At first glance, financial advisors surveyed for Investment Executive’s (IE’s) 2012 Report Card on Banks and Credit Unions appear to be a bunch of happy campers, with performance ratings either improving or remaining steady compared with last year. However, upon closer inspection, it becomes evident that the firms in the survey still have some gaps to close in order to improve satisfaction levels in certain categories.

“I love working with an organization that has an image of stability,” says an advisor in Ontario with Toronto-based Canadian Imperial Bank of Commerce, “but it shouldn’t change its strategic focus as often as it does.”

An advisor in Alberta with Edmonton-based Servus Credit Union Ltd. shares a similar sentiment: “We’re getting better at most things, but there’s still a long way to go.”

Whether praising firms or venting about their shortcomings, advisors had plenty to say to IE researchers Brent Jolly, Johnna Ruocco and Gian Verano, who spoke with 236 advisors at six banks and one credit union. Advisors were asked to provide two ratings, one for their firm’s performance and another on the importance of that category to their businesses.

Ratings for 35 categories were based on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.” Individual ratings were then averaged for each category, for both the firms individually and the Report Card overall. The “IE rating” is the average of all categories for each firm, excluding the “overall rating by advisors,” which was how advisors rated their firms overall out of 10.

What advisors value most remains unchanged from previous Report Cards, with “firm’s ethics” and “firm’s stability” remaining at the top, proving that the secure work environment that the major deposit-taking institutions in Canada provide are what their advisors love most.

“I feel like I am working for a family bank,” says an advisor in British Columbia with Toronto-based Bank of Nova Scotia. “We are always taken care of. It’s a big company that feels like a mom-and-pop shop. It never lays anyone off.”

One difference this year in the importance ratings is that “firm’s total compensation” has jumped into a tie for third place from being in sixth place in 2011. It appears advisors now are placing a greater value on both their pay packages and being recognized for a job well done.

“There should be a higher base salary even it if means lowering bonuses,” says an advisor in Quebec with Montreal-based National Bank of Canada, who rated compensation at 10.0 in importance.

Adds an advisor in Ontario with Toronto-based TD Canada Trust: “What I like the most is that our bonuses aren’t tied just to production. There’s a large part that comes from client feedback. That way, people really are focused on providing a great client experience.”

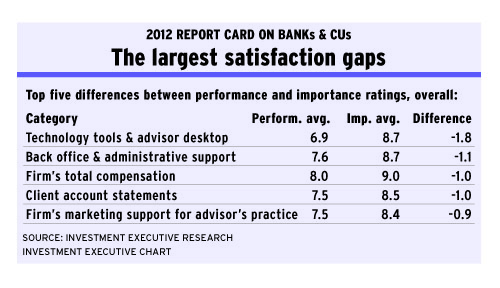

On the other hand, there also continues to be a significant difference, or satisfaction gap, between the importance advisors place on some categories and how their firms are performing in those categories. Both “technology tools and advisor desktop” and “back office and administrative support” continue to fall short of advisors’ expectations. Those categories have the two largest satisfaction gaps, at 1.8 and 1.1, respectively.

“It’s hard to do your job properly when you don’t have the right tools,” says a National Bank advisor in Ontario. “It’s like trying to cut a slab of marble with a feather duster sometimes.”

Servus, for its part, is in the midst of upgrading its technology platform. The credit union is a product of the merger of three credit unions in 2008; it is now in the process of combining the three legacy computer systems into one banking system.

“There are a number of other systems that will be introduced as part of this project,” says Randy Biberdorf, Servus’s vice president of wealth management, “so it’s going to advance our capability in things such as loan origination, mobile and Internet banking, and customer-relationship management.”

But when it comes to the back office, Biberdorf says, problems in this area are industry-wide: “When you’re a salesperson with paper and processes, the two don’t always mix well.”

Communication is key to any advisor’s business, especially during a big change such as a merger. So, this year, two new communication-related questions were added to the Report Card: “firm’s effectiveness in keeping advisors informed” and “firm’s receptiveness to advisor feedback.”

Another change this year was a new emphasis on wealth-management support services. Categories related to this field were grouped together into one section on the survey, and two new questions were added: “support for developing an investment plan for clients” and “support for overall wealth-management process.”

In contrast, the number of questions relating to products was reduced this year.

Regardless of these changes, the top firms continue to shine. The top performer in last year’s Report Card, Toronto-based Royal Bank of Canada (RBC), was again at the head of the class this year. RBC advisors are more than just content – they rated the “firm’s stability” at a perfect 10.0.

That said, it is TD that really stood out this year with 22 first-place ratings – eight of them a result of major jumps in scores.

© 2012 Investment Executive. All rights reserved.