Securities regulators have faced significant turmoil over the past year, but that underlying uncertainty wasn’t evident to the firms in the financial services industry, which registered little difference in their opinions regarding the overall performance of their overseers.

Indeed, the latest edition of Investment Executive’s Regulators’ Report Card – which is based on surveys of chief compliance officers at 110 dealer firms this year – found surprisingly few changes in the overall scores that these dealers gave the regulators in last year’s Report Card.

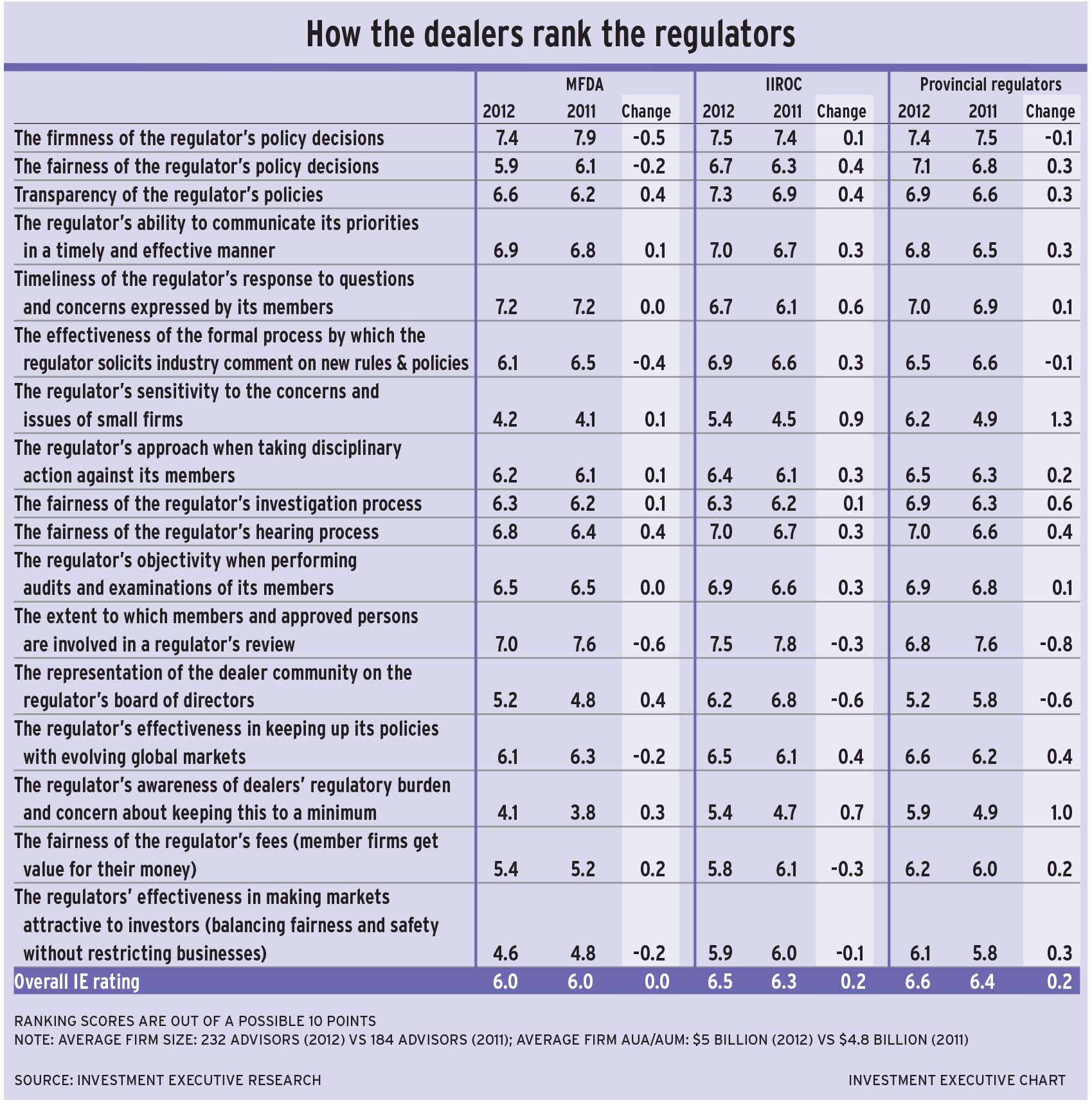

The 2012 survey resulted in no change in the overall average rating for the Mutual Fund Dealers Association of Canada from last year’s survey, and only marginal changes – to the upside – in the scores for the Investment Industry Regulatory Organization of Canada and the various provincial regulators. (Ratings for the individual securities commissions are amalgamated in IE’s results to account for small sample sizes in most provinces.)

Ordinarily, the fact that these scores haven’t changed much wouldn’t be unexpected, as the regulators are notoriously slow to evolve. This year, however, the stability in their scores is somewhat surprising because 2011 was such a monumentally unsettled year for the regulators.

To start, the real possibility of a fundamental overhaul of the regulatory structure hung over the regulators all year long.

First, there was the landmark hearing before the Supreme Court of Canada to consider the constitutionality of proposed federal securities legislation that would have effectively brought about the creation of a national securities regulator after decades of debate.

That hearing took place in April 2011, then left the staffs of the provincial regulators wondering all year whether they would soon be facing a massive consolidation – and a fight for jobs, in many cases – until the SCC’s unexpected unanimous rejection of the federal bid at yearend.

At the same time, the self-regulatory organizations (the MFDA and IIROC) flirted with the idea of their own merger once again. Ultimately, that idea was dropped, despite considerable interest on the IIROC side, although the issue percolated in the background throughout much of the year. (See story on page 21.)

Moreover, along with the fact that the regulators’ futures were so clouded in uncertainty last year, they also have been grappling with more than their typical load of major policy issues, including:

– a proposal to restructure the trading and clearing landscape in Canada;

– growing pressure from policy-makers to tackle new issues raised by the global financial crisis, including the monitoring of systemic risk and the supervision of over-the-counter derivatives;

– and all of the other novel policy problems created by the ever-evolving financial markets.

Yet, amid all of this uncertainty and with all of these challenges on the agenda, it seems that the dealers have barely noticed any change in regulatory performance. It’s as if the regulators have been the proverbial ducks of the financial services industry this past year – placid on the surface, yet paddling furiously beneath.

That said, while the overall ratings for the regulators, which represent the average of their marks in 17 categories, didn’t change much year over year, there were some significant changes in individual categories.

Indeed, the scores for both IIROC and the provincial regulators rose in 13 categories and declined in the other four. For the MFDA, it was more of a mixed bag, with its ratings increasing in nine categories, decreasing in six and unchanged in two.

As always, it’s important to remember that higher scores aren’t necessarily a good thing in this particular Report Card survey. These scores reflect the views of one of the regulators’ primary constituencies, the dealer community. But regulators serve numerous masters, including issuers, investors and governments – all of whom may have differing views. So, unlike IE‘s other Report Cards, for which higher ratings are always better, that situation isn’t necessarily the case here.

Nevertheless, the biggest jumps in ratings for individual categories occurred for the provincial regulators, which saw their ratings in “the regulator’s sensitivity to the concerns and issues of small firms” and “the regulator’s awareness of dealers’ regulatory burden and concern about keeping this to a minimum” categories jump by at least a full point – albeit from very low levels.

These gains are offset by declines in their scores for “the extent to which members and approved persons are involved in a regulator’s review” and “the representation of the dealer community on the regulator’s board of directors” categories. However, these are both categories that are much more relevant to the SROs, as only a relatively small group of dealers are directly supervised by provincial securities commissions.

Considering the importance of the categories in which the scores for the provincial regulators rose significantly – and the relative insignificance of the areas in which their scores dropped significantly – it’s fair to say the provincial regulators did see a meaningful improvement in the dealers’ opinion of them this year.

Not only did the provincial regulators receive higher marks in most categories compared with the previous year’s survey, their higher grades came in several critical categories, including: “the fairness of the regulator’s investigation process”; “the fairness of the regulator’s hearing process”; “the regulator’s effectiveness in keeping up its policies with evolving global markets”; “the regulator’s effectiveness in making markets attractive to investors”; “the fairness of the regulator’s policy decisions”; and “the transparency of the regulator’s policies.”

These overall trends in scores for the provincial regulators are mimicked in the scores for the country’s biggest regulator, the Ontario Securities Commission, which accounts for about 60% of the responses in IE‘s survey.

However, the biggest jump in scores was for the Alberta Securities Commission, which leapfrogged the B.C. Securities Commission to sit as the top-rated provincial regulator by the dealers.

The OSC still ranks third, with the Autorité des marchés financiers remaining in fourth spot among the Big Four. However, it’s important to remember that outside of Ontario, the sample sizes are relatively small.

As with the provincial regulators, IIROC also saw the biggest jumps in its scores in both its sensitivity to the concerns of small firms and its efforts to minimize the regulatory burden. The regulator received lower scores for both dealer representation on its board and dealer involvement in regulatory reviews.

IIROC also saw meaningful gains in its scores for: “timeliness of the regulator’s response to questions and concerns expressed by its members”; fairness of policy decisions; transparency of its policies; and its success at keeping its policies up to speed with evolving global markets.

In contrast, the MFDA’s scores were flat year over year. But it was the only regulator to see its score rise in the category of dealer representation on the regulator’s board, which follows the efforts by the MFDA in recent years to bolster the quality of its governance.

The MFDA also got higher marks from dealers for: transparency in its policies; the fairness of its hearings; and awareness of the regulatory burden. The areas in which the MFDA saw notable declines in its scores include: the extent to which firms and reps are involved in reviews; “the firmness of the regulator’s policy decisions”; and “the effectiveness of the formal process by which the regulator solicits industry comment on new rules and policies.”

Overall, the regulators have improved their standing only slightly in the eyes of the dealers over the past year – no small achievement, given the turmoil they have faced.

© 2012 Investment Executive. All rights reserved.