Given the sheer size, reach and market power of Canada’s big banks, they have been formidable players in the retail investment business. But new data suggest that the banks may be much more fearsome competitors than previously presumed.

Investment Executive‘s (IE) 2015 Report Card on Banks and Credit Unions (CUs) reveals that branch-based financial advisors are quite powerful players in the retail investment business. In fact, advisors working at banks and CUs appear to be running a solid second to the brokerage industry in terms of both assets under management (AUM) and productivity – outpacing other segments of the business by a substantial margin. And advisors who ply their trade at banks and CUs are generating these results for much less pay.

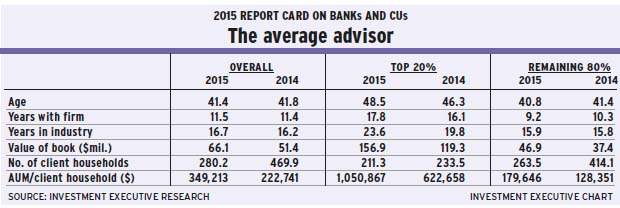

Looking at the demographic data on advisors whom IE surveyed this year, average age, tenure in the industry and time spent with their current firms was in line with what was reported in 2014. Yet, the numbers for advisors’ businesses look notably different.

For example, advisors’ average AUM was $66.1 million this year, up from $51.4 million in 2014. More significant, the average advisor is handling about 280 client households, down from 470 client households last year. Not surprising, these two trends have had a substantial impact on advisors’ productivity metrics – as measured by AUM per client household. The average advisor had almost $350,000 in AUM/client household, vs $222,740 a year ago.

These significant shifts probably are due, in part, to refinements in our survey methodology, as IE research journalists were much more strict about screening out producing branch managers and targeting only front-line advisors. This strictness probably helps to explain the big drop in number of client households.

At the same time, this more diligent screening resulted in smaller sample sizes, which, in turn, introduces more variance to the data. Although isolating the impact of these changes is difficult, they clearly had a significant effect on the data – and these huge swings don’t necessarily reflect a major change in the bank-based advisory business.

Of course, methodology that affects the data to such an extent makes year-to-year comparisons less reliable. But this year’s more focused data generate a truer profile of the average advisor – and of a much more significant contender for the investment business of Canadian households.

In past years, the average advisor working at a bank or CU appeared to be on par with the average mutual fund dealer rep in terms of AUM and productivity. The latest data show that although advisors working at banks and CUs still trail their counterparts at the brokerages by a good margin, they were well ahead of mutual fund dealer reps in terms of the size of their books of business.

Average AUM/client household was more or less equivalent for the average bank-based advisor and the average mutual fund dealer rep in 2014. This comparison also held true when advisor populations in each channel were divided into top performers (the top 20%, as measured by AUM/client household) and the remaining 80% of advisors.

Now, advisors with banks and CUs appear to be well ahead of mutual fund dealer reps. This year, mutual fund dealer reps reported a small decline in their productivity year-over-year, both on an overall basis and within the subsets of the top 20% of advisors and the remaining 80%.

Although the latest data from advisors with deposit-taking institutions can’t be relied upon to track shifts accurately in those advisors’ productivity over the past year, these advisors were much further ahead in terms of both AUM and productivity across all three segments of advisors (overall, the top 20% and the remaining 80%).

The average AUM among the top 20% of advisors who work at banks and CUs in this year’s survey was $156.9 million – more than double the average AUM of $67.2 million for top-performing mutual fund dealer reps. Furthermore, average productivity for the top advisors with banks and CUs was more than $1 million this year, about double the average productivity for the top echelon of mutual fund dealer reps ($519,012).

Among the remaining 80% of advisors with deposit-taking institutions, average AUM was $46.9 million and average AUM/client household was $179,646. For both metrics, these advisors were well ahead of the remaining 80% of mutual fund dealer reps – although the margin of difference was not nearly as wide as it was for the top-performing advisors in their respective channels.

Nevertheless, these data present a new picture of the competitive landscape. Although advisors in the brokerage channel still were far out in front of advisors who work at deposit-taking institutions and mutual fund dealers, these last two groups aren’t neck and neck for second place any longer; advisors working at banks and CUs have a decisive edge over mutual fund dealer reps.

This revised view of the retail investment industry is all the more remarkable when you consider the different revenue and income models these channels utilize. Although mutual fund dealer reps’ revenue is driven almost entirely by fees and commissions, 72.6% of the revenue for advisors working at banks and CUs comes from their salary.

For these advisors, the trade-off for the greater security of working for a bank and earning a salary is much lower take-home pay vs the average mutual fund dealer rep. Despite holding a significant edge in AUM and productivity, 71.9% of advisors working at banks and CUs said they earn less than $100,000 a year vs 26.3% of mutual fund dealer reps.

Furthermore, 24.1% of advisors with banks and CUs reported that they earn between $100,000 and $250,000 a year vs 36.6% of mutual fund dealer reps. And while only 3.9% of advisors working at deposit-taking institutions said they generate $250,000 or more in annual compensation, 37% of mutual fund dealer reps said they fall into this income bracket.

So, although advisors working at banks and CUs may be much more productive than mutual fund dealer reps, their careers apparently aren’t nearly as lucrative.

That said, apart from pure take-home pay, there are other benefits in working for a large financial services institution: along with a greater sense of security and stability, advisors in the banking channel may enjoy greater employee benefits, more institutional support and more flexible working arrangements.

Still, another possible explanation for the compensation gulf is asset allocation. Advisors in the banking channel have a much bigger share of their AUM in banking products that don’t generate much revenue. In fact, these advisors reported that about 31.3% of their AUM is in some type of banking product (vs just 2% for mutual fund dealer reps). This large disparity in banking product AUM also may account for some of the difference in the size of advisors’ books of business, as mutual fund dealer reps mostly deal with the pure investment portion of client households’ overall financial assets, not deposits.

This vastly different asset allocation also signals another sacrifice that comes from working at a bank: independence. The average advisor working at a deposit-taking institution also reported that about 8% of AUM is in proprietary managed products – more than double the rate of 3.5% for mutual fund dealer reps.

As well, the biggest AUM category for bankers still was mutual funds, with a 56.4% share of the average book. Although this figure wasn’t broken down into in-house vs third-party mutual funds, other aspects of these advisors’ AUM point to much greater use of in-house products.

© 2015 Investment Executive. All rights reserved.