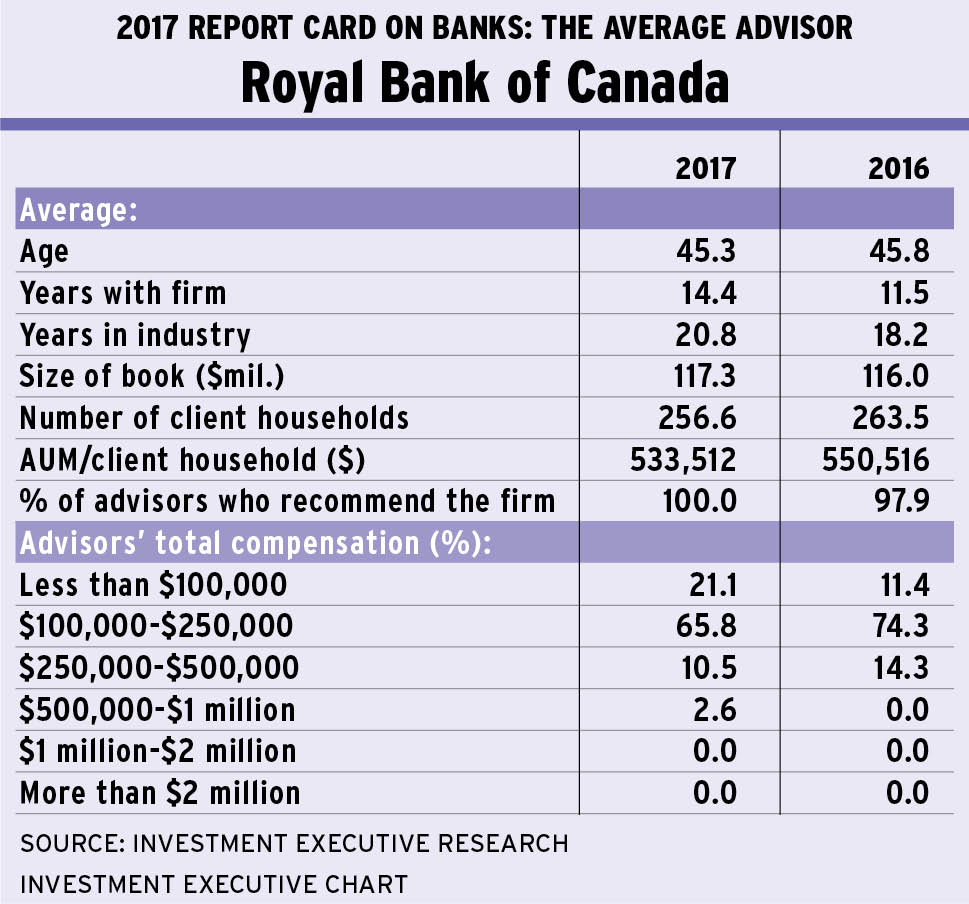

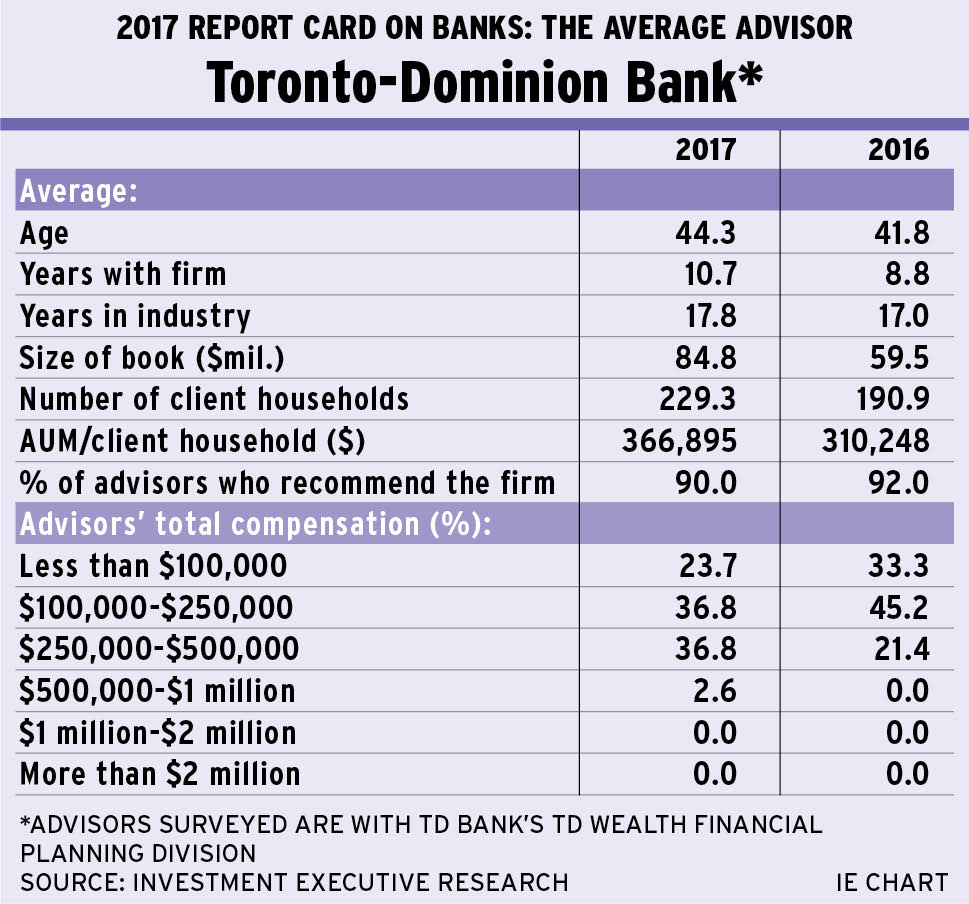

Canada’s Big Six banks are often viewed as a monolith — a largely homogenous force that dominates the Canadian financial services sector. Yet, the data obtained for Investment Executive‘s 2017 Report Card on Banks indicate that the banks’ branch-based investment businesses are far from identical.

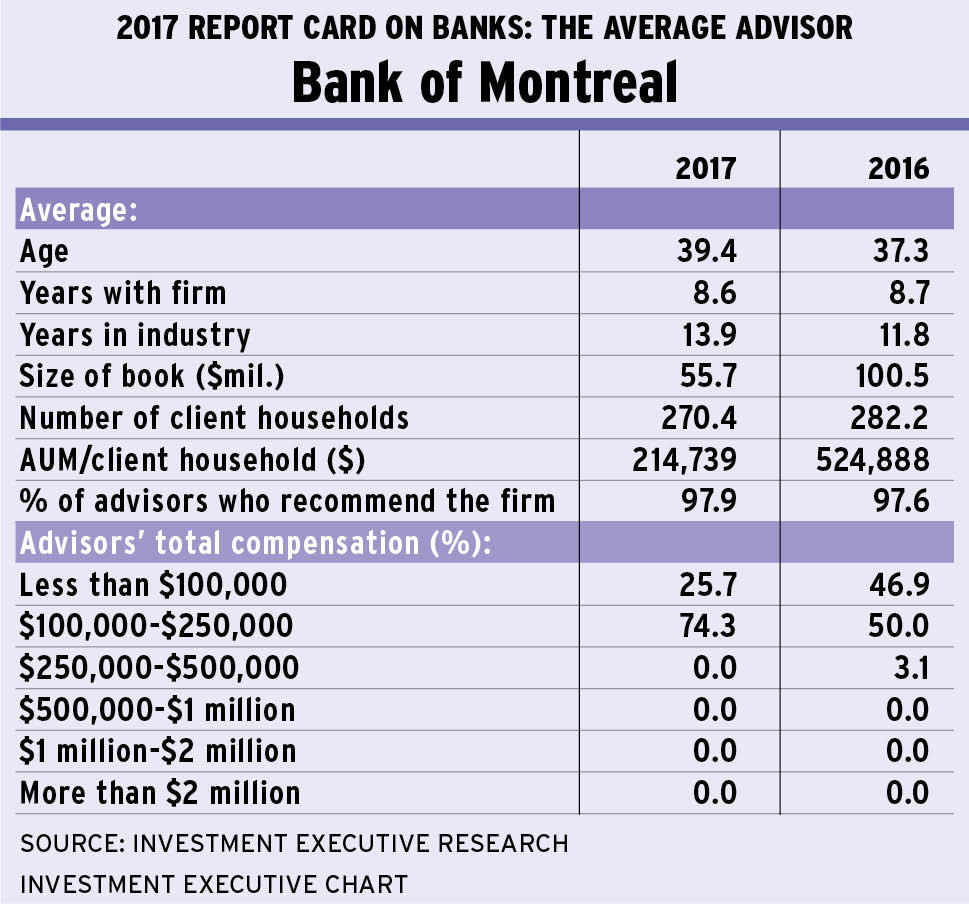

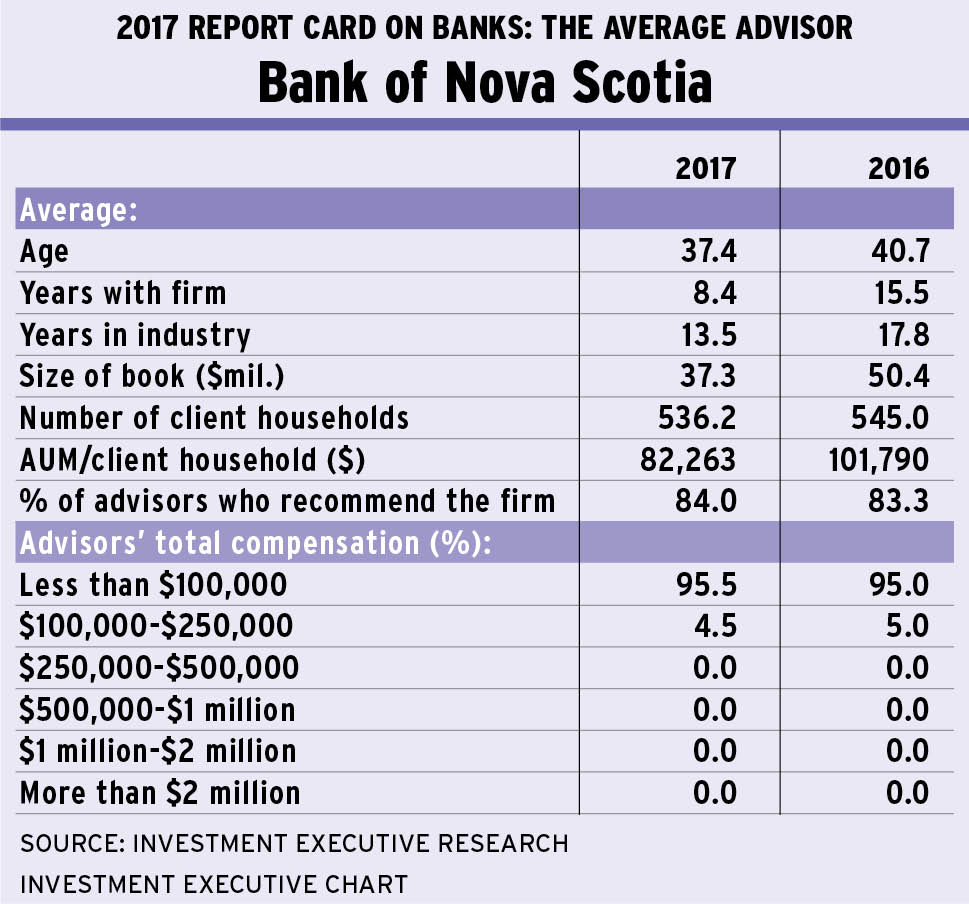

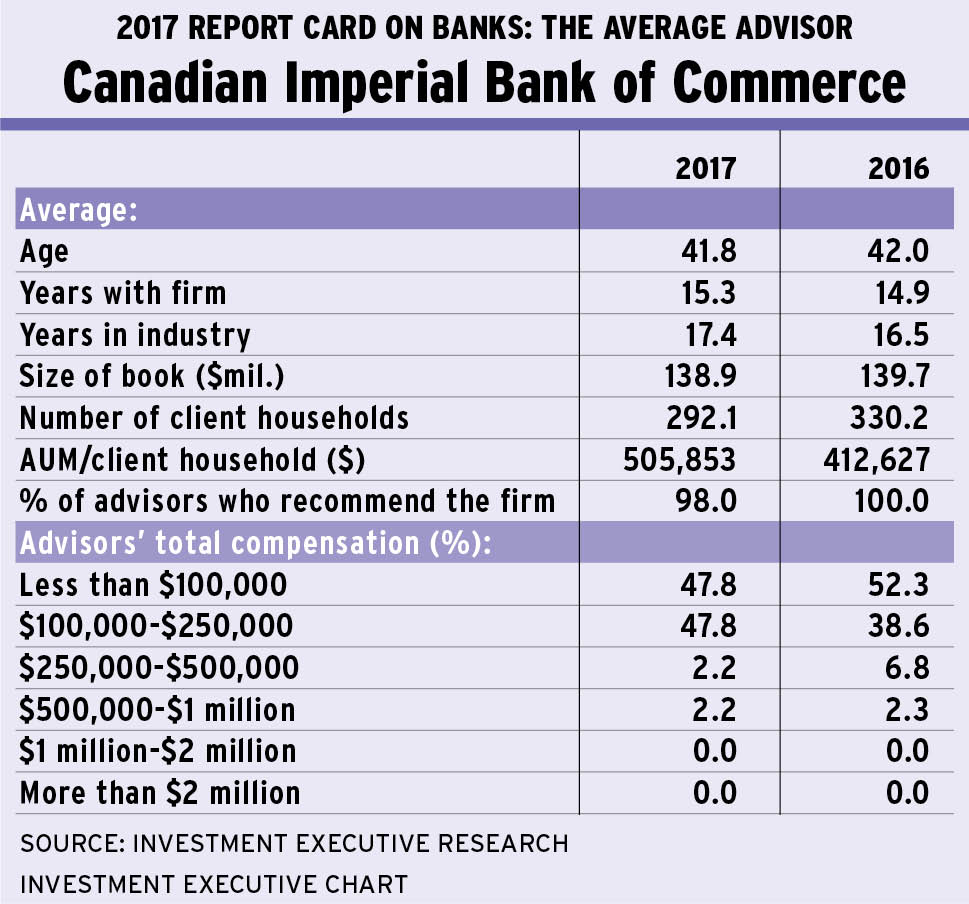

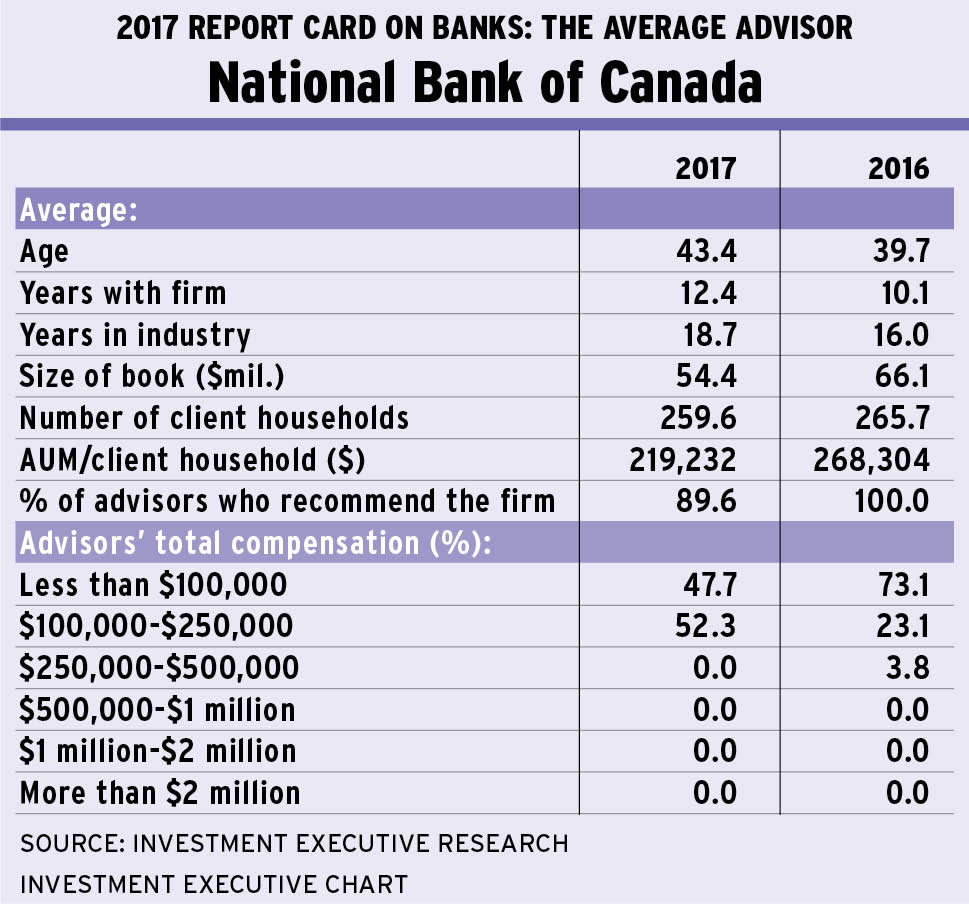

In fact, the results of this year’s Report Card reveal that the banks appear to be taking different approaches to this segment of their retail financial services business. Drilling into the data for each bank reveals a wide gap in the size of the books that branch-based financial advisors are running, their productivity levels and the compensation they’re receiving.

At some banks, branch-based advisors resemble full-service advisors at brokerages and dealers; at others, they appear to be positioned much closer to traditional frontline retail bankers. These differences in approach, coupled with data that can be particularly volatile because of relatively small sample sizes, suggests that there’s a wide range of variation in the banks’ investment businesses.