Canadian equities, particularly cyclical stocks, are likely to do well in 2014 as global economies start to heat up.

As export demand expands globally, so will returns, says Craig Fehr, investment strategist with Edward D. Jones & Co. LP in St. Louis: “We’re likely to see another good year for Canadian equities in 2014.”

Canada’s economy is expected to grow by 2.5% this year vs about 1.7% in 2013, says Alex Lane, vice president and fund portfolio manager with Dynamic Funds, a division of 1832 Asset Management LP, in Toronto.

With stronger growth globally as well as at home, portfolio managers are paying attention to cyclical stocks and to stocks with exposure beyond Canada’s borders.

“Because we believe we’re in an accelerating global economic recovery environment, we prefer cyclicals over defensive stocks,” says Lane. “We’re more interested in things such as industrials, technology, health care and consumer discretionary.”

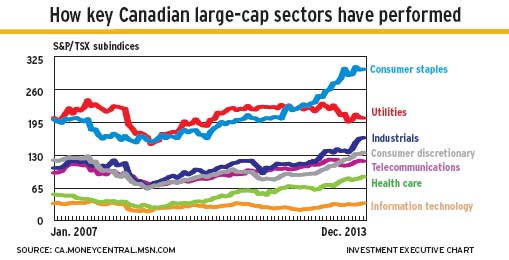

Here’s a closer look at the sectors of the Canadian large-capitalization equities market, excluding financials (see story on page B18), resources (see story on page B13) and gold (see story on page B4):

– Consumer staples. The tough competition in this sector and its relative immunity to economic ups and downs make these stocks less interesting to portfolio managers and analysts, who mostly rank the outlook for this sector as “neutral.”

Consumer staples are “probably not where we’re focusing our attention at this particular stage because we want to have that little extra torque and cyclicality,” says Paul Taylor, chief investment officer for fundamental equities with BMO Asset Management Inc. in Toronto. He notes that Loblaw Cos. Ltd. has performed well, but the “razor-thin margins” of grocers and increased competition from U.S.-based retailers, such as Wal-Mart Stores Inc. and Target Corp., will make consumer staples a difficult sector in the future.

Although the market is difficult, portfolio managers still hold shares in some of the big names in this sector. For example, Richard Nield, portfolio manager in Austin, Tex., of Invesco Canadian Premier Growth Fund, sponsored by Invesco Canada Ltd. of Toronto, has held shares in Shoppers Drug Mart Ltd. for some time and has benefited from Shoppers’ recent acquisition by Loblaw. “There’s still some positive arbitrage there, which is why we still own Shoppers,” says Nield, who is unsure whether he’ll continue to hold the stock in the Invesco fund.

Nield prefers Metro Inc. over Loblaw because of its presence in Quebec and in the Greater Toronto Area and its strong operations: “It’s a good blue-chip name.”

Alimentation Couche-Tard Inc. is making good use of acquisitions to gain exposure to other markets, including Europe, says Mark Pugsley, vice president of equities with Standard Life Investments Inc. in Montreal. “The company has a good track record and model of organic growth at the store level, reducing costs and a solid mergers and acquisitions strategy.”

– Consumer discretionary. Portfolio managers are overweighted in this sector because it’s poised to take advantage of the expanding global economy. Of the two big names in this sector – Magna International Inc. and Canadian Tire Corp. Ltd. – most portfolio managers prefer Magna.

“It has a lot of cash on its balance sheet,” says Darren Lekkerkerker, portfolio manager in Toronto with Pyramis Global Advisors, a unit of Boston-based FMR LLC. “And I think it’s looking to do a lot of acquisitions and that could help the firm.”

Taylor also foresees Magna doing well in 2014 because of the expected uptick in the automobile market, with U.S. production now surpassing pre-recessionary levels. As well, Taylor expects auto repairs to increase because the average age of vehicles in the U.S. has increased: “The amount of activity related to repair will be much higher, and the turnover cycle should be higher as we go forward.”

Other favoured stocks in this sector include Gilden Active Wear Inc., Dollarama Inc., Tim Hortons Inc., Hudson’s Bay Co. (HBC) and Cineplex Inc.

Taylor likes Cineplex because it’s well run and positioned to take part in the upswing of cyclical sectors.

HBC is likely to do well because of its recent acquisition of U.S. luxury retailer Saks Inc., Lane says. He notes that its same-store sales growth in Canada is second only to Dollarama, then adds that there’s a possibility of spinning off real estate holdings into a real estate investment trust now that HBC has a critical mass with the Saks deal.

– Telecommunications. Most portfolio managers rank this sector as “underweight.” These stocks had been favoured for their yield, says Lekkerkerker, but that is likely to change as interest rates rise. He’s also concerned about government intervention: “I think that’s a little bit of a scary thing when the government wants to lower your pricing and create more competition in the group.”

In contrast, Taylor favours this sector because “for any of our yield-hungry portfolios, it’s a great way to get that very predictable, juicy yield and bulk up in a very stable value sector.”

– Information technology. Although BlackBerry Ltd. (formerly Research in Motion Ltd.) is no longer the darling of the Canadian IT world, there still are plenty of good finds in this sector. Most portfolio managers rate IT as “overweight.”

Lekkerkerker likes CGI Group Inc. because of its strong management team, cash flow and its recent acquisition of U.K.-based tech services company Logica Ltd.

Nield favours OpenText Corp., which also has a history of acquisitions and strong operations: “It maybe struggled a little bit in finding organic growth on the licensing side, but it’s very strong at cutting costs.”

Lane is interested in Celestica Inc., an industrial manufacturer of tech products, because of its restructuring and diversification into aerospace and medical equipment, acquisitions and organic growth: “This has been a name that’s long been out of favour that we think is exceptionally undervalued.”

– Health care. Many portfolio managers prefer to look outside of Canada for health-care stocks, but there are some good firms in Canada.

Lekkerkerker likes Valeant Pharmaceuticals International Inc. because of its business model, cash flow, attractive price and J. Michael Pearson – “The best CEO in health care.”

Lane also holds Valeant in several of the funds he manages – and also holds Catamaran Corp., a Canada-based pharmacy-benefit manager operating in the U.S. He likes its economies of scale for pricing drugs and its growth potential.

– Utilities. Portfolio managers are underweighted in this sector because of the high valuations. “I’m not interested at all, frankly,” says Nield. “People are there because of the dividend yield. And, to me, [the companies] just look very expensive.”

– Industrials. With the global economy expected to pick up, portfolio managers are particularly bullish on this beaten-down sector.

One pick is SNC-Lavalin Group Inc. Says Fehr: “Talk about a stock that’s been kind of down and out, and now offers an attractive opportunity for us.” Not only has the stock “been punished quite a bit” for management turnover, but the longer-term outlook for infrastructure investment is positive.

Pugsley’s top picks for this sector include Stantec Inc., an engineering and design firm and Progressive Waste Solutions Ltd., a waste-management company. Both companies have exposure to the U.S.; Progressive Waste also is well positioned to take advantage of any upswing in commercial construction waste and housing starts.

The one potential black cloud in this sector is Bombardier Inc., mainly because of the uncertainty around its C-series jets. “Initial results,” Taylor says, “indicate that the order book for the C-series is just not going to deliver.”

© 2014 Investment Executive. All rights reserved.