Q: Time to discuss your discipline and process. Danny, you are a value manager, as is Mark.

Bubis: When we build out a portfolio and look at individual names, we look at the valuation and the valuation opportunity. Our horizon is three to five years. We assess whether there is a mean-reversion opportunity regarding the company or the sector it’s in. We look at the persistency of the company’s earnings and cash-flow stream. We evaluate risk, related to both the stock and the portfolio as a whole, how the pieces fit together. The Canadian portion of CI Canadian Investment has fewer than 40 names. The foreign content is managed in portfolios. The U.S. portion has about 35 names.

Thomson: We’re research-intensive, bottom-up value investors. We’re looking for the arbitrage between where the stock is trading in the public market and what the business is worth, using the present value of future free cash flow. We require a minimum 50% return over three years. Risk mitigation is very important to what we do. Beutel Goodman Canadian Equity, an all-Canadian fund, has between 30 and 35 names. It currently has 32 names.

O’Brien: I would be in the growth-at-a-reasonable-price or GARP box. TD Canadian Equity looks to achieve long-term capital appreciation through investments in high-quality, principally Canadian, equity securities. You’ll see a large-cap bias throughout the portfolio. We usually run between 50 and 70 names. It’s currently around 64, of which 18 are foreign names. The top-10 holdings are about 50% of the portfolio. We’re primarily bottom-up fundamental managers. But, as a starting point, I do make a top-down assessment. For example, the banks and the rails are great businesses.

Q: Time to talk sectors. Let’s start with financial services, which was recently 35% of the S&P/TSX Composite Index.

Thomson: We have a 41% weighting in the financial sector in Beutel Goodman Canadian Equity.

O’Brien: I have some 38.5% in financial services in TD Canadian Equity.

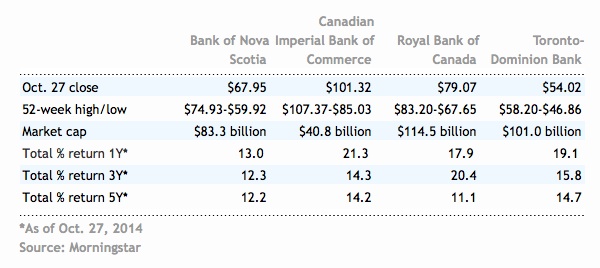

Thomson: These stocks account for 57% of the composite index’s earnings versus their 35% weight in the index. Therein lies the opportunity over time. The Canadian banks are good, stable businesses that generate a lot of free cash flow. They currently trade at 11 to 12 times forward earnings-per-share estimates. We have a big weight in bank stocks at around 28% of Beutel Goodman Canadian Equity versus 22% in the index.

Toronto-Dominion Bank (TSX:TD), Bank of Nova Scotia (TSX:BNS), Royal Bank of Canada (TSX:RY) and Canadian Imperial Bank of Commerce (TSX:CM) are in the top-10 holdings in the portfolio. TD and Royal have the best domestic retail-banking franchises. Over time, they have been able to lever that into sustaining or growing market share. Scotiabank doesn’t have their size of market share, but it has been able to punch above its weight. Commerce is a value buy.

Q: Danny, in CI Canadian Investment, Royal, TD, Scotiabank, and Commerce are in the top-10 holdings.

Bubis: We’re approximately market-weight in financials in the Canadian portion of the fund. There’s a new CEO at Commerce. Victor Dodig took over the reins in mid-September. He visited our offices recently and it was interesting that he didn’t mention capital markets once. His discussion was more about the core retail franchise, wealth management and largely about execution.

Thomson: The risk is that Dodig could overspend on acquisitions on the wealth-management side. Commerce’s head of retail banking, David Williamson, is doing a good job. That’s critical. Commerce is a formidable producer of cash flow.

At TD, the incoming CEO, Bharat Masrani, who takes over this spot on Nov. 1, will likely continue to focus on the bank’s retail franchise. Masrani did a good job in the United States. TD has a lot of depth. Tim Hockey is good as TD’s head of Canadian banking.

Q: What of Royal’s changing of the guard? David McKay was appointed president in February and CEO on Aug. 1.

Thomson: The jury is still out. The franchise is key. Provided Royal stays away from doing really sizeable acquisitions, the franchise will trump management. Its risk control in its capital-markets group, which includes corporate and investment banking, has historically been strong. We’ll see how the new team, which has been in place for a little while, does in a downturn.

Q: In TD Canadian Equity, Royal, Scotiabank, TD and Commerce are top-10 holdings.

O’Brien: The big go-forward question is what does Royal decide to do strategically? It’s already so big in Canada and generates large amounts of capital. Is the bank going to be content to keep increasing its dividend by 5% or 7% every year? Or will it try to create another external growth platform and will that end well or badly for shareholders?

Bubis: Scotiabank has historically been seen as a premium franchise. Of late, it has been trading at a slight discount to the group. We added to it recently. The Canadian banks all have their core domestic business and then they are deploying capital in different external strategies. TD has its U.S. retail business. Scotiabank has more of a Latin American, emerging-markets business. With the slowdown in some of these markets, this is a little out of favour and it has created a buying opportunity.

Thomson: Scotiabank is well managed and has good risk controls. The concern that I have is the foreign exposure. If you look at the bank’s market share in a lot of these markets, it’s about 6% or 7% or 8%. So it’s not well positioned, unlike TD’s strong position in the United States. Scotia is operating in smaller markets and with lower market shares.

O’Brien: Scotiabank doesn’t need to plant more flags in more countries and more regions, but rather consolidate its position in the markets it has chosen.

Thomson: Bank of Montreal (TSX:BMO)has the poorest domestic franchise. Over time, this doesn’t translate into good results. On current results, TD and BMO are trading about the same multiple.

Q: What about the outlook for Canadian bank stocks?

Bubis: Earnings growth will likely be in the single-digit range, and given where dividend payout ratios are, the dividend growth is going to be similar to that.

Thomson: The dividend payout ratios are 42% to 50%.

Bubis: With the recent sell-off, the dividend yields on the bank stocks were 3.7% to 4.2% depending on the bank. Will P/E multiples expand? They’re in a decent range at 11 to 12 times, at present. If you can get that 4% or 5% earnings growth with a dividend yield similar to that, then you’re looking at a 7% to 9% total return. At recent count, Government of Canada 10-year bonds were below 2%. So you’re looking at double the income, with a reasonable capital-appreciation outlook.

This is part two of a three-part series.

The roundtable concludes on Friday.