Canada’s financial advisors have some work to do in bolstering the confidence their older clients have about their retirement finances, according to the most recent results of a consumer survey conducted by Mississauga, Ont.-based Credo Consulting Inc. in partnership with Montreal-based TC Media‘s Investment Group. (Investment Executive is published by TC Media’s Investment Group.)

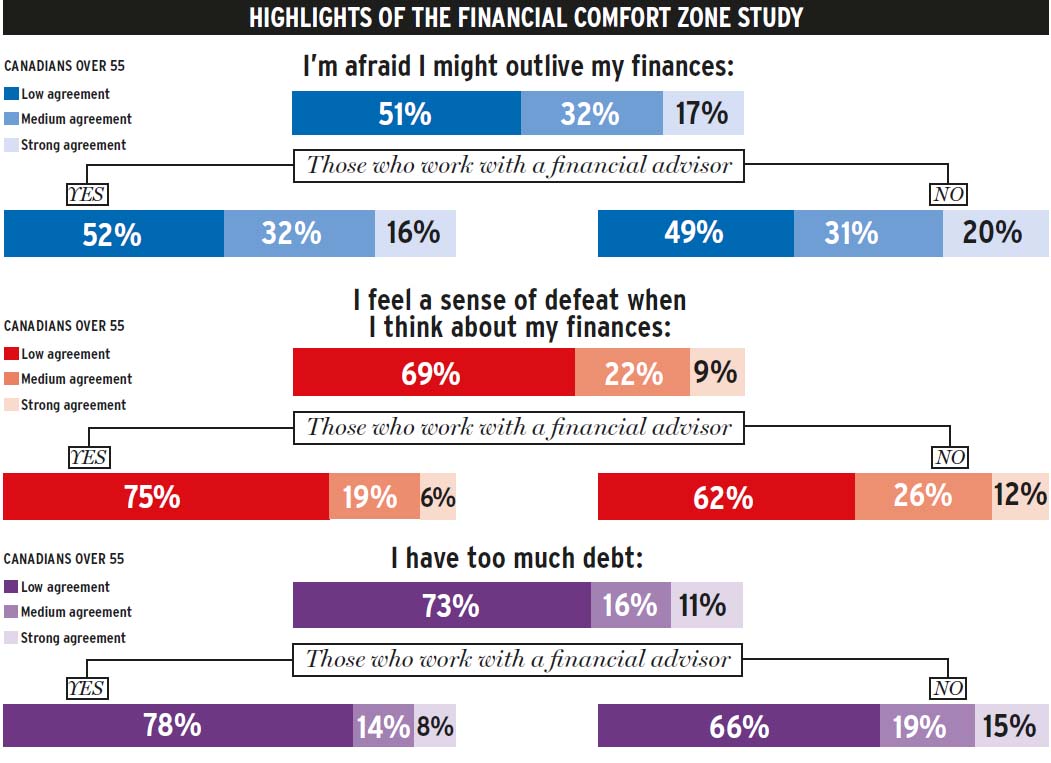

The Financial Comfort Zone Study found that almost half (48%) of Canadians aged 55 and older who have a financial advisor are concerned that they will outlive their finances in retirement. That’s not far from the 51% of survey participants without advisors who fear outlasting their retirement finances.

Survey participants also were asked for their level of agreement with the statement: “I feel a sense of defeat when I think about my finances.”

Although slightly more than two-thirds (69%) of older Canadians rated their agreement with that statement as being low, a substantial number (31%) of participants’ agreement was medium or strong. Among older Canadians with advisors, 25% were in medium or strong agreement with the statement, compared with those without advisors (38%).

The ongoing national survey of Canadian consumers, conducted in English and French, is designed to gain insight into the relationships among financial advice, financial well-being and overall life satisfaction in Canada. Results discussed here reflect the views of about 6,000 Canadians; the intention is to poll 12,000 within 12 months.

Although the survey suggests advisors generally do make a difference in helping their clients prepare for retirement, there still is an interesting opportunity for advisors willing to get creative in order to assure clients they will not outlive their finances, says Hugh Murphy, managing director of Credo Consulting.

One way to accomplish this is to spend more time communicating to your clients’ how their portfolios will allow them to fulfil their retirement goals, as opposed to discussing how portfolio returns fare vs an index, says Sara Gilbert, founder of Strategist Business Development in Montreal.

“The role of the advisor has definitely changed,” Gilbert says. “It’s more relationship-based and definitely more coaching-based.”

For example, discussion of individual retirement goals should be conducted in the context of affordability. If a client wants to purchase a cottage for retirement, any discussions about the client’s investment portfolios must communicate to the client whether he or she can afford that cottage.

Many Canadians’ fears about their inability to afford retirement are unfounded, notes Tim Cottee, vice president of retiree planning at Investors Group Inc. in Winnipeg, making your role in providing that realistic view of clients’ finances especially important.

As for why a significant number of older Canadians feel somewhat hopeless regarding their finances, Cottee notes that this demographic is the first cohort of pre-retirees that will rely more heavily on the performance of the financial markets for retirement funding, thanks to the declining use of defined-benefit pension plans in the private sector.

“[This demographic] has way more exposure to the markets,” he says, “and they’re retiring on top of a truly volatile market.”

Baby boomers are unsure of how much money is actually required in retirement and are frightened by the large numbers that are casually thrown around, says Barry LaValley, founder of the Retirement Lifestyle Center Inc. in Nanaimo, B.C.

You should have honest conversations with your clients about their health needs, family obligations and desire to keep working or volunteering, as well as the level of funds that will be needed in this stage of life, says LaValley: “You’re really helping people plan for the last third of their life. It’s not planning for vacations and bucket list stuff.”

Slightly more than one-quarter (27%) of older Canadians are in medium or strong agreement with the idea that they have too much debt, according to the survey. This is another area in which Canadians with advisors feel they are ahead: 22% of those with advisors feel burdened by debt as opposed to 34% of those who not use an advisor.

Fewer older Canadians being concerned about holding significant debt is not surprising, says Cottee: “Canadians are a relatively practical group of people, and it doesn’t change when they enter into retirement. Going into retirement in debt is an impractical thing in a majority of retirees’ minds.”

Meanwhile, Canadians under the age of 55 are more concerned than their older counterparts about outliving their finances, and more of the younger group feel a sense of defeat about their financial situation.

For example, 62% of Canadians under the age of 55 are in medium or strong agreement with the idea that they worry about outliving their finances, compared with 49% of the older survey participants who stated the same. Although younger Canadians have more time until retirement, they also have significant financial obligations, such as a home purchase, Murphy explains.

Investors who are in their mid-30s and have had some time to build up assets can be a good market for advisors, says Gilbert. She adds that advisors can be proactive wealth managers who can demonstrate to their younger clients what their retirement can look like if they save and invest.

© 2016 Investment Executive. All rights reserved.