As a growing number of clients cross the divide and into senior citizenship, financial advisors who ply their trade with Canada’s banks say their firms are paying greater attention to teaching advisors how to identify and deal with the physical and mental issues related to aging.

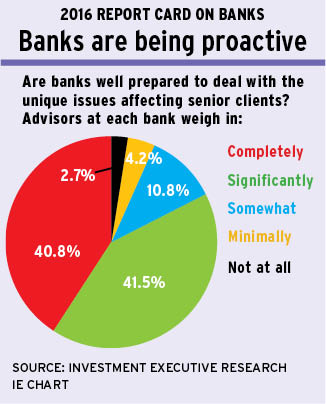

For the first time, advisors surveyed for this year’s Report Card on Banks were asked, in a supplementary question, how well their firm is prepared to deal with the unique issues relating to senior clients, given that regulators now place greater emphasis on aging and this specific demographic. And more than four of five advisors surveyed said their firms are well prepared to do this.

When advisors were asked to rate their banks on a scale of one to five – with one representing “not at all” and five representing “completely” – 82.3% of survey participants said their firms are either “significantly” (41.5%) or “completely” (40.8%) prepared to deal with these issues. In contrast, only 10.8% of advisors said their firms are “somewhat” prepared, and a scant 6.9% of advisors consider their banks to be unprepared to meet these challenges.

Advisors who praised their banks highly said their firms offer specific training, such as planning for caregiving or putting powers of attorney in place. Some banks also offer guidance to their advisors regarding the red flags to look out for in terms of client incapacity – and how to proceed from that point.

“We have a specific team that deals with this, and we’ve already had conference calls on what to look for,” says an advisor in Ontario with Toronto-based TD Canada Trust.

“There’s a different set of rules for seniors, and we always have to err on the side of caution and there is an extra amount of checks we have to do,” says an advisor in Ontario with Toronto-based Royal Bank of Canada (RBC). “We’ve held seminars on financial abuse. We have the training to stop it.”

Having such training in place is critical not only for advisors, but for the banks themselves, says Michael Walker, vice president and head of branch investments with RBC: “We’re making sure our advisors are equipped to understand issues such as financial abuse – that [our advisors] understand the red flags. We’re making sure advisors have good background and training so they understand the implications of those issues, how to follow up and what we can and cannot do from a privacy standpoint.

“This is a complex area, and we need to make sure our advisors have a good foundation and know how to access our experts behind the scenes to engage the right authorities when necessary.”

In contrast, advisors who said their banks are not well prepared to deal with seniors’ issues complained that advisors are left on their own for the most part.

“I have clients with early onset dementia, and we have zero training on [how to deal with] that,” says an advisor in British Columbia with Toronto-based Bank of Nova Scotia. “It’s very difficult.”

But regardless of whether advisors feel their banks are well prepared to deal with the unique issues affecting senior clients, several advisors expressed concern about the difficulties seniors have in keeping up with technology as their banks move toward technology-based methods of providing information and services.

“[The bank] is focusing so much on technology that they’re leaving the elderly behind,” says an advisor in Atlantic Canada with Toronto-based Bank of Montreal.

Some advisors were concerned that seniors still are more comfortable dealing with someone face to face and may be reluctant to use even basic tools such as online banking – although this may be changing as younger seniors are being taught to use technology to their benefit.

“There’s a big emphasis on technology right now,” says an advisor in Alberta with Montreal-based National Bank of Canada. “We’re trying to catch the baby boomers and teach them before they are too old to learn how to use these tools. We want to make doing so easier for them down the road.”

Most banks offer clients a choice of face-to-face meetings and/or technology-based services. In fact, according to research from the banks, more clients of all ages are demanding technological convenience and are doing a growing portion of their business with the bank via a computer or mobile device.

Specifically, a recent poll from Toronto-based Canadian Imperial Bank of Commerce (CIBC) found that 73% of Canadians prefer the convenience of banking remotely – from anywhere, at anytime – without having to visit a branch for their day-to-day needs. Clients aged 55 and over indicated they are willing to try new banking or payment technology, but tend to wait for the innovation to be widely used before adopting it, according to CIBC’s research.

“What we’re hearing is that the majority of our clients – and Canadians – prefer the convenience of banking remotely. It really is something that we think is refreshing, even to those whom we may not think are adaptable to the technology, [such as older clients],” says Scott Wambolt, senior vice president, national sales and service, with CIBC.

“The assumption is that older people still like to work the old-fashioned way – and they still very much treasure and value the human connection,” says Lee Bennett, senior vice president, TD Wealth Financial Planning. “However, they also love the flexibility that digital provides.”

© 2016 Investment Executive. All rights reserved.