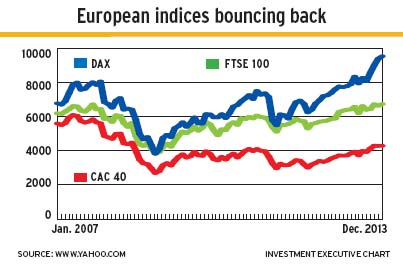

European markets experienced a healthy rebound in 2013, but portfolio managers suspect that those markets will be less robust in 2014, even though economic conditions are poised to improve. Nonetheless, portfolio managers continue to see investment opportunities on the Continent, even in the weak peripheral countries that many had been largely avoiding over the past several years.

Portfolio managers are assuming the region will return to modest growth of 1%-2% this year – compared with a 0.4% contraction in 2013 – amid improving employment markets, a healthier banking system and less fiscal austerity.

“In 2014, we actually are very likely going to see positive economic growth,” says Stephen Oler, portfolio manager with Pyramis Global Advisors in Smithfield, R.I., a unit of Boston-based FMR LLC (a.k.a. Fidelity Investments) and portfolio co-manager of Fidelity Europe Fund. “But it’s not going to be robust.”

Some portfolio managers are concerned that European markets have been overly optimistic about the extent to which economic conditions are improving, and that last year’s strong performance has not been justified by the fundamentals. Among this group is Rajiv Jain, managing director and chief investment officer (CIO) with Vontobel Asset Management Inc. in New York and portfolio co-manager of BMO European Fund: “The underlying situation, we feel, has not improved as much as people believe.”

Many of the strongest performing stocks in 2013 were concentrated in cyclical sectors, such as financials, technology and media companies, signalling a shift away from the cautious approach that investors had been taking as the sovereign-debt crisis triggered by the global market collapse of 2008 unfolded.

However, not all cyclical sectors outperformed. Resources stocks, such as mining and oil and gas companies, had a tough year, along with real estate. Other underperformers included utilities and food/beverage companies.

So, it won’t be easy to identify winning investment themes in Europe in the year ahead. “The markets aren’t likely to do as well in 2014 as they did in 2013,” says Martin Fahey, head of European equities with I.G. International Management Ltd. in Dublin and portfolio manager of Investors European Equity Fund. “That’s because we have a number of headwinds that we have to face.”

There is no shortage of risks and challenges that threaten to hamper market performance in the year ahead. For example, recent strength in the euro has pushed the value of that currency to about US$1.38 from US$1.28 in July, which has made European exports less competitive. Because exports make up a substantial portion of the region’s economy, any decline in trade activity can affect economic growth considerably. “If the euro were to continue to strengthen,” Fahey says, “that is not good for European growth.”

However, the banking sector has shown improvement, says Oler. “The banking system has gone through a couple of years of huge healing,” he says. “[Banks’] balance sheets have been strengthened, non-performing loans have stopped rising and capital positions are strong. So, the banking system is healthy for the first time in five years.”

Next: Banking sector risks

@page_break@

Banking sector risks

There still are risks in the sector, however. Lending activity remains in decline and shows few signs of recovering in the near future. The banks are likely to focus on maintaining high capital levels, Fahey says, until they see the results of the stress tests being conducted by the European Central Bank, which are scheduled to be released in the autumn of 2014. Those results will reveal whether regulators consider the region’s banks’ balance sheets to be strong enough.

“That could be very positive,” Fahey says, “or it could be very negative” – that is, if enough banks are deemed to have sufficient capital, there could be significant increases in lending; but if a lot of banks don’t pass the stress tests, lending could contract further.

The fragile state of the economic recovery in peripheral countries such as Greece, Portugal, Spain, Ireland and Italy also poses risks. Although these countries’ economies have begun to show some improvement, the majority of the economic growth in Europe continues to come from the stronger regions of Germany, the U.K. and Scandinavia. Says Dominic Wallington, CIO with RBC Global Asset Management (U.K.) Ltd. and lead portfolio manager of RBC European Equity Fund: “The peripheral countries, although they appear to have stabilized, clearly have lower growth rates than [in] northern Europe.”

Greece and Spain, two of the countries hit hardest by the debt crisis, continue to face hefty unemployment rates of 26% and 27%, respectively, which presents a considerable hurdle to growth. In addition, these countries continue to battle high debt levels despite the implementation of widespread austerity measures in recent years.

“You’re still going to have a period of deleveraging within the eurozone,” Fahey says, “particularly in those peripheral countries, because debt levels are still too high. So, that’s going to act as a headwind for a number of years.”

Against this backdrop of challenges and risks, investors will need to be more selective about the investments they make in 2014, carefully assessing the fundamentals of any given company.

“We feel that over the next 24-month horizon, the opportunity set is changing,” says Jain. “Indexing may not do as well, but stock-pickers could actually do very well.”

Given the plethora of challenges on Europe’s domestic front, Jain urges investors to consider large-cap European companies that have global exposure. Because many of these stocks have demonstrated weaker performance in the past year amid a flock of riskier and lower-quality stocks, Jain says, a buying opportunity has emerged.

“The good news is that a lot of quality names are much cheaper than they were 12 months ago,” Jain says. “You can actually buy [shares in] high-quality franchises [that are] globally driven at pretty attractive prices.”

For example, Jain favours consumer-goods companies Nestlé SA, based in Switzerland, and Unilever Group of London and Rotterdam. Both firms have stable earnings, strong management teams and significant exposure to rapidly growing emerging markets. Given the recent declines in their stock prices, both companies now are valued attractively.

“If you take a longer-term view, these names are extremely well positioned,” Jain says. “Even if Europe doesn’t do well, these companies would be much less affected than a lot of cyclicals.”

Jain also likes prescription eyewear companies Essilore International SA, based in France, and Luxottica Group SpA, based in Italy. Given the steady demand for optical products, these companies enjoy stable earnings regardless of the underlying economic environment. In addition, thanks to both companies’ widespread global exposure, they have strong growth prospects.

Certain automakers also have strong prospects. European auto sales are expected to rise slightly in 2014, following a decline of about 3% in 2013, while auto sales in North America are expected to increase by 4% in 2014, according to Fahey. He likes Germany-based Porsche Automobil Holding SE. Although this company faces a number of legal cases related to its failed attempt to buy Volkswagen Group in 2008, the stock could perform well this year if the cases end favourably for Porsche.

Many investors still are leery of financial stocks, which has beaten down their valuations. However, given the prudent steps that financial services institutions have taken to bolster their capital positions, some portfolio managers believe financials are better positioned than the markets realize.

“Expectations are very low,” says Oler, whose Fidelity fund is overweighted in financials. “The underlying fundamentals are stronger than the market expects.”

In particular, Oler likes London-based Lloyds Bank PLC, which has the largest share of bank accounts and mortgages in the U.K. Oler also favours asset-management companies UBS AG and Credit Suisse Group AG, both based in Switzerland, which have been benefiting from recent strength in the stock market.

Wallington’s RBC fund also is slightly overweighted in financials. “They are still best in class [among] blue-chip companies,” he says. He likes Swedbank AB, a Swedish bank with a very strong capital base and a high level of profitability.

Many of the top stock picks are concentrated in the stronger core countries. However, portfolio managers are seeing increasing investment opportunities in peripheral markets, especially Spain. That country’s economy has taken drastic steps to improve its competitiveness, says Philippe Ithurbide, head of global research, analysis and strategy with Paris-based Amundi Asset Management. He notes that Spain’s labour productivity has increased significantly, while labour costs have dropped.

“If you look at the dynamic in terms of growth, the dynamic in terms of competitiveness,” says Ithurbide, “Spain is probably, at the moment, the country where the potential of companies is the highest.”

As an example, Peter Hadden, Oler’s colleague and portfolio co-manager at Pyramis, prefers Spain-based Amadeus IT Holding SA, which specializes in software for airlines and in other software products for the travel and tourism industry.

Many portfolio managers’ funds also have exposure to banks in Spain, including Banco Popular Español SA and CaixaBank SA.

© 2014 Investment Executive. All rights reserved.