Regardless if investment advisors rated their firm positively or negatively in the annual Brokerage Report Card during the past decade, they’re willing to recommend their firm to other advisors more often than not on a consistent basis.

-

BRC 2018: How a firm’s ratings impact advisors’ recommendations

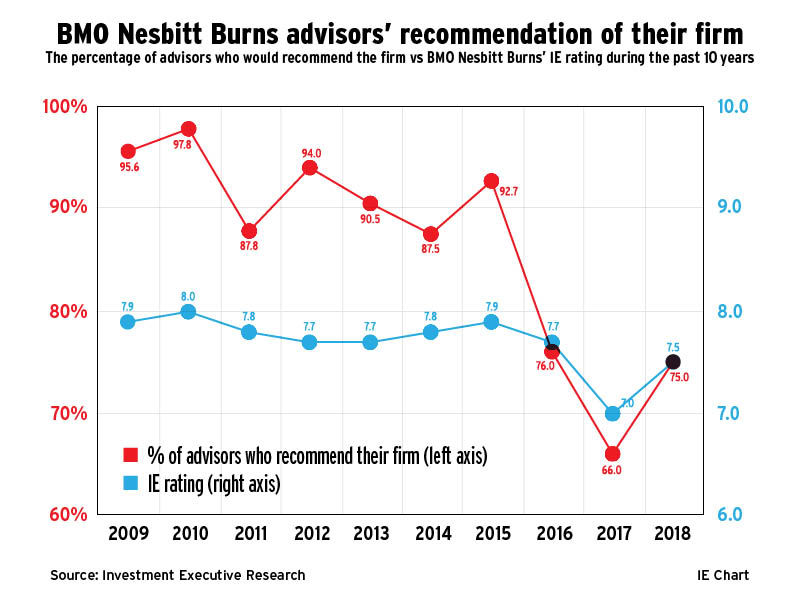

BMO Nesbit Burns

The percentage of Nesbitt advisors who would recommend their firm to another advisor has declined during the past 10 years. In 2010, 97.8% of Nesbitt advisors said they would recommend their firm because they considered it a good place to run an advisory business. This high point also corresponded with Nesbitt’s highest IE rating of 8.0 during the past decade. Since then, the trend has been largely downward, with the steepest drop taking place in 2016, when 76% of Nesbitt advisors said they would recommend their firm vs 92.7% in 2015. That percentage dropped again to 66% in 2017, a 10-year low for Nesbitt. This year, things have bounced back a little as 75% of Nesbitt advisors said they would recommend their firm.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

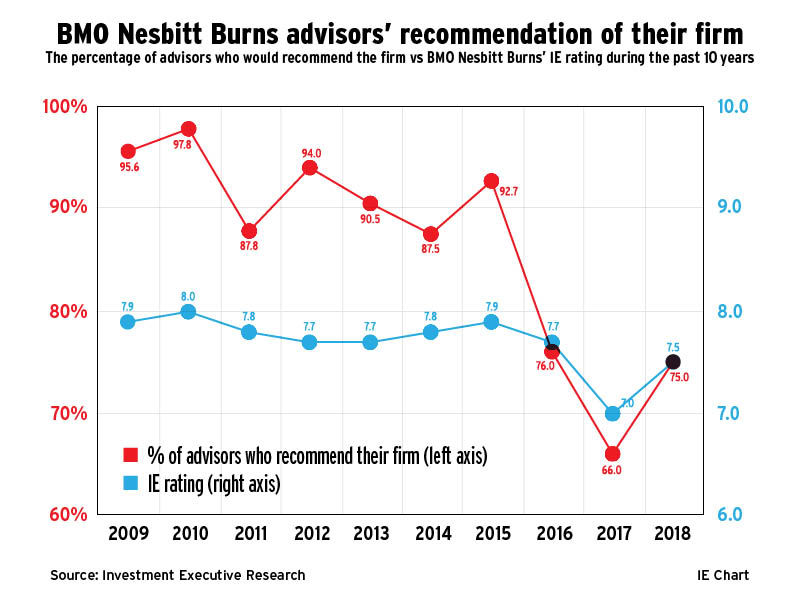

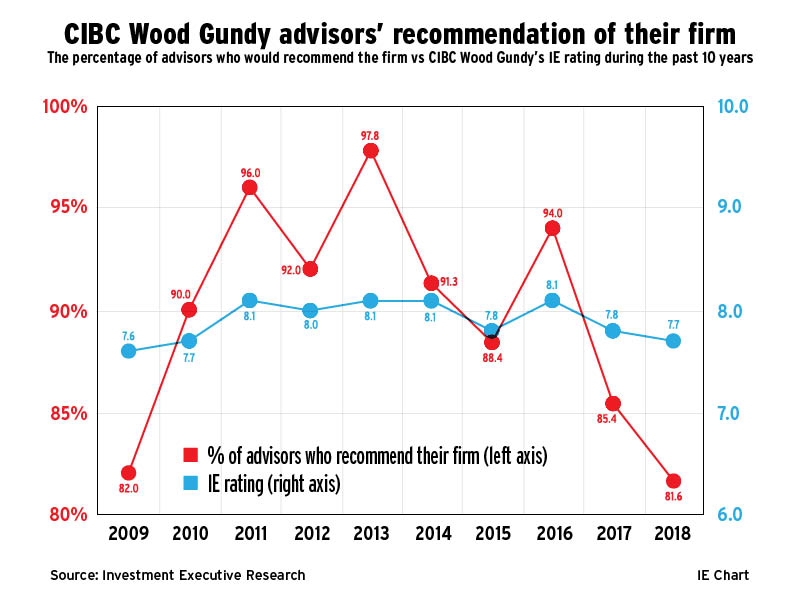

Canaccord Genuity Wealth Management (Canada)

Canaccord advisors generally are quite happy to recommend their brokerage as the percentage of those who said they would do so has remained above the 90% mark during the past 10 years — with one exception. The high point for the firm came in 2010, when 97.8% of advisors said they would recommend the firm because of its independent culture. Conversely, the biggest drop came in 2015, when 86.2% of advisors said they would recommend the brokerage. That year, Canaccord also had one of its lowest IE rating of the past decade. Since then, the firm’s ratings have rebounded; its IE rating of 8.0 this year was a 10-year high. This is reflected in the fact 95% of Canaccord advisors said they would recommend their brokerage to another advisor.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

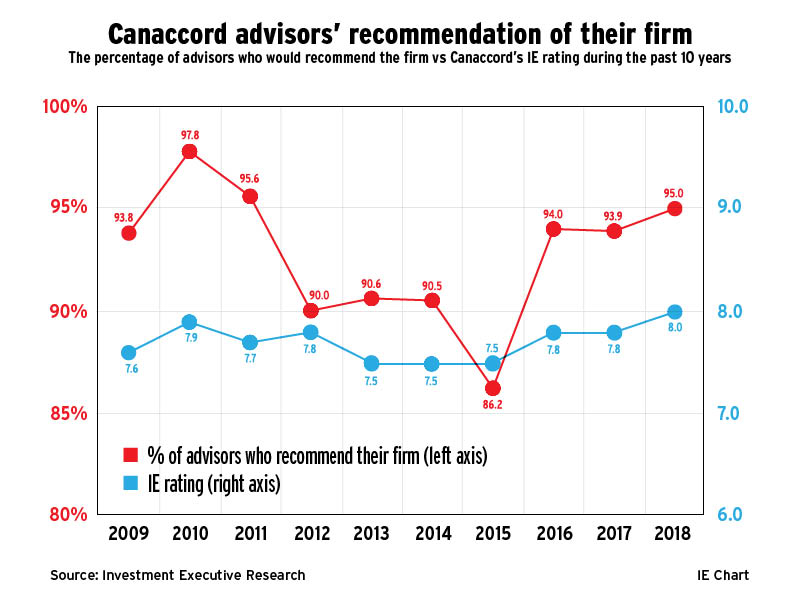

CIBC Wood Gundy

Wood Gundy’s IE rating has been rather cyclical over the past 10 years — as has the percentage of advisors willing to recommend the firm. In 2009, 82% of Wood Gundy advisors said they would recommend the brokerage as it received an IE rating of 7.6, its lowest score in the past 10 years. Those 18% of advisors who were hesitant to recommend the firm pointed to technology issues. Things reached a high point for Wood Gundy in 2013, when 97.8% of advisors said they would recommend the firm because of its corporate culture. Wood Gundy’s IE rating was also a higher 8.1 that year. This year, though, the percentage of Wood Gundy advisors who said they would do so has dropped back to 2009 levels along with the IE rating.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

Edward Jones

Edward Jones advisors believe their brokerage is a good place to work. This is evident in the fact that 100% of advisors surveyed said they would recommend the firm three times during the past 10 years. Furthermore, that percentage has not dropped below 91.3% during this time span. For the most part, advisors say they would recommend Edward Jones for several reasons — from the firm’s training to its ethics to its conservative approach to investments. The fact Edward Jones advisors are partial to their brokerage also is clear from the relatively strong IE rating the firm has posted during the past decade.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

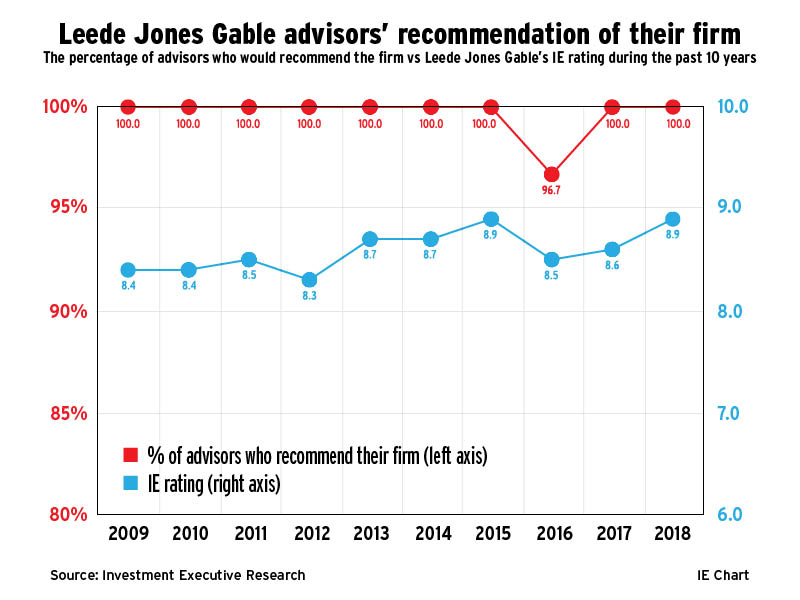

Leede Jones Gable

Leede advisors believe they work at the right place and that other advisors also would find the firm to be a right fit. This sentiment is made clear by the fact 100% of survey participants said they would recommend Leede to another advisor nine times in the past 10 years. Similarly, the brokerage has posted one of the highest IE rating, ranging from 8.3 to 8.9, during the past decade. On the whole, Leede advisors enjoy the corporate culture at their firm and would happily recommend it to other like-minded advisors.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

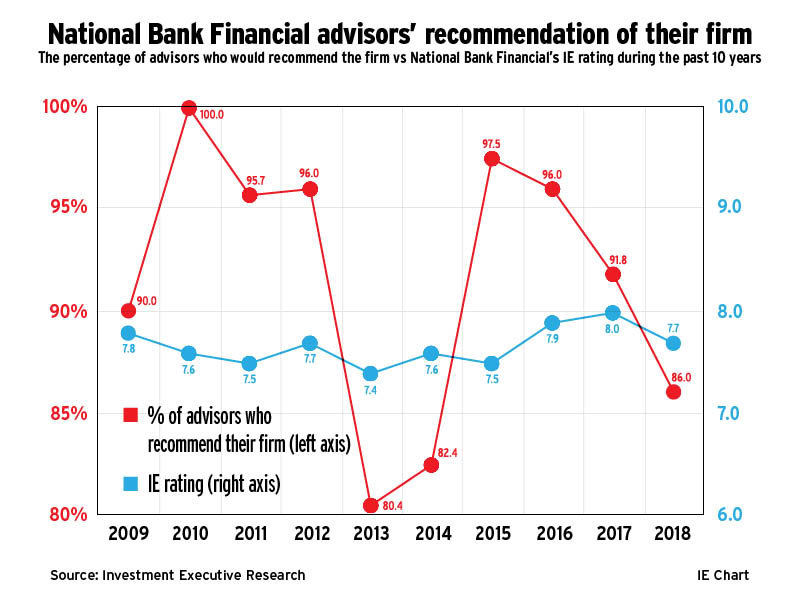

National Bank Financial

NBF’s IE rating has seen some ups and downs during the past 10 years along with the number of advisors willing to recommend the firm — although the two benchmarks aren’t always correlated. For example, 100% of NBF advisors surveyed in 2010 said they would recommend their brokerage, yet NBF’s IE rating that year was 7.6, its third-lowest rating within the past 10 years. This year, the benchmarks moved a little more in lockstep as the firm’s IE rating dipped to 7.7 while the percentage of advisors who would recommend the firm also declined to 86%. Those who would think twice before recommending NBF said it’s because they don’t agree with the direction in which management is taking the brokerage.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

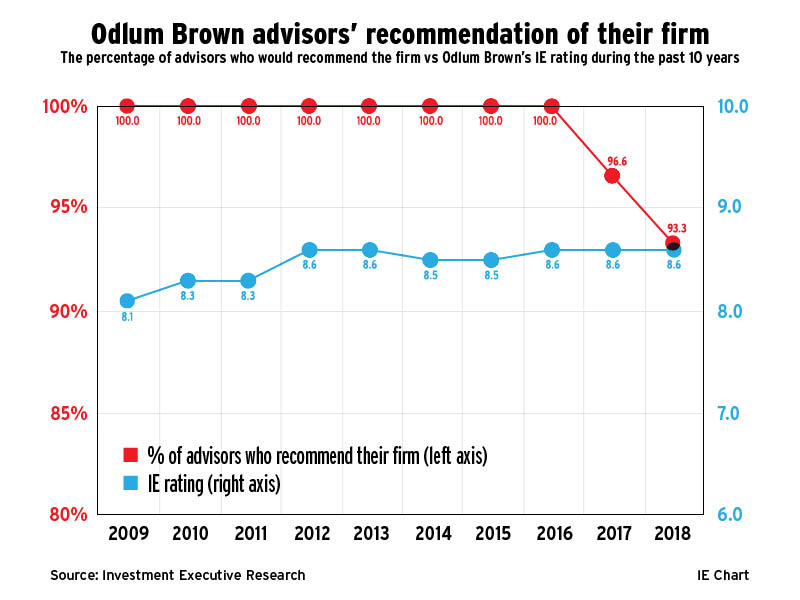

Odlum Brown

Odlum Brown has had a strong showing in the Report Card during the past 10 years as it has received one of the highest IE rating in that time. As a result, advisors are happy to recommend the brokerage. In fact, between 2009 and 2016, 100% of Odlum Brown advisors surveyed said they would recommend their firm to another advisor because of its positive work environment. In the past two years, though, that percentage has dropped slightly — to 96.6% in 2017 and 93.3% in 2018. On the whole, advisors remain very positive about the firm, but said that if there’s one area in which the firm could do a little more, it’s technology.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

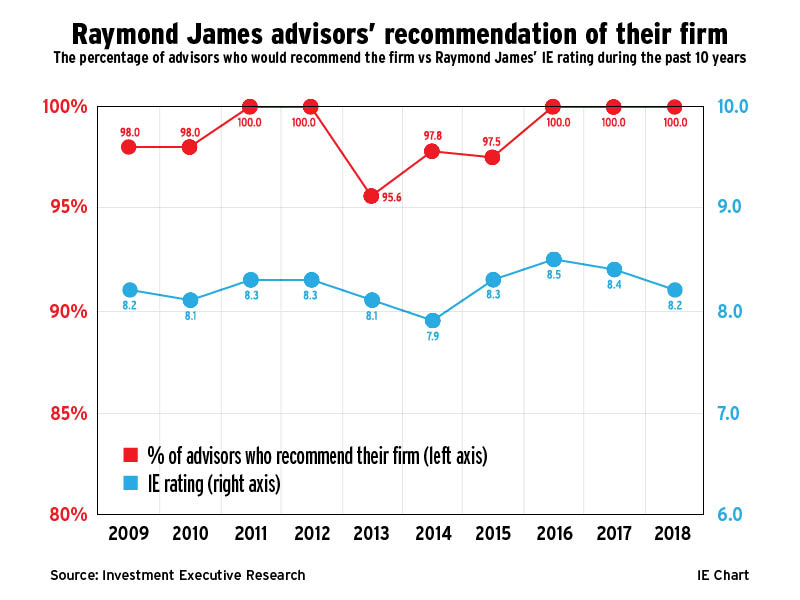

Raymond James

Raymond James advisors are happy to recommend their brokerage to another advisor. In fact, 100% of Raymond James advisors surveyed said they would recommend their firm five times in the past 10 years. Furthermore, that percentage has never dropped below 95.6%. Raymond James’ IE rating also has been fairly steady over the past 10 years, ranging from a low of 7.9 in 2014 to a high of 8.5 in 2016. When it comes to the reasons why Raymond James advisors would recommend their firm, many pointed out that they own their books of business and run an independent practice, but are still part of a good, overall corporate culture.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

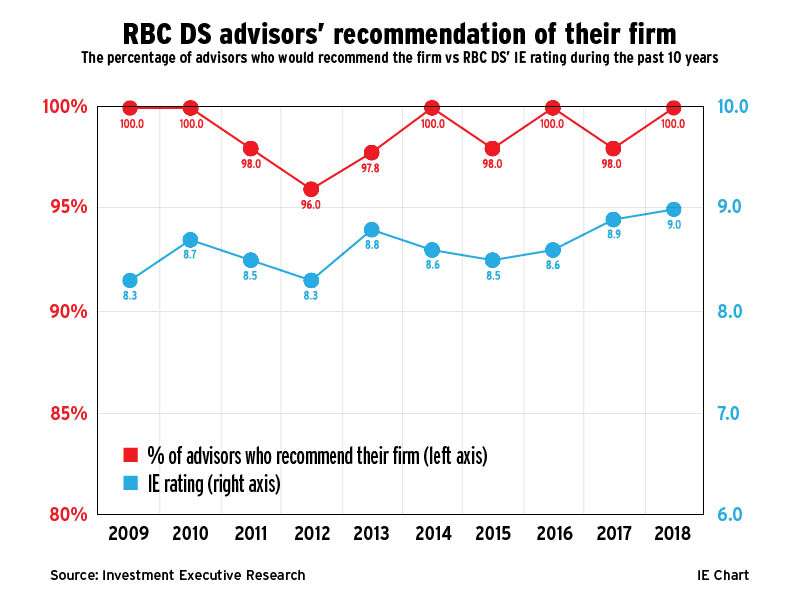

RBC Dominion Securities

DS advisors are among the most likely of the advisors surveyed for this Report Card to recommend their firm to another advisor. Case in point: 100% of DS advisors said they would recommend their brokerage to another advisor five times in the past 10 years — and that figure has never dropped below 96%. This is the highest percentage of all firms in the Report Card. Generally, DS advisors said they would recommend their brokerage because of its parent bank’s strength as well as the support they receive for wealth-management-related services. Not surprising, DS has also had among the strongest IE rating during this time, ranging from a low of 8.3 in 2009 and 2012 to 9.0 in 2018.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

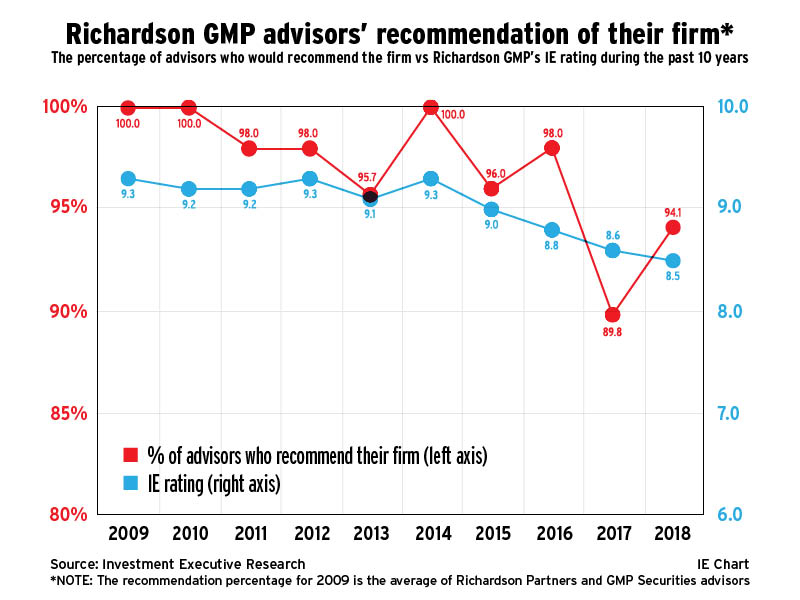

Richardson GMP

Although Richardson GMP’s IE rating has dipped slightly in recent years, most of its advisors are still willing to recommend the brokerage. In fact, 100% of Richardson GMP advisors surveyed said they would recommend their firm to another advisor three times in the past 10 years. However, many of those advisors add the following caveat: they would make the recommendation to an advisor only if her or she was the right fit for the firm. One exception to this trend came in 2017, when 89.8% of advisors said they would recommend the firm; that represented a 10-year low. Advisors hesitant about recommending the firm said it was because of Richardson GMP’s potential sale in 2016. Things have started to turn around since as 94.1% of advisors said they would recommend the firm in 2018.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

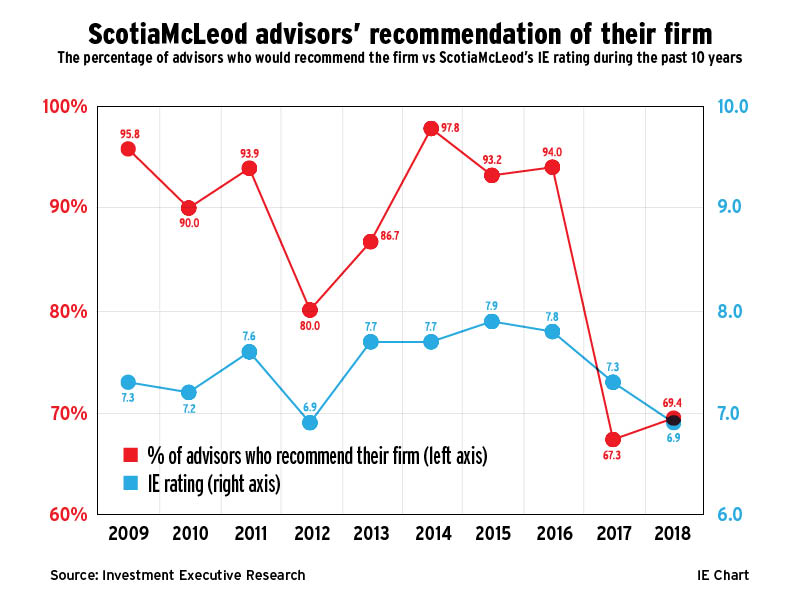

ScotiaMcLeod

As ScotiaMcLeod’s IE rating has gone up and down during the past 10 years, the firm’s advisors have hesitated to recommend the brokerage at times. In fact, 2014 represented a high point for the firm, when 97.8% of advisors said they would recommend ScotiaMcLeod to another advisor because of its positive work environment. That sentiment began to change soon thereafter, though, with a noticeable drop to 67.3% in 2017 from 94% the previous year as advisors expressed concerns about the brokerage’s direction following a series of advisor layoffs that took place later in 2016. In 2018, ScotiaMcLeod advisors still are hesitant to recommend their firm as the percentage of those who said they would do so has remained relatively low, at 69.4%.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

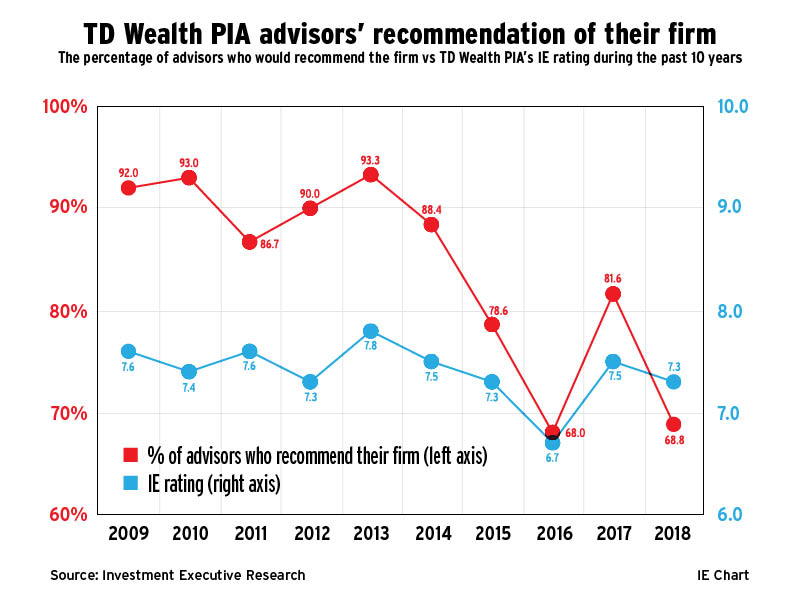

TD Wealth Private Investment Advice

The majority of TD Wealth PIA advisors surveyed since 2009 have said they would recommend their firm — although the percentage has swung dramatically in recent years. Indeed, 2013 proved to be a high point for TD Wealth PIA (then TD Waterhouse), as 93.3% of advisors said they would recommend it to another advisor. In 2016, however, only 68% of TD Wealth PIA advisors said they would do so; this decline was in step with a drop in TD Wealth’s IE rating to a 10-year low of 6.7 that year. After seeing a bit of a rebound in 2017, when 81.6% of advisors said they would recommend the brokerage as the IE rating rose to 7.5, TD Wealth PIA has experienced a bit of a setback this year as only 68.8% of advisors said they would recommend the firm.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive -

BRC 2018: How a firm’s ratings impact advisors’ recommendations

Overall

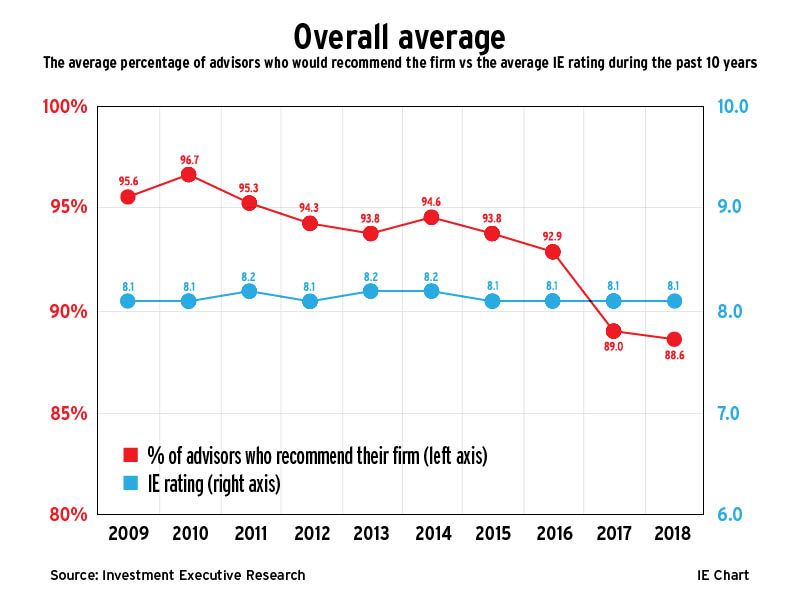

The majority of advisors surveyed for this Report Card have been more than happy to recommend their firm to another advisor during the past 10 years — although the overall percentage who do so has been shrinking. In 2009, 95.6% of advisors said they would happily suggest that other advisors join their firm. That average remained above 90% until 2017, when it dropped below that threshold for the first time. Advisors were a little hesitant to recommend their firms again this year, with 88.6% saying they would do so. These recent drops are due, in part, to the significant declines in the percentage of advisors at some brokerages who said they would recommend the firm, such as BMO Nesbitt Burns, ScotiaMcLeod and TD Wealth Private Investment Advice.Author: Fiona Collie Source: Investment Executive Research Copyright: Investment Executive

The reasons why advisors are happy to recommend their brokerage can vary from the firm’s positive work environment to its commitment to independence. However, there have been times over the years when some advisors have been a little hesitant to suggest other advisors join their brokerage; that feeling is sometimes reflected in a firm’s IE rating for that year. (The IE rating is the average of all the categories on the Report Card’s main ratings table for which a brokerage received a score.)

View this slideshow to take a closer look at the percentage of advisors who would recommend their firm to another advisor, and why, as compared with the brokerage’s IE rating during the past 10 years.