The main ratings table for the Brokerage Report Card reveals advisors’ specific concerns and praise for their firms in more than 30 categories in a quantifiable manner. Taken together, these ratings provide a sense of a brokerage firm’s advisor work force’s overall morale.

To that end, the “IE rating” highlighted on the ratings table is an average of all the ratings advisors provided for all the categories for a given firm. Overall, the Report Card average of these IE ratings between 2008 and 2017 was remarkably stable while the IE ratings for individual firms remained within a range of a full point — with some exceptions.

This slide show compares the IE ratings of each of the 12 investment included in the Report Card, offering a snap shot of the highs and lows of advisor morale over the past 10 years.

-

How brokerages have fared during the past 10 years

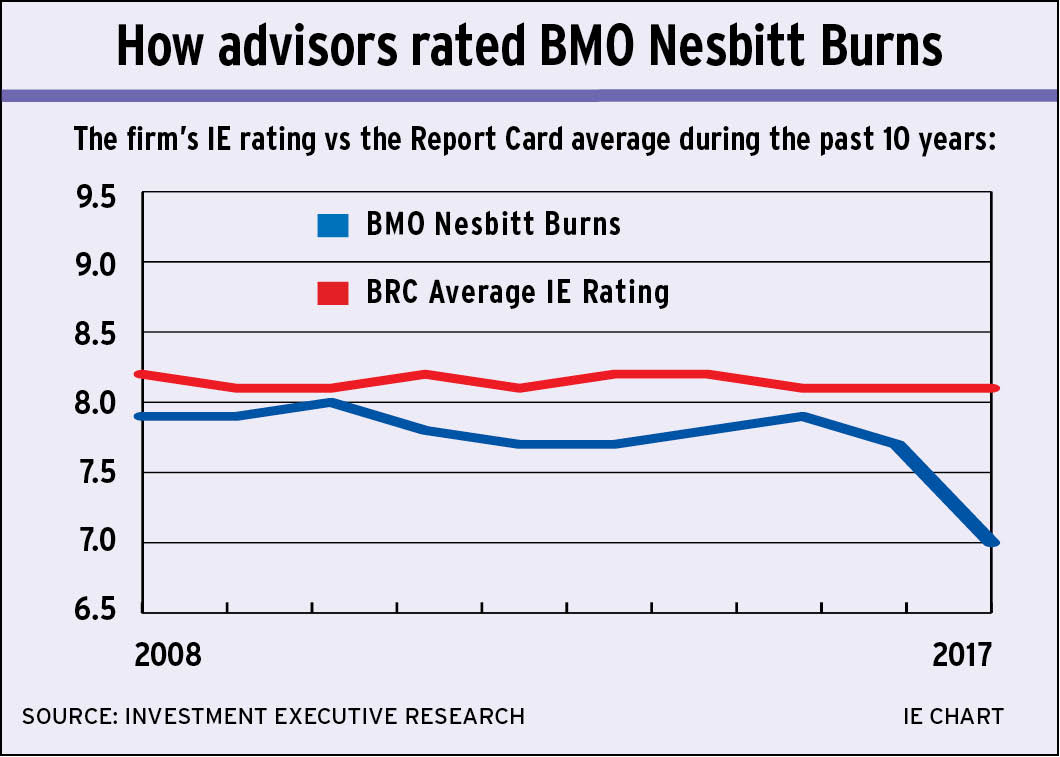

BMO Nesbitt Burns Inc.

Nesbitt has generally underperformed over the past decade, as its IE rating has been chronically below the Report Card average. Although the firm has been fairly consistent, with its IE rating ranging from 7.7 to 8.0 during the past decade, it dropped off markedly to 7.0 in 2017 because of advisors’ frustration with the bank-owned firm’s changing corporate culture.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

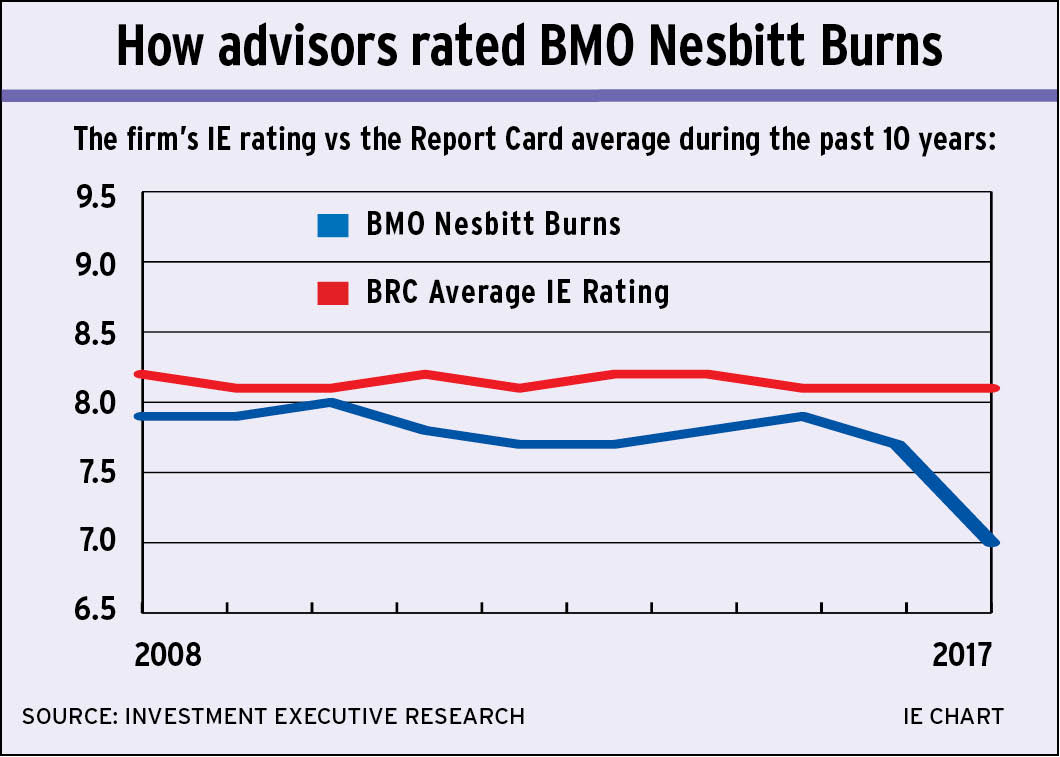

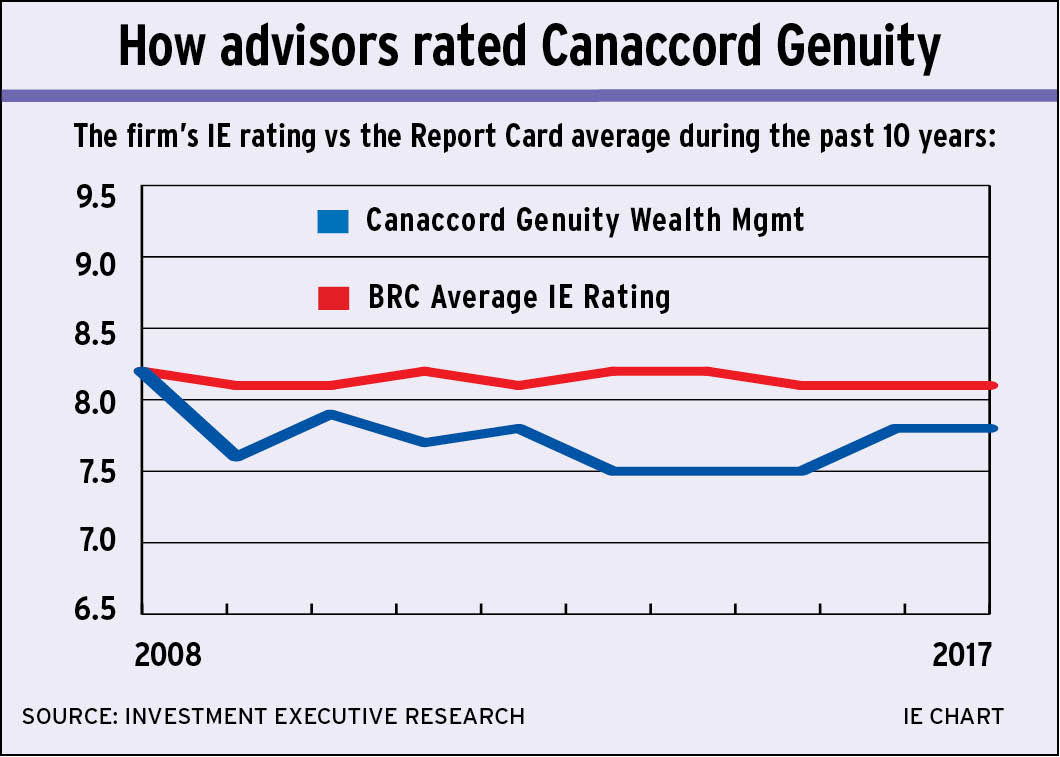

Canaccord Genuity Wealth Management (Canada)

Canaccord’s IE rating has seen its ups and downs over the past 10 years. After a strong showing in 2008, the firm’s IE rating dropped as advisors felt the fallout from the firm’s entanglement with asset-backed commercial paper (ABCP). Canaccord’s IE rating then hit a bottom of 7.5 in 2013 because of advisors’ frustration with management over the closure of a 16 branches in 2012. The firm has since seen a turnaround in its ratings as advisors feel more confident about its direction.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

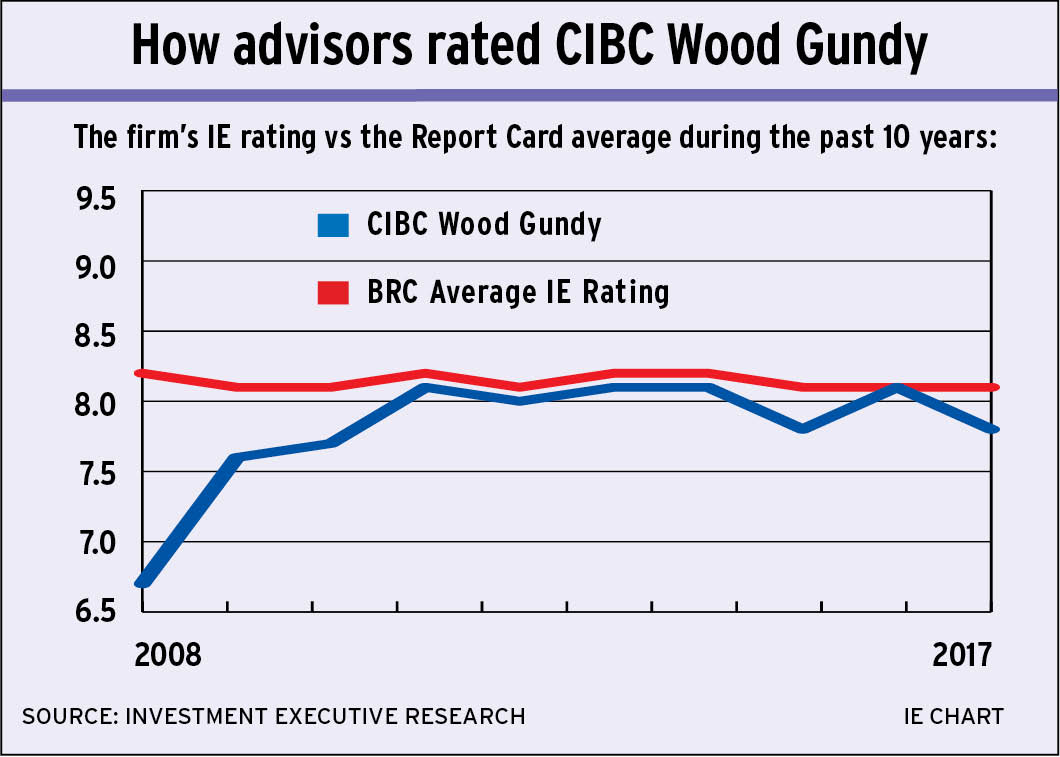

CIBC Wood Gundy

Advisors were quite displeased with CIBC Wood Gundy in 2008 as their firm’s parent bank was hit hard by the collapse of the subprime mortgage market in the U.S. and its investments in ABCP. In fact, the firm had the lowest IE rating of 6.7 that year. Since then, though, Wood Gundy’s ratings have bounced back thanks in large part to the leadership of Monique Gravel, who has since retired, and the expansion of the firm’s support services and experts.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

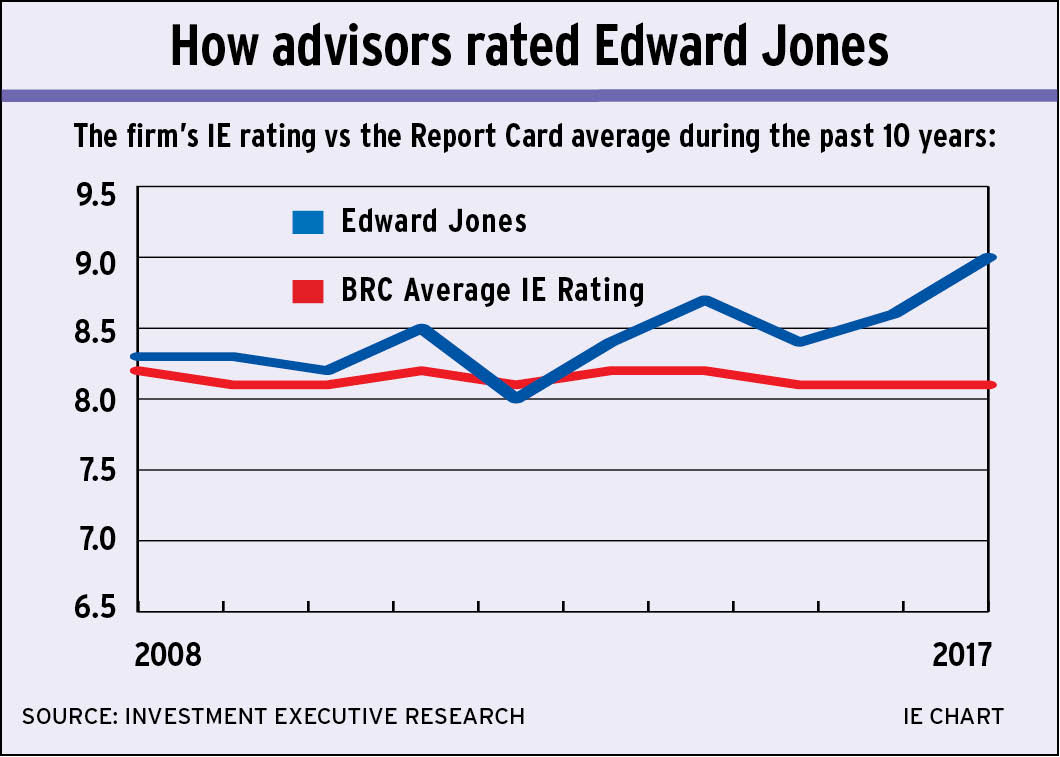

Edward Jones

It’s been mostly good news for Edward Jones over the past decade. With the exception of a few dips along the way, advisors have generally been very pleased with the firm’s support services and partnership model. In fact, Edward Jones’ IE rating hit a 10-year high of 9.0 in 2017.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

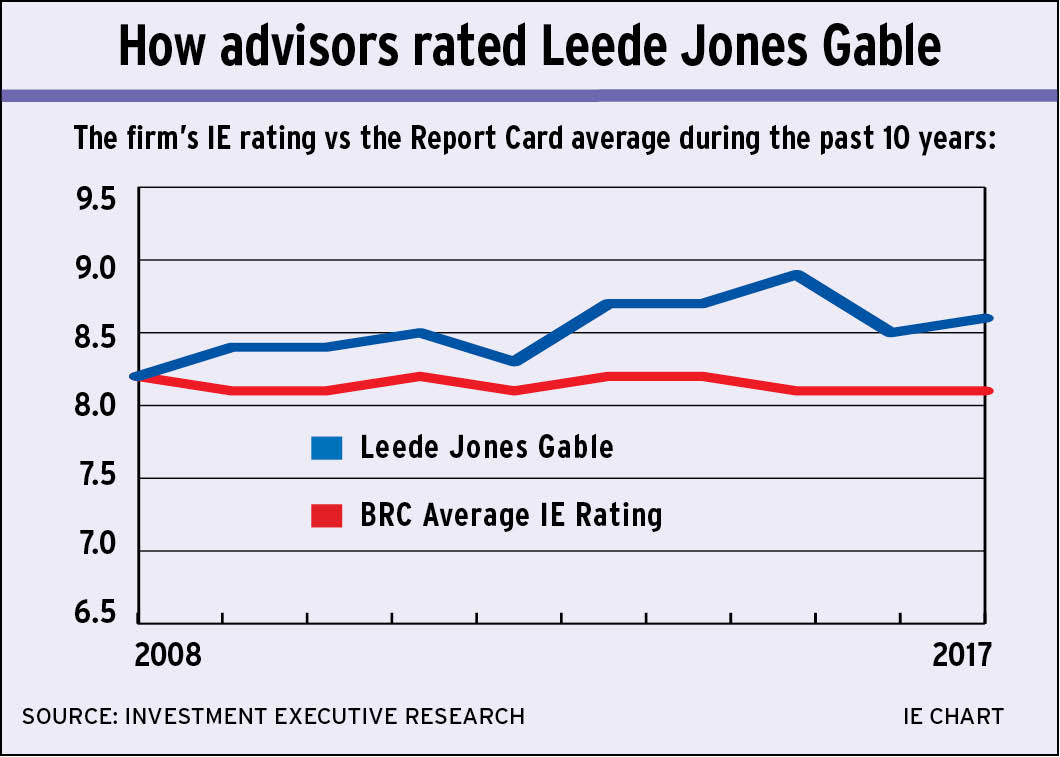

Leede Jones Gable Inc.

Over the past 10 years, Leede has received consistent ratings from its advisor base. In fact, its IE rating has generally been above the Report Card average. With the exception of a small drop in 2016 following Leede Financial Inc.’s 2015 merger with Jones Gable & Co. Ltd., the small dealer’s IE rating has improved over the years as it grows its advisor force and national footprint.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

National Bank Financial Ltd.

The ABCP crisis did not affect National Bank Financial (NBF) as much as other brokerage firms, but its involvement in that scandal was enough for the firm to have a below-average IE rating in 2008. The firm’s rating then slid further to a 10-year low of 7.4 in 2013 as a result of the growing pains involved in acquiring Wellington West Holdings Inc. and HSBC Securities (Canada) Inc. This year, however, things are starting to look up for NBF as its IE rating reached a new 10-year high of 8.0.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

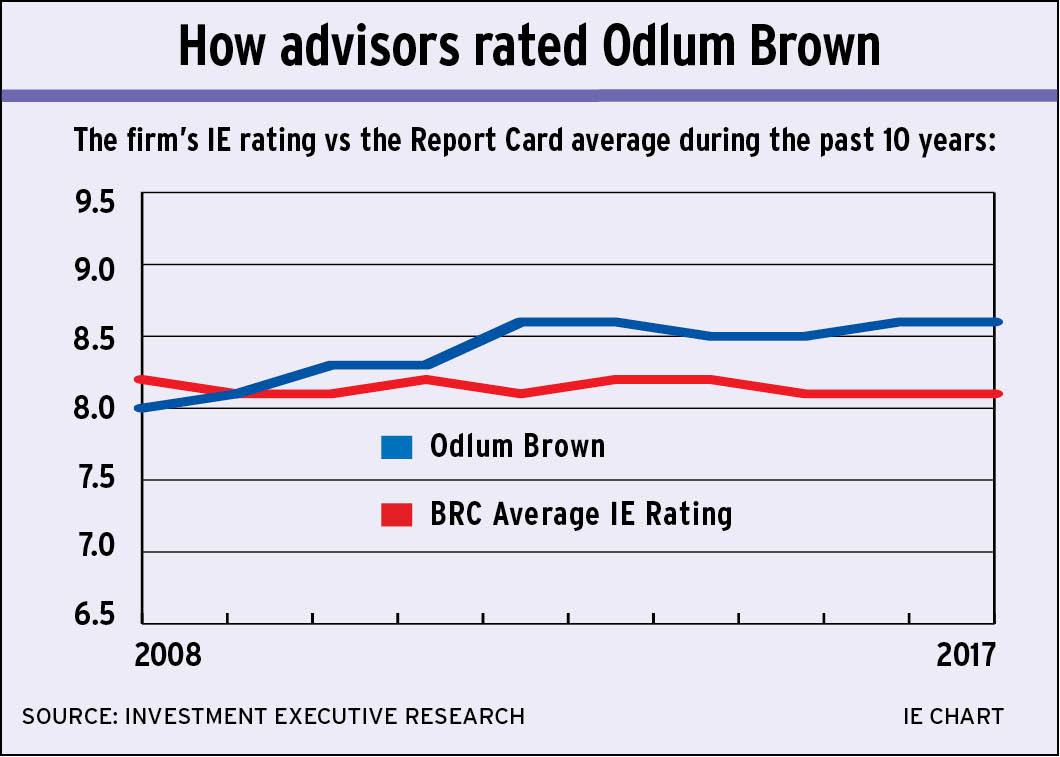

Odlum Brown Ltd.

This small, regional investment dealer on the West Coast has routinely received an above-average IE Rating. In fact, Odlum Brown advisors have praised their firm in the areas that matter most to all advisors — including the “firm’s ethics,” “freedom to make objective product choices” and “firm’s stability” — year in and year out since 2008.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

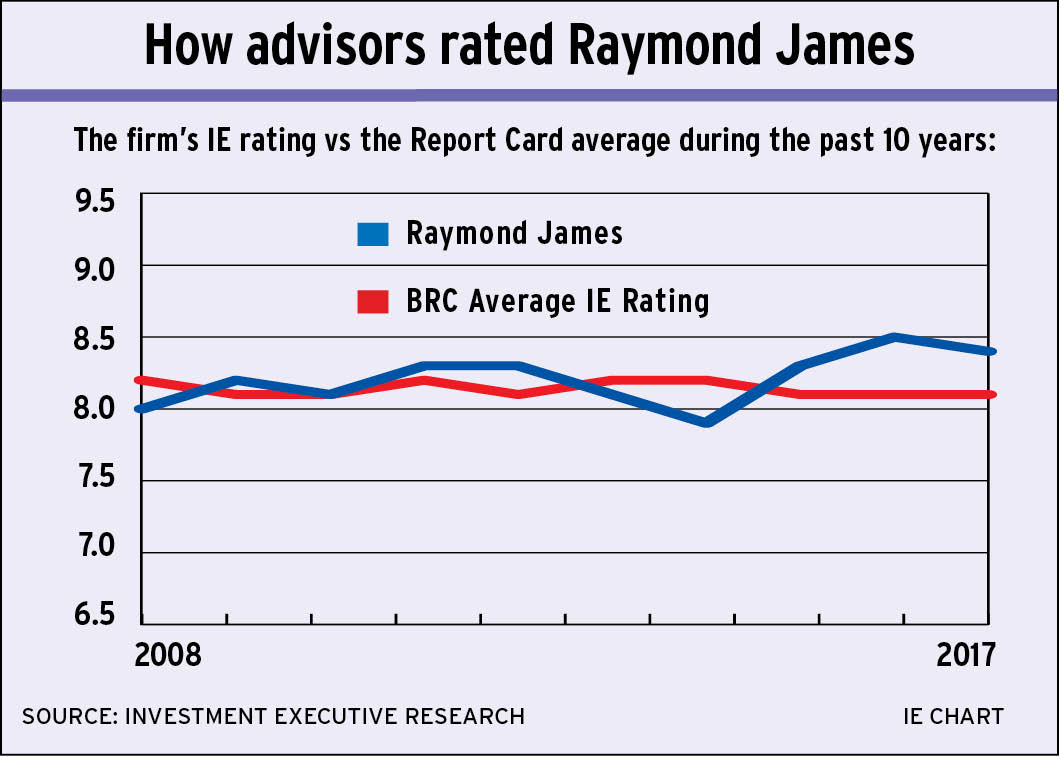

Raymond James Ltd.

Raymond James’ IE rating has remained fairly steady over the past 10 years — and it has managed to stay close to the industry average. The big exception was in 2014, when the firm’s IE rating dipped to 7.9. The firm saw its IE rating rise back up to 8.3 the following year after advisors saw significant improvements in the support services available to them.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

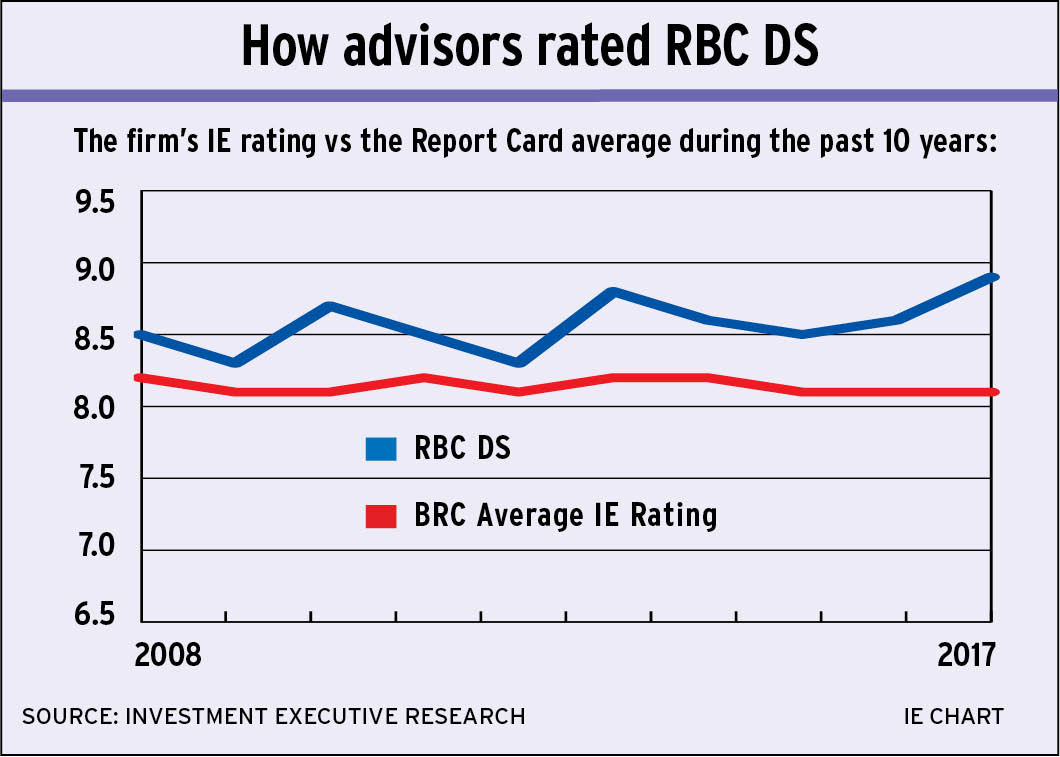

RBC Dominion Securities Inc.

DS advisors have given their brokerage firm strong ratings over the past 10 years; as a result, the brokerage’s IE rating has consistently been above the industry average. In addition, DS has also been the firm to beat among the bank-owned brokerages as advisors routinely rate the firm highly in categories that are important to them, such as firm’s stability.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

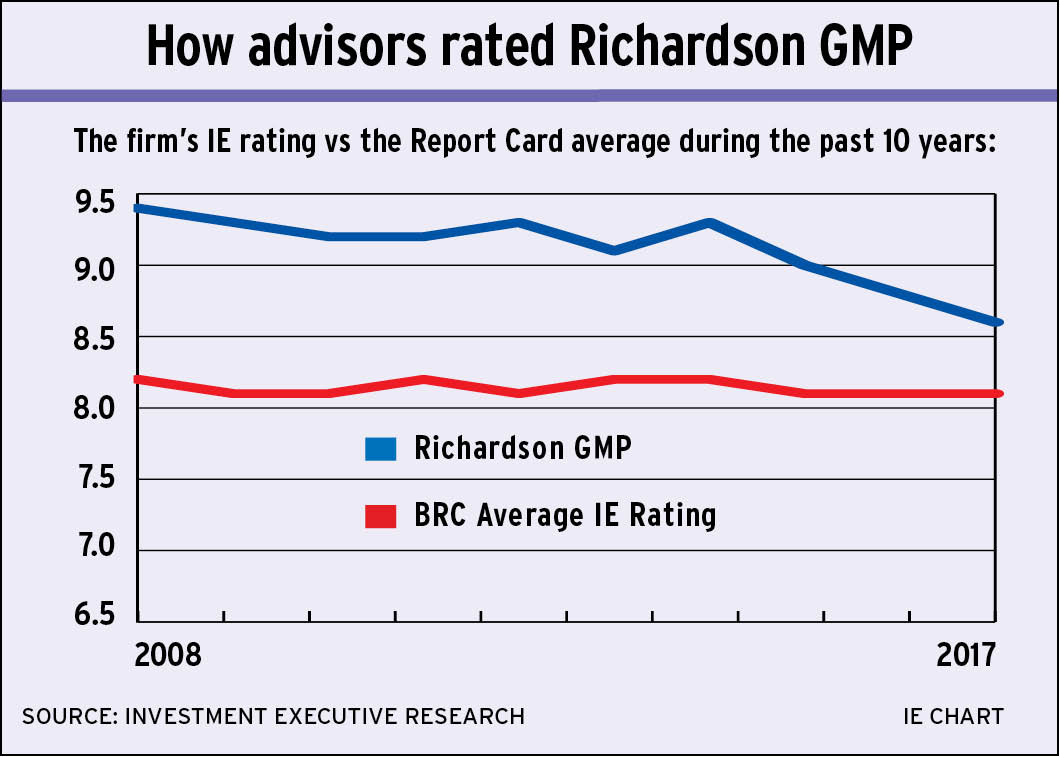

Richardson GMP Ltd.*

Richardson GMP has boasted strong IE ratings of 9.0 or higher for most of the past decade as advisors have consistently praised the firm’s independent business model and equity ownership program. However, Richardson GMP has seen a slight dip in its IE rating over the past two years, hitting a 10-year low of 8.6 in 2017. (*Note: Richardson GMP’s IE rating for 2008 and 2009 is an average of its predecessor firms: Richardson Partners Financial Ltd. and GMP Private Client LP.)Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

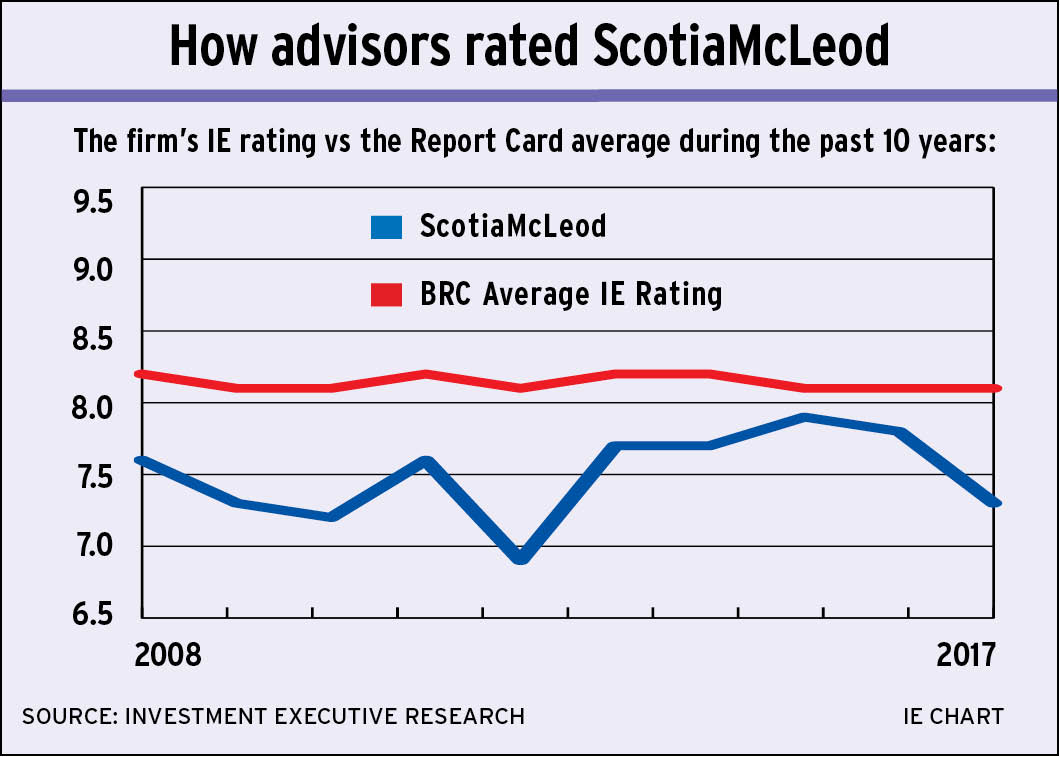

ScotiaMcLeod Inc.

ScotiaMcLeod advisors have not given their management an easy ride in the Report Card over the years. In the past 10 years, ScotiaMcLeod has consistently rated below the Report Card average. This was often because of advisors’ frustration with the firm’s technology platforms. Advisors’ dissatisfaction with the brokerage’s tech came to a head in 2012 when its IE rating hit a 10-year low of 6.9. ScotiaMcLeod seemed to be turning things around until 2017, when advisors complained about their firm’s strategic direction.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

How brokerages have fared during the past 10 years

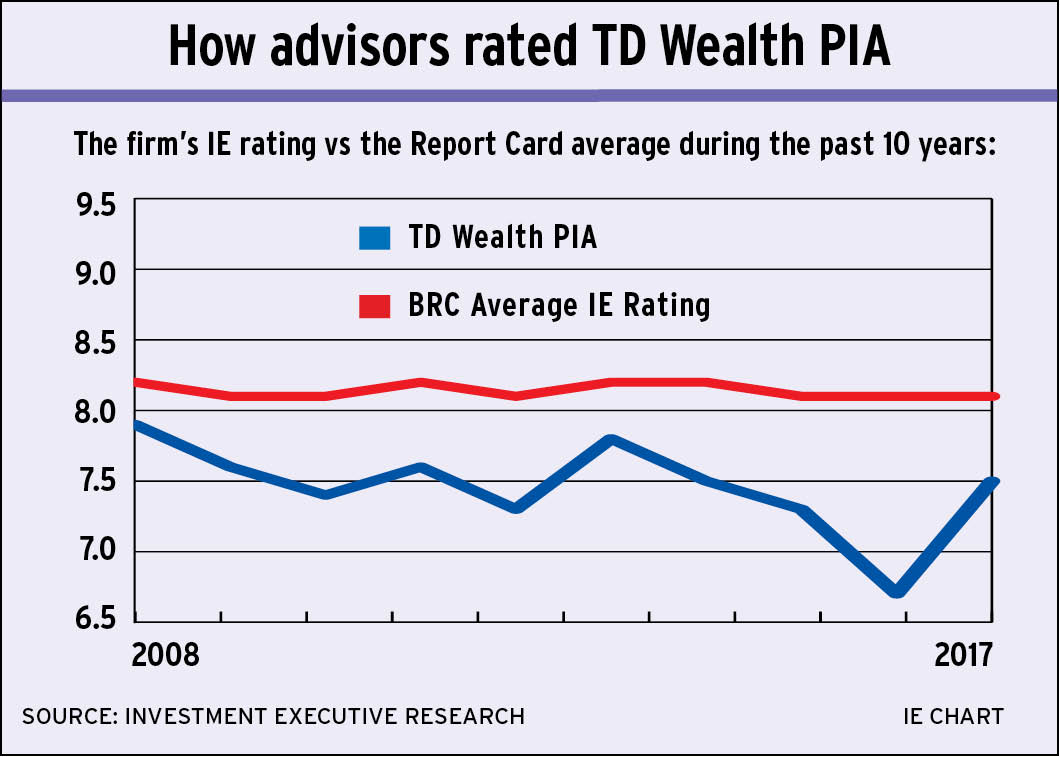

TD Wealth Private Investment Advice

Advisors with TD Wealth Private Investment Advice (TD Wealth PIA) were also unafraid to voice their frustrations with management. To that end, TD Wealth PIA’s IE rating has consistently been below the Report Card average — particularly in 2016, when advisors were upset over changes to their payout grids. This year, however, TD Wealth PIA saw a turnaround in its ratings because advisors feel more confident about the firm’s strategic direction.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive