Editor’s note: In today’s part two of an equity-income roundtable series, the managers discuss the valuations of Canadian stocks in defensive sectors, and why they haven’t abandoned energy stocks.

The panellists:

Jason Gibbs, vice-president and portfolio manager at 1832 Asset Management LP. Gibbs is a senior member of the firm’s equity-income team, which has a wide range of mandates including Scotia Canadian Dividend, Scotia Income Advantage and Dynamic Global Infrastructure.

Michele Robitaille, managing director and equity-income specialist at Guardian LP, a sub-advisor to the BMO family of funds. The Guardian equity team’s mandates include BMO Growth & Income and BMO Monthly High Income II.

Peter Frost, senior vice-president and portfolio manager at AGF Investments Inc. His responsibilities include two income-oriented balanced funds: AGF Monthly High Income and AGF Traditional Income. He also manages AGF Canadian Stock, the firm’s domestic-equity flagship.

Q: Given the challenge facing the Canadian energy sector, what has happened in the Canadian equity market?

Robitaille: There has been a flow of funds to the more defensive sectors such as telecommunication-services stocks, consumer names and utilities. Exacerbating this risk-off trade in energy is the fact that the Canadian banks had pretty weak fourth-quarter earnings and muted outlooks for 2015. A lot of the banks’ capital-market revenues are energy-related. Normally, the flow of investor funds in a risk-off situation would go from energy and materials into financials. This has not happened. Telecom stocks, consumer stocks and utilities are quite expensive.

Frost: Yes, valuations are pretty high for a lot of these companies.

Gibbs: They’re expensive and have been for a number of years, if you look at price-earnings ratios. There is this ongoing and substantial demand for simple businesses that have free cash flow and pay out dividends. There’s a shortage of these companies.

Frost: They’ve been trading as bond proxies. It’s hard for investors to get decent income from their bond portfolios, so they go, for example, to the telecommunication-services stocks.

Gibbs: If you can buy a Telus Corp. (TSX:T) or a Rogers Communications Inc. (TSX:RCI.B) with a dividend yield of close to 4%, that’s better than a bond. The P/E ratios on these more defensive stocks are high, but there’s a reason for that. If there’s an increased supply of these companies or if interest rates move higher, there could be issues. I don’t see that changing for a while. I’m in the lower-for-longer interest-rate camp.

Robitaille: I agree with the lower-for-longer theme. Rates are not moving dramatically higher any time soon.

Q: What happened to the stocks of Canadian energy producers given the decline in the oil price?

Robitaille: They’ve been crushed. The first fall in the stocks tended to be pretty indiscriminate. Investors looked at basic metrics, without evaluating the quality of the management teams and their flexibility, and the quality of the companies’ assets.

Q: Have you bought or sold any energy stocks lately?

Frost: I’ve been consolidating some holdings. I owned two energy-services companies: Trican Well Service Ltd. (TSX:TCW) and Calfrac Well Services Ltd. (TSX:CFW). Calfrac got creamed as much as Trican. I consider that the former is a better company, so I switched out of Trican and added to Calfrac. I had trimmed a fair portion of my energy holdings in mid-2014 and then started to buy them back, when the oil price started to fall.

Gibbs: I remain cautious near-term because you’re in the middle of this price war among the energy-producing countries. We’ve been high-grading our energy holdings. We sold a number of smaller names.

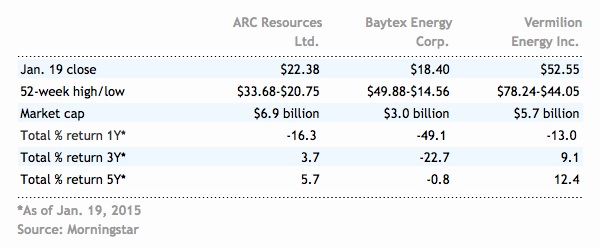

Robitaille: We added to a couple of our holdings, Baytex Energy Corp. (TSX:BTE) and Vermilion Energy Inc. (TSX:VET). Baytex is balanced between heavy oil and light oil. It has high-quality assets and a strong management team and board of directors. It was proactive and prudent in cutting its dividend.

Frost: In AGF Monthly High Income, I added to Baytex and established a holding in Bonterra Energy Corp. (TSX:BNE). I also added to Vermilion, which has the advantage of having gas assets in Europe.

Robitaille: Vermilion has a stake in the Corrib Gas Field in Ireland, which is coming on stream.

Gibbs: I also own Vermilion. I’ve done so for a long time. It has a conservative management team and an excellent balance sheet.

Q: How would you classify ARC, Baytex and Vermilion?

Robitaille: They are the intermediate producers.

Q: Time to briefly discuss your stock-selection discipline.

Robitaille: We do bottom-up fundamental analysis, with a focus on sustainability of the dividend stream and growth in that underlying dividend stream. We look for companies in industries that we like and focus on those companies with a strong, sustainable competitive advantage. We look at earnings and EBITDA (earnings before interest, taxation, depreciation and amortization) and the balance sheet. Management is a big consideration. We’re looking for growth and prefer internal growth. We do apply a macro overlay to the portfolio because of the dominance of sectors like energy and financials. We generally run about 40 names in BMO Monthly High Income II.

Gibbs: Our discipline is to focus on businesses that offer quality at a reasonable price. It is rare to find these high-quality businesses at a cheap price. We look for oligopoly-type industries, which provide some pricing power. We want management teams that focus on free cash flow and are dedicated to giving some of that back to shareholders. Scotia Canadian Dividend generally has 50 names.

Frost: I screen some 5,000 companies every month looking for companies with high yield for AGF Monthly High Income and for companies with the highest dividend growth for AGF Traditional Income. After this quantitative work, I do more qualitative work and spend a lot of time talking to management. I tend to equal-weight my stock holdings. I own between 40 and 60 names in Traditional Income and between 50 and 70 names in Monthly High Income.

Q: Time to talk sectors and stocks in your portfolios. Let’s start with a brief discussion on your energy weights and major energy holdings.

Robitaille: BMO Monthly High Income is slightly underweight relative to its benchmark, which is 85% the S&P/TSX Composite High Dividend Income Index and 15% Real Estate Investment Trusts. At the end of December, the fund had 25.9% in energy, 13.9% of the portfolio in energy producers and 12% in energy infrastructure and services companies.

Our strategy is to market-weight the energy producers and overweight the mid-stream and pipeline companies. The biggest energy-producer weightings are ARC Resources Ltd. (TSX:ARX) and Vermilion. We do have some bigger weights in energy-infrastructure stocks such as AltaGas Ltd. (TSX:ALA) and Keyera Corp. (TSX:KEY), which each represent close to 3% of the portfolio.

Frost: In the Monthly High Income portfolio, I have 27% in energy and in Traditional Income, I have 22% in energy. My benchmark for the equity holdings in these funds is the S&P/TSX Composite Index, which has 22% in energy.

Looking at the energy producers, I have a significant weighting in ARC in Monthly High Income. ARC has a conservative management team, which has been prodded by investors to grow faster but it has resisted this.

Robitaille: ARC has high-quality assets, such as its low-cost Montney asset. The company is committed to a balanced dividend model, ensuring that its dividend-payout ratio stays in line and its balance sheet is strong.

Gibbs: Scotia Canadian Dividend has 17% in energy, which includes 7% of the portfolio in energy producers and 10% in infrastructure companies. The fund is benchmarked against the S&P/TSX Composite Index, so it is underweight energy.

My biggest holdings among the energy producers are Suncor Energy Inc. (TSX:SU) and Canadian Natural Resources Ltd. (TSX:CNQ). These are core blue-chip producers with good balance sheets and they should grow over time. They are increasing their focus on generating free cash flow.

Frost: I own both.

Gibbs: Turning to the pipeline stocks, they’re not as cheap as they used to be. I would still hold on to them. Investors should consider high-grading their pipeline holdings, as we have done, into names such say Enbridge Inc. (TSX:ENB) and Pembina Pipeline Corp (TSX:PPL).

Frost: I own Enbridge.

Robitaille: We own Enbridge, as well. In terms of high-grading our pipeline holdings, we have switched our holding in TransCanada Corp. (TSX:TRP) into Enbridge. In this more uncertain regulatory environment, TransCanada has a more lumpy growth profile.

Gibbs: You want to overweight Enbridge. TransCanada, which is in the portfolio, is one of the cheaper energy-infrastructure stocks in North America. Its growth will be a little less than that of Enbridge. If TransCanada’s Energy East Project (to transport oil from Western to Eastern Canada) goes through, as it is expected to do, it will be material for the company.