The financial advisors surveyed for Investment Executive‘s 2015 Dealers’ Report Card are feeling like they are stuck on the proverbial hamster wheel. They’re making significant efforts to meet increasing regulatory requirements and client demands, but advisors can’t seem to grow their businesses despite all their hard work.

Specifically, a snapshot of the state of the average advisor’s business reveals just how difficult it has been for advisors to gain any traction. The average advisor reported a decline in assets under management (AUM) to $34.4 million vs $36.5 million last year. (See story on page C6.)

Furthermore, with AUM down for the first time since the global financial crisis, advisors also saw their pay take a dip: 62.9% of advisors surveyed said they earned less than $250,000 over the past year vs 60.6% of advisors who reported earning that amount in last year’s survey. (See page C10.)

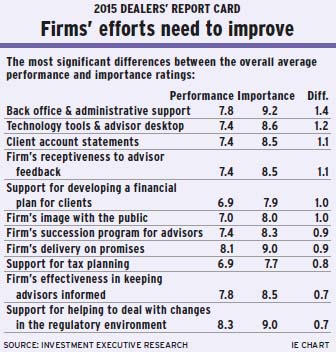

To make matters worse, advisors don’t feel as though they’re getting the necessary support from their firms. A close look at the ratings that advisors gave their firms reveals much advisor frustration. Fifty of the individual ratings that advisors gave their firms in the categories in the main table on page C4 dropped by half a point or more vs 37 ratings that rose by that same margin. In addition, there are several significant “satisfaction gaps” between the overall average performance and average importance ratings, which suggests that advisors are looking for help from their firms to get their practices moving forward – and aren’t getting it.

A particularly contentious area for advisors is their dealers’ “back office and administrative support.” This category had the third-highest overall average importance rating in the Report Card but also the highest satisfaction gap in the survey. As in years past, one of the biggest issues that advisors have with their back offices is the volume of mistakes that poorly trained employees there have made. (See page C12.)

“They need more seasoned staff,” says an advisor in Ontario with Markham, Ont.-based Worldsource Wealth Management Inc. “I understand the new hires are more cost-effective, but they don’t know enough to do the job properly.”

An exception to the rule is Mississauga, Ont.-based Investment Planning Counsel Inc. (IPC) whose back office rating rose the most among the firms in the survey. This improvement is due to advisors believing their firm has gained traction in getting its back office in fine working order following several acquisitions over the past few years.

Specifically, IPC provides extensive training to advisors, assistants and back-office staff. IPC also sought feedback from advisors and improved the back-office system as a whole rather than simply focusing on merging various systems into one, says John Novachis, executive vice president of corporate development at IPC: “While we were changing systems, we were also changing processes that were much better in helping manage the advisor/client relationship.”

For many advisors, financial planning is one way to manage that relationship with their clients better, which explains the higher importance rating of 7.9 they gave to the “support for developing a financial plan for clients” category, up from 7.2 in 2014. Specifically, advisors are looking for greater support from their firms in this category because planning shows clients the value of the financial advice that advisors provide. (See page C10.)

In fact, financial planning is becoming so important to advisors that Calgary-based Portfolio Strategies Corp., a “bare bones” independent dealer, has introduced support for financial planning by providing its advisors with a discount on Montreal-based EquiSoft’s WealthElements software as a result of increased demand.

“The firm is introducing financial planning software [for which] we can pay a fee to receive,” says a Portfolio Strategies advisor in Alberta. “I bought into it, and it’s integrated into the back-office support. I’m looking forward to that.”

One of the reasons advisors consider financial planning to be more important is the second phase of the client relationship model (CRM2). With fee disclosure becoming mandatory, advisors feel it’s important to emphasize the various services they offer clients, such as financial planning.

“[CRM2] sounds like the end of the world to some people, but I think it’s an opportunity to show the value you add,” says an advisor on the Prairies with Winnipeg-based Investors Group Inc.

In fact, advisors surveyed for this year’s Report Card were asked, via a supplementary question, how dramatically they expect the implementation of CRM2 to impact their businesses. Almost half the advisors said they expect CRM2 to disrupt their business – even if the changes are for the better.

“I had to change my presentation style with clients. But, ethically, we are heading in the right direction,” says an advisor on the Prairies with Lévis, Que.-based Desjardins Financial Security Independent Network. (See page C13.)

Although this supplementary question was a new addition to this year’s Report Card survey, most questions remained the same. In that regard, “freedom to make objective product choices” and “firm’s ethics” are still the two categories that are the most important to advisors – and are the categories in which firms tend to perform best.

For example, advisors with Richmond Hill, Ont.-based Global Maxfin Investments Inc. value the freedom and independence they have at their firm.

“I’ve been in the business so long, I just want the ability to do what I need to do and someone to process it,” says a Global Maxfin advisor in Alberta.

Independence is a category in which Global Maxfin advisors feel their firm excels. In fact, the firm has continued to see an upswing in its ratings following a successful showing in 2014; its ratings rose by half a point or more in seven categories.

“Nothing is perfect, but there is a lot on offer here,” says a Global Maxfin advisor on in Alberta. “You just have to be willing to overlook some of the weaker areas.”

One weaker area is leadership. Some Global Maxfin advisors said the Ontario Securities Commission’s permanent suspension last year of the firm’s founder, Sam Bouji, as the ultimate designated person of two affiliated companies has damaged both the firm’s reputation and their practices.

In fact, advisors are keen to point out that leadership can have a significant impact – positive or negative – on a company, from its overall stability to its corporate culture. (See page C5.)

How we did it

The process of how financial advisors rate their firms for Investment Executive‘s (IE) Dealers’ Report Card has remained consistent, year in and year out. However, the survey questionnaire that advisors are asked to respond to is always evolving – and that was the case again in 2015.

Specifically, IE research journalists Joy Blenman, Kevin Philipupillai, Kelsey Rolfe and Anne-Marie Vettorel, asked 492 advisors at 11 dealer firms to rate their firms in 31 categories for this year’s Report Card, four fewer than in 2014. That’s because “firm’s consumer advertising,” “support for helping clients accumulate assets for retirement,” “support for overall wealth-management process” and “firm’s approach to diversity and inclusion” were dropped from the survey.

In addition to these changes, advisors were asked to rate their “firm’s support for helping clients plan for post-retirement income” in 2014; this year, the question was rephrased as “support for constructing a deaccumulation strategy for retired clients.” The intent was for both of these questions to represent the same topic and to compare the ratings year-over-year. However, the revised wording confused advisors; the results were so different from 2014 that we treated this category as a new one.

Meanwhile, the way advisors rated their firms in the 31 categories in this year’s Report Card remained the same as in years past: advisors were asked to provide two ratings for each category – one for their firms’ performance and another for the importance of that category to their business. Each rating is on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.”

© 2015 Investment Executive. All rights reserved.