Editor’s note: In part two of this week’s coverage of Morningstar’s global-equity roundtable, the managers discuss their geographic and sector exposure and explain the thinking behind some of their health-care holdings.

The panellists:

Peter Moeschter, executive vice president and portfolio manager with Templeton Global Equity Group, Franklin Templeton Investments. A value manager, Moeschter runs both EAFE (Europe, Australasia and Far East) and global portfolios for retail and institutional clients.

Michael Hatcher, head of global equities and director of research at Trimark Investments, a division of Toronto-based Invesco Canada Ltd. A value manager, Hatcher’s extensive responsibilities include Trimark Europlus and Trimark Global Fundamental Equity.

Matt Moody, vice president, investment management and a member of the Mackenzie Ivy team at Mackenzie Investments. The team’s wide range of mandates includes Mackenzie Ivy Foreign Equity and Mackenzie Ivy European Class. The Mackenzie Ivy team seeks to buy high-quality businesses and not overpay for them.

Q: Looking at both your global and European equity portfolios, would you say that they have a defensive or a cyclical tilt?

Moeschter: It is a little more of a cyclical tilt.

Moody: We are conservative investors. That typically steers us toward defensive-type companies. That said, the weighting that we have in defensive-type names, as categorized by Morningstar, has dropped significantly over the last five or six years. The funds hold more economically sensitive names. This is a byproduct of valuations. Defensive companies are not necessarily defensive stocks, if they become overpriced.

Hatcher: On the margin, the last couple of names that we have added in Europe have more cyclical exposure, because these stocks have come under pressure. That is not a tilting of the portfolio.

Q: Let’s look more closely at country performance. Referencing MSCI World Index data from the beginning of 2014 to recent close, Europe has decidedly underperformed the United States, which produced solid double-digit returns. In Europe, Germany, for example, had a negative double-digit return over that period. Austria and Portugal were extremely weak, France and Italy much less so, but still in the red. Spain and the United Kingdom were also slightly negative.

Moeschter: After a good two-year run in European stocks to mid-2014, there is recognition this year that the earnings growth has yet to come through. So far this year, the earnings growth has been pretty mediocre and expectations were higher. For example, German industrial companies selling to markets in Eastern Europe and Asia have come under pressure.

Q: Your European funds have a significant exposure to the UK.

Moody: We are finding good companies in the UK. Our style is to invest in high-quality companies that have a sustainable competitive advantage and are often global leaders. We tend to find them in a cluster of countries like the UK, Scandinavia and often in Switzerland. Not so much in some of the other countries.

Hatcher: I do have a high exposure to UK-based companies in Trimark Europlus. They are global, dominant companies, like liquor company Diageo PLC, [which has an ADR on New York and trades under the ticker DEO].

Moeschter: We have a fairly big weight in the UK as well. Looking ahead, there is a business risk here, if the UK votes to leave the European Union.

Q: Turning briefly to Asia, where are you finding opportunities in this region for your global funds? Japanese stocks in the benchmark index were essentially flat for the year to recent close.

Moody: We have zero weighting in Japan in Mackenzie Ivy Foreign Equity. Japanese stocks have tended to be expensive. We’re looking a little more intensively now at Japan. The country’s monetary policy is very aggressive and this is making us nervous. We have some exposure to South Korea, where we found good valuations. We added a few names last year. (MSCI classifies South Korea as an emerging market.)

Hatcher: We have exposure to other Asian-based companies in our global fund, more so than we do to Japanese companies. Our biggest weight in Asia is a Chinese conglomerate, Fosun International Ltd., which started off in China and has been going global.

Moeschter: We tend to be underweight in Japan in global portfolios. We have investments in Japanese auto companies such as Nissan Motor Co., Ltd. and Toyota Motor Corp. We’ve been increasing our Nissan weight. These are consumer-discretionary stocks. We have a consumer-staples stock, Suntory Beverage & Food Ltd., which has markets in Japan, Southeast Asia, the UK and parts of Africa. We have more exposure to Asia-ex Japan. Japanese stocks are quite expensive.

Q: Time to discuss the main sectors and the stocks in these sectors in your global portfolios. Let us start with the two significant defensive sectors in the MSCI World Index — health care and consumer staples. Health-care stocks (12.6% of the benchmark) have put up a strong performance since the beginning of the year to recent close.

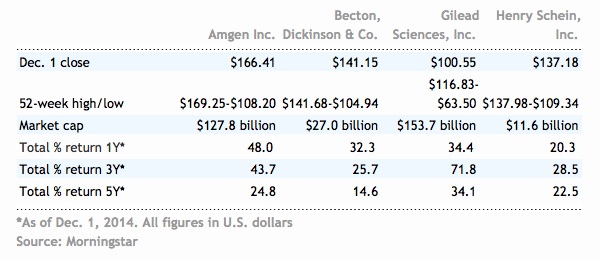

Moeschter: It’s our second largest weight in the global portfolios, with financials, which are the largest weighting in the benchmark, being a little larger. There are a lot of U.S. names that we hold. Health care includes small-value items, such as consumables, as well as expensive drugs and therapies. For example, Gilead Sciences, Inc. (Nasdaq:GILD) , a U.S.-based holding in the portfolio, recently came out with a new HIV treatment that is very expensive. Another U.S. holding is Amgen Inc. (Nasdaq:AMGN).

In health care, we’ve been taking advantage of the end of the patent cliffs. These (patent expirations) were an issue some years ago for a number of pharmaceutical companies. The companies have cut costs, improved their focus, and their drug development is starting to work. This is resulting in stronger earnings. The stocks have done well. They’re a hold for us. We consider that there is still a lot of upside. A European pharmaceutical company that we own is Bayer AG. On the surface, it’s not the cheapest stock anymore. We added it a few years ago. The company was caught between being both a pharmaceutical and a chemicals company. It has become more focused on health care. It’s looking at spinning off its chemicals business, where it’s a global leader in some of its plastics and coating products. Bayer’s outlook is still good.

Moody: We’re slightly underweight in health care in Mackenzie Ivy Foreign Equity. Some of our larger, long-term holdings in the United States include Henry Schein, Inc. (Nasdaq:HSIC), which sells dental supplies and equipment worldwide. In general, we find big pharmaceutical companies to be a challenge. There is a question mark over the sustainability of their earnings, taking a longer-term view. Their earnings could be tied to one or two big drugs and, even if they’re not, the companies are subject to health-care spending, which is under pressure.

Hatcher: I always approach this sector with a little nervousness because both government and consumer spending on health care could come under pressure. A health-care stock that is fairly immune to this and is a major holding in Trimark Global Fundamental Equity is U.S.-based Becton, Dickinson and Co. (NYSE:BDX). This has been a company that has been developing syringes coming up to 100 years. There are many other aspects to its business. Syringes are inexpensive and, at the same time, they are critical. Becton, Dickinson has good growth in the developed markets and it is going into the developing markets.

Moody: Becton Dickinson is also a significant holding in Mackenzie Ivy Foreign. We have held it for several years and like it for many of the same reasons. The company has a roughly 70% global market share. It is a low-cost producer with zero defects in its products. These consumables are unlikely to be first on the chopping block if you are a hospital procurements officer.