With a seemingly endless stream of regulatory changes disrupting various aspects of the insurance industry’s day-to-day business, insurance advisors increasingly are depending upon their firms or managing general agencies (MGAs) for information and guidance in meeting new compliance responsibilities.

That said, the results of Investment Executive’s 2014 Insurance Advisors’ Report Card indicate that although some firms have stepped up their support in this category, other firms have left advisors feeling as though they’re on their own.

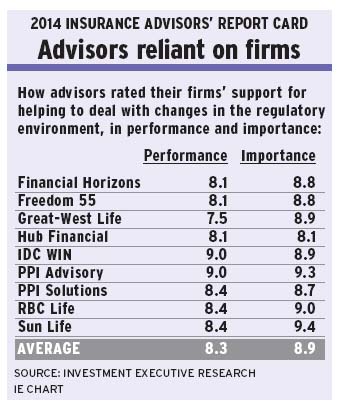

Advisors, when asked to rate their firms in the “support for helping to deal with changes in the regulatory environment” category, gave their firms an overall average performance rating of 8.3. However, the category is one that advisors consider vital to their businesses, given the rapid pace of regulatory change underway; advisors gave this category an overall importance rating of 8.9.

For example, Canada’s new anti-spam legislation, which came into effect on July 1, represents the latest disruption to advisors’ prospecting and communication practices, coming just a few years after advisors were forced to adapt to the introduction of the National Do Not Call List.

Insurance advisors also became subject to new anti-money laundering rules earlier this year, which expanded the paperwork and due diligence that advisors are required to complete for each sale of an insurance policy.

And although the ongoing regulatory reforms associated with the client relationship model do not directly affect the sale of insurance products, those changes are significant for insurance advisors who are also giving clients advice on investments.

Keeping up with all of these changes is a key challenge for advisors. “Everything is coming out fast and furious,” says an advisor in Ontario with Waterloo, Ont.-based Sun Life Financial (Canada) Inc.

Adds an advisor in the same province with Mississauga, Ont.-based IDC Worldsource Insurance Network Inc. (IDC WIN): “Our industry is making it impossible to run a business.”

Industry executives also acknowledge the challenges that this steady pace of regulatory reform present. “Where is this all going?” asks Vicken Kazazian, senior vice president of Sun Life’s career sales force. “That is the big concern.”

Nevertheless, firms and their advisors have little choice but to adapt and prepare for all these changes. And the firms rated highest in the regulatory support category by their advisors are those that not only keep advisors informed of their evolving compliance responsibilities but also take steps to help their advisors meet these responsibilities efficiently.

For example, IDC WIN, which tied for the highest performance rating in the category, at 9.0, keeps its advisors updated through campaigns and webinars and also provides advisors with templates and checklists to help with compliance.

“[The firm] is very good at getting compliance information out,” says an IDC WIN advisor in Ontario. “They’re very aggressive about staying on top of that.”

Sun Life, which earned a rating of 8.4 in the category, was also praised for its open communication. The firm distributes a newsletter that deals specifically with regulatory updates and offers webinars and detailed information on regulatory matters via its intranet.

“Sun Life is really good at keeping us updated,” says a Sun Life advisor on the Prairies. “They’re constantly sending us emails, alerting us to what could happen.”

Not all firms have gone to the same lengths to keep advisors informed. Winnipeg-based Great-West Life Assurance Co. (GWL), for instance, received the lowest score in the category (7.5).

Although Hugh Moncrieff, senior vice president of GWL’s Gold Key distribution network, says the firm has practices in place to communicate regulatory changes and to help its advisors comply, GWL advisors say they’re often unaware of looming changes.

“We’re left on our own,” says a GWL advisor on the Prairies.

Adds a colleague in the same region: “I don’t even know what the changes are.”

Advisors at other firms complain that they’re simply not notified quickly enough.

“The information doesn’t get down to us,” says an advisor in British Columbia with Mississauga-based RBC Life Insurance Co. “By the time we get it, it’s too late.”

Adds an advisor in Ontario with Kitchener, Ont.-based Financial Horizons Inc.: “They could be a little more timely [in] updating us on the changes.”

One firm that has stepped up its regulatory compliance support in response to the recent plethora of reforms is London, Ont.-based Freedom 55 Financial, which saw its score in the category jump to 8.1 from 7.5 year-over-year.

“There’s even a greater focus on compliance,” says Mike Cunneen, senior vice president of Freedom 55’s wealth and estate planning group. “We have announced a new leadership role that’s responsible for all our compliance strategies across our division. And that’s everything from launching new tools and templates, helping to train advisors [and] helping them understand what their compliance obligations are.”

Advisors have taken notice. “We’re ahead of most companies,” says a Freedom 55 advisor in Alberta. “We’re really proactive.”

Even more proactive on the regulatory front is Toronto-based PPI Advisory, which tied for the top performance score in the category. That MGA, beyond simply providing support in dealing with regulatory changes, strives to have influence on the regulations themselves.

“We’ve taken a leadership position in the industry,” says Jim Burton, chairman and CEO of PPI Advisory, “both through the Conference for Advanced Life Underwriting and through Advocis, in working in advancing the interests of agents on the regulatory front.”

© 2014 Investment Executive. All rights reserved.