Five years ago, financial advisors were reeling as a result of the global financial crisis. They saw the value of their books of business drop precipitously while having to work extra-hard to keep their clients.

How times have changed. The results of Investment Executive‘s (IE) 2014 Report Card series reveal that advisors have reached new heights in their books of business while continuing to grow their client rosters. At the same time, firms across the board continue to deliver on what advisors consider most important to their practices.

The average advisor now has an all-time high of $60.7 million in assets under management (AUM) in his or her book of business, up from $54.1 million last year – and from $45.3 million in 2009. In fact, advisors in three of the four financial services sector channels saw significant increases in their AUM this year, with advisors in the brokerage channel enjoying the largest gains; the average book in that channel rose to $101.8 million from $92.7 million year-over-year. At the same time, advisors now are serving an average of 351.7 client households, up from 329.6 last year. (See story on page 1.)

Although advisors are on Cloud 9, thanks to surging stock markets, they continue to place great importance on the same core values they’ve always demanded from their firms. Above all, “firm’s stability,” “firm’s delivery on promises,” “freedom to make objective product choices for clients,” and “firm’s ethics” continue to matter most to advisors, with the overall average importance ratings for these categories ranging from 9.4 to 9.6.

“We just celebrated our 90th birthday, and our CEO has done a great job of directing the firm in a challenging climate,” says an advisor in British Columbia with Vancouver-based Odlum Brown Ltd. when discussing his firm’s stability. “A lot of private firms are being taken over by the banks, but we are still going strong.”

Odlum Brown received one of the highest performance ratings in the Report Card series in the firm’s stability category, at 9.9. This regional firm sees little turnover among its advisors, support staff and management, and it’s dedicated to growing organically, bringing in three new advisors in 2013. The firm also revamped its mentoring and training program to provide a smoother transition for younger associates to move into an advisory role. As a result, Odlum Brown advisors also praise their firm’s corporate culture, which includes equity ownership for both advisors and support staff.

“I am compensated more than I ever thought I would be, and they keep giving me shares in the firm,” says an Odlum Brown advisor in B.C. “I really feel like a part of a team this way.”

Equity ownership continues to a be well-loved perk for advisors, unlike many of the rewards and recognition programs that firms offer as incentives. In previous years, the “firm’s reward/recognition program” category was part of the “firm’s total compensation” category. Two years ago, the two subcategories were separated and reward/recognition program was introduced as a separate category in the Insurance Advisors’ Report Card, then added to the remaining Report Cards this year. However, many advisors see these programs as less than enticing and would rather focus on what goes into their wallets.

“With any firm, it doesn’t matter where you work, if you’re getting perks, that’s just money not being paid to you,” says an advisor in B.C. with Mississauga, Ont.-based Investment Planning Counsel Inc. (IPC). (See story on page C8.)

Another category that originally was introduced in the Insurance Advisors’ Report Card and has now been added to all the Report Cards in the series is “support for helping to deal with changes in the regulatory environment.” This category was first added as a response to the way insurance firms were helping advisors deal with changes relating to the National Do Not Call List. Today, this question extends across to the financial services sector with the introduction of the second phase of the client relationship model (a.k.a. CRM2) and the implementation of Canada’s anti-spam legislation. This category is so relevant to advisors that it had one of the top 10 overall average importance ratings, at 9.0. (See story on page C5.)

“There have been some regulatory developments in the past few years, and there is too much being pushed through the system that’s negatively affecting our day-to-day [business],” says an advisor in Ontario with Toronto-based CIBC Wood Gundy. “I had hoped for a more staggered approach, but the regulatory developments have had a negative impact on my business.”

In order to hear what advisors had to say about all of these topics, IE researchers Scott Barber, Jacob Boon, Alexandra Bosanac, Geoff Davies and Leah Golob spoke with 1,683 financial advisors at 40 firms across four distribution channels over a six-month period.

Although the number of firms in the Report Card series has dropped from 44 in 2013, there has been increasing consolidation within some of the distribution channels. The brokerage channel saw one of the biggest acquisitions in the independent space, when Richardson GMP Ltd. acquired Macquarie Private Wealth Inc. (both based in Toronto) in late 2013. In the mutual fund dealer channel that same year, IPC purchased Ottawa-based Independent Planning Group Inc., while Windsor, Ont.-based Sterling Mutuals Inc. was added to the Dealers’ Report Card for the first time. In the insurance channel, consolidation continues among the managing general agencies as Woodbridge, Ont.-based Hub Financial Inc. has scooped up Winnipeg-based Daystar Financial Group Inc.

In addition, Mississauga, Ont.-based PFSL Investments Canada Ltd. and Toronto-based World Financial Group Insurance Agency of Canada Inc. were removed from the Report card series this year as it became evident that both firms’ unique, marketing-based business model was not a viable option for the Report Card series.

To obtain the ratings in the Report Card series, advisors at all the firms are contacted randomly and asked to provide two ratings for each category: one for their firm’s performance in that category and another indicating how important that category is to their business. The ratings are based on a scale from zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.”

Individual ratings then are averaged for each category, both for each firm and for each of the four Report Cards. A firm’s IE rating indicates the average of all the categories for which that firm was rated; the “overall rating by advisors” is the rating out of 10 that advisors gave their firm as a whole on average.

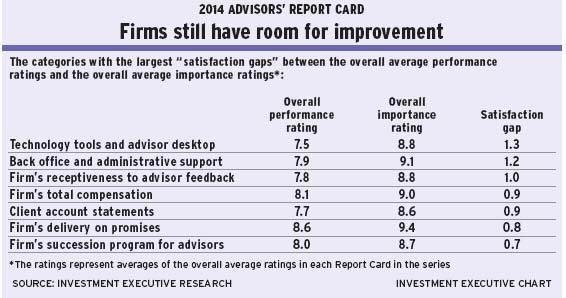

These ratings can reveal “satisfaction gaps,” which occur when there is a significant difference between the overall average performance and importance ratings that advisors bestowed on a category. Throughout the Report Card series, categories such as “technology tools and advisor desktop,” “back office and administrative support” and total compensation had satisfaction gaps that increased over the past year. Above all, this means that firms are far from meeting their advisors’ expectations.

“[The firm] has always been behind on technology,” says an advisor in Ontario with Toronto-based Assante Wealth Management (Canada) Ltd. “We are still using paper forms.”

“Turnovers [in the back office] are too high,” says an advisor in Alberta with Toronto-based TD Wealth Private Investment Advice. “We encounter unskilled people far too often in our day-to-day operations.”

But, as always, there are firms that stand out in these categories. For example, Calgary-based Leede Financial Markets Inc. had the top performance rating among all Report Cards this year in the back-office category, at 9.5.

“[The back-office staff] are good at what they do,” says a Leede advisor in Alberta. “They are very quick. They realize that we are a service industry and that service is still the No. 1 thing we need to do.”

Over the past 11 years, Leede has had minimal turnover in its back office. As well, all staff are trained to handle any request advisors may have, says Robert Harrison, the firm’s president and CEO: “We might hire someone [for one area of the back office], but we cross-train them in other facets of the back office so if someone is off ill, or there is an emergency, we are able to take care of the advisors on a timely basis.”

© 2014 Investment Executive. All rights reserved.