A look at the average IE rating that each insurance agency received in Investment Executive‘s Insurance Advisors’ Report Card reveals that although advisors may have differing opinions about their respective agencies, on the whole, they feel well supported in their businesses.

The fact advisors feel so well supported by their firms is clear from the steady and strong IE ratings their insurance agencies have posted this decade. In fact, from 2010 to 2017 the average IE rating in this Report Card has remained between 8.2 and 8.5. (The IE rating is the average of all the categories for which an insurance company is rated by its advisors.)

View this slideshow to take a closer look at how advisors have rated their managing general agency (MGA), dedicated agencies and personal producing general agencies (PPGA) during the past eight years.

-

How insurance advisors have rated their firms this decade

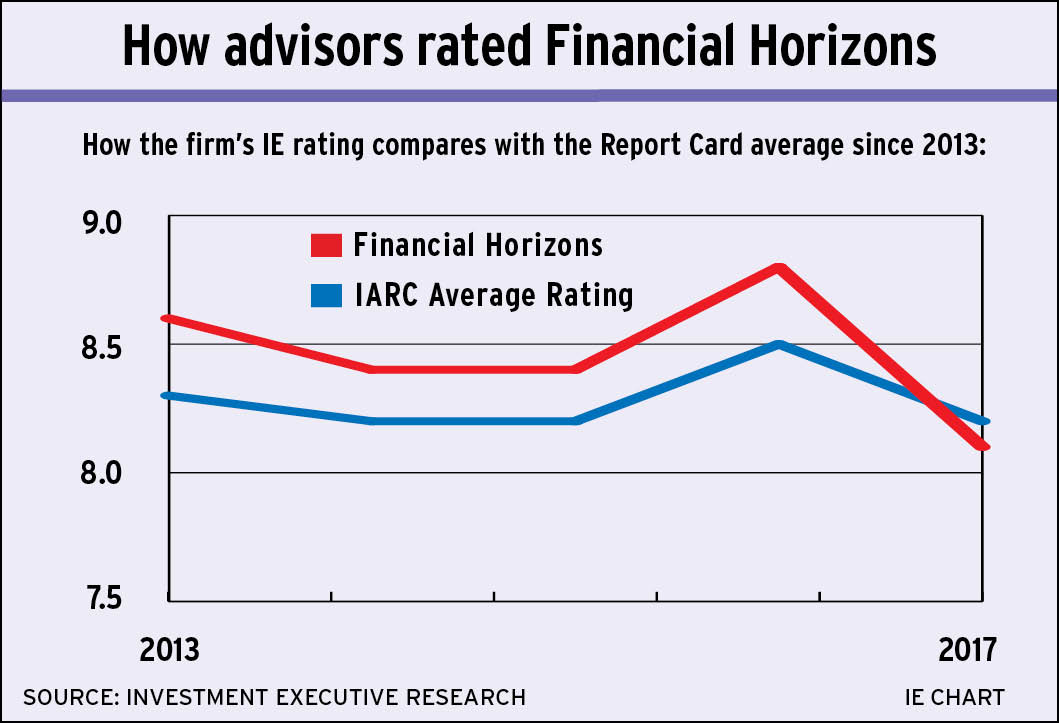

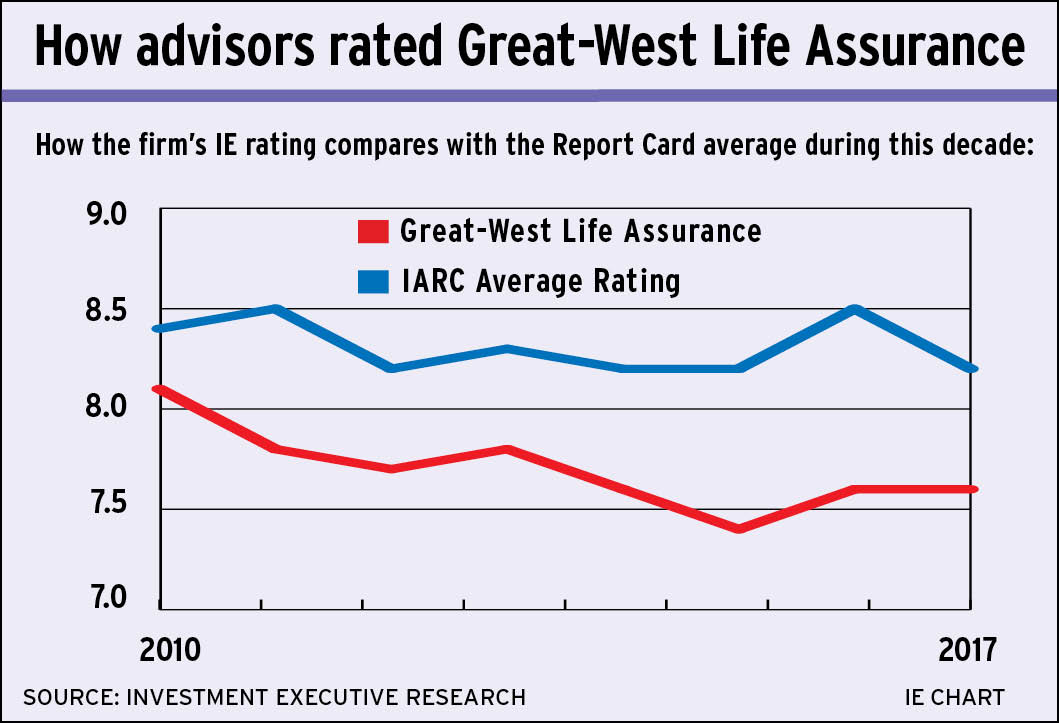

Financial Horizons

Financial Horizons is the most recent addition to this Report Card, having made its début in 2013. During this time, the MGA’s IE rating has generally exceeded the Report Card average. However, this year was the exception as Financial Horizons’ IE rating hit a low of 8.1, just below the Report Card average of 8.2. In part, this decline was due to advisors’ uncertainty around the MGA’s sale to Winnipeg-based Great-West Lifeco. Inc. in May, which is when the research for this year’s Report Card was being conducted.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How insurance advisors have rated their firms this decade

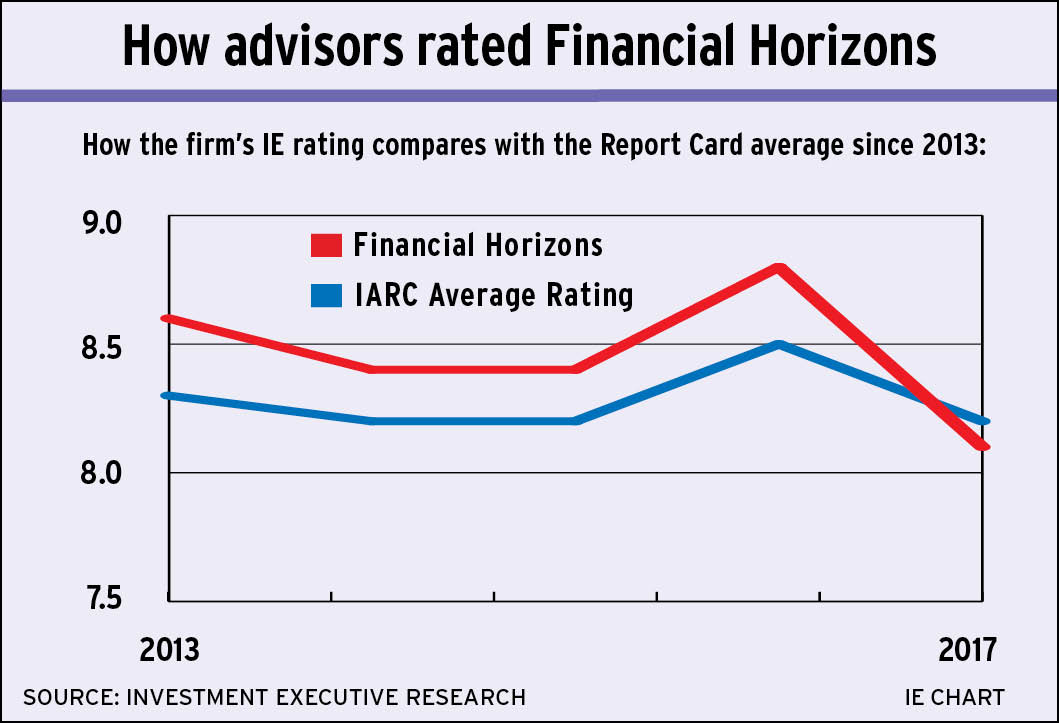

Freedom 55 Financial

Freedom 55 Financial’s IE rating has remained well below the Report Card average since 2010. During that time, advisors have often bemoaned the state of Freedom 55’s technology, whether it’s in terms of “technology tools and advisor desktop” or “back office support for new business (application processing).” As such, Freedom 55’s IE rating has remained stuck between 7.1 and 7.8 during this time.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How insurance advisors have rated their firms this decade

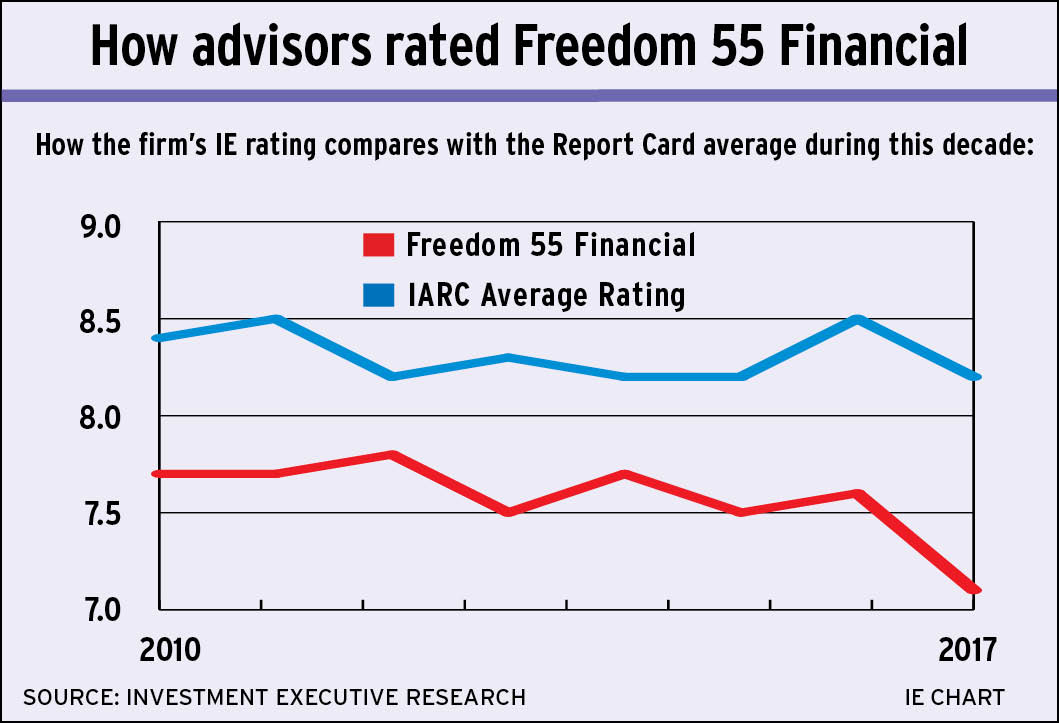

Great-West Life Assurance

Great-West Life Assurance’s (GWL) IE rating has consistently ranked below the Report Card average since 2010. During that time, GWL’s ratings have been mixed, but more often than not, advisors gave the PPGA significantly lower ratings of half a point or more in several categories, including “ongoing training,” “support for developing a financial plan for clients” and tech tools. Much like their counterparts at sister firm Freedom 55 Financial, the rocky rollout of the New Business Now application was a particularly sore spot for GWL advisors.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How insurance advisors have rated their firms this decade

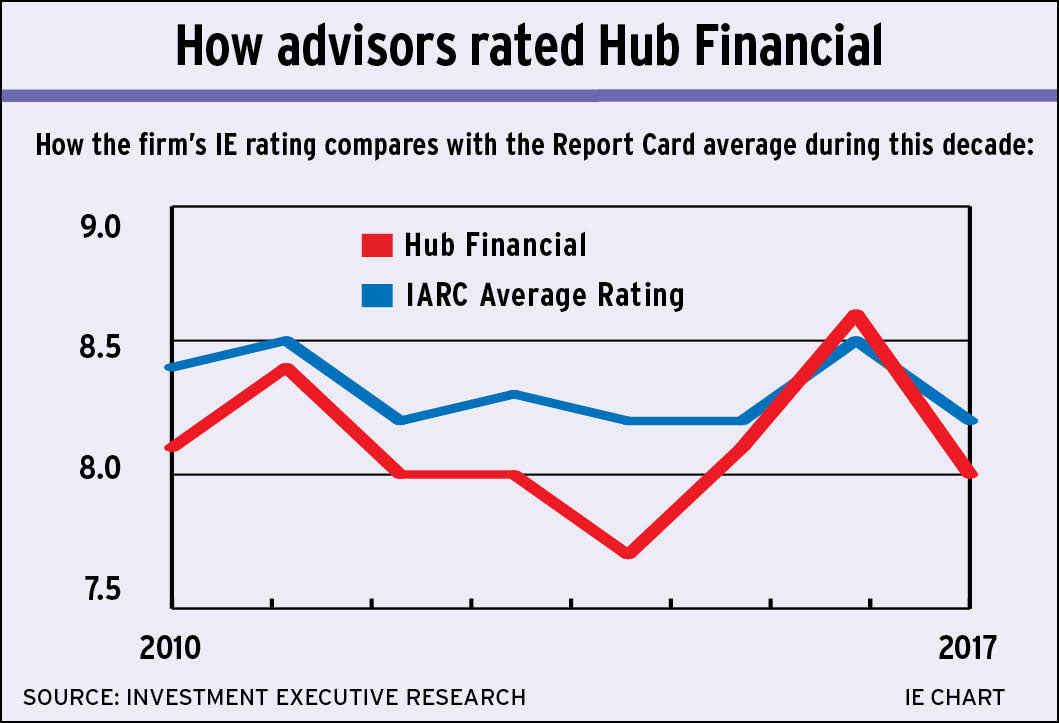

Hub Financial

Hub Financial’s IE rating has typically run close to, or slightly below, the Report Card average since 2010. Furthermore, the MGA also has the widest spreads in its IE rating of any firm included on the main table, ranging from a low of 7.7 in 2014 to a high of 8.6 in 2016. This year, however, Hub saw its IE rating drop to 8.0 after its advisors ranked the MGA significantly lower by half a point or more in eight categories.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How insurance advisors have rated their firms this decade

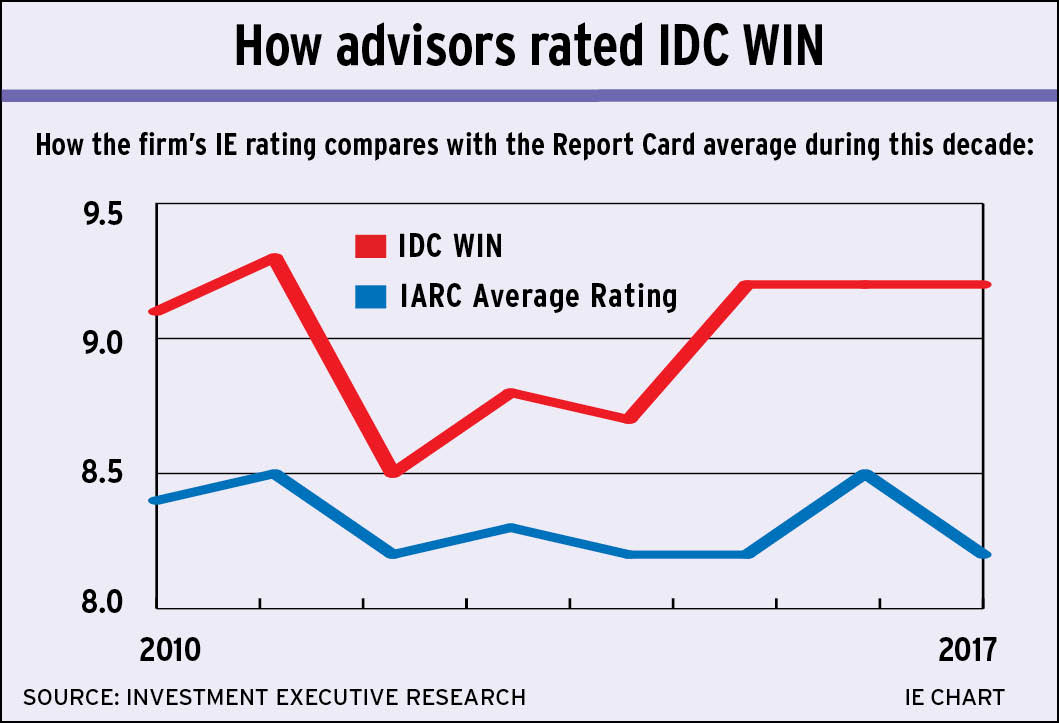

IDC WIN

IDC Worldsource Insurance Network (IDC WIN) has posted strong IE ratings since 2010. As a result, it has consistently beaten the Report Card average. Its lowest IE rating during this time — of 8.5 in 2012 — took place as the firm dealt with hiccups following the 2011 merger between IDC Financial and Worldsource Insurance Network, which led to the insurance agency’s current structure. IDC WIN’s rating jumped back up in 2015 to 9.2, an average it has maintained since as advisors praised the MGA in several categories, including tech tools and back-office support.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How insurance advisors have rated their firms this decade

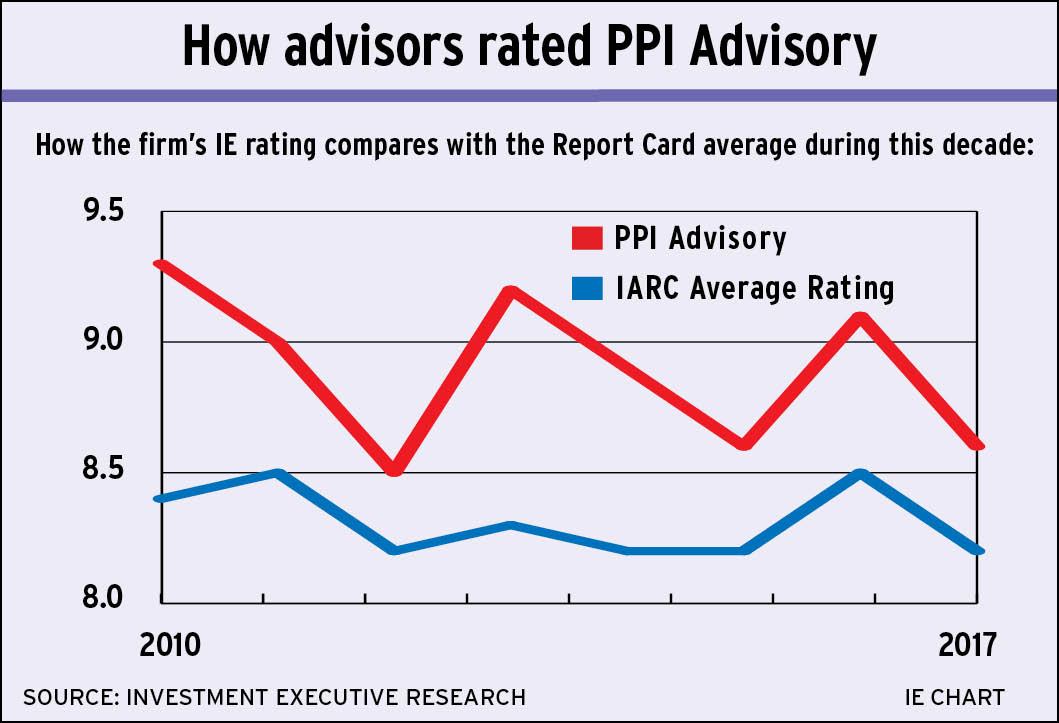

PPI Advisory

PPI Advisory is another firm that has enjoyed consistently high IE ratings during the past eight years. Although 2010 marked a high point for PPI Advisory, its ratings have not fallen below 8.5 as it has continued to meet advisor expectations in several categories including “quality of firm’s product offering” and “firm’s/MGA’s marketing support for advisors’ practice.”Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How insurance advisors have rated their firms this decade

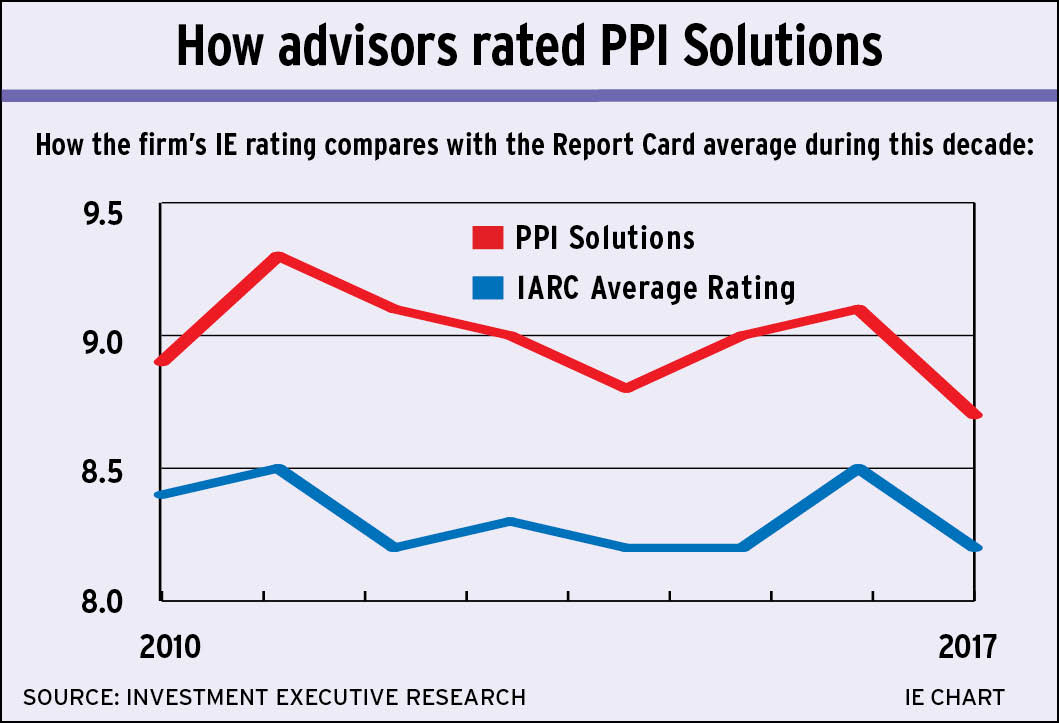

PPI Solutions

Since PPI Solutions first appeared in this Report Card in 2010, the MGA has posted a steady stream of above average IE ratings. Even when PPI Solutions ratings declined, as was the case in 2014 and 2017, its overall performance remained strong as the firm delivered in the areas that mattered most to advisors: “freedom to make objective product choices for clients,” “firm’s/MGA’s ethics” and “firm’s/MGA’s stability.”Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How insurance advisors have rated their firms this decade

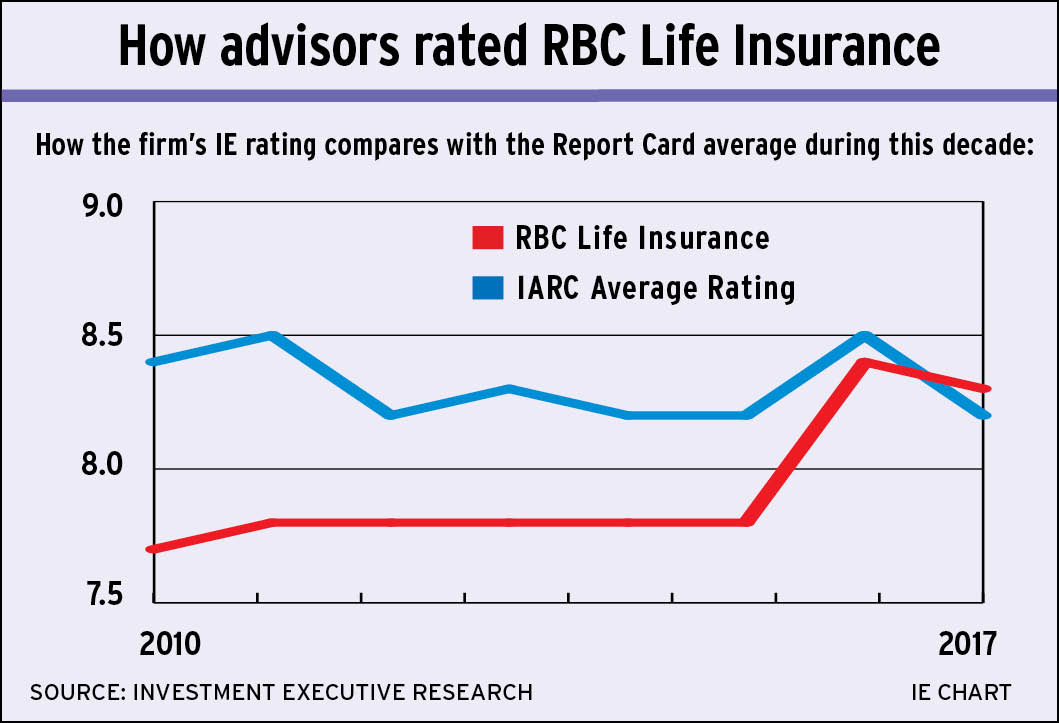

RBC Life Insurance

RBC Life Insurance has one of the steadiest IE ratings in this Report Card. In fact, with the exception of the past two years, RBC Life has posted an IE rating of 7.7 or 7.8 rating since 2010. However, 2016 proved to be a breakout year for the bank-owned insurance agency as it earned an IE rating of 8.4 after advisors rated the dedicated sales agency higher by a half a point or more in 17 categories.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How insurance advisors have rated their firms this decade

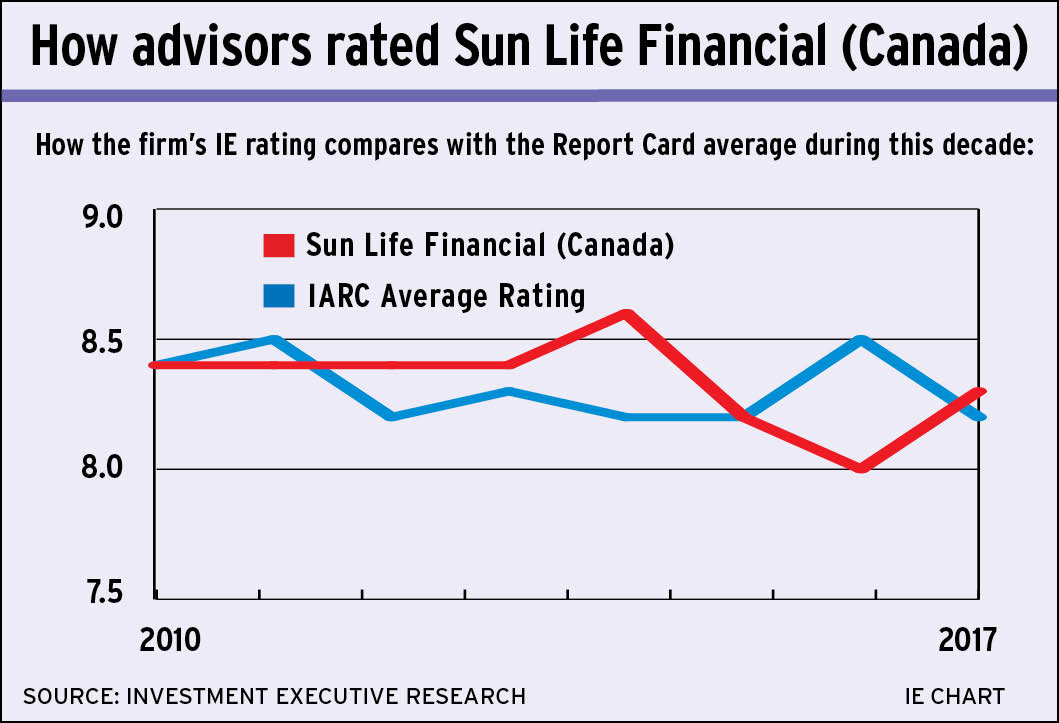

Sun Life Financial (Canada)

Sun Life Financial (Canada)’s IE ratings have typically remained close to the Report Card average during the past eight years — with two exceptions,. Sun Life’s ratings experienced a somewhat steep decline between 2014 and 2016 as the dedicated sales agency posted its highest IE rating of 8.6 and its lowest of 8.0 within those three years. This year marked a slight comeback for Sun Life, as its IE rating rose to 8.3 after receiving significantly higher scores of half a point or more in 11 categories.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive