According to many economic experts consulted for Investment Executive‘s 2016 Global Outlook and Asset- Allocation Report, this year is going to be another year of modest global economic growth.

Only two of 17 global strategists and portfolio managers consulted for IE‘s 2016 report say that growth in the U.S. – the world’s largest economy – might be greater than 2.5%. Economies in Europe are expected to grow by 1.5%; in Japan, a bit less. Russia and Brazil continue to lag, remaining in recession.

On the brighter side, India’s economy could expand by 7.5%-8%. However, China’s is unlikely to do better than 6%-6.5%.

“We’re at a unique moment in the global business cycle,” says Jurrien Timmer, director of global macro at Fidelity Investments Asset Management, a unit of FMR LLC, in Boston. “The global cycle is very ‘desynchronized,’ which will make 2016 a balancing act as the U.S. Federal Reserve Board (Fed) raises rates, but not too fast, while China eases and depreciates its currency, but, again, not too fast.”

In this economic environment, it appears that the Fed didn’t need to increase interest rates last month, when it raised its overnight rate to 50 basis points (bps) from 25 bps, because there is no inflationary pressure in the U.S. economy.

Instead, the Fed appeared to be intent on using a rate increase to maintain its credibility: in other words, to support the view that its policies since the financial crisis of 2008-09 have worked and that economic growth is strong enough to raise rates to more traditional levels.

“The rate increase was more psychological,” says Wendell Perkins, senior portfolio manager with Manulife Asset Management (U.S.) LLC in Chicago. “It’s relatively meaningless in terms of policy.”

Both investing strategists and global financial markets expect further Fed increases in 2016. But the magnitude and speed of those moves will depend on how well the U.S. economy does with higher rates. The Fed is looking for the level at which the economy can create enough jobs to keep unemployment low without generating inflationary pressure.

This economic environment isn’t a recipe for high investment returns, but there should be some growth in corporate earnings and, thus, in stock prices. Considering that returns on fixed-income investments are expected to remain very low, an investment strategy that allows for an overweighted position in equities could bear fruit.

However, care is required in choosing stocks – poor choices may lead to bruising losses. The emphasis should be on quality companies, with the caveat that some of these stocks already are overvalued, particularly in the U.S.

Clients also need to be prepared by their financial advisors for a potentially rocky ride. Timmer says that markets will be “on edge,” which will create more volatility. But, he adds, there will be opportunities for active investment management.

Markets are concerned about a number of specific risks. Probably the most important is whether the U.S. economy can withstand higher interest rates. But there also are fears that China’s fading economy could have a hard landing.

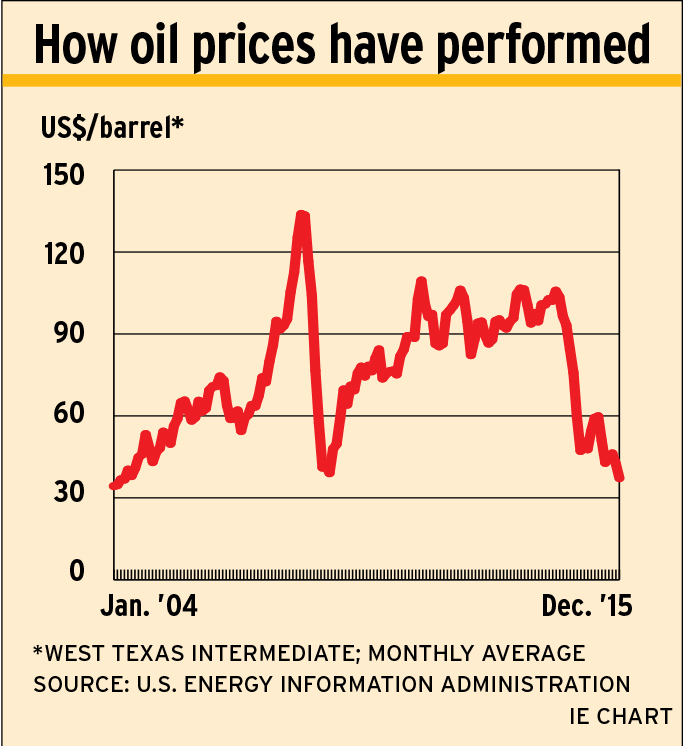

Oil price jitters are likely to continue. There is no consensus on where oil prices are headed, and markets will be looking for signals. Most of the strategists consulted by IE expect the oil price to move to the mid-US$40-a-barrel range, up from the US$37 at which it ended the year. On the other hand, further declines haven’t been ruled out.

Here’s the outlook for the major countries’ and regions’ economies, as well as our strategists’ suggestions for asset allocation.

– U.S. The U.S. economy is puzzling. The unemployment rate is down to 5%, which is viewed as full employment; however, there are fewer people looking for work. The participation rate – people working or looking for a job – was only 62.5% last year vs 66.1% in mid-2008. If the participation rate were still 66.1%, the jobless rate would be 9%.

Retail sales are growing, but not at a fast clip. “Consumers aren’t pulling their weight,” says Stephen Lingard, senior vice president, Franklin Templeton Solutions, with Franklin Templeton Investments Corp. in Toronto. “They are cautious. They haven’t seen big wage gains and may feel their jobs are tenuous.”

Krishen Rangasamy, senior economist with National Bank of Canada in Montreal, expects somewhat softer consumer spending this year as job creation slows from 2015’s surge and as the benefit of lower gasoline prices fades.

Corporate profits were pulled downward last year by the collapse in the oil price and the resulting losses for energy companies. But corporate earnings also were dampened by the high U.S. dollar (US$), which acted as a drag on exports and reduced revenue from foreign sales for the big U.S.-based multinationals when translated into US$.

In addition, a high percentage of gains in earnings per share came from higher margins achieved through cost-cutting and share buybacks. This way of boosting profits “isn’t as healthy as organic growth,” says Lingard.

All these uninspiring numbers lead a few strategists to believe that the U.S. is on very shaky legs. Neither Ross Healy, chairman of Strategic Analysis Corp. in Toronto, nor Nandu Narayanan, chief investment officer at Trident Investment Management LLC in New York, believe there is any underlying growth in the U.S.

On the contrary, they expect a recession, although not necessarily this year. Their thesis is that quantitative easing (QE) has not worked because it has masked but not dealt with the underlying problem of huge government debt that is slowly strangling that economy.

However, that’s a minority view. The Fed and most strategists expect U.S. economic growth to continue – and a few believe it could surprise on the upside. François Bourdon, chief investment solutions officer with Fiera Capital Corp. in Montreal, believes U.S. growth could be 3.5%-4% in 2016.

Craig Basinger, chief investment officer at Richardson GMP Ltd. in Toronto, is less optimistic.

But both Bourdon and Basinger believe that the U.S. economy could do better than its projected 2.5% growth. What’s needed to boost growth is higher wages – and Basinger already sees signs of that. He notes that Arkansas-based Wal-Mart Stores Inc. has raised its floor on wages and there’s talk of various states raising their minimum wage.

l Europe. The threat of recession was finally put to bed last year – at least, for the time being. One reason for the reprieve in still struggling Europe is the low oil price, which has encouraged consumer spending and cut business costs. But the European Central Bank’s QE program is also key. (See story on page 26.)

“The [debt] market is working better in terms of the availability and price of loans for small businesses and consumers,” says Charles Burbeck, co-head of global equity portfolios at UBS Global Asset Management (U.K.) Ltd. in London, U.K.

QE should continue. Basinger, Perkins and Todd Mattina, chief economist and strategist, asset-allocation team, with Mackenzie Financial Corp. in Toronto, believe that QE could result in better than expected economic growth.

On other fronts, Greece’s crisis is resolved – for now. It’s likely to re-emerge, but the strategists consulted by IE believe that even if the country defaults on its loans, there’s now little risk of contagion spreading to other struggling European countries.

The huge inflow of refugees from Syria and other countries in the Middle East is both a plus and a minus. The population bump will stimulate growth because of government spending to support the immigrants. But there could be negative political ramifications if support grows for populist and extreme right-wing parties that take issue with the arrival of the refugees.

– Japan. Economic data for the world’s third-largest economy was not strong in 2015, but that’s partly because of a sales tax increase in 2014 that led to a reduction in consumer spending. What’s needed to stimulate economic growth is higher wages, which may be starting to materialize. (See story on page 29.)

QE will continue in Japan, and that policy should mean continued growth, particularly as the much lower yen helps to drive exports. Indeed, some strategists, including Basinger and Lloyd Atkinson, an independent financial and economic consultant in Toronto, believe that after decades of stagnation, Japan’s economy could surprise on the upside.

Reforms, such as opening up inefficient domestic sectors to foreign competition, are needed to stimulate and sustain longer-term growth. Such a change has long been resisted, but may be inevitable if the Trans-Pacific Partnership trade agreement is implemented.

In the meantime, Japan’s government is working hard to improve corporate governance, including rewarding companies that become more shareholder-friendly. Combining that policy with a much lower yen and improving domestic growth makes Japan “a good place [for investors] to be,” Timmer says.

– China. Knowing what’s happening in China is hard because there’s little transparency in the country’s economic and financial systems. Official economic data may be manipulated to show what the government wants.

China’s growth probably was lower than the 6.5%-7% targeted by the government for last year. Timmer, for one, suggests that the growth figure could be closer to only 1%-2%, but others, including Burbeck, are quite optimistic. Burbeck believes China could surprise on the upside in the next few years and turn in solid annual growth of 6.5%-7%. (See story on page 28.)

The government continues to implement reforms that are likely to have an effect on growth. For example, ending the “one child” policy is applauded, as the country’s population is aging fast. Rangasamy also points to efforts to create a social safety net for families and migrant workers.

Most strategists consulted by IE aren’t worried that China will slide into recession, and are confident the government will use preventative means, including loosening monetary policy and tapping huge foreign reserves to finance stimulative spending. However, global financial markets are expected to remain concerned and thus react quickly and negatively to any suggestion that a hard economic landing is happening.

– Other emerging economies. Although 2016 will probably be better than 2015, most emerging markets will continue to struggle. Not only have resources producers been hit hard by the slump in commodity prices, but many emerging economies are struggling to service their US$-denominated debt. And many of these countries export to China and have been affected by the slowdown there. The only bright spots are India, where growth has picked up under Prime Minister Narendra Modi; and Mexico, which is benefiting from U.S. growth. (See story on page 32.)

How does all this affect choices for your clients’ portfolios?

In general, the strategists suggest over-weighting equities vs fixed-income: not only are bond yields already low, prices of existing bonds will drop further as interest rates rise. That scenario includes Canadian bonds, even though the Bank of Canada is not expected to raise its overnight rate. Canadian bonds trade in international markets vs U.S. bonds, particularly Canadian issues of five years or longer duration, notes Craig Alexander, vice president, economic analysis, at the C.D. Howe Institute in Toronto.

However, some strategists are anticipating the end of the current business cycle, which began after the global financial crisis of 2008-09. Lingard, for example, is no longer overweighted in equities for the first time since 2008; underweighted in fixed-income because of anticipated losses in that asset class as interest rates climb; and thus overweighted in cash.

Within equities, European and Japanese stocks, which have more attractive valuations, are favoured. Burbeck thinks there could be considerable expansion for European stocks – but not for Japanese equities – as some investors remain skeptical about prospects for Japanese stocks.

However, Atkinson prefers investing in the U.S., because it remains the world’s most flexible and dynamic economy.

In addition, there is interest in stocks related to health care, technology, some industrials and financials. Atkinson likes financials in particular because that’s where there’s “a lot of technical revolution that’s cutting costs and improving the delivery of services.”

A modest but sustained upward movement in the price of oil would likely push up quality oil and gas stocks from the unreasonably low levels to which they have fallen, leading many strategists consulted by IE to recommend overweighting energy. The risk of being wrong isn’t a major one, as long as these investments are in low-cost companies with good balance sheets.

Another sleeper is emerging markets, where valuations are generally low. However, timing is important. Lingard, for example, says he could be buying emerging-market equities by the end of 2016. He doesn’t foresee strong earnings growth, but thinks there will be improvement in multiples, which, he says, are compressed now: “Markets have discounted a lot of bad news.”

Burbeck thinks Russia could provide opportunities, especially if the oil price rises. The ruble is down more than 50% against the US$ since mid-2014, monetary policy is being eased and government finances are in good enough shape for fiscal stimulus.

© 2016 Investment Executive. All rights reserved.