After years of struggling to establish strong, self-sustaining growth, the U.S. economy appears to be at a cross-roads. Now, everyone is waiting for the U.S. Federal Reserve Board to raise short-term interest rates and prove that quantitative easing (QE) has worked and the economy can grow without very low interest rates.

The consensus among analysts is that the Fed will act about mid-year, a view that is reflected in the short-term market rates. But the Fed has said that the decision to raise rates will be data-dependent, indicating that the central bank won’t move until it’s convinced that the economy is on a self-sustaining path.

Currently, there isn’t concern about inflation rising strongly, given that market interest rates indicate that markets are expecting lower inflation than the Fed’s 2% target.

But growth in real gross domestic product (GDP) in the third quarter vs the second quarter was a strong 5% at a seasonally annualized rate, a level that should not require the stimulus of short-term rates near zero. Thus, this is an appropriate time to start raising rates to more normal levels – at which the Fed has the flexibility to lower rates if the economy falters or raise them if demand gets too hot.

A plus for the U.S. econony is the huge drop in oil prices. Even though lower oil prices are cutting profits and investment in the energy sector, lower prices are increasing consumers’ disposable income and cutting transportation costs for industries. The positives appear to outweigh the negatives. Already, consumer discretionary stocks reflect expectations that cheaper gasoline will help other consumer purchasing.

Some other economic indicators are less positive. The strong increase in the US$ vs most currencies, including the euro and yen, is making U.S. goods less competitive and could dampen export growth. Manufacturing utilization rates are at levels below the highs of 2001-08 and of the 1990s.

And housing appears unlikely to support business growth. New house construction has dropped from 1.5 million units a year before 2008 to one million units. Sales of existing houses dropped by 6% in November, and prices have been declining since the middle of 2014. The relative performance of housing stocks also dropped steadily through 2014.

The stock market last year also offered a similarly negative view of automotive stocks, which are cyclical – and have been underperforming.

Age also may affect the business expansion and bull market in stocks. It is going on six years since the last U.S. recession ended, and the stock market’s bull cycle is already one of the three longest in history. Age can make market psychology more vulnerable to a surprise – whether that is the shock of higher interest rates or unexpected timing of the event.

Still, pretax corporate profits in the third quarter were close to the record levels of 2012 and 2013, which is positive for equities.

Certainly, stock markets bought this view, as shown by the run-up in equities as 2014 ended. However, it’s not yet clear whether the nervousness at the end of 2014 and the beginning of this year is significant.

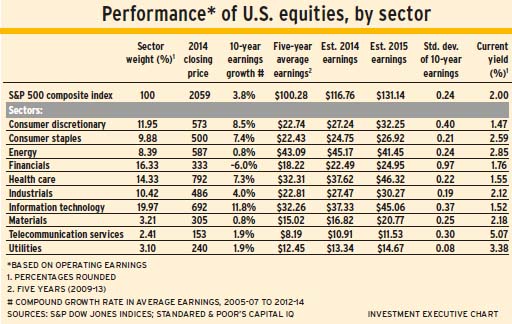

Utilities were the most favoured sector in the stock market as 2015 began, showing the greatest price strength over the most recent six months. Consumer discretionary, consumer staples, financials and health care followed. Industrials and information technology (IT) were next in line, with higher relative performances than the S&P 500 composite index.

Least favoured sectors were energy, materials and telecommunications services.

Ibbotson Associates Inc. of Chicago is the source for industry-standard asset return analyses, as well as for asset-allocation and portfolio-construction services. For conservative portfolios, Ibbotson recommends a rough balance among consumer staples, energy, financial, health care, industrials and utilities. For more aggressive portfolios, the firm suggests concentrated allocation in IT, health care and financial stocks.

Here’s a look at the U.S. sectors in more detail:

– Information technology. The largest of the 10 sectors in the U.S. market, IT led in earnings growth over the past decade. Consensus earnings growth in 2015 is 21%, well above average. But keep in mind the sector’s earnings growth has been volatile. Apple Inc., the dominant sector stock (almost 17% of the sector’s index weight), continues to stand out. Consensus estimates project a 15% sales gain in the fiscal year ending September 2015 and a 20% earnings gain. Microsoft Corp. has “buy” recommendations, mainly because of an anticipated 13% revenue gain in the fiscal year ending June 2015, and an 18% rise in earnings in the following year.

Other “buy” recommendations in this sector, however, are concentrated below the 10 largest stocks. Earnings revisions have been trending higher for Intel Corp., Visa Inc., MasterCard Inc. and Texas Instruments Inc. Hewlett-Packard Co. gets positive votes as being in a recovery situation.

– Financials. This, the second-largest sector, will react most directly to the Fed’s moves on rates. The sector index has retraced only 55% of its 2008-09 collapse and the market has treated financials as only average performers over the past year.

Over a decade, there has been no growth in this sector’s earnings, and earnings volatility has been high. Estimated growth in 2015 is 11%, slightly less than the anticipated gain for the entire S&P 500 index.

Consensus estimates for earnings gains are fairly modest among the 15 largest of the 85 institutions in the sector. Exceptions are Bank of America Corp. and Citigroup Inc., for which analysts expect 2014’s big earnings declines will be more than recovered in 2015.

– Health care. This sector will be difficult to ignore in 2015, following its 27% price rise in 2014. Ten-year earnings growth, however, is only fourth-best among the sectors, but with the virtue of low volatility. In 2015, a 24% rise in earnings is forecast.

Biotechnology has been the leader in health care. Analysts expect superior earnings gains again in 2015 by Celgene Corp., Amgen Inc. and Biogen Idec Inc. Estimates for these companies have gradually been revised higher. Similarly, estimates have been rising for AbbVie Inc. and Actavis PLC. Market action suggests that Medtronic Inc. has potential for a big rise.

Expectations for slender earnings gains apply to most traditional “big pharma” companies except for Eli Lilly & Co., which is expected to experience an estimated 16% rise in earnings.

– Consumer discretionary. This sector is likely to be highly unpredictable. Should the U.S. economy continue to grow, this cyclical sector will shine, with analysts forecasting earnings gains in 2015 of 18%.

There are problems in some consumer industries, however. For example, sales have been trending down for the fast-food leader, McDonald’s Inc. General merchandise stores, such as the big “dollar” store chains, also have struggled to maintain sales volume.

– Industrials. This is a sector that normally tracks closely with the S&P 500 index – neither outperforming nor underperforming for long. After outperforming since mid-2012, this sector has turned downward relative to the S&P 500.

Two industries – aerospace/defence and industrial conglomerates – account for almost half the sector. Boeing Co., dominant in aerospace, has a record order backlog. Analysts expect a slim 3% earnings rise for this stock in 2015; despite that, its price momentum continues to rise.

General Electric Co., the largest stock in the industrials sector and the largest conglomerate, has been lagging the market. Earnings growth has been slow, but the consensus for 2015 is a 7% rise.

Transportation has had outstanding growth and continues to outperform the market. Airlines appear to have entered a new era of sustained profitability. Lower fuel prices will help, but the benefits will be delayed because airlines hedge their fuel prices. Consensus earnings estimates indicate gains of 34%-57% for the four major carriers, Delta Air Lines Inc., Southwest Airlines Co., American Airlines Group Inc. and United Continental Holdings Inc.

– Consumer staples. These stocks, which are prized for their defensive qualities, spurted higher after the middle of 2014 on fears of an economic slowdown. Earnings are forecast to rise by 9% in 2015. Among the largest stocks, Procter & Gamble Co. and Wal-Mart Stores Inc. have current appeal because of expected sales gains in 2015. Consensus estimates project a 14% earnings gain by CVS Health Corp.

Among the smaller companies, consensus estimates indicate a 17% rise in 2015 earnings for Archer-Daniels-Midland Co. and a 13% rise for Constellation Brands Inc.

– Energy. There has been little earnings growth in the past decade, and with the collapse of crude oil prices, a gain of barely 1% is foreseen for 2015. Whether oil prices have reached bottom is a question still to be settled.

– Materials. This is a much different sector on Wall Street compared to Canada. Although this sector’s domestic counterpart is stocked with mining companies and fertilizer producers, the U.S. materials sector primarily is a chemicals affair. Lower oil prices will benefit chemical producers, so sector earnings are estimated to grow by 24% in 2015.

– Utilities. These became growth stocks in 2013, rising by 20% as fears of a rise in bond yields were dispelled – perhaps temporarily. The sector yields 3.5% in dividends. The sector subindex has lost ground relative to the S&P 500 index since 2009.

– Telecom services. This sector is too small to be an S&P 500 index sector. That’s because telecom stocks that might be expected in the sector – Verizon Communications Inc. and AT&T Inc., for example – are classified with IT.

Relative to the market, this sector’s index is at new lows.

© 2015 Investment Executive. All rights reserved.