP. Although these products have been registered plans since 1972, some rules have changed and your clients may not be aware of the increasing flexibility within RESPs.

“The interesting thing with RESPs is even though they tend to be smaller accounts and the time horizon may be shorter [than RRSPs], the rules around them are quite complex when you get into all of the different scenarios over time,” says Curtis Davis, director of tax and estate planning with Toronto-based Mackenzie Financial Corp.

Tax planning professionals within an advisor’s firm or asset manager are a valuable resource in advisors’ ability to stay up to date on changing rules, says Davis.

And your financial planning skills may be the most valuable asset you have in helping your clients understand their best option for tax-efficient investments. Clients immediately think of their own RRSPs or tax-free savings account to shelter any extra money; but, depending on the age of their children, RESPs may be the most beneficial, thanks to the government grants, says Iermieri.

Timely topic

The RESP is a timely topic, as many families with children under the age of 18 are receiving the new federal Canada child benefit. You should talk to your clients about using some of that money to add to an RESP, says Golombek.

Some Canadians are less likely than others to turn to RESPs, which are least utilized in Quebec. Less than one-fifth (16%) of Quebeckers who have a financial advisor have an RESP; in contrast, the plans are most popular in Ontario, where 21% of Ontarians who have an advisor have an RESP.

The difference in tuition fees between the two provinces may explain why Quebeckers are less likely to invest in an RESP, according to Iermieri. Data from Statistics Canada indicate that Quebec had the second-lowest average tuition fee in the 2015-16 school year; Ontario had the highest average fee.

Quebec’s move in recent years to increase tuition fees slowly may encourage further participation in that province.rmieri says Desjardins has already seen an increase over the past 12 months.

The online Comfort Zone survey polled more than 8,000 Canadians. The survey is meant to gain insight into the relationships among financial advice, financial well-being and overall life satisfaction in Canadian society. Canadians are polled monthly, and the number of survey participants will grow to 12,000 within 12 months.

© 2016 Investment Executive. All rights reserved.