A rising tide in the stock markets over the past year appears to be lifting all boats in the financial services sector – including those of insurance advisors. They saw growth in both assets under management (AUM) and compensation, even as their core insurance business appears to be weakening a bit.

The research for Investment Executive‘s 2014 Insurance Advisors’ Report Card found that insurance industry reps appear to be enjoying solid gains in the investment component of their books. The average advisor’s AUM rose to $21.1 million from $16.9 million year-over-year. Although these totals remain far smaller than for other sales forces in the sector, such as brokers and mutual fund dealer reps, the year-over-year growth of about 25% is nevertheless impressive.

This gain in AUM neatly echoed the performance of the S&P/TSX composite index, which rose by about 25% over the past 12 months. So, it appears likely that the AUM gains that the average insurance industry advisor experienced was fuelled primarily by robust market performance rather than by any major swing in strategy toward investments.

That’s not to say that market gains are the sole source of higher AUM for insurance advisors. Some of the gains also are likely to be a result of net inflows – either from higher investment allocations from existing clients or the addition of new clients.

The data from this year’s Report Card show that overall client numbers are up compared with 2013. This year, the average rep reported that he or she is serving 657.8 client households, up from 603.7 last year. That’s a healthy increase of 9%, but it doesn’t fully account for the much stronger increase in AUM over the same period. Market conditions have surely had a big part to play.

But, regardless of whether this growth in AUM is being driven by markets, net inflows or both, the trend does appear to be impacting advisors’ businesses – both bolstering their bottom line results and shifting their underlying revenue mix.

For example, although first-year commissions and policy renewals still account for the vast majority of the average advisor’s total compensation (79.2%, combined), fee- and asset-based revenue sources both were up a bit from last year.

Fee-based revenue now makes up 16.4% of the average advisor’s total compensation, up from 14.9% last year. At the same time, fee-for-service arrangements now amount to 1.8% of total compensation, up from just 0.6% in 2013.

These trends suggest that investments and related services, such as financial planning, now supply a greater share of the average advisors’ income.

This trend also helps to explain how a greater proportion of insurance advisors are reporting higher income at a time when their primary revenue source – first-year commissions – has dropped in most major product categories.

Looking at the breakdown for total compensation for the overall average insurance advisor population, the majority of advisors still reported earning $100,000-$500,000 a year. Indeed, the proportion of advisors that reported that they fall into this category rose to 52.4% from 50.5% year-over-year.

And there was growth at the very high end of the earnings scale as well. Although the percentage of advisors who reported earning $500,000-$1 million a year is unchanged, at 12.5%, the percentage of advisors who said they bring in more than $1 million in annual compensation rose to 8% from just 5.7%.

At the same time, all of the income categories that fall below the $100,000 threshold saw declining membership. The proportion of insurance reps who reported earning $50,000-$100,000 a year was down to 19.9% from 22.3%. And the percentage of advisors who said they earn less than $50,000 a year also dropped, to 7.1% from 8.7% year-over-year.

It would be too simple to draw a straight line from financial market gains to higher AUM and through to these apparent compensation increases. That’s because there surely are numerous factors at play; still, the gains in the average insurance advisor’s investment book appears to correlate to a rise in his or her bottom-line compensation.

This is particularly significant, given that insurance advisors reported a decline in the value of first-year commissions for most of their core products. For example, estimated first-year commissions in life products for the average advisor were down to $127,253 from $141,402 year-over-year, and estimated commissions from both money products and living benefits also were down.

The exception to this trend was segregated funds, for which estimated first-year commissions rose slightly to $52,562 from $51,547. Indeed, seg funds have surpassed money products as the second-most lucrative source of first-year commissions for insurance advisors (behind life insurance). The fact that seg fund revenue rose while revenue for all other insurance products dropped suggests that the strength in equities markets has helped to attract AUM and drive revenue for advisors.

Another possible beneficiary of these trends is third-party managed products. Mutual funds remain – by far – the biggest component of the average advisor’s investment book at 64.9% (down from 67.2% last year). Similarly, the share for proprietary managed products also dropped year-over-year, to 17.6% from 18.3%. In fact, revenue from third-party managed products (up from 14.5% year-over-year) and proprietary managed products now comprise an identical 17.6% of investment revenue.

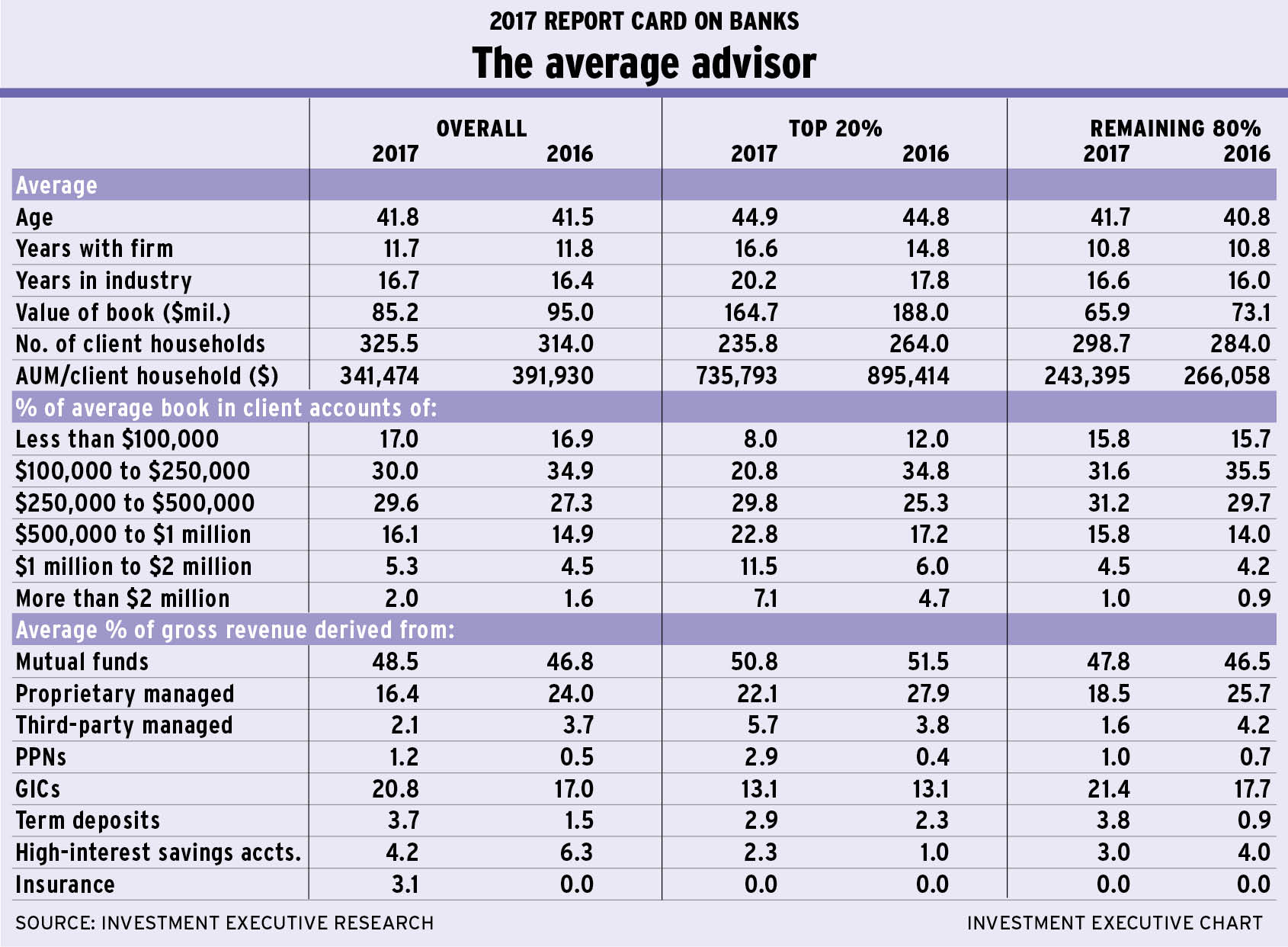

Notably, it’s not the industry’s top-producing advisors who are driving most of these trends. Dividing the industry into the top 20% of reps and the remaining 80% – as measured by reported total compensation – it’s apparent that all of the growth in AUM has come from the remaining 80% of advisors. For these advisors, AUM was up by almost 50% year-over-year. Compared with the top 20% of advisors, the remaining 80% are more highly leveraged toward, and thus have benefited from, the strengthening markets over the past year.

In contrast, the top-producing advisors appeared to be much less sensitive to the ebbs and flows of equities markets. In fact, these top-producing advisors’ businesses also were geared much more closely to their core life insurance business.

For example, the data show that top producers generate substantially larger first-year commissions than the remaining 80% of advisors. And the top producers also garner a much bigger share of total revenue from renewals.

© 2014 Investment Executive. All rights reserved.